The United States will implement sweeping changes to SNAP benefits on December 1, introducing tighter income rules and expanded work requirements that could push hundreds of thousands of low-income adults off the program, according to federal implementation guidance and recent estimates from the Congressional Budget Office (CBO).

SNAP Benefits

| Key Fact | Detail / Statistic |

|---|---|

| New implementation date | December 1, 2025 |

| Estimated people losing benefits | ~1.1 million over the next decade |

| Expanded work requirement age range | Adults 18–64 |

| States losing waiver flexibility | Most counties under 10% unemployment |

States, advocacy groups, and federal officials anticipate a turbulent adjustment period through early 2026. Recertification surges, verification delays, and shifting eligibility rules may result in temporary disruptions to benefits.

“Implementation will determine the real impact,” said Dr. Morris of Brookings. “The next six months will be critical in assessing how deeply these changes affect food security nationwide.”

A Major Shift in SNAP Benefits Policy Begins in December

The Supplemental Nutrition Assistance Program (SNAP), which serves nearly 42 million Americans each month, will undergo some of its most significant changes in decades. The adjustments include stricter income rules, expanded work requirements, and narrower exemption categories for vulnerable adults.

The reforms stem from the One Big Beautiful Bill Act, a federal budget package passed in July 2025 that restructured several federal safety-net programs. According to the U.S. Department of Agriculture (USDA), states must meet a December 1 implementation deadline, leaving administrators little time to overhaul systems and notify recipients.

Anti-hunger organizations warn that the transition could be disruptive. “These changes are not just administrative tweaks,” said Maria Ortiz, policy director at National Hunger Coalition. “They reshape who is allowed access to food assistance in the U.S. and under what conditions.”

Why Congress Changed SNAP: The Policy Debate Behind the Overhaul

Supporters Cite Labor Force Participation Concerns

Members of Congress who backed the revisions argue that expanded workforce participation is essential for long-term economic stability. Several proponents referenced post-pandemic labor shortages as evidence that more “able-bodied adults” should be working or training.

“What we’re doing is restoring accountability while making sure help goes to those truly in need,” said a senior Senate sponsor during debate over the legislation.

Economists at the American Enterprise Institute, a right-leaning policy organization, have long argued that work requirements increase employment among low-income adults. Their studies suggest that structured work rules can boost participation rates in some sectors.

Critics Warn the Rules Overlook Real-World Barriers

Opponents contend that the legislation imposes unrealistic expectations on workers with unstable schedules, limited job access, or restricted transportation.

“The assumption that jobs are abundant and accessible to all doesn’t match what we observe in rural and low-income urban communities,” said Dr. Anya Sharma, a social policy professor at Ohio State University.

Several nonpartisan bodies, including the Government Accountability Office (GAO), have warned in prior reviews that work requirements often reduce benefit rolls without significantly increasing employment.

Understanding the New Income Rules

Stricter Verification and Documentation

Beginning in December, SNAP offices will enforce tougher verification procedures designed to ensure households accurately report income, expenses, and assets. States must adopt tighter standards for:

- Pay stubs and employer-provided wage documentation

- Housing and utility deductions

- Bank account balances and countable assets

- Unreported gig-economy or cash-based income

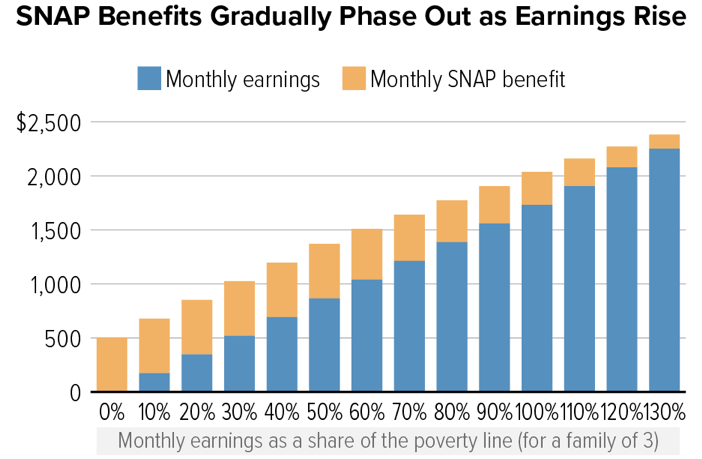

A report from the Center on Budget and Policy Priorities notes that even small shifts in how deductions are calculated can reduce benefits for families near the eligibility ceiling.

Case Example: A Single Parent Household

A single parent with one child earning $1,750 per month might previously have qualified with a modest child care deduction. Under the new formula, stricter deduction rules may reduce eligibility or lower benefit amounts.

Consumer advocates warn that small errors—missed pay stubs, inconsistent hours, or lapses in documentation—could result in temporary or permanent loss of benefits.

Expanded Work Requirements: The Most Consequential Change

Widening the Age Range to 64

The age range for Able-Bodied Adults Without Dependents (ABAWDs) is expanding from 18–54 to 18–64, capturing millions of older adults. These individuals must now complete:

- 80 hours of work per month, or

- Participation in approved training, education, or volunteer programs

Failure to meet requirements for three months within a 36-month window triggers loss of benefits.

Labor experts express concern that adults in their late 50s and early 60s often face significant hiring barriers. “We see steep declines in hiring for workers over 55, particularly in physically demanding or technology-heavy sectors,” said David Roemer, a senior labor economist at Georgetown University.

Exemptions Narrowed for Key Vulnerable Groups

Previously, exemptions applied to:

- Veterans

- People experiencing homelessness

- Individuals who aged out of foster care

- Adults living in high-unemployment areas

Most of these exemptions will be reduced or removed.

Advocacy groups argue that these populations often struggle with mental health challenges, disability, limited transportation, and unstable housing, making consistent compliance difficult.

State Impact: Limited Waivers and Uneven Economic Conditions

Waivers Restricted to Areas Above ~10% Unemployment

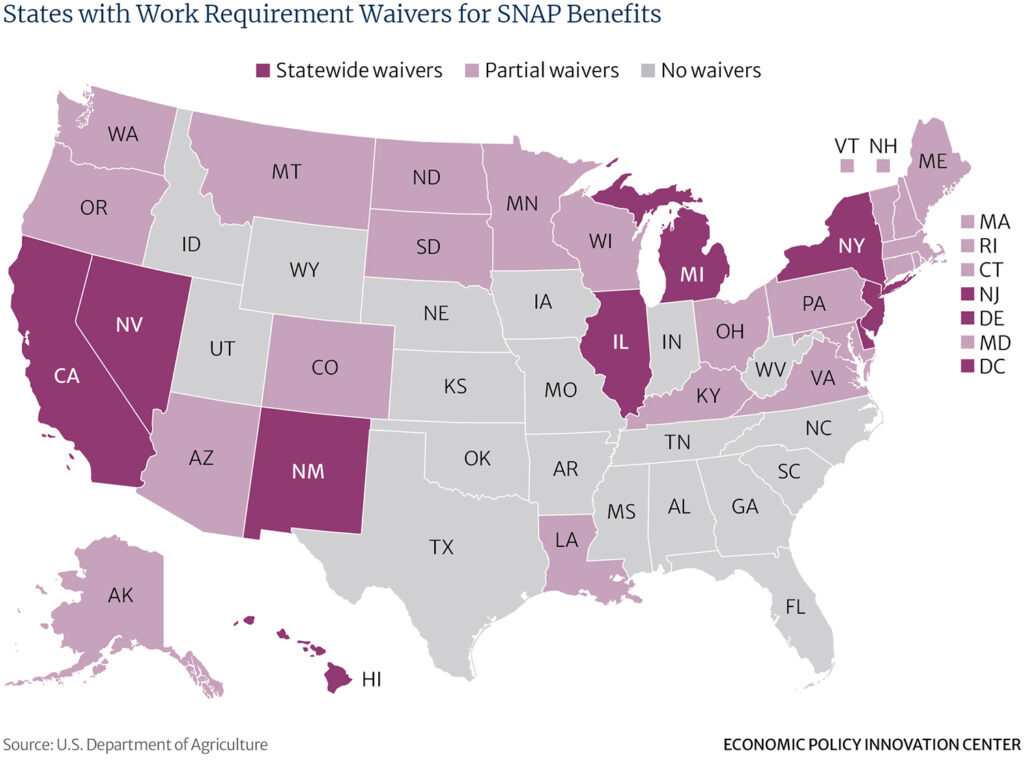

Under past policy, states could exempt counties or regions facing economic hardship. Beginning in December, waivers will be allowed only in areas with unemployment rates above roughly 10%, a level far exceeding typical U.S. averages.

According to Stateline, only a small number of counties—mostly in parts of Alaska, Michigan, and New Mexico—currently qualify.

States Facing Administrative Burdens

Officials in Florida, Pennsylvania, and Oregon say their agencies face tight deadlines to retrain staff and update eligibility software. Several state administrators reported concerns about:

- Staff shortages

- Outdated case-management systems

- Time required to notify and recertify millions of households

“Even eligible households could lose benefits because of paperwork delays,” said an official with the National Association of State Human Services Agencies.

Real-World Scenarios: Who Is Most at Risk

Workers With Variable Schedules

Retail, warehouse, and service workers often face inconsistent hours. A week of reduced shifts may mean falling below required thresholds, while overtime weeks complicate reporting.

Rural Households With Limited Job Access

Rural counties frequently lack training programs, volunteer opportunities, and reliable public transit—factors essential for meeting work requirements.

Adults Aged 55–64 With Health Limitations

Many older adults have chronic conditions that do not qualify as full disabilities but still limit the ability to maintain steady work.

Noncitizens With Previously Accepted Legal Status

Some humanitarian categories may face stricter review or disqualification under new federal criteria.

Economic Impact of SNAP Benefits Shift Again in December: What Researchers Expect

Potential Reduction in Food Insecurity—Or Worsening?

Studies diverge. Supporters argue that pushing more adults to work will reduce long-term poverty. Critics warn that reduced food access may worsen health outcomes, increase medical spending, and destabilize households.

A Pew Research Center review of past SNAP policy shifts found that work requirements have historically led to significant caseload declines but minimal gains in employment.

Effects on Local Economies

SNAP benefits circulate directly into local grocery stores and small businesses. Economists estimate that each SNAP dollar generates between $1.50 and $1.80 in local economic activity.

Reductions in program participation may disproportionately affect:

- Small-town grocers

- Farmers’ markets

- Food manufacturers

- Transportation to rural food outlets

How the U.S. Compares Globally

Most wealthy nations provide some form of food or income assistance, but the U.S. is unusual in tying food access to employment for non-disabled adults.

Countries such as Canada, Germany, and the United Kingdom rely more on unconditional income supports, often without strict monthly work-hour thresholds.

Dr. Sofia Klein, a researcher at the London School of Economics, says the U.S. approach reflects a “work-first philosophy not shared by many peer nations.”

Medicare Rate Shock for 2026: How Much More Will You Pay Next Year?

Political Outlook and Possible Legal Challenges

Several advocacy organizations indicate they may challenge aspects of the law in federal court, arguing that certain provisions violate administrative procedure or improperly limit state flexibility.

Congressional oversight hearings are expected next spring, with both parties signaling deeper scrutiny of implementation outcomes.

The Biden administration has said it will “ensure smooth and lawful implementation,” while some lawmakers have hinted at possible amendments if early data show unexpected harm.