The White House is reviewing Trump’s $2000 Tariff Rebate, a proposed payment funded by federal tariff revenue that President Donald Trump says could reach eligible adults as early as mid-2025. The administration has offered limited details about eligibility, distribution methods, and total cost, raising questions about feasibility. Lawmakers, trade experts, and budget analysts remain divided on the plan’s long-term impact on household finances and the broader U.S. economy.

Trump’s $2000 Tariff Rebate

| Key Fact | Detail / Statistic |

|---|---|

| Proposed rebate amount | $2000 per eligible adult |

| Expected eligibility | Incomes below roughly $100,000 |

| Estimated annual tariff revenue | $200–$300 billion |

| Projected annual rebate cost | About $600 billion |

Understanding Trump’s $2000 Tariff Rebate Proposal

President Donald Trump has called the rebate a way to “return money back to the American people,” arguing that tariff revenues should benefit the households most affected by inflation and rising costs. The initiative is part of a broader economic agenda aimed at reshaping U.S. trade, tax, and revenue systems.

According to administration officials, the plan is still under internal review, and the Treasury Department has not released a final framework. Treasury Secretary Scott Bessent said the rebate could target households earning “less than, say, $100,000,” suggesting the administration is considering income thresholds to manage overall cost.

Policy strategists say the rebate reflects a larger political message: tariffs are not just a trade-policy tool but also a potential source of household relief. Critics argue that the idea overlooks the complexity of tariff economics and the limits of federal revenue.

How the Trump’s $2000 Tariff Rebate Might Work

Eligibility and Household Impact

While exact qualifications are pending, early comments indicate the rebate could mirror the structure of previous federal relief programs. Households below a specific income level—possibly $100,000 for individuals or $200,000 for joint filers—may receive the full amount. It remains unclear whether dependents would qualify for partial payments.

Tax experts say the structure matters. If the payment is tied to income tax filings, households with delayed returns or complex filings could face longer wait times.

“The operational side is critical,” said Dr. Linda Kerry, a tax administration specialist at the University of Michigan. “If the government wants fast delivery, it must coordinate closely with the Internal Revenue Service and state agencies.”

Distribution Methods Under Consideration

Officials have floated several options:

- Direct deposits, similar to pandemic-era stimulus payments

- Paper checks sent through the U.S. Postal Service

- Advance tax credits applied through next year’s filings

- Digital Treasury payments using existing government platforms

Each option carries trade-offs. Direct deposits are fastest but require up-to-date banking details. Paper checks increase administrative costs. Advance tax credits may delay relief for many households.

Funding the Trump’s $2000 Tariff Rebate: The Tariff Revenue Challenge

Projected Costs vs. Available Revenue

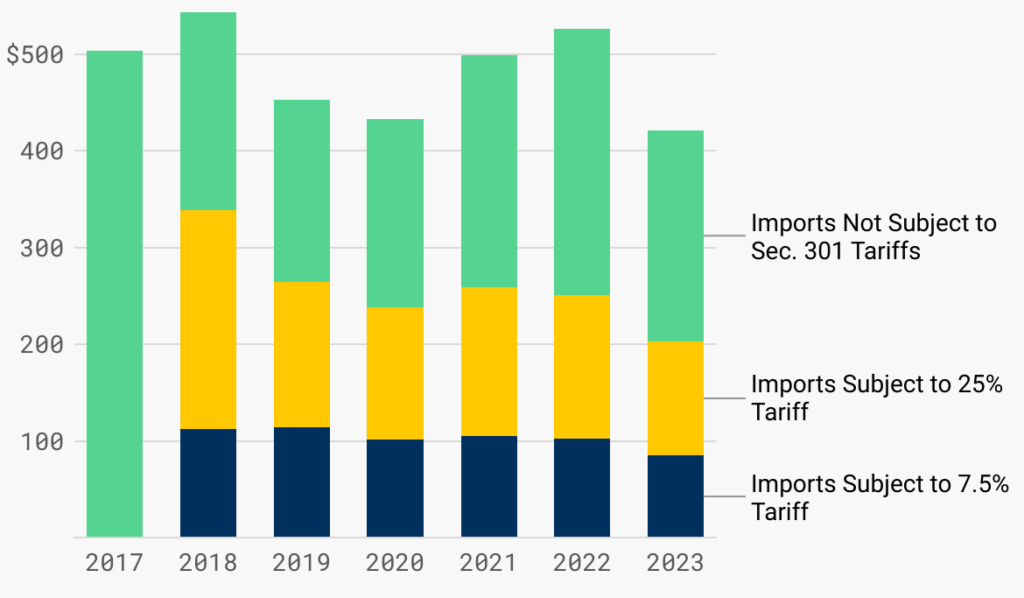

Independent economists estimate that universal $2,000 payments could cost approximately $600 billion per year. By comparison, federal tariff collections generally total $200–$300 billion annually, depending on trade volumes, tariff schedules, and global economic conditions.

“Even significant tariff expansions are unlikely to generate the revenue needed to sustain payments of this scale,” said Dr. Elaine Porter, a trade economist at Georgetown University. “There is a very wide gap between the promise and the math.”

Potential Tariff Changes

Officials have hinted that certain new or expanded tariffs—particularly on strategic goods—may increase revenue. However, trade groups warn that aggressive tariff hikes could increase costs for importers and consumers.

The U.S. Chamber of Commerce said in a recent statement that tariff increases “risk raising prices on essential goods, hurting the same households the rebate aims to help.”

Legal and Legislative Considerations

Congressional Approval Required

Most federal direct-payment programs require legislation. Administration lawyers say the White House cannot authorize recurring rebates without congressional authority, though it could possibly issue one-time credits under certain emergency powers.

Several Republican senators have questioned the plan’s fiscal implications. Democrats have asked for detailed projections and clarity about which tariffs would fund the program.

Court Challenges and Trade Law Constraints

Parts of the U.S. tariff structure are currently being challenged in federal courts. If judges rule that certain tariffs exceed presidential authority under the International Emergency Economic Powers Act, revenue losses could follow.

“Legal uncertainty adds another layer of risk,” said Mark Devereaux, a former trade counsel for the Senate Finance Committee. “If tariff revenue falls because of a court ruling, the entire rebate proposal could be jeopardized.”

Historical Precedent: How This Compares to Past Federal Relief

Economists often compare the plan to past direct payments:

- 2001 tax rebate checks under President George W. Bush

- 2008 economic stimulus payments during the financial crisis

- 2020–2021 COVID-19 relief payments under the CARES Act and American Rescue Plan

While these programs delivered significant short-term financial support, they were funded through congressional appropriations—not through tariff revenue.

“This proposal is unique because it relies on a revenue stream that fluctuates with global trade,” said Professor Samuel Leigh of the Brookings Institution. “That alone creates structural uncertainty.”

Economic Stakes and Potential Effects

Inflation Risks and Consumer Prices

Several economists warn that large-scale payments could push inflation higher if supply chains remain constrained. Others say the impact might be modest if the payments are offset by decreased consumer spending on imported goods.

Tariffs themselves generally increase the price of imported items, especially electronics, machinery, and household goods. Rebates may offset some of those increases for lower-income families, but analysts say the net effect would vary widely across demographics.

Industry Reactions

Major industry groups are split. Retailers who rely on imported goods say tariff hikes could significantly increase costs. Domestic manufacturers say the policy could help level the competitive field against foreign producers. Agricultural groups, however, fear retaliation from trading partners.

Political Implications Ahead of 2025

The rebate debate comes at a politically sensitive time as policymakers prepare for next year’s legislative cycle. Supporters say the plan could provide meaningful relief to households struggling with rising prices. Critics argue it may be structured more as a political promise than a practical economic policy.

Some analysts say the rebate could influence upcoming budget negotiations, especially if lawmakers demand clearer fiscal offsets.

Others warn that shifting trade policy to fund domestic payments risks escalating global trade tensions.

Global Trade Context

International Reactions and Economic Tensions

Several U.S. trading partners have expressed concern about expanded tariffs. Officials in the European Union, Mexico, and Canada have signaled they may respond with targeted tariffs if the U.S. imposes broad increases.

Trade experts say such moves could reduce overall trade volume, thereby shrinking tariff revenue—the very funding source the rebate depends on.

“The irony is that retaliation from trading partners could undermine the program before it even launches,” said Dr. Nisha Patel, a senior fellow at the Center for Strategic and International Studies.

Implementation Scenarios: Best-Case, Middle-Case, Worst-Case

Best-Case Scenario

- Congress approves the program early in 2025

- Revenue projections meet expectations

- Payments begin by late summer 2025

Middle-Case Scenario

- Congress delays decision until budget negotiations

- Payments are reduced or delivered as tax credits

- Rollout begins in early 2026

Worst-Case Scenario

- Legal rulings reduce tariff revenue

- Congress rejects funding

- No payments are issued

Social Security 2026: Bigger Raise, New Limits, and One Costly Change

Looking Ahead

The White House says it will release more detailed guidance once internal fiscal analyses are complete. Until then, households and lawmakers must wait for clearer information about eligibility, timing, and long-term funding. Whether Trump’s $2000 Tariff Rebate becomes a meaningful 2025 financial benefit—or remains a contentious political idea—will depend on economic conditions, legal developments, and congressional negotiations in the coming months.