The 2026 Social Security cost-of-living adjustment (COLA) will deliver a 2.8% increase beginning in January, raising average monthly payments for more than 70 million Americans. The year will also bring higher earnings limits and a larger taxable wage ceiling, while a significant rise in Medicare Part B premiums is expected to reduce how much of the raise beneficiaries actually keep.

Social Security 2026

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA | 2.8% increase; average check rises from ~$2,015 to ~$2,071 |

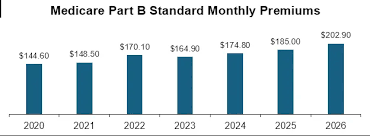

| Medicare Part B Premium | Expected to rise ~10% to $202.90 |

| Earnings Limit (Below FRA) | $24,480 before reductions apply |

| Taxable Wage Base | Rises to $184,500 from $176,100 |

| FRA Requirement | Full retirement age remains 67 for workers born in 1960+ |

| Official Website | Social Security Administration |

Although 2026 brings new challenges and opportunities for retirees and workers alike, the broader debate over Social Security’s future remains unsettled. Policymakers and analysts expect renewed efforts in Congress to address long-term financing before the end of the decade.

Why Social Security’s 2026 Changes Matter

The Social Security Administration (SSA) announced that benefits will rise by 2.8% in 2026, an adjustment driven by inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). According to the SSA, this will increase the average monthly retirement benefit by about $56, raising it to $2,071.

Economists say the increase is meaningful, though smaller than the high-inflation spikes seen in recent years. “A COLA of 2.8% is moderate by historical standards, but it’s consistent with inflation settling into a post-pandemic range,” said Dr. Marcus Hill, an economist at Georgetown University.

Yet this raise comes with complications. Medicare Part B premiums — deducted from many retirees’ benefit checks — are projected to jump in 2026, reducing the net value of the COLA.

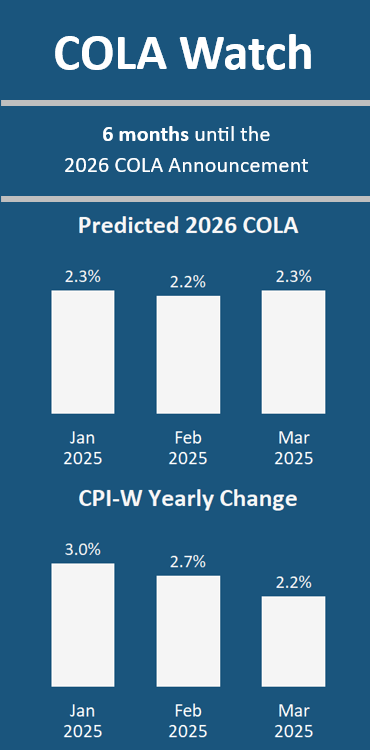

How the COLA Was Calculated

The COLA is not set by Congress but instead follows a formula written into federal law. The SSA compares the average CPI-W index from Q3 2024 to Q3 2025, calculating the percentage increase year over year.

- If inflation rises → COLA goes up

- If inflation falls → COLA decreases

- If inflation drops below zero → COLA can freeze, but cannot go negative

The CPI-W tracks inflation experienced by working households, not seniors specifically. Many policy experts argue this misaligns with older Americans’ higher spending on healthcare and housing.

“The COLA formula has not kept pace with the real-world expenses older adults face,” said Mary Johnson, Social Security and Medicare analyst at the Senior Citizens League, in a statement to the Associated Press.

Comparing 2026 With the Last Decade

For context, COLA levels over the previous 10 years:

| Year | COLA |

|---|---|

| 2016 | 0% |

| 2017 | 0.3% |

| 2018 | 2.0% |

| 2019 | 2.8% |

| 2020 | 1.6% |

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.5% |

| 2026 | 2.8% |

While 2026’s COLA lands near the middle of the decade’s range, analysts emphasize that recent inflation has eroded buying power faster than benefits have grown.

Major Changes for 2026: Beyond the Raise

Higher Earnings Limits for Working Beneficiaries

For Americans who continue working while receiving Social Security benefits:

- Below full retirement age (FRA):

Earnings limit rises to $24,480.

SSA withholds $1 in benefits for every $2 above the limit. - Year of reaching FRA:

Earnings limit increases to $65,160.

SSA withholds $1 for every $3 above the limit.

These thresholds allow greater financial flexibility for part-time workers and retirees supplementing their income.

Increase in the Taxable Wage Base

The maximum annual earnings subject to Social Security payroll taxes rise to:

- 2026: $184,500

- 2025: $176,100

This affects high-earning workers and increases FICA contributions. It also lays the groundwork for higher potential benefits later.

The Costly Change: Medicare’s Premium Increase

The standard Medicare Part B premium is projected to rise by 10%, reaching $202.90/month. According to MarketWatch and Medicare trustees’ projections, this could erase nearly one-third of the average beneficiary’s COLA increase.

For many retirees:

- COLA provides +$56/month.

- Part B premium increase removes roughly −$17 to −$20/month.

- Net increase: ~+$35 to +$38/month.

“Healthcare costs continue to rise faster than general inflation,” said Dr. Angela Ruiz, a policy expert at the Kaiser Family Foundation. “The elderly population is disproportionately affected because medical spending grows as people age.”

Who Will Feel the 2026 Changes Most

1. Fixed-Income Retirees

Retirees heavily reliant on Social Security may see only a modest net improvement, especially if they face rising rent, prescription costs, and food prices.

2. Older Adults with High Medical Needs

Because healthcare inflation outpaces CPI-W, many seniors will experience real declines in purchasing power.

3. Working Beneficiaries

Those still in the workforce should benefit from higher earnings limits. Part-time workers can keep more of their income before triggering benefit reductions.

4. High-Income Workers

Higher taxation due to the increased wage cap results in:

- Lower take-home pay in 2026

- Higher future benefit potential

5. Americans Nearing Retirement

As the full retirement age (FRA) remains at 67, individuals born in 1960 or later must plan for delayed full benefit eligibility.

Long-Term Solvency Concerns Remain

According to the 2024 Social Security Trustees Report, the combined retirement and disability trust funds face partial depletion by the mid-2030s unless Congress intervenes.

Experts outline three main policy paths:

Option 1: Raise Taxes

Supported by many Democratic lawmakers:

- Increasing payroll tax cap

- Raising payroll tax rate slightly

- Applying Social Security tax to extremely high incomes

Option 2: Reduce Benefits

Supported by some Republican lawmakers:

- Gradually raising FRA to 68 or 69

- Adjusting benefit formula

- Implementing means testing

Option 3: Mixed Reforms

Economists at the nonpartisan Committee for a Responsible Federal Budget (CRFB) say a blended approach is “the only politically viable long-term solution.”

“The longer Congress waits to act, the more abrupt the necessary changes will be,” said Dr. Anya Sharma, senior fellow at the CRFB.

Legislative Landscape Heading into 2026

Congress is not currently advancing major Social Security reform legislation, but several proposals remain under discussion:

- Social Security 2100 Act (Democratic proposal)

- Trust Act stabilization committees (bipartisan concept)

- Targeted benefit adjustments for low-income seniors

Analysts expect renewed debate ahead of the 2026 midterm elections, especially as the trust-fund deadline approaches.

SNAP Just Got a “Fundamental Rebuild” — 42 Million Americans Must Reapply Immediately

What Beneficiaries Should Do Now

- Review updated benefit amounts via My Social Security online portal.

- If working, ensure projected earnings fall within 2026 limits.

- Adjust budgeting for higher Medicare Part B deductions.

- Evaluate supplemental insurance options if healthcare costs rise.

- Monitor legislative discussions on solvency reforms.

FAQ About Social Security 2026

Will my benefits increase in 2026?

Yes. Benefits rise 2.8% beginning January 2026, per the SSA.

Why is COLA lower than inflation in some categories?

COLA uses CPI-W, a measure tied to working households, not seniors. Healthcare inflation often rises faster.

Will the Medicare premium increase reduce my COLA?

Yes. For many retirees, about one-third of the raise will be absorbed by higher premiums.

Is Social Security running out of money?

It is not “running out,” but the trust funds are projected to face partial depletion by the mid-2030s unless Congress reformulates revenue or benefits.