The Final November Social Security Checks were issued this week as the Social Security Administration (SSA) completed its last payment cycle of the month. Most beneficiaries received funds through the agency’s staggered birthdate-based schedule, while the month’s Supplemental Security Income (SSI) benefits were paid early due to the calendar shift. Officials say payments have been delivered nationwide, though some Americans are still waiting because of routine banking delays.

Final November Social Security Checks

| Key Fact | Detail / Statistic |

|---|---|

| Final November Social Security payment date | November 26 for beneficiaries born 21st–31st |

| SSI benefits sent early | Paid October 31 due to Nov. 1 falling on a weekend |

| Total people receiving Social Security | About 72 million nationwide |

| Official Website | ssa.gov |

Understanding How Social Security Payments Are Scheduled

The Social Security payment schedule uses a three-tiered system tied to birthdates. According to the SSA’s official calendar, payments for individuals born between the 21st and 31st were issued on Wednesday, November 26, marking the final distribution of November.

Those born earlier in the month received payments on November 12 or November 19. The system, implemented in 1997, was designed to reduce administrative strain and space out distribution across the month.

“The staggered schedule helps ensure beneficiaries experience fewer delays and that processing systems remain stable,” an SSA spokesperson said in a statement released earlier this month.

For millions of retirees, survivors, and individuals receiving Social Security Disability Insurance (SSDI), these payments remain a crucial source of income. According to the SSA’s 2024 Trustees Report, Social Security benefits account for at least half of total income for more than half of retired households.

Why SSI Recipients Had No November Payment

While most Social Security beneficiaries received payments this month, SSI benefits follow a separate timeline. Because November 1 fell on a Saturday, the SSA advanced the November SSI payment to October 31, a standard adjustment that occurs whenever the first of the month lands on a weekend or federal holiday.

As a result, SSI beneficiaries did not receive a second payment in November.

“This is a normal part of our schedule and does not affect the amount recipients receive,” the SSA explained in its public guidance. The agency emphasized that recipients are not losing a payment; they simply received it earlier.

SSI benefits are targeted at low-income Americans—children with disabilities, adults with limited income, and many seniors who otherwise would face severe financial hardship.

Who Is Still Waiting for Their November Benefit?

Although the Final November Social Security Checks have been issued, some Americans are still waiting for deposits to appear. SSA officials note that delays often arise from factors outside the agency’s control, including banking hours, account changes, and regional mail slowdowns.

The National Council of Social Security Management Associations (NCSSMA) reported that post-holiday processing times contributed to many of the late-month delays.

Groups Most Likely to Experience Delays

- New beneficiaries awaiting their first month of payments

- Individuals who recently changed bank accounts

- People still receiving paper checks, particularly in rural areas

- Beneficiaries with accounts at small credit unions with limited processing hours

- Recipients flagged for account verification issues

The SSA recommends waiting three full business days after a scheduled payment date before contacting the agency.

“In many cases, it’s simply a matter of the bank posting the deposit,” said David Camp, a regional representative with NCSSMA.

How Social Security Payments Influence Household Budgets

For many households, the Final November Social Security Checks arrived during a period of elevated living costs. According to the U.S. Bureau of Labor Statistics (BLS), essential expenses such as rent, healthcare, and groceries remain higher than pre-pandemic levels.

A 2024 analysis by the Center for Retirement Research at Boston College found that Social Security benefits replace only about 37% of preretirement income for the average worker, underscoring why many recipients budget carefully around their monthly payment dates.

“Older adults on fixed incomes are among those most affected by rising prices,” said Dr. Alicia Munnell, the center’s director, in an interview with Reuters. “Timely benefit distribution is essential, especially for households with limited savings.”

What Happened Historically When Social Security Faced Delays?

Payment delays are rare, but they have occurred during administrative transitions or nationwide crises. During the early weeks of the COVID-19 pandemic, supply chain disruptions and staffing constraints caused regional slowdowns in paper-check delivery. Electronic payments, however, largely continued uninterrupted.

The SSA has repeatedly emphasized that Social Security is considered an essential federal function, meaning payments continue even during government shutdowns. The agency reaffirmed this policy again in late 2024 when Congress debated temporary funding measures.

“Benefits will continue to be issued on time regardless of government shutdown status,” the SSA stated.

How Banks Process Federal Benefit Payments

Financial institutions process federal deposits through the U.S. Treasury’s Automated Clearing House (ACH) network. While most deposits appear overnight, smaller institutions may post them later in the day due to batch-processing schedules.

According to the American Bankers Association, delays are more common after federal holidays or at the end of the month, when many payments are processed simultaneously.

Banks may also place temporary holds on accounts if:

- A beneficiary changes their routing number

- Suspicious transactions are detected

- A mismatch exists between the SSA account name and bank records

These internal safeguards can slow payment posting but are designed to reduce fraud.

Fraud Risks and How the SSA Protects Beneficiaries

Social Security payments remain one of the most targeted federal benefits for identity theft and fraud. The SSA and the Office of the Inspector General (OIG) warn beneficiaries about:

- Scam calls impersonating SSA employees

- Fake “payment verification” emails

- Phishing attempts requesting bank information

- Fraudulent text messages claiming issues with benefits

In 2024, the OIG reported more than 350,000 scam attempts linked to Social Security nationwide.

The SSA urges beneficiaries to use its mySocialSecurity online portal to monitor deposits, check account changes, and receive official communications.

Demographic Snapshot: Who Receives Social Security?

According to the SSA’s most recent annual report:

- 50 million beneficiaries are retired workers

- 8 million receive disability benefits

- 6 million receive survivor benefits

- About 7.5 million Americans receive SSI benefits

Women represent 55% of all Social Security recipients, reflecting longer average lifespans. Nearly one-third of beneficiaries live in households where Social Security makes up 90% or more of total income.

These figures highlight why predictable delivery of the Final November Social Security Checks is vital for financial stability.

Preparing for the 2026 COLA Increase

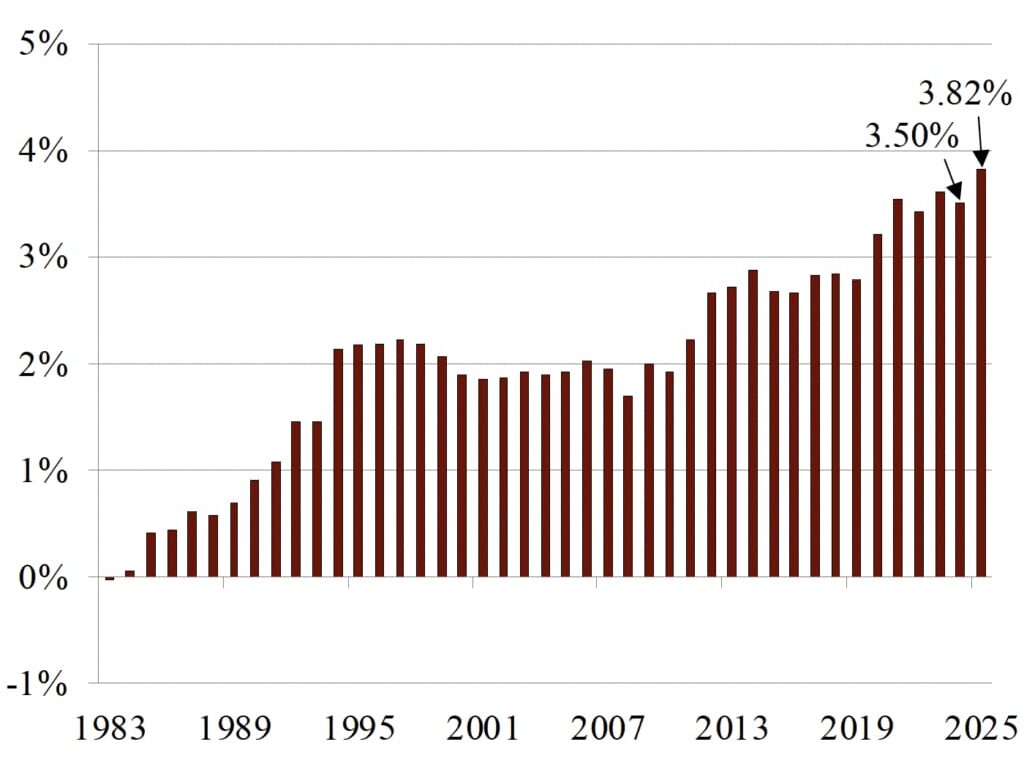

A 2.8% COLA increase takes effect in January 2026. The adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a metric used since the 1970s to track inflation’s impact on household expenses.

According to the SSA:

- The average retired worker will see an increase of about $48 per month

- Disability benefits will rise proportionally

- SSI benefits will adjust automatically

Economists say the increase will provide modest relief, but rising healthcare and housing costs continue to pressure older Americans.

“COLAs preserve purchasing power, but they don’t fully offset higher living expenses,” said Dr. Tyler Evans, an economist at the University of Michigan.

New Social Security Rule Shocks Widows — Only 1 Group Still Qualifies

Looking Ahead: What Beneficiaries Can Expect in December and Beyond

The SSA says December payments will be issued on the regular schedule, and beneficiaries will receive mailed notices detailing their updated 2026 benefit amounts.

The agency also plans to release updated earnings limits, Medicare premium adjustments, and new guidelines for individuals who work while receiving Social Security.

“Our goal is to ensure beneficiaries have clear, timely information heading into the new year,” the SSA said in a press statement.

FAQ About Final November Social Security Checks

1. Why didn’t I receive an SSI payment in November?

SSI benefits were paid early on October 31 because November 1 fell on a Saturday.

2. What if my Social Security deposit is late?

Wait three business days after your scheduled date, then contact the SSA or your bank.

3. How do I know which Wednesday I’m paid on?

The Social Security payment schedule is based on your birthdate: 1–10, 11–20, or 21–31.

4. Will the COLA increase change December payments?

No. The COLA increase takes effect in January 2026.