The 3 Final Social Security Changes taking effect in 2026 will adjust benefits, retirement ages, and work-related income rules for millions of Americans, according to federal projections. The updates include a cost-of-living increase, a shift in full retirement age, and higher earnings-test thresholds that may reduce early filers’ benefits if they continue to work.

3 Final Social Security Changes

| Key Fact | Detail / Statistic |

|---|---|

| COLA Estimate | 2.7%–2.8% in 2026 |

| Full Retirement Age | Reaches 67 for those born 1960+ |

| Earnings Limit | Expected ~$24,480 for early filers |

| Official Website | Social Security Administration |

The SSA will finalize COLA and earnings-test numbers in October 2025, and analysts caution that inflation trends could still shift the projections. For now, the 3 Final Social Security Changes represent the most significant adjustments retirees will face entering 2026. Policymakers continue to debate broader reforms, but any long-term solution will require bipartisan agreement.

The 3 Final Social Security Changes and Their National Impact

The Social Security Administration (SSA) says the changes arriving in 2026 are part of a long-planned modernization process designed to reflect rising life expectancy, inflation patterns, and workforce shifts. The adjustments mark the final stages of reforms authorized decades ago, but their effects will be felt most heavily today as the U.S. population ages.

1. Cost-of-Living Adjustments Are Expected to Rise in 2026

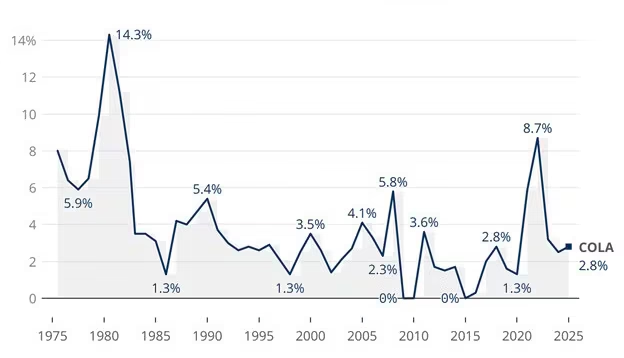

The cost-of-living adjustment (COLA) is projected at 2.7% to 2.8%, based on early estimates from the Department of Labor’s Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The final number will be released in October 2025, but analysts say the range is unlikely to change drastically unless inflation accelerates.

The average benefit of about $2,015 per month in 2025 could increase to roughly $2,071 in 2026.

Yet, experts warn that rising medical and housing costs continue to outpace COLA.

“COLA keeps benefits aligned with inflation, but it does not fully reflect the real expenses seniors face,” said Mary Johnson, policy analyst at the Senior Citizens League.

Who Benefits Most

- Retirees with fixed incomes

- Disabled workers receiving SSDI

- Survivors receiving monthly benefits

Who Gains the Least

- Retirees in high-cost states

- Individuals with significant out-of-pocket medical expenses

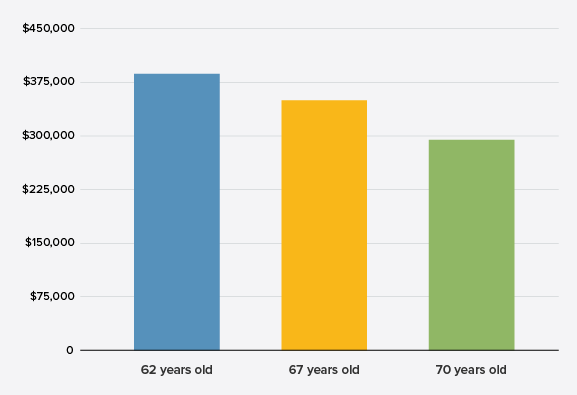

2. Full Retirement Age (FRA) Reaches 67 in 2026

The second major change is the increase in the Full Retirement Age to 67, completing a transition first enacted through the Social Security Amendments of 1983. The change applies to anyone born in 1960 or later.

Why Full Retirement Age Was Raised

Congress raised FRA in the 1980s in response to:

- Longer life expectancy

- Rising federal spending

- Pressure on Social Security trust funds

Back then, lawmakers agreed that a gradual increase would extend the system’s solvency without sharply reducing benefits.

What FRA Means For Claimants

If an individual files early at age 62, the permanent reduction will now reach up to 30%, according to SSA guidance.

Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College, said the change reflects “a reasonable adjustment to the longer lifespans Americans enjoy today,” but she noted that the increase “can be difficult for workers in physically demanding jobs who need benefits earlier.”

Example Case Study

Maria, age 62 in 2026, files early:

- FRA is 67

- She faces a 30% reduction for life

James, age 67 in 2026, files at FRA:

- Receives full benefit

- Can continue working with no earnings-test applied

3. Earnings-Test Limits Will Rise, Affecting Early Filers Who Still Work

The third change impacts Americans who claim benefits before FRA and continue to work. SSA applies an “earnings test” that temporarily withholds some benefits for individuals with income above a certain limit.

2026 Earnings Test Estimates

- Approx. $24,480 limit for early filers

- $1 withheld for every $2 earned over the limit

- A higher limit applies in the year a person reaches FRA

Expert Perspective

Andrew Biggs, senior fellow at the American Enterprise Institute, says the earnings test is “one of the most misunderstood parts of Social Security.”

“Many people believe the withheld benefits are lost permanently,” he said. “In reality, the SSA recalculates benefits at FRA, although the temporary loss can strain budgets.”

Who This Change Affects

- Early retirees working part-time or seasonally

- Individuals returning to the workforce

- People supplementing retirement income due to inflation

What These Changes Mean for Different Groups

Lower-Income Retirees

Benefit reductions from early filing hit hardest among lower-income seniors who often have little savings.

Middle-Income Households

Many middle-income retirees will need to reassess work plans to avoid earnings-test clawbacks.

Younger Workers

Those born after 1960 must plan for a later full retirement age and consider working longer.

Women and Caregivers

Because women are more likely to take career breaks, longer working years may widen retirement-saving gaps.

Broader Context: Why These Changes Are Happening Now

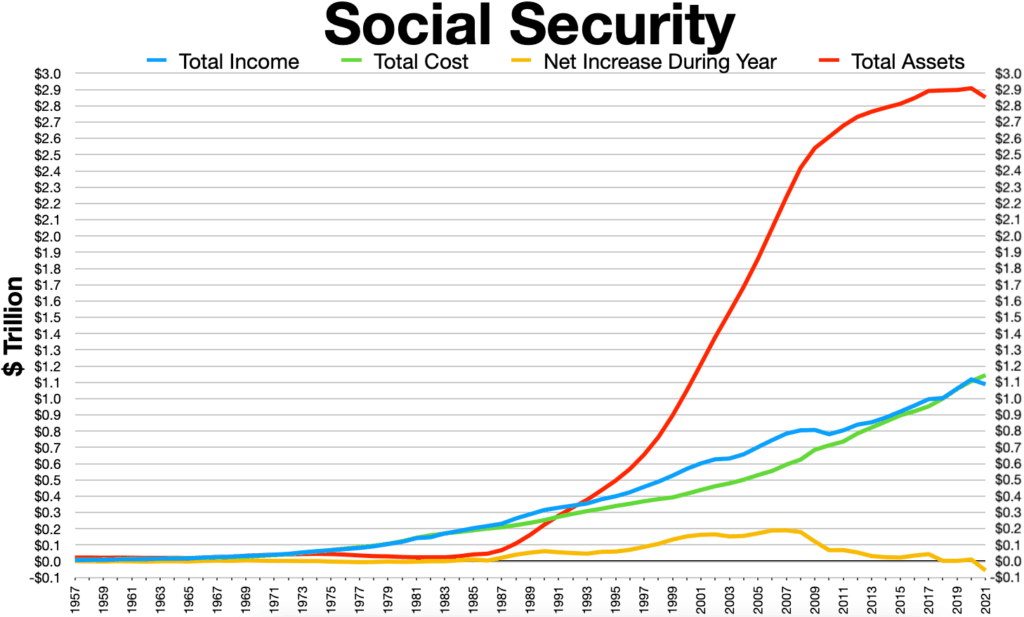

The updates come at a time when Social Security faces long-term funding challenges.

Trust Fund Outlook

The Congressional Budget Office (CBO) reported in 2024 that:

- The Old-Age and Survivors Insurance (OASI) Trust Fund may become insolvent by 2033–2035

- Without congressional action, benefits could face across-the-board cuts of 20% to 25%

Demographic Pressures

- The number of Americans over age 65 will nearly double between 2010 and 2040.

- Fewer workers support more retirees.

“We have a structural imbalance between incoming payroll taxes and outgoing benefits,” said Charles Blahous, a Social Security trustee and researcher at the Mercatus Center.

Policy Proposals Being Discussed in Washington

Lawmakers have introduced multiple competing proposals, though none have passed.

Democratic Proposals

- Raise the payroll tax cap

- Increase benefits for the lowest earners

- Adjust COLA to reflect the CPI-E (elderly index)

Republican Proposals

- Gradually raise the early filing age

- Change benefit formulas for future retirees

- Reduce long-term spending growth

Advocacy Groups

AARP has urged Congress to reach “a bipartisan, durable solution” before trust fund depletion becomes unavoidable.

Practical Guidance for Americans Preparing for 2026

Financial planners recommend several steps:

1. Review Your SSA Statement

The SSA website offers updated projections.

2. Consider Delaying Filing

Waiting even one or two years can significantly increase lifetime benefits.

3. Be Strategic About Working While Collecting

Avoid crossing earnings-test thresholds unless necessary.

4. Increase Retirement Savings

Workers under 50 can save up to $23,000 annually in 401(k)s in 2024, with higher limits for those 50+.

5. Consult a Financial Advisor

Certified planners can model break-even points and tax implications.

FAQ About 3 Final Social Security Changes

How is COLA calculated?

COLA is based on average third-quarter CPI-W data compared to the previous year.

Are earnings-test reductions permanent?

No. Withheld benefits are partially restored at FRA.

Does the FRA change affect spousal benefits?

Yes. Reductions for early filing apply to spousal benefits as well.

Do the changes affect Medicare?

No. Medicare rules and costs are separate, though often linked for retirees.