The Social Security Tax Guide explains how long-standing federal income limits determine whether Americans pay taxes on their Social Security benefits. The Internal Revenue Service (IRS) uses fixed thresholds, unchanged for decades, to calculate tax liability based on a retiree’s combined income. These rules affect millions of beneficiaries every year as rising Social Security payments push more households into taxable ranges, even when their overall purchasing power has not meaningfully increased.

Social Security Tax Guide

| Key Fact | Detail / Statistic |

|---|---|

| When taxation begins | Taxes may apply when combined income exceeds $25,000 (single) or $32,000 (joint) |

| Maximum taxable amount | Up to 85% of Social Security benefits may be taxed |

| National impact | About 40% of beneficiaries owe federal tax on their benefits annually |

| When thresholds were last updated | 1983 and 1993, with no adjustment for inflation |

For now, retirees must continue navigating a complex tax structure shaped by income limits that have remained frozen for decades. Analysts say any meaningful change will depend on wider negotiations about long-term Social Security financing, leaving beneficiaries waiting to see whether Congress takes action in the coming years.

How Income Rules Determine Taxes on Social Security Benefits

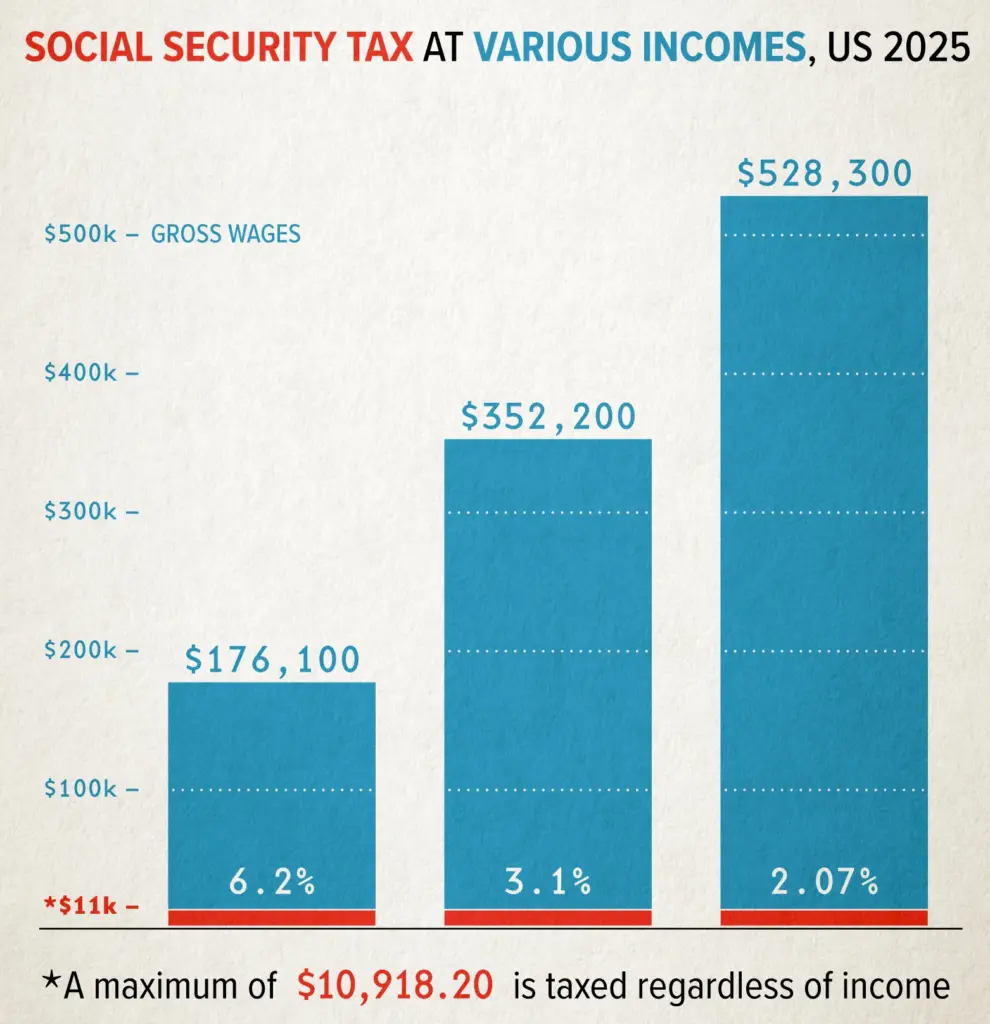

Federal law requires the IRS to tax a portion of Social Security benefits when a recipient’s combined income exceeds preset limits. Combined income is calculated using a formula that includes adjusted gross income, nontaxable interest, and half of a person’s annual Social Security payments. According to the IRS, these thresholds were originally designed to ensure that higher-income retirees contributed more to the system while protecting lower-income beneficiaries.

The Federal Income Thresholds

The thresholds that determine whether benefits are taxable have not changed since they were created more than three decades ago. Federal taxes may apply under the following circumstances:

- Single filers: combined income above $25,000

- Married couples filing jointly: combined income above $32,000

- Married filing separately (living together): benefits are almost always taxable

- Married filing separately (living apart): same thresholds as single filers

These income levels were set in 1983 and expanded in 1993. “Because the thresholds are not indexed to inflation, more middle-income retirees are affected each year,” said Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College, during a 2023 briefing.

Understanding the 50% and 85% Tax Rules

When income passes the lower limit, up to 50% of Social Security benefits may be subject to income tax. When income exceeds the upper threshold—$34,000 for individuals and $44,000 for joint filers—up to 85% of benefits can be taxed.

The IRS notes that this does not mean retirees lose 85% of their benefits. Instead, that portion is included in taxable income and taxed at the recipient’s individual income tax rate.

Why Social Security Income Limits Have Remained Unchanged

The income thresholds were part of major Social Security reforms passed in 1983 and 1993. Lawmakers at the time argued that higher-earning retirees should contribute more revenue to help fund the program. The Government Accountability Office has noted that adjusting the thresholds for inflation would significantly reduce tax revenue flowing into the Social Security and Medicare trust funds—money that the programs now rely on.

Growing Impact on Middle-Income Retirees

When these rules were written, the income thresholds affected only the top tier of retirees. Over time, cost-of-living adjustments (COLAs) increased benefit amounts, even when wage growth and savings failed to keep pace. Analysts at the Urban Institute say this has drawn millions of moderate-income households into tax liability.

“In practice, the burden has shifted downward,” said Richard Johnson, senior fellow at the Urban Institute. “Retirees who were never meant to pay these taxes are now paying them simply because benefit amounts rise while thresholds do not.”

Differences in State Taxation of Social Security Benefits

Federal tax rules apply nationally, but states vary widely in whether they tax Social Security income. According to the National Conference of State Legislatures, 38 states and the District of Columbia do not tax benefits, while a smaller group—including Colorado, Kansas, Minnesota, and Utah—tax them under certain conditions.

Several states, including Nebraska and Missouri, are phasing out benefit taxation. Other states adjust their tax rules each year to account for inflation or income levels.

This variation means two retirees with identical income may face different tax burdens depending on where they live.

Real-World Scenarios That Show How Taxation Works

Case studies help illustrate how minor income changes can push retirees into taxable brackets. Below are simplified examples based on IRS rules.

Scenario 1 – Single Filer Just Above Threshold

A single retiree receiving $20,000 in Social Security benefits and $15,000 in other taxable income would have a combined income of $25,000—exactly at the IRS threshold. Only a small percentage of benefits might be taxable, depending on deductions.

Scenario 2 – Married Couple With Investment Income

A couple receiving $35,000 in combined Social Security benefits and $25,000 in pension income would have a combined income exceeding $52,500, placing them in the 85% taxation range.

Scenario 3 – Impact of Required Minimum Distributions (RMDs)

When retirees reach age 73, required minimum distributions from IRAs or 401(k)s can unexpectedly elevate their taxable income. Tax experts say RMDs are one of the most common triggers that push retirees into higher Social Security tax brackets.

“Even modest retirement withdrawals can tip someone into the 85% category,” said Mark Steber, chief tax officer at Jackson Hewitt.

Tools That Help Retirees Estimate Their Tax Exposure

The IRS provides worksheets in Publication 915 to help retirees determine how much of their Social Security income may be taxable each year. These worksheets require detailed income information, making them helpful for retirees who want to estimate taxes in advance.

The AARP Public Policy Institute recommends annual reviews because even moderate year-to-year changes—such as interest earnings or part-time work—can affect tax liability.

Strategies to Reduce or Manage Taxable Income

Retirement planners frequently highlight ways to reduce taxable income or spread it across years to lessen tax burdens.

Managing Withdrawals

Retirees can adjust annual withdrawals from IRAs or other savings accounts to avoid pushing income above the federal thresholds.

Converting Traditional IRAs to Roth IRAs

Roth conversions are taxed upfront but may reduce taxable income later in retirement. This strategy is often used during years when retirees have lower income.

Timing Social Security Benefits

Delaying Social Security until age 70 increases monthly benefit amounts but may reduce the number of years those benefits are taxable, depending on income sources.

Spreading Capital Gains Across Multiple Years

Selling investments gradually rather than in one large transaction may help retirees stay below critical income thresholds.

Final November Social Security Checks Are Out—Here’s Who Gets Paid and Who’s Left Waiting

The Policy Debate Over Reforming Social Security Taxation

Lawmakers across the political spectrum have proposed reforms to the taxation of Social Security benefits. Some argue that adjusting the income thresholds for inflation would protect middle-income retirees. Others say removing taxes entirely would simplify the system and help retirees better manage rising living costs.

However, the Congressional Budget Office estimates that eliminating federal taxes on Social Security benefits could reduce federal revenue by tens of billions of dollars per year—an outcome policymakers have called difficult without broader Social Security reform.

FAQ About Social Security Tax

Are all Social Security benefits taxable?

No. Taxes apply only when combined income exceeds IRS thresholds. Supplemental Security Income (SSI) is never taxable.

Do most retirees pay federal tax on their benefits?

About 40% do, according to the Congressional Research Service.

Can states tax Social Security benefits?

Yes. Some states tax benefits, but most do not.

Does working while receiving benefits increase tax liability?

Yes. Wages, self-employment income, and investment earnings can push retirees into taxable ranges.