Several U.S. states are preparing to issue $1000 Payments in December, following the rollout of a New State Rule designed to distribute tax rebates and cost-of-living relief to eligible residents. State officials say the updated Eligibility Criteria aim to better target households most affected by persistent inflation and rising living costs. Payments are expected to arrive between mid- and late December, according to state revenue departments.

$1000 Payments in December

| Key Fact | Detail |

|---|---|

| Payment Amount | Up to $1,000 per eligible filer or household, depending on state |

| Payment Window | Dec. 10–28, with variation by state |

| Eligibility Criteria | Income caps, residency verification, and timely tax filing |

What the New State Rule Means for Residents

The New State Rule is a broad term for budget directives, tax code amendments, and surplus-distribution rules adopted in several states this year. These measures enable governments to deliver year-end relief payments using surplus funds, higher-than-projected tax revenues, or leftover pandemic-related appropriations.

According to a statement from the Colorado Department of Revenue, these payments help “return excess taxpayer funds during peak seasonal spending periods.” Arizona and Minnesota officials echoed this sentiment, emphasizing that December payouts offer timely assistance as families prepare for holidays, heating bills, and property tax deadlines.

Historical Context: How December Payments Became a Policy Trend

State-level rebates are not new, but year-end payments have gained momentum in recent years:

- In 2021–2022, federal stimulus rounds demonstrated that rapid direct payments could stabilize household budgets.

- In 2022–2023, several states, including Colorado and Minnesota, issued “inflation relief” or “surplus refunds.”

- In 2024, more states adopted refund mechanisms tied directly to tax surpluses.

Dr. Marisa Bennett, an economist at the Pew Charitable Trusts, said states are “responding to stronger-than-expected revenues and public demand for inflation relief.” However, she noted that few states have made such payments permanent, calling them “opportunistic tools rather than long-term policy.”

Expanded Eligibility Criteria: Who Qualifies for the $1000 Payments in December?

Eligibility varies significantly across states, but most follow three primary criteria. Based on state revenue office guidance, the requirements include:

Income Limits

Many states adopt income thresholds similar to previous federal relief programs:

- Up to $75,000 annual income for single filers

- Up to $150,000 for married couples

- Additional allowances for households with dependents

Officials argue that income-based criteria ensure funds reach households facing the most pressure from inflation and rising housing costs.

“Middle-income families continue to feel the strain of elevated prices,” said Dr. Lena Morris of the University of Michigan, noting that rebates help “offset financial stress during a critical spending period.”

Residency and Filing Requirements

Most programs require:

- Valid state residency during the prior tax year

- A 2023 or 2024 tax return filed by the state’s established deadline

- No outstanding tax debts in some states

Failure to meet residency requirements or resolving tax audit flags can delay payments.

Dependents and Special Categories

Several states offer enhanced payments for:

- Parents or guardians with dependents

- Seniors over 65

- Veterans or disabled taxpayers

Minnesota’s revenue agency confirmed that households with dependents may exceed the $1,000 threshold.

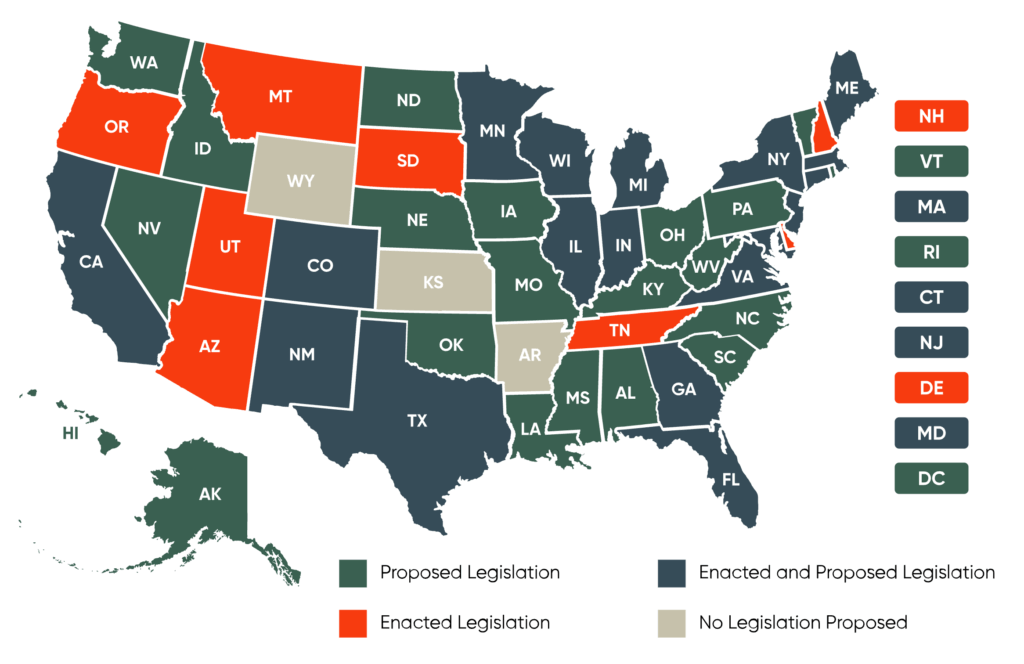

State-by-State Breakdown of December Payments

While not exhaustive, the following states are among the most prominent participants in December payments:

Colorado

- Amount: ~$800–$1,000 per taxpayer

- Basis: Taxpayer’s Bill of Rights (TABOR) surplus

- Distributed: Direct deposit for most filers

Colorado Treasurer Dave Young said the rule “ensures surplus funds are promptly returned to taxpayers.”

Arizona

- Amount: Up to $750 for dependents, with some households reaching $1,000

- Basis: “Family Tax Rebate” provision

- Eligibility: Parent or guardian with qualifying dependents

State lawmakers said the goal is to “ease the holiday burden for working families.”

Minnesota

- Amount: $520 (individuals), $1,040 (married couples), plus $260 per dependent

- Basis: Surplus distribution from record state revenue

- Timing: Early to mid-December

Budget analysts warn this level of surplus may not recur in 2025.

Georgia

- Amount: $250–$500

- Basis: Amended budget surplus act

- Eligibility: 2023 tax filers meeting income thresholds

Georgia’s Department of Revenue said December payments help “reduce household pressure amid ongoing inflation.”

When Will Residents Receive Their $1000 Payments in December?

States are working on tight schedules. According to official statements:

- December 10–18: Initial direct deposits

- December 18–24: Checks mailed for residents without bank information on file

- December 24–28: Final batch processing

Arizona officials advised residents to expect delays due to holiday banking hours, while Minnesota’s treasury noted that weather disruptions could affect mailing timelines.

How States Are Paying for the Program

Funding varies widely:

- Surplus Revenues: Colorado, Minnesota

- Tax Overcollections: Georgia, North Carolina

- Legislative Appropriations: Arizona

- Pandemic-Era Federal Funds: Limited cases, mostly small supplements

A report from the National Association of State Budget Officers found that “2024 state surpluses were driven by stronger employment numbers, consumer spending, and high-income tax receipts.”

However, the report also warns that revenue growth is slowing in several regions.

Dr. Samuel Ritchie of the Brookings Institution says:

“States are in a unique fiscal moment. Many have surpluses now, but projections indicate flatter revenue growth in 2025.”

How These Payments Affect Inflation and the Broader Economy

Economists say state-level rebates are too small to significantly influence national inflation, but they can affect local pricing for:

- Holiday retail

- Grocery demand

- Short-term household spending

A Moody’s Analytics brief found that one-time state payments tend to boost short-term consumption without meaningfully shifting long-term inflation trends.

Local businesses in Colorado and Arizona told reporters they expect increased December sales as a result of the payment timing.

Consumer Guidance: How Residents Can Safely Check Payment Status

State agencies urge caution due to rising scams around rebate programs.

Residents should:

- Verify information through official state .gov websites

- Avoid clicking links in unsolicited emails or texts

- Ensure direct deposit details are updated

- Retain tax documents in case state verification is required

The Internal Revenue Service (IRS) has reported increased phishing attempts citing “holiday stimulus payments.”

What Happens If You Don’t Receive Your Payment?

Common causes of payment delays include:

- Errors on tax returns

- Missing or outdated mailing addresses

- Unverified residency

- Identity verification holds

- Bank account mismatches

Most states allow residents to use online portals to track payment status and submit supporting documents.

Perspective from Residents and Lawmakers

Public response is mixed. Some residents welcome the relief while others argue it does not address systemic affordability issues.

Colorado resident Maria Torres told local reporters that the payment “will help with heating costs, which are higher this year,” while an Arizona nonprofit group noted that “families still struggle with rising rents and childcare expenses.”

Lawmakers emphasize that these payments are not permanent benefits, but rather one-time relief measures made possible by unusual fiscal conditions.

Could Monthly or Annual Payments Become Permanent?

Several states are exploring recurring rebate frameworks. However, experts caution that these programs face two obstacles:

- Revenue volatility in states tied heavily to income and sales taxes

- Political differences over surplus spending priorities

A policy paper from the Urban Institute notes that permanent rebates could strain future budgets unless states restructure tax systems or create dedicated funds.

Is the 4% Withdrawal Rule Still Safe? Why Retirees Are Re-Evaluating the Strategy

The Outlook for 2025

Fiscal analysts expect fewer states to offer large year-end payments next year due to slowing revenue growth. However, targeted relief—such as child tax credits, renter tax refunds, and senior assistance programs—may continue.

Lawmakers in Minnesota and Colorado say they will reassess December payments in their 2025 legislative sessions.

Final Paragraph

As states finalize their December distributions, officials urge residents to monitor official portals for updates and avoid misinformation. While the $1000 Payments in December offer valuable short-term support, their future depends on revenue conditions and legislative priorities in the coming year.