Reports claiming a “new Social Security rule” has sharply limited widow benefits have spread across social media, raising concerns among millions of Americans who depend on survivor payments. Despite the widespread attention, federal officials say no new Social Security rule has been introduced in 2024 or 2025. Instead, experts point to long-standing policies that continue to shape who qualifies for survivor benefits and how payments are calculated.

New Social Security Rule

| Key Fact | Detail |

|---|---|

| No new rule restricting widow benefits | SSA confirms no survivor eligibility changes |

| Existing “widow(er)’s limit” affects benefits | Reduces payments if deceased spouse claimed early |

| Over 3.6 million widows receive benefits | Survivor benefits are a major part of U.S. retirement income |

| Public confusion driven by viral posts | Misinterpretations of older rules fuel panic |

Advocacy organizations say public confusion demonstrates the need for clearer communication from federal agencies. As Congress considers future Social Security reforms, experts expect survivor benefits to remain a central point of discussion for families and policymakers alike.

Understanding the Claims Behind the “New Social Security Rule”

Claims about a rule eliminating benefits for most widows began circulating in late 2024, fueled by blogs and short-form videos that suggested only one “special group” remained eligible. These stories often lacked citations or misrepresented decades-old regulations as recent changes.

The Social Security Administration (SSA) has repeatedly stated it has not adopted any new regulation restricting survivor benefits.

“There have been no recent changes to survivor eligibility,” an SSA spokesperson told Reuters in an emailed statement. “The policies governing survivor benefits remain the same as published in federal law.”

What Survivor Benefits Currently Provide

Social Security survivor benefits are designed to support families after the death of a working spouse. According to the SSA’s 2024 report, about 3.6 million widows and widowers receive survivor payments each month, with an average benefit of $1,774.

Survivor benefits can begin:

- At age 60 for widows and widowers

- At age 50 if the surviving spouse is disabled

- At any age when caring for a child under 16 or a child with disabilities

“The survivor program is foundational for families facing loss,” said Dr. Melissa Hardy, a professor of gerontology at Penn State University. “Many households depend heavily on this income, especially for older widows.”

Long-Standing Rules Behind Today’s Confusion

Although the online claims are inaccurate, they often reference real policies that many Americans are unaware of. These rules can reduce benefits or delay eligibility, especially for younger widows.

1. The Widow(er)’s Limit (RIB-LIM)

One of the most misunderstood rules is the widow(er)’s limit, often called RIB-LIM. This regulation caps a widow’s survivor benefit if the deceased spouse filed for retirement benefits early.

For example:

If a worker filed at age 62, reducing their monthly check, the widow cannot receive more than that reduced amount—regardless of her age at filing.

“Families are sometimes surprised,” said Dr. Kathleen Romig of the Center on Budget and Policy Priorities, “because they assume survivor benefits always equal 100 percent of the worker’s full retirement amount. That’s not true if early claiming occurred.”

2. The Nine-Month Rule

Federal law requires a couple to be married for at least nine months to qualify for survivor benefits, unless the death resulted from an accident or military service. This rule dates back decades and has not changed.

3. Remarriage Rules

While remarriage after age 60 (or 50 for disabled widows) does not affect eligibility, remarriage before those ages generally makes a widow ineligible for survivor benefits based on a previous spouse’s record.

4. Non-U.S. Citizen Rules

International marriages have specific rules. According to the SSA, some non-citizen widows may lose benefits if they live outside the United States in a country without a Social Security agreement.

A Look at the Origins: How Survivor Benefits Evolved

Survivor benefits were added to the Social Security Act in 1939, originally focused on protecting widowed mothers who relied on a male breadwinner. Over time, Congress expanded the system to reflect modern families.

Key Changes Over the Decades:

- 1965: Disabled widows allowed to claim benefits at age 50

- 1972: Cost-of-living adjustments (COLA) introduced to protect against inflation

- 1983: Gradual increase in full retirement age, indirectly affecting survivor benefit calculations

- 2000: Change allowing widows to keep survivor benefits after remarriage after age 60

Despite these updates, many underlying rules—such as the widow(er)’s limit—have remained unchanged for decades.

Why Misinformation Spread So Quickly

Analysts say fear, confusion, and unclear personal finance content contribute to rapid viral spread.

“A single headline claiming only one group ‘still qualifies’ can generate panic,” said Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget. “Survivor benefits are complex. Misunderstandings are almost guaranteed when nuance is lost.”

Posts lacking citations or mixing unrelated rules with speculation gained millions of views on platforms like TikTok and Facebook.

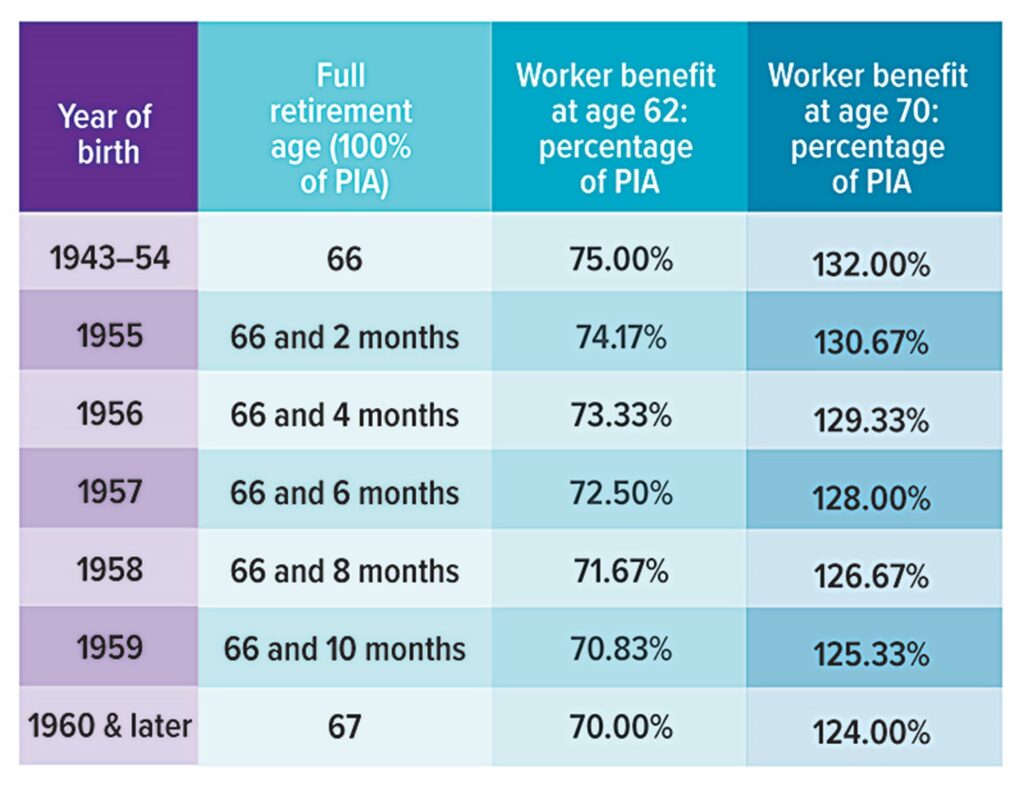

How Survivor Benefits Are Calculated

While many Americans assume they will receive the deceased spouse’s full monthly amount, the calculation is more complicated.

Factors That Influence Payment Amount:

- Worker’s claiming age

- Survivor’s claiming age

- Full Retirement Age (FRA)

- Early claiming penalties

- Delayed retirement credits

- Family maximum benefit rules

- Any benefits the survivor already receives on their own record

A widow claiming at age 60 may receive 71.5 percent of the deceased spouse’s benefit. Claiming at full retirement age can provide 100 percent.

Economic and Demographic Impact

Survivor benefits play a critical role in preventing poverty among older Americans. According to the Pew Research Center, widows are more likely than married women to rely on Social Security for the majority of their income.

Key demographic findings:

- Nearly one in three widows depend on Social Security for 90% or more of their income.

- Women live longer on average, making survivor benefits essential for retirement security.

- Black and Hispanic widows face higher economic vulnerability and rely more heavily on survivor benefits.

“These benefits are not just helpful—they’re lifesaving for many,” said Dr. Tanya Clay, a senior fellow at the National Academy of Social Insurance.

Potential Policy Changes Under Discussion

While no rule has changed recently, lawmakers and policy groups have proposed reforms to modernize the system.

Proposals include:

- Increasing survivor benefit percentages

- Adjusting the widow(er)’s limit

- Enhancing benefits for low-income widows

- Allowing partial survivor benefits while working

- Simplifying the claiming process

None of these proposals have been enacted, but analysts say debate will intensify as Congress considers broader Social Security reforms.

Critical Deadline Set: Retirees Must Act by December 31 to Receive New 2.8% COLA

What Widows Should Do Now

The SSA recommends widows take the following steps:

1. Review your benefits online

Create a “my Social Security” account to check your estimated survivor benefits.

2. Contact the SSA directly

For complex cases, speaking with a representative is advised.

3. Keep documentation

Marriage certificates, death certificates, and proof of age will be needed for claiming.

4. Consider timing

Delaying survivor benefits until full retirement age can significantly increase monthly payments.

FAQ About New Social Security Rule

1. Did any new Social Security rule recently change widow eligibility?

No. The SSA confirms that survivor rules have not changed in 2024 or 2025.

2. Is it true that only one group of widows still qualifies?

No. This claim originated from misleading online posts.

3. Can widows still get 100% of a spouse’s benefit?

Yes—if they claim at full retirement age and if the deceased spouse had not taken early retirement.

4. Does remarriage affect eligibility?

Remarriage after age 60 does not affect survivor benefits.

5. Are disabled widows treated differently?

Yes. Disabled widows can claim benefits at age 50.