A new policy proposal to create a Social Security COLA cap for the nation’s highest-benefit retirees is gaining national attention as lawmakers search for ways to strengthen the long-term finances of the retirement program. The plan would continue to provide annual cost-of-living adjustments to all beneficiaries but would limit how much the largest payments could grow each year, marking one of the most targeted reforms discussed in recent years.

New Social Security Plan

| Key Fact | Detail |

|---|---|

| Purpose of proposal | Slow benefit growth for the highest-paid beneficiaries while protecting inflation adjustments for most retirees |

| Financial impact estimate | Could reduce long-term spending growth by tens of billions over a decade |

| Who is affected | Only those with the largest monthly benefits, typically high earners with long and high-wage careers |

Why the Proposal Emerged

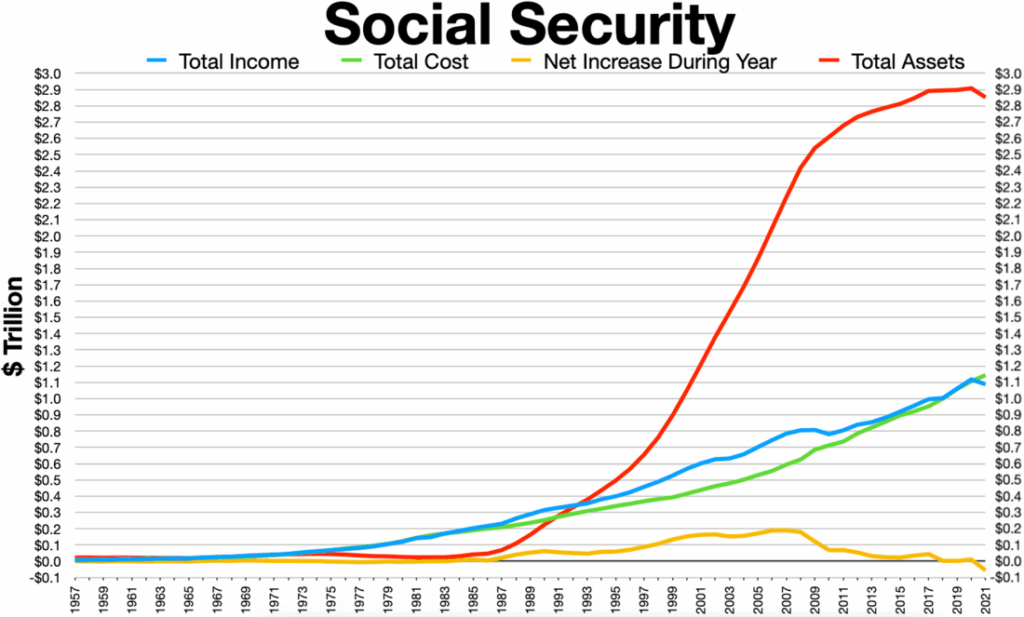

Mounting Pressure on the Trust Fund

For nearly a decade, the Social Security retirement trust fund has faced the same warning: without policy changes, reserves could be exhausted within the next ten to fifteen years. Once depletion occurs, the program can only pay out what it collects in payroll taxes, which would automatically reduce benefits for all recipients.

Economists note that the underlying challenge is structural. The retiree population is growing as Americans live longer, while the number of workers contributing payroll taxes is not increasing at the same pace. The gradual aging of the population, combined with long periods of low birth rates, has shifted the balance between contributions and benefits.

A Social Security COLA cap represents an attempt to moderate spending growth without touching the base benefits of retirees who depend most heavily on the program. Instead, it concentrates adjustments on retirees with higher benefit levels, who may have greater financial capacity to absorb smaller increases.

How the COLA System Works

The Current COLA Formula

The Cost-of-Living Adjustment, or COLA, is an annual increase in Social Security benefits designed to keep pace with inflation. Since 1975, COLAs have been tied to a federal price index that measures the cost of goods and services.

In most years, the COLA ranges between 1% and 4%, though periods of high inflation can push it higher. The goal is straightforward: protect the purchasing power of retirees whose income relies on fixed monthly payments.

Why Reformers Target COLA

Financial analysts emphasize that COLA growth is one of the largest drivers of long-term program spending, second only to demographic changes. Because COLA applies to all beneficiaries, even small percentage increases translate into substantial federal costs.

Proponents of reform argue that giving the full COLA to retirees with the largest benefits—often exceeding $40,000 to $60,000 per year—may no longer be fiscally sustainable. A COLA limit is seen as a way to slow cost growth without broadly reducing benefits.

How a Social Security COLA Cap Would Work

The Cap Mechanism

Under the proposed system, the government would continue calculating the COLA as usual. However, instead of applying that full percentage to all benefit levels, the plan would limit the maximum dollar amount of the increase received by high-benefit retirees.

For example:

- If inflation produces a 2.5% COLA, a retiree receiving $20,000 per year would still receive the full increase.

- A retiree receiving $55,000 annually might see their increase capped at the dollar amount corresponding to a smaller benefit level—such as what the 75th-percentile beneficiary receives.

In practice, the cap introduces a sliding scale that grows slower at the top but preserves full inflation protection for most beneficiaries.

Impact on High Earners

A high earner with a $50,000 annual benefit might normally receive a $1,250 increase in a year with a 2.5% COLA. Under a cap, that increase could be limited to a set value—perhaps $900 or $1,000—depending on the policy design.

Experts say that while this reduces the growth of benefits over time, it does not immediately cut base benefits. The effect compounds gradually, which policymakers view as less disruptive than across-the-board reductions.

Reactions From Policy Experts

Supporters Highlight Fairness and Targeting

Those supporting the proposal argue that the highest-benefit retirees are better positioned to absorb slower benefit growth. Supporters also say that protecting full COLAs for lower and middle-income retirees reinforces the program’s mission of providing basic economic security for older adults.

One fiscal researcher noted that “the structure makes the system more progressive without eliminating inflation protection entirely.”

Critics Express Concerns Over Erosion of Benefits

Opponents argue that the COLA cap could gradually erode the real value of benefits for retirees who spent decades paying higher payroll taxes. They also warn that any cap—even if targeted—may set a precedent for future reductions.

Advocacy groups representing older Americans emphasize that retirees face rising medical, housing, and energy costs that often outpace inflation measures. They caution that limiting growth for any group may understate the financial pressures faced by retirees.

Broader Context for The Debate

Historical Perspective

Social Security has undergone several reforms since its creation in 1935, including major updates in 1972 and 1983. Each reform reflected a balance between stabilizing finances and preserving commitments to retirees.

The Social Security COLA cap represents a newer type of policy lever—one that affects growth rather than initial benefits.

Inflation Debates

Some economists argue that the index used for COLA underestimates retirees’ cost pressures, especially in healthcare. Others say the formula already overcompensates during volatile economic periods.

Introducing a cap within this broader debate raises questions about whether current measures properly reflect retirees’ actual expenses.

Who Would Be Affected

Beneficiaries Least Likely to See Change

- Retirees with average or below-average benefits

- Workers with low or moderate lifetime earnings

- Widows, widowers, and disability recipients with smaller benefit amounts

These groups would continue receiving the full annual COLA as calculated.

Beneficiaries Most Likely to See Reduced Growth

- High earners with long, full-time careers

- Retirees who delayed claiming benefits to maximize monthly payments

- Dual-income households with combined high benefits

For these retirees, the COLA limit may represent a noticeable change over time, especially during years of higher inflation.

How Analysts Model the Effects

Long-Term Federal Savings

Budget analysts estimate that limiting COLA growth for the top 10% to 25% of beneficiaries could reduce long-term costs by tens of billions of dollars within a decade. The total depends heavily on:

- the percentile threshold,

- the indexing formula, and

- whether the cap itself grows annually.

Distributional Effects

Financial models show that:

- The bottom 75% of beneficiaries maintain full inflation adjustments.

- The top 5% see the largest reduction in long-term benefit growth.

- The overall progressivity of Social Security increases.

International Comparisons

Several industrialized countries have already implemented similar measures, limiting pension growth for higher-income retirees while preserving inflation adjustments for lower earners. These experiences show that targeted adjustments can help extend solvency without cutting base benefits.

$1000 Payments on November 20 — Are You Eligible to Get Payout on This Week?

Future Outlook

As policymakers debate how to handle the looming trust fund shortfall, the Social Security COLA cap is emerging as one of the more politically feasible options. It avoids the more controversial approaches of raising the retirement age or sharply increasing payroll taxes.

However, the fate of the proposal will depend on bipartisan negotiations, economic conditions, and how the public responds to discussions of limiting growth for wealthier retirees.