Millions of Americans receiving monthly Social Security benefits will not see their COLA increase reflected in their payments until January, the Social Security Administration (SSA) confirmed. While the annual cost-of-living adjustment is designed to help retirees keep pace with rising prices, the timing of federal payment rules, Medicare premium deductions, and different eligibility categories affects when beneficiaries actually receive the higher amount.

Why Some Retirees Will Not See Their COLA Increase

| Key Fact | Detail |

|---|---|

| 2026 COLA Rate | 2.8% increase for Social Security benefits |

| First Month of Higher Social Security Payments | January 2026 |

| First Month of Higher SSI Payments | December 31, 2025 |

| Biggest Factor Reducing Net Gains | Medicare Part B premium increases |

| Beneficiaries Most Affected by Timing | Retirees on Social Security but not SSI |

| Official Website | SSA |

The SSA encourages beneficiaries to monitor their accounts and stay informed about policy changes that may affect future payments. As inflation and economic conditions evolve, policymakers and consumer advocates continue to debate how best to preserve retirees’ purchasing power while maintaining the long-term solvency of Social Security.

How the COLA Increase Is Calculated and Why Timing Matters

Every October, the Social Security Administration announces the following year’s cost-of-living adjustment. The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a federal inflation measure published by the Bureau of Labor Statistics.

According to the SSA’s official notice, the COLA applies to benefits paid in January, regardless of when retirees receive their monthly deposits.

“COLA adjustments begin with benefits payable for January, in accordance with the Social Security Act,” the agency said. That means retirees do not see higher deposits until their first Social Security payment of the new year.

Why January Matters

Most retirees receive payments on the second, third, or fourth Wednesday of the month. Because of this schedule, the COLA does not appear until a January deposit hits the account—sometimes nearly three weeks into the new year.

This timing is often misunderstood. Retirees may notice announcements about the COLA in October, but the adjustment does not affect their checks until January.

Why SSI Recipients Receive the COLA Earlier

Supplemental Security Income (SSI) recipients are paid differently from Social Security retirees. SSI payments for January are issued on December 31, because January 1 is a federal holiday.

This places SSI beneficiaries among the first Americans to receive the new COLA.

By contrast, Social Security retirees must wait until their regularly scheduled January payment.

Medicare Premiums May Reduce the Net Effect of the COLA Increase

Part B Premiums Often Rise at the Same Time

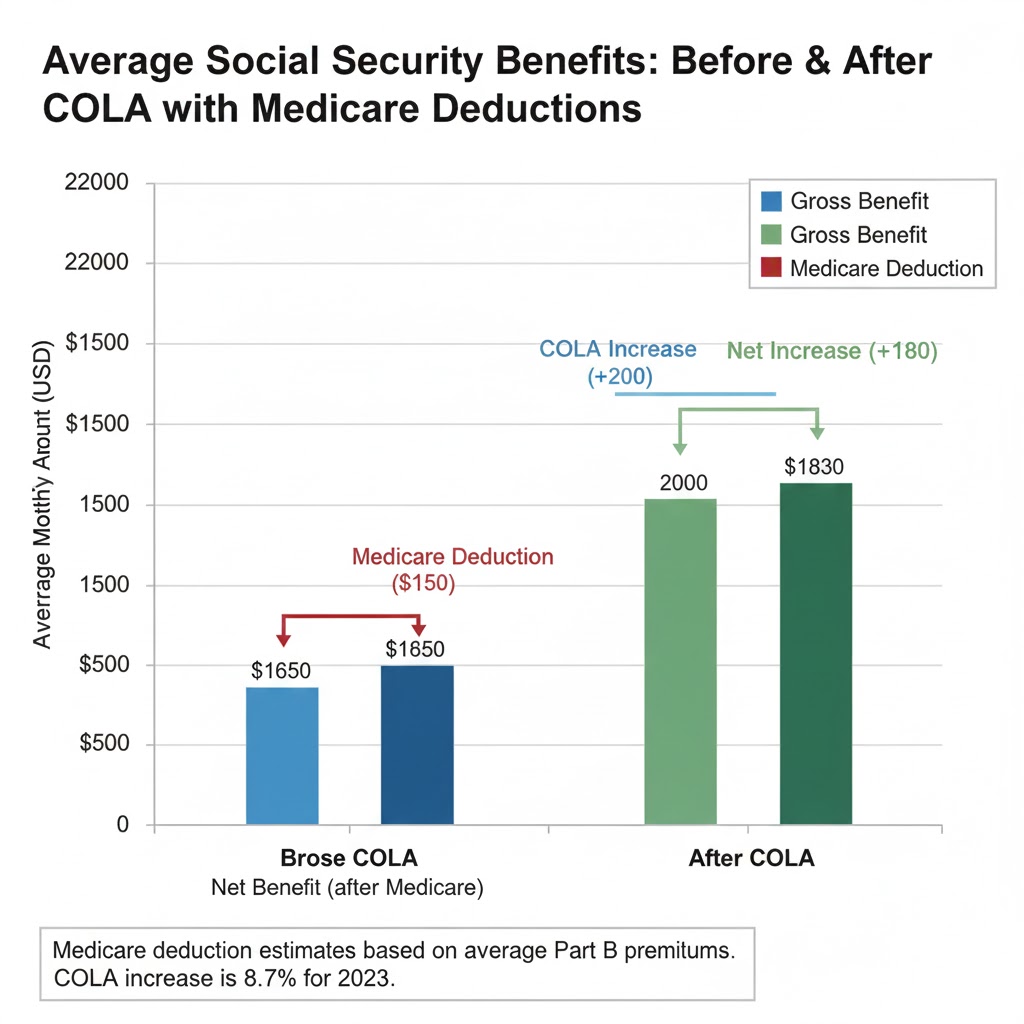

Many retirees do not feel the full impact of the COLA because Medicare Part B premiums increase each January. These premiums are deducted directly from Social Security benefits.

“A higher COLA does not always translate into a higher monthly deposit if Medicare costs rise sharply,” said Dr. Elaine Waldron, a public policy researcher at Boston University.

According to the Department of Health and Human Services, Medicare premiums reflect changes in healthcare spending, prescription drug costs, and federal policy decisions.

Part D and Medicare Advantage Costs Also Shift

For retirees enrolled in drug coverage or Medicare Advantage plans, out-of-pocket premiums and deductibles may also change at the start of the year. These adjustments can reduce the immediate impact of the COLA increase.

Payment Calendars Create Additional Delays

The SSA uses a staggered payment schedule:

- Second Wednesday: Retirees born on the 1st–10th

- Third Wednesday: Retirees born on the 11th–20th

- Fourth Wednesday: Retirees born on the 21st–31st

Retirees paid later in the month see the COLA-adjusted benefit later than those in earlier groups.

This results in up to a three-week difference in when retirees first see the COLA increase.

Who Is Most Likely to Experience a Delay or a Smaller Increase

1. Retirees With Medicare Premium Deductions

Those enrolled in Parts B or D experience the most noticeable reductions. Their COLA may appear smaller or may be completely absorbed by premium increases.

2. Retirees With Benefit Holds

Beneficiaries who recently filed claims, changed addresses, or resolved overpayments may experience administrative holds, delaying the adjusted payment.

3. Workers Who Claim Early Benefits

Retirees earning above the annual earnings limit may see benefit reductions, affecting how the COLA is applied or reflected.

4. Retirees in Certain States

A small number of states coordinate separate deductions (such as Medicaid offsets), which can affect the net increase.

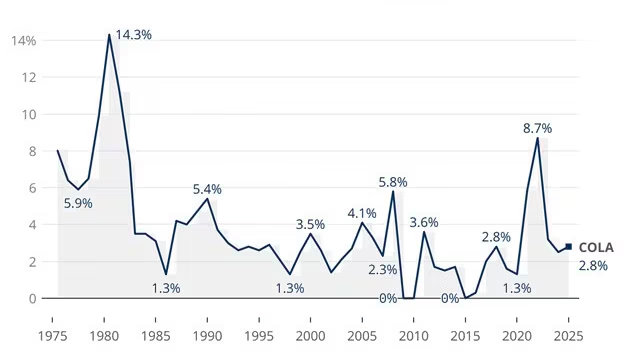

Historical Context: How This Year’s COLA Compares

The 2.8% COLA for 2026 is moderate compared with recent years. According to historical SSA data:

- 2022: 5.9%

- 2023: 8.7% (largest since 1981)

- 2024: 3.2%

- 2025: 3.2% (projected)

- 2026: 2.8%

“We are returning to more typical inflation levels after a period of unusual volatility,” said Dr. Karen Musa, an economist at the University of Michigan.

Experts note that even moderate changes can influence retiree budgets, especially for those with limited savings.

Economic Pressures Behind the COLA Formula

Inflation Has Been Slowing

Federal Reserve data shows a gradual cooling of inflation, reflected in lower COLA percentages compared to the record increases of 2022 and 2023.

Housing and Healthcare Remain Persistent Challenges

Retirees face disproportionate costs in these categories.

According to the Kaiser Family Foundation:

- Retirees spend nearly 14% more on healthcare than working-age adults.

- Housing costs for older Americans have risen at twice the rate of wages over the last decade.

These factors can lead retirees to feel that COLA adjustments, even when accurate, do not fully reflect real-world expenses.

Debate Over Whether the COLA Is Adequate

Critics argue that CPI-W does not accurately represent senior spending patterns. Seniors spend more on:

- Prescription drugs

- Healthcare services

- Housing maintenance

- Utilities

These categories often grow faster than CPI-W inflation.

Groups including the National Active and Retired Federal Employees Association (NARFE) advocate switching to CPI-E, an experimental measure focused on elderly consumers.

“COLA calculations should reflect the cost of aging, not the cost of commuting,” said Ann Weston, policy director for NARFE.

Impact on Low-Income Retirees

Low-income retirees are most vulnerable to delays in the COLA increase, especially those who rely almost entirely on Social Security income.

According to the Social Security Administration:

- For one in four retirees, Social Security provides 90% or more of their income.

- For half of retirees, Social Security provides at least 50% of income.

A delay of several weeks can create financial strain for older adults living month to month.

How Beneficiaries Can Prepare for the COLA

Experts recommend that retirees:

- Check their “my Social Security” account in November

- Review Medicare plan statements for upcoming premium increases

- Update direct deposit information

- Track expected deposit dates using the SSA calendar

Financial planners also suggest creating a small cushion in December to absorb any delays.

Social Security Update — Government Restores Benefits for 830,000 Older Americans

Long-Term Outlook for Social Security Payments

The SSA’s latest Trustees Report projects that the program’s trust funds will be depleted in the early 2030s without legislative action. After that point, incoming tax revenue would cover only about 80% of scheduled benefits.

While Congress is expected to intervene, uncertainty remains.

“COLA increases protect purchasing power today, but the program’s long-term stability depends on decisions lawmakers have yet to make,” said Dr. Richard Holman, a senior fellow at the Brookings Institution.