The U.S. government is urging millions of older Americans to review their health coverage, financial records, and benefit information ahead of the Social Security deadline on December 7, which marks the end of the annual Medicare Open Enrollment period. Federal officials say the date is critical for retirees who must confirm or update their Medicare plans, avoid unexpected medical expenses, and ensure their Social Security deductions and records remain accurate heading into the new year.

Social Security Deadline

| Key Fact | Detail / Statistic |

|---|---|

| Annual Medicare Open Enrollment Deadline | December 7 |

| Changes Take Effect | January 1 of the following year |

| Average Monthly Social Security Benefit | $1,907 as of 2024 |

| Medicare Beneficiaries in the U.S. | ~66 million people |

| Percentage of Retirees Paying Part B via Social Security | About 80% |

| Official Website | Social Security Administration |

Several nonprofit organizations, including the National Council on Aging, plan to publish new guides in the coming weeks to help seniors better understand the evolving Medicare landscape. Local community centers and libraries are also preparing to host informational sessions as the enrollment window closes.

Why the Social Security Deadline Matters More This Year

While the Social Security Administration (SSA) does not require retirees to renew their retirement benefits annually, the Social Security deadline has become shorthand for the Medicare enrollment cutoff that directly affects how benefits are processed.

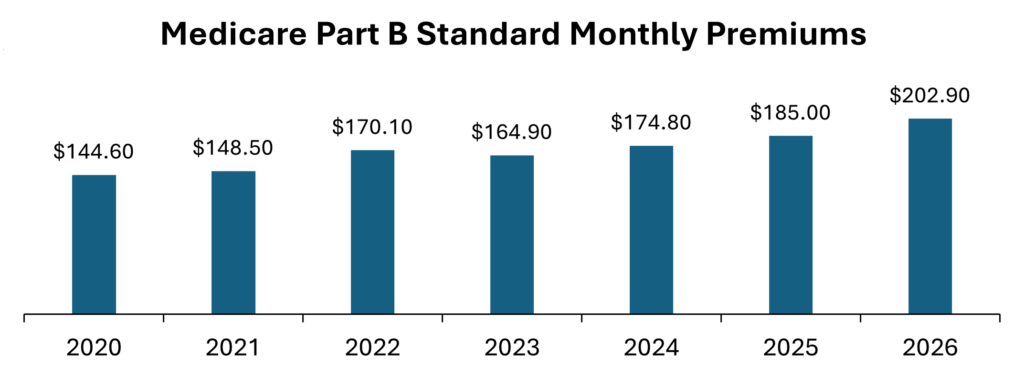

This year, the deadline takes on greater significance due to shifting healthcare costs, new policy changes affecting prescription drugs, and adjustments to Part B premiums, which are often deducted directly from Social Security checks.

Federal officials say retirees who fail to review their plans by December 7 may face higher out-of-pocket costs or reduced access to preferred doctors and pharmacies.

“Beneficiaries should examine their Medicare choices closely to make sure their plans meet next year’s needs,” CMS Administrator Chiquita Brooks-LaSure said during a recent briefing. She noted that several plans have adjusted their drug formularies, premiums, and provider networks for 2025.

What Changes for Retirees in 2025

Shifts in Drug Pricing Under Federal Reforms

Prescription drug costs remain one of the most significant financial concerns for older Americans. The Inflation Reduction Act introduced limits on out-of-pocket medication expenses, but some insurers have modified formularies or changed which medications require prior authorization.

Healthcare economist Dr. Lisa Harwood of the University of Michigan said the changes “may save many retirees money in the long term, but individuals still need to check which specific drugs are covered before the deadline.”

Updates to Medicare Advantage Plans

Medicare Advantage (Part C) plans have continued to grow in popularity, now covering about half of all Medicare beneficiaries. Yet these plans often see annual shifts in:

- Provider networks

- Dental, vision, and hearing benefits

- Copayment structures

- Maximum out-of-pocket limits

Consumer advocates warn that retirees should not assume their 2024 coverage will remain identical in 2025.

Social Security Records Must Be Reviewed Annually, Officials Say

The Social Security Administration urges retirees to log in to their SSA online accounts and check essential information such as:

- Earnings histories

- Benefit amounts

- Direct deposit details

- Medicare enrollment status

- Address and contact information

“Ensuring that your records are accurate is critical for avoiding overpayments or underpayments,” SSA spokesperson Dorothy Clark said in a recent announcement.

Errors in retirement benefits often go unnoticed until tax season or until discrepancies appear in Medicare billing, officials say.

How Missing the Social Security Deadline May Affect Retirees

Missing the Social Security deadline—and by extension, the Medicare Open Enrollment window—can lead to several consequences:

1. Continuing in a More Expensive Plan

If retirees do nothing, their existing Medicare plan renews automatically. This can be problematic if:

- Premiums increase

- Drug coverage changes

- A preferred doctor drops out of the plan

- A plan’s maximum out-of-pocket limit rises

2. Incorrect Benefit Deductions

Because Medicare premiums are often automatically deducted from Social Security payments, enrollment mistakes may cause inaccurate deductions starting in January. This can temporarily reduce monthly income until corrected.

3. Limited Ability to Switch Plans

After December 7, retirees who wish to switch Medicare Advantage plans must wait until the Medicare Advantage Open Enrollment Period from January 1 to March 31. Changes at that time are more limited.

Retirees Speak: Real-World Effects of Missing the Deadline

Retiree interviews conducted by senior advocacy nonprofits highlight the importance of the deadline.

Margaret Hill, a 74-year-old retiree in Ohio, missed the enrollment deadline last year. Her prescription drug plan removed a medication she uses daily, raising her annual out-of-pocket costs by about $1,600. “I didn’t know my plan had changed,” she said. “Now I check every year.”

In Florida, James Turner, 68, found that his preferred cardiologist left his Medicare Advantage network. “If I hadn’t switched, I would have had to pay out-of-network rates,” he explained.

Advocacy groups say these cases are common and illustrate why retirees must review changes.

Expert Analysis: Why Policy Makers Keep December 7 Firm

Policy analysts say the December 7 date is designed to give Medicare sufficient time to process plan updates before the new coverage year begins on January 1.

A Congressional Research Service report notes that lawmakers have considered extending the window, but Medicare officials argue that a firm deadline ensures that insurers, pharmacies, and healthcare systems have enough time to coordinate updated benefits.

Dr. Megan Lewis, a public policy researcher at Harvard University, said the timeline “helps maintain consistency and reduces administrative delays that could disrupt coverage.”

Economic Context: Rising Costs Drive Increased Urgency

The broader economic environment is also shaping government messaging this year.

Healthcare Costs Continue to Outpace Inflation

Although national inflation has cooled, healthcare inflation remains higher than average. CMS estimates suggest that national health spending grew by more than 6 percent in 2024.

Social Security Cost-of-Living Adjustment (COLA) for 2025

Retirees will receive a cost-of-living adjustment next year, but analysts note that any increase may be absorbed by rising Medicare expenses and premiums.

Economist Daniel Rivera of the Brookings Institution said, “Many retirees underestimate how much Medicare premiums and medical costs affect their net Social Security income.”

What Retirees Should Do Before December 7

Retirement planners encourage retirees to complete the following checklist:

1. Compare Medicare Plans Using the Medicare Plan Finder

The plan finder provides details on premiums, covered drugs, network providers, and estimated out-of-pocket costs.

2. Contact Insurers Directly if Coverage Is Unclear

Officials say retirees should not hesitate to call plan representatives for clarification. Phone wait times are highest in the final week before the deadline.

3. Confirm Social Security Account Information

Checking for outdated banking information or incorrect earnings records can prevent disruptions.

4. Document All Changes

Retirees should keep printed or digital confirmation records in case discrepancies arise in January.

5. Seek Free Counseling Services

State Health Insurance Assistance Programs (SHIPs) provide free, unbiased guidance.

These services are available in all 50 states and often book up before the deadline.

Looking Ahead: What May Change for 2026 and Beyond

Future policy discussions are already underway.

- Lawmakers continue to debate whether to broaden Medicare negotiation powers for prescription drugs.

- Experts expect further adjustments to Part B premiums, especially if healthcare spending continues to rise.

- The SSA is developing new digital tools to help retirees review benefits more easily, including mobile-friendly enrollment features.

Dr. Harwood, the University of Michigan economist, said these changes “reflect the growing complexity of managing retirement benefits in an aging America.”

The 3 Final Social Security Changes Are Here — And One May Hit Your Wallet Hardest

FAQ About Social Security Deadline

What is the Social Security deadline on December 7?

It refers to the final day of Medicare Open Enrollment, a period when retirees must review or update their health plans.

Does Social Security itself require renewal?

No. Social Security retirement benefits do not require annual renewal, but Medicare-related decisions can affect how benefits are deducted and administered.

What happens if I miss the deadline?

Your existing Medicare plan will automatically renew, even if costs or coverage change.

How often should I review my Medicare plan?

Experts recommend reviewing it every year because plan costs and benefits frequently change.

Will my Social Security payment change next year?

Yes. Annual cost-of-living adjustments and Medicare premium changes affect the final payment amount.