The Social Security Administration (SSA) has released the full December 2025 payment schedule, giving retirement, disability and Supplemental Security Income (SSI) beneficiaries a clear timeline for when their funds will arrive during a month shaped by federal holidays and year-end adjustments. The updated calendar outlines key payment dates, including early deposits caused by holiday closures and the January 2026 SSI payment shift.

Full December Payment Schedule

| Key Fact | Detail / Statistic |

|---|---|

| Standard Social Security payment schedule | Payments issued on Wed. depending on beneficiary birth date |

| December 2025 SSI schedule | SSI deposited Dec. 1; January 2026 SSI expected Dec. 31 due to holiday |

| Early payment rule | Benefits shift to previous business day if date falls on holiday/weekend |

| Number of beneficiaries | 70+ million Americans receive monthly Social Security or SSI |

| COLA increase for 2025 | 3.2% cost-of-living adjustment |

| Official Website | Social Security Administration |

The December 2025 calendar gives beneficiaries a stable view of when their payments should arrive, including the early January deposit at year’s end. As the SSA continues modernizing its systems and inflation trends shape future COLA adjustments, recipients can expect greater clarity about benefit timing and monthly income planning in the years ahead.

Understanding the December 2025 Social Security Payment Schedule

The December payment schedule is crucial because it falls during a month with federal holidays, year-end processing requirements and benefit shifts that affect millions of households. According to the Social Security Administration (SSA), monthly deposits follow two primary systems: one for Social Security retirement, survivor and disability benefits, and another for Supplemental Security Income (SSI).

How Social Security Payment Timing Is Determined

Social Security retirement, disability (SSDI) and survivor benefits are generally issued on Wednesdays based on the beneficiary’s birth date. This system has been in place since 1997 to distribute deposits evenly across the month.

- Birthdays 1–10 → Paid on the second Wednesday

- Birthdays 11–20 → Paid on the third Wednesday

- Birthdays 21–31 → Paid on the fourth Wednesday

An SSA spokesperson said in a recent briefing, “The staggered schedule reduces administrative pressure and ensures more predictable deposit patterns for beneficiaries and banks.”

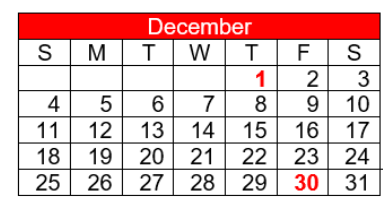

For December 2025, this results in the following dates:

- Dec. 10, 2025 – Second Wednesday

- Dec. 17, 2025 – Third Wednesday

- Dec. 24, 2025 – Fourth Wednesday

The Dec. 24 payment is particularly notable because it arrives on Christmas Eve, the last business day before the federal holiday.

What Happens When Payment Dates Fall on Holidays

Federal holidays trigger advance payment rules. Under SSA regulations, if a payment date falls on:

- a Saturday,

- a Sunday, or

- a federal holiday,

then the payment is issued on the closest previous business day.

This impacts SSI more often than Social Security, because SSI is normally paid on the first of the month — a date that frequently lands on weekends or holidays.

The December 2025 SSI Payment Schedule

Unlike retirement and disability benefits, Supplemental Security Income (SSI) is paid on the first day of each month. In December 2025:

- The regular SSI payment arrives Monday, December 1.

- The January payment is scheduled for December 31, 2025, due to the New Year’s Day holiday.

This means some SSI beneficiaries receive two payments in December, though only one applies to that month’s income.

Why Two SSI Payments Happen in December

This common year-end occurrence results from federal law, not an increase in monthly benefits. Early payments help ensure uninterrupted access to funds.

Dr. Marjorie Holmes, a senior analyst at the nonpartisan Center on Budget and Policy Priorities (CBPP), explained:

“An early January payment is an administrative necessity. It does not alter total annual benefits but ensures timely access during the holiday period when banking delays are most common.”

December 2025 Payment Calendar at a Glance

To help recipients plan, here is the complete December 2025 payment calendar:

| Benefit Type | Payment Date | Notes |

|---|---|---|

| SSI | Monday, Dec. 1 | Regular monthly payment |

| Social Security (1st–10th birthdays) | Wednesday, Dec. 10 | Second Wednesday |

| Social Security (11th–20th birthdays) | Wednesday, Dec. 17 | Third Wednesday |

| Social Security (21st–31st birthdays) | Wednesday, Dec. 24 | Fourth Wednesday |

| SSI (January 2026 benefits) | Wednesday, Dec. 31 | Early due to Jan. 1 holiday |

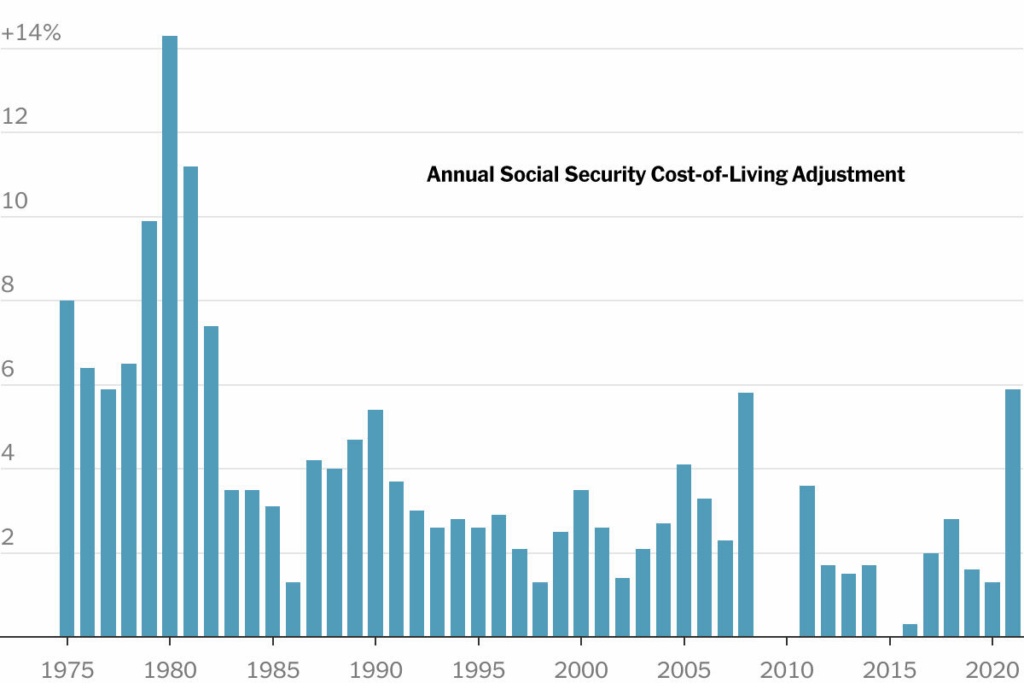

How COLA Affects December 2025 Benefits

In late 2024, the Social Security Administration announced a 3.2% cost-of-living adjustment (COLA) for 2025, based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

COLA impacts December benefits in two ways:

- The December 2025 payment uses the 2025 COLA rate.

- The January 2026 payment—deposited early on Dec. 31—reflects the 2026 COLA rate, which will be announced in October 2025.

This means many households will see:

- A consistent 2025 benefit amount through the month of December.

- A new, increased amount with the early January payment on December 31.

Quote from SSA:

“COLA ensures benefits keep pace with inflation so recipients maintain purchasing power as cost pressures shift,” said an SSA senior communications officer.

How December Payments Impact Recipient Budgets

For millions of Americans who rely on Social Security as their primary or sole income, December is a critical month for managing:

- increased holiday expenses,

- winter heating and utility bills,

- year-end medical costs,

- and property tax deadlines in some states.

According to the National Council on Aging (NCOA), over 40% of retirees depend on Social Security for 90% or more of their income.

Expert insight:

Professor Dylan Carter, an economist at the University of Michigan, noted:

“The holiday timing of Social Security payments can create cash-flow strain for lower-income households. Early SSI deposits at year’s end help bridge that gap.”

What To Do If Your December Payment Is Delayed

While most payments arrive on time, delays can occur due to:

- banking errors,

- outdated direct deposit information,

- bank holidays,

- or processing issues.

The SSA recommends waiting three business days past the expected date before contacting them.

Steps to resolve issues:

- Check your bank account or direct deposit history.

- Confirm your expected payment date using SSA documentation.

- Contact your financial institution for pending deposits.

- If still unresolved, call the SSA at 1-800-772-1213.

Policy Developments Affecting December Payments

Several policy discussions in Congress could affect future payment scheduling, though none impact December 2025 directly:

1. The debate over shifting all benefit payments to Fridays

Some lawmakers argue a consolidated payment schedule could reduce administrative costs, though SSA reports suggest Wednesday timing improves system performance.

2. Discussions on expanding SSI asset limits

Current SSI asset limits have been unchanged since 1989. Advocacy groups argue that adjusting them would stabilize long-term financial planning.

3. Proposals to change COLA formulas

Some policymakers support using a “seniors’ CPI” (CPI-E), which better reflects retiree spending patterns.

None of these proposals are yet enacted, but several analysts believe they could appear in legislative debate in 2025.

Historical Context — December Payments Over the Last Decade

Looking at past December patterns helps explain why two-payment months are common for SSI.

Over the last ten years:

- SSI payments for January have been issued early 7 out of 10 years.

- Holiday shifts have sent payments as early as December 29, depending on the calendar.

- Social Security retirement/disability benefits rarely shift unless Christmas or New Year’s falls mid-week.

Forward-Looking Considerations

The SSA has increasingly emphasized digital communication, My Social Security online accounts and modernized direct deposit systems.

The agency noted in a 2024 modernization report:

“We anticipate that by 2027, more than 95% of beneficiaries will manage their benefit information digitally.”

This trend may help reduce payment uncertainty, especially in complex holiday schedules like December.