The 4% withdrawal rule, a once-reliable benchmark for retirement planning in the United States, is facing renewed scrutiny as economists warn that shifting market conditions may undermine its long-term safety. Financial researchers, advisory firms, and government data point to slower growth, longer life expectancy, and persistent inflation—factors that challenge whether retirees can still depend on the rule with confidence.

4% Withdrawal Rule

| Key Fact | Detail |

|---|---|

| Original guideline | Withdraw 4% in the first year of retirement, adjust for inflation |

| Current expert recommendation | Many researchers now suggest 3–3.5% as safer |

| U.S. life expectancy at age 65 | ~19 years for men, ~21 for women |

| Inflation pressure | Inflation peaked at 9.1% in 2022 |

| Market return forecasts | Expected long-term returns lower than historical averages |

While the debate continues, most experts agree that disciplined spending, a diversified portfolio, and regular adjustments remain essential in today’s economy. The ongoing discussion around the 4% withdrawal rule reflects a shift toward more flexible retirement planning strategies that adapt to changing conditions.

Why the 4% Withdrawal Rule Became a Standard

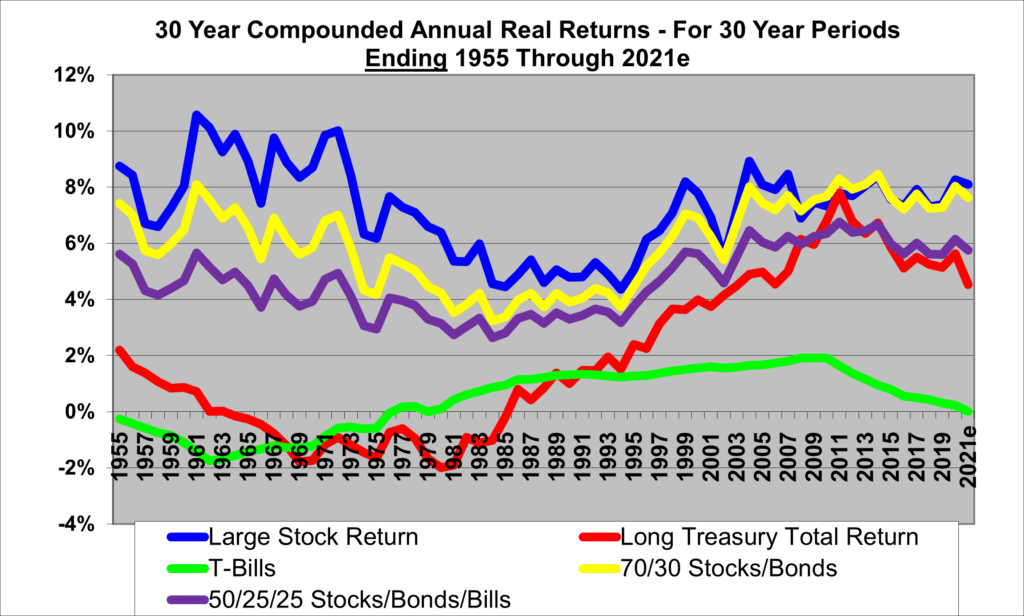

The rule was introduced in 1994 by financial planner William Bengen, who analyzed decades of U.S. stock and bond performance, including periods of severe economic stress. His findings showed that withdrawing 4% of a retirement portfolio in the first year, with inflation adjustments thereafter, survived nearly every 30-year period in the historical record.

The approach became widely accepted after the Trinity Study, an academic paper published in the late 1990s, reinforced Bengen’s conclusions. Financial advisers embraced the model because it was simple, evidence-based, and gave retirees a clear baseline for planning.

Why Experts Are Questioning the Rule Today

1. Market Returns May Be Lower for Decades

Forecasts from Morningstar, Vanguard, and J.P. Morgan suggest that future stock and bond returns may not match the strong performance of the last century. Morningstar’s 2023 report recommends a 3.3% safe withdrawal rate, based on updated market projections.

“Real returns may fall short of historical norms, which puts pressure on traditional strategies,” said Christine Benz, director of personal finance at Morningstar.

2. People Are Living Longer

Life expectancy at age 65 continues to rise. Many retirees must now plan for 30–35 years of withdrawals instead of the 20–25 years assumed when the rule was created. Longer retirements increase the risk of running out of savings.

3. Sequence-of-Returns Risk Is More Serious Than Many Realize

The order in which investment returns occur can significantly impact portfolio survival. Heavy losses early in retirement, combined with fixed withdrawals, can reduce a portfolio faster than most households expect.

“This risk is often underestimated but can be devastating,” said Dr. Wade Pfau of The American College of Financial Services.

4. Inflation Erodes the Rule’s Stability

Inflation surged in 2021–2023, forcing retirees to withdraw more than planned. The 4% rule assumes steady inflation adjustments, but sudden spikes can push withdrawal rates beyond sustainable levels.

How Financial Experts Are Responding

Dynamic Withdrawal Models

Researchers increasingly recommend flexible strategies such as guardrails, ceilings and floors, or percentage-based withdrawals. These approaches adjust spending according to market performance rather than relying on fixed annual increases.

The Employee Benefit Research Institute (EBRI) found that dynamic models significantly increase portfolio longevity during volatile periods.

More Conservative Investment Planning

Target-date funds, used by millions of retirees, now use more conservative stock allocations than a decade ago. This reflects broad industry concern about long-term returns.

Growing Interest in Annuities

Some advisers recommend including annuities to create guaranteed income streams, especially for retirees concerned about longevity risk. The U.S. Department of Labor has encouraged employers to offer annuity options in 401(k) plans.

Global Comparisons: What Other Countries Do

The debate over safe withdrawal rates extends far beyond the United States.

- Canada: Many advisers recommend 3.5–4%, depending on market outlook.

- United Kingdom: Due to inflation volatility, advisers often recommend 3–3.5%.

- Australia: Retirees combine private savings with the Age Pension, reducing dependence on fixed withdrawal rules.

- Japan: Low returns and long lifespans often lead advisers to recommend 2–3% withdrawal rates.

These differences highlight how economic conditions and national retirement systems influence withdrawal strategies.

Winter 2025 Social Security Payments Exposed: Here’s What Retirees Can Really Expect

How Retirees Are Adjusting with 4% Withdrawal Rule

A 2024 EBRI survey found that:

- 52% of retirees withdraw less than 4% annually

- 34% worry their savings won’t keep up with inflation

- Nearly one-third have reduced discretionary spending

Households with guaranteed income sources, such as pensions or annuities, feel more secure. Others prefer delaying Social Security benefits to increase future income.

Policy Factors Affecting Withdrawal Strategies

Social Security Funding Concerns

The Social Security Administration warns that its trust funds may be depleted by 2033 if Congress fails to act. After that, benefits could drop to roughly 77% of current levels.

Potential Tax Increases

Several tax provisions from the 2017 Tax Cuts and Jobs Act expire in 2025, potentially raising taxes for retirees. This could affect withdrawal planning and net income.

Rising Healthcare Costs

Medicare trustees warn that premiums and out-of-pocket medical costs are rising faster than general inflation. Healthcare remains one of the most unpredictable parts of retirement spending.

Will the 4% Rule Survive?

Experts say the rule still has value but needs to be adapted.

“The 4% rule is a good starting point, but retirees should factor in modern research,” Bengen said in a recent interview.

Advisers increasingly recommend reviewing withdrawal plans each year, adjusting for inflation, market performance, and personal circumstances.