The U.S. government has reversed a proposed regulation that threatened the Social Security benefits of roughly 830,000 older Americans, restoring payments that advocacy groups said were essential to seniors’ financial stability. This Social Security Update follows months of public pressure, congressional scrutiny, and concerns from disability-rights organizations about the impact of the rule. Federal officials said the withdrawal reflects a renewed focus on fairness and accuracy in determining eligibility.

Social Security Update

| Key Fact | Detail / Statistic |

|---|---|

| Seniors protected by rule reversal | ~830,000 older Americans |

| Newly restored benefits for public-sector retirees | 3.1 million+ payments processed |

| Cost-of-living increase for 2026 | 2.8% COLA (~$56/month avg.) |

| Long-term solvency challenge | Trust fund deficit projected by 2034 |

Why the Government Reversed the Rule

The withdrawn rule sought to tighten disability eligibility for individuals 55 and older. It would have redefined certain occupational categories, making it harder for older workers with limited mobility, chronic illness, or low-wage job histories to qualify for benefits.

According to early analysis from advocacy groups, the change would have “placed an unfair burden on older workers already facing age-related employment barriers.” Several lawmakers criticized the proposal, arguing that it relied on outdated assumptions about workplace physical demands.

Officials close to the decision said the agency ultimately determined the policy required “further evaluation” before implementation.

Restoring Social Security Benefits for At-Risk Older Americans

Many of the 830,000 affected individuals work or previously worked in physically demanding industries—including manufacturing, food service, custodial work, and home healthcare—where late-career injuries are common and retraining opportunities remain limited.

Advocates from the National Council on Aging argued that the proposal relied on an “overly narrow understanding of employability,” especially for individuals with degenerative conditions. They warned that thousands could fall into poverty as a result of losing access to disability and retirement pathways.

With the rule withdrawn, seniors already receiving disability benefits will continue under existing standards, and individuals in the application pipeline will maintain current eligibility guidelines.

Larger Context: The Repeal of WEP and GPO

A separate but major change influencing this Social Security Update is the January 2025 repeal of the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These rules previously reduced Social Security payments for millions of public-sector workers—teachers, firefighters, police officers, and federal employees—whose jobs included pensions not tied to Social Security contributions.

The repeal, signed into law under the Social Security Fairness Act, restores full benefits retroactive to January 2024.

According to the Social Security Administration, more than 3.1 million payments have already been processed, totaling over $17 billion. Some beneficiaries are receiving sizable retroactive lump sums, depending on how long WEP or GPO had reduced their earnings.

Labor organizations praised the repeal, calling it “long overdue.” Lee Saunders, president of the American Federation of State, County and Municipal Employees, described it as “a historic restoration of fairness for workers who dedicated their careers to public service.”

Why the Reversal Matters

Financial Stability for Older Adults

For many older Americans, Social Security accounts for the largest share of their annual income. The proposed rule would have removed benefits from individuals who often have:

- Limited retirement savings

- Chronic health conditions

- Employment histories shaped by low-wage or physically demanding work

- Barriers to re-entering the workforce later in life

With inflation still above pre-pandemic levels, advocacy groups argued that losing even a portion of monthly payments could lead to food insecurity, housing instability, or delayed medical treatment.

Economic Pressures Continue

Even with the reversal, seniors face financial pressure as the cost of essentials—housing, food, transportation, and prescription drugs—continues to rise. This is why the 2026 Cost-of-Living Adjustment (COLA), set at 2.8%, has generated both relief and frustration.

Some policy analysts say the increase is too small to match real-world inflation for retirees, especially given rising Medicare premiums.

Impact on Social Security’s Long-Term Solvency

While beneficial to millions, the combined effect of the rule reversal and WEP/GPO repeal adds financial pressure to the Social Security Trust Fund. The 2025 Trustees Report projects the fund may no longer be able to pay full benefits by 2034 unless Congress takes action.

Economists say that restoring benefits to seniors improves equity but accelerates the need for broader reform. Proposed solutions include:

- Raising payroll tax caps

- Redirecting certain federal revenues

- Gradual increases in retirement age (a politically contentious option)

- Targeted benefit adjustments

Experts stress that the sooner Congress acts, the less disruptive the changes will be.

How Seniors Can Check Their Eligibility for Social Security

For individuals unsure whether they qualify for restored benefits, the SSA recommends:

- Checking their “my Social Security” online account

- Reviewing past statements for WEP/GPO reductions

- Contacting regional SSA offices

- Monitoring online notices for lump-sum retroactive payment updates

Public service workers should look for documentation indicating whether their previous pension came from “non-covered” employment, which determined whether WEP/GPO applied.

Broader Reactions

Support from Advocacy Groups

Organizations such as the American Association of Retired Persons (AARP) welcomed the decision, calling it a “vital protection at a critical time.” They argued that policy decisions affecting older Americans must acknowledge life expectancy trends, labor-market inequities, and health challenges.

Criticism from Fiscal Hawks

Some members of Congress expressed concern about expanding benefits without identifying long-term funding sources. They argue that political pressure can lead to short-term decisions that complicate long-term solvency challenges.

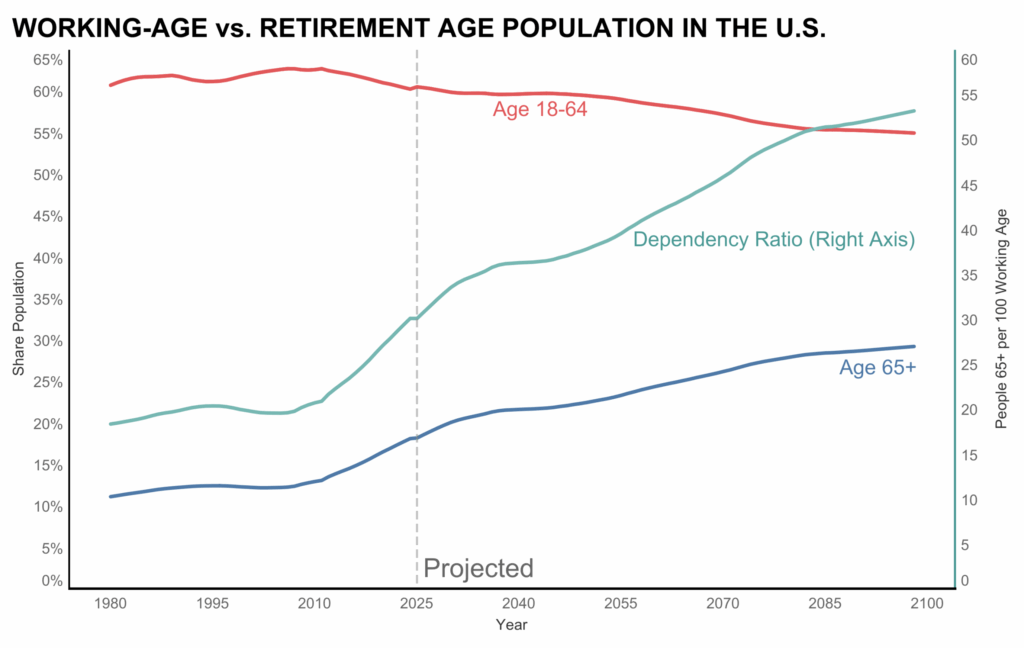

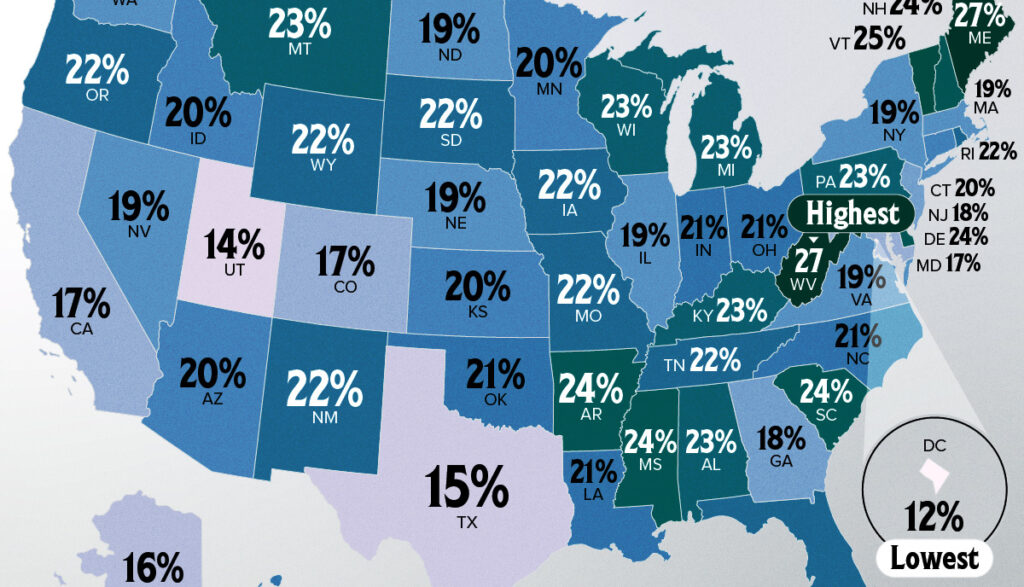

Why This Social Security Update Resonates Nationally

The restoration of threatened benefits and repeal of WEP/GPO highlight a broader debate about the role of Social Security in an aging society. As nearly 12,000 Americans turn 65 every day, the federal government faces mounting pressure to:

- Modernize eligibility frameworks

- Adapt to shifting workforce dynamics

- Balance equity with financial sustainability

These conversations will likely shape U.S. domestic policy throughout the next decade.

What Happens Next

The SSA will continue distributing restored payments throughout 2025 and 2026. More guidance for public-sector retirees and older workers is expected later this year, including updates to eligibility manuals and automated review systems.

Lawmakers from both parties say additional reforms are likely, although consensus remains difficult. For the 830,000 older Americans protected by the rule reversal, the decision offers immediate financial relief—but long-term uncertainty remains.