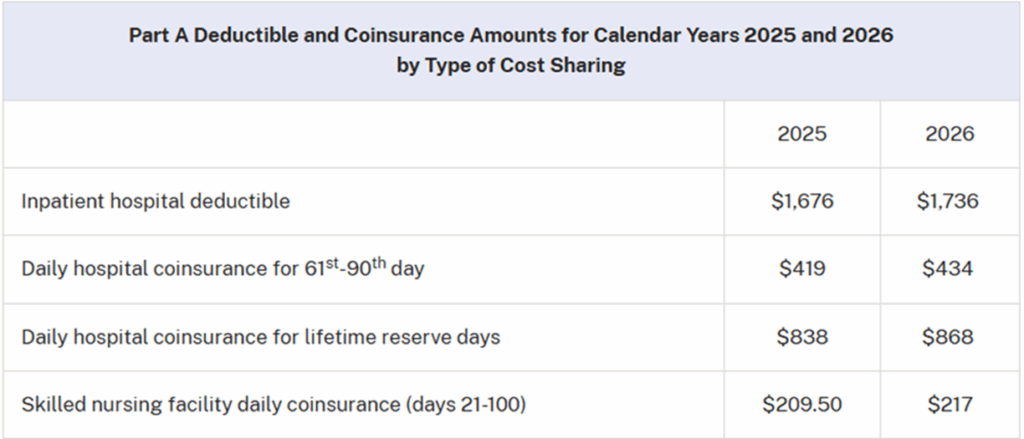

The U.S. government’s Medicare’s 2026 changes will significantly shape how retirees experience the upcoming Social Security cost-of-living adjustment. Medicare Part B premiums will increase sharply, while the Social Security COLA remains modest. The shift will affect retirees differently, depending on income, enrollment timing, and eligibility for key protections.

Medicare’s 2026 Changes

| Key Fact | Detail / Statistic |

|---|---|

| Social Security COLA for 2026 | 2.8% increase, raising average benefit from ~$2,015 to ~$2,071 |

| Medicare Part B Premium | Standard premium increases to $202.90, about a 10% jump |

| Share of COLA absorbed by premium increase | Roughly one-third of the average COLA |

| Affected groups | New Medicare enrollees, high-income retirees (IRMAA), workers on SS |

The SSA will release detailed benefit notices to all Social Security recipients closer to the end of 2025, outlining how Medicare’s 2026 changes will affect their payments. Advocacy groups expect increased demand for benefits counseling and financial assistance programs as retirees adjust to the new cost structure.

How Medicare’s 2026 Changes Interact with Social Security

The Social Security cost-of-living adjustment, or COLA, is designed to preserve retirees’ purchasing power as prices rise. According to the Social Security Administration (SSA), the 2026 increase is set at 2.8 percent, reflecting inflation patterns over the previous year.

However, many older Americans will not see that full increase in their bank accounts. Medicare Part B premiums—deducted directly from Social Security checks for most retirees—will rise to $202.90, nearly a 10 percent increase over 2025.

Dr. Ellen Porter, a health-policy researcher at the Brookings Institution, explains: “When Medicare premiums rise faster than Social Security benefits, retirees effectively experience a pay cut in real terms. The 2026 premium jump is large enough to erode much of the COLA for millions of households.”

The “Hold Harmless” Rule—and Who It Protects

One of the most important factors shaping retiree outcomes in 2026 is the federal “hold harmless” rule. This provision prevents an individual’s Social Security check from decreasing due to a rise in Medicare Part B premiums.

To qualify, retirees must:

- Already receive Social Security benefits

- Pay the standard Medicare Part B premium

- Have premiums deducted directly from their Social Security payment

- Not be in higher-income IRMAA tiers

According to Medicare policy analysts at the Kaiser Family Foundation (KFF), about 70 percent of Medicare beneficiaries qualify for the protection in most years.

But millions are left out, including:

- New Medicare enrollees

- High-income retirees paying IRMAA surcharges

- Retirees not yet collecting Social Security

- People whose premiums are paid by Medicaid

Lauren Matthews, director of policy at the National Council on Aging, said, “Hold harmless is often misunderstood. It protects many, but not all, retirees. Those who are excluded can face immediate and painful increases in healthcare costs.”

Who Gains—and Who Loses—in 2026

Retirees Who Benefit Most

The retirees most likely to keep the largest share of their Social Security COLA are:

- Individuals already taking Social Security

- Those who pay the standard Part B premium

- Lower-income households eligible for Supplemental Security Income (SSI)

- Individuals enrolled in Medicare Savings Programs that cover premiums

These groups will still face rising healthcare costs, but their net Social Security benefit should increase modestly.

Groups Likely to See Little to No Net Increase after Medicare’s 2026 Changes

1. Higher-Income Retirees (IRMAA)

Roughly 8 percent of Medicare beneficiaries pay higher premiums due to income-related monthly adjustment amounts (IRMAA). IRMAA surcharges can add hundreds of dollars monthly for those in upper income tiers.

Because IRMAA is not covered by hold harmless protections, these retirees will bear the full premium increase.

2. New Medicare Enrollees in 2026

Newcomers to Medicare do not receive hold harmless protections during their first year of enrollment. Their Social Security drafts will reflect the full cost increase, leaving many with smaller-than-expected net benefits.

3. Retirees Not Yet Claiming Social Security

Individuals choosing to delay benefits—often for strategic financial reasons—will face higher Medicare premiums without the offset of a COLA increase.

4. Retirees Still Working

The Social Security earnings limit for 2026 will increase to $24,480 for those younger than full retirement age. Exceeding the limit reduces benefits temporarily, compounding the effects of rising Medicare costs.

What’s Driving Rising Medicare Costs?

The Centers for Medicare & Medicaid Services (CMS) attributes the 2026 premium increase to several factors:

- Higher utilization of outpatient services

- Growth in provider payment rates

- Rising prescription drug expenditures

- Increased program administration costs

- A rebound in care deferred during the pandemic

Health economist Dr. Miguel Herrera at Johns Hopkins Bloomberg School of Public Health said, “Medicare is facing structural pressures as the population ages. Premium increases reflect underlying demand and cost trends in the healthcare system.”

Historical Context—Why 2026 Stands Out

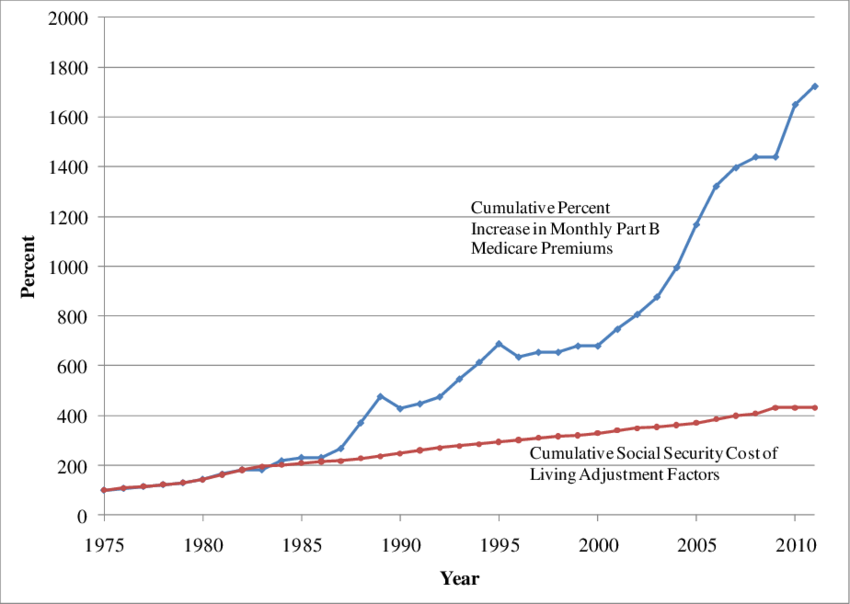

Medicare premiums rise almost every year, but the 2026 jump is significant.

- The standard Part B premium increase is among the largest in the past decade.

- COLA growth remains modest compared to years of high inflation such as 2021–2022.

- More retirees are reaching eligibility age as the baby-boomer generation enters its late 60s and 70s.

According to SSA trustees, the beneficiary population is growing faster than the workforce paying into the system, adding pressure to both Medicare and Social Security trust funds.

Congressional Debate and Policy Outlook

The 2026 adjustment arrives amid broader debates in Washington about the long-term solvency of major federal entitlement programs.

- The Medicare Hospital Insurance Trust Fund is projected to face financial strain later this decade.

- Social Security’s Old-Age and Survivors Insurance (OASI) fund faces potential shortfalls by the mid-2030s without legislative action.

Republican and Democratic lawmakers have proposed different approaches, including adjusting payroll taxes, raising eligibility ages, and revising Medicare payment formulas. No major reforms have passed Congress to date.

Sen. Claire Donnelly, a member of the Senate Special Committee on Aging, said in a recent interview, “We are at a pivotal moment. The 2026 premium increase highlights how urgently Congress must address the financial stability of these lifeline programs.”

Practical Steps Retirees Should Take Now

Experts recommend several actions as retirees prepare for 2026:

1. Review Your Medicare Plan During Open Enrollment

Medicare Advantage and Part D prescription-drug plans vary significantly in premiums and drug formularies. Annual plan reviews can reduce out-of-pocket expenses.

2. Verify Eligibility for Medicare Savings Programs

Low-income retirees may qualify for programs that cover Part B premiums or reduce other cost-sharing.

3. Assess IRMAA Exposure

Strategic management of withdrawals from retirement accounts, such as Roth conversions, can help keep income below IRMAA thresholds.

4. Consider Timing for Social Security Claims

Delaying benefits increases monthly payments, but it also means bearing Medicare costs without the benefit of a COLA increase.

5. Track Legislative Developments

Congressional negotiations on Medicare drug pricing and Social Security solvency could materially affect retirees’ future benefits.

Inside Social Security’s 2025 Overhaul: Faster Service, Bigger Payments, and Seamless Digital Access

Broader Economic Implications

Rising Medicare costs and limited Social Security increases also intersect with wider economic trends:

- Inflation remains elevated for food, rent, and utilities—areas that disproportionately affect older adults.

- Healthcare inflation continues to outpace general inflation.

- Retiree poverty rates may climb if incomes fail to keep pace with essential costs.

Dr. Andrea Sinclair, a senior economist at the Urban Institute, noted, “The relationship between Medicare premiums and Social Security checks is becoming a defining factor in retirement security. If current trends persist, more retirees will struggle to maintain stable living standards.”