Retirees across the United States are preparing for higher Social Security checks in 2026 after the Social Security Administration confirmed a 2.8% cost-of-living adjustment. This increase will raise monthly benefits for more than 70 million Americans. Although the adjustment applies nationwide, retirees in certain states will see larger dollar gains because their average baseline benefits are already higher.

Social Security Checks

| Key Fact | Detail |

|---|---|

| 2026 COLA Increase | 2.8% |

| Average Monthly Raise | About $56 |

| Highest-Gain States | CT, NJ, NH, DE, MD |

| Official Website | Social Security Administration |

States Seeing the Largest Increases in Social Security Checks

Although COLA applies uniformly, the percentage increase translates into different dollar amounts depending on the underlying benefit. States with higher earnings histories tend to have retirees who receive larger checks.

A recent analysis by Nasdaq identified Connecticut, New Jersey, New Hampshire, Delaware, and Maryland as the states where the largest nominal increases will occur. These states also have higher median household incomes and stronger long-term wage trends.

“Monthly benefits reflect decades of wage activity, so states with stronger lifetime earnings naturally see larger adjustments,” said Dr. Lena Torres, an economist at the Urban Institute.

How Much Will Retirees in Leading States Gain?

In 2026, the average retired worker nationwide is expected to receive about $56 more per month. In higher-income states, that figure may reach $60 or more. Connecticut retirees are projected to see the biggest nominal increase—slightly above $60—while those in Maryland may see increases closer to $59.

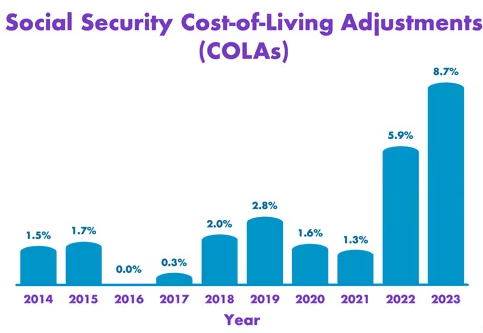

Historical Context: How 2026 Compares to Past COLAs

The cost-of-living adjustment (COLA) was introduced in 1975 to help Social Security benefits keep pace with inflation. Before that time, Congress had to vote on every increase manually, leading to long stretches without adjustments despite rising living costs.

The 2.8% adjustment for 2026 is significant when compared with recent years:

- 2025 COLA: 2.4%

- 2024 COLA: 3.2%

- 2023 COLA: 8.7% (the highest since 1981)

Inflation declined steadily during 2024 and 2025, leading to moderate increases in 2026. The Social Security Administration calculates COLA using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure produced by the U.S. Bureau of Labor Statistics.

“CPI-W captures the inflation experienced by working households, which is not always identical to the inflation experienced by older adults,” said Richard Johnson, a senior fellow at the Urban Institute. “Medical costs, for example, often rise faster for seniors.”

How CPI-W Determines COLA

COLA is based on average inflation from July through September of the preceding year. If prices rise, benefits increase. If they fall, benefits remain unchanged. The formula is designed to preserve purchasing power rather than create additional income.

Some advocates argue that the CPI-W does not adequately reflect the needs of older adults, who spend a larger share of their income on health care. They support replacing the CPI-W with a dedicated index, the CPI-E, designed specifically for elderly consumers. The Bureau of Labor Statistics has tracked CPI-E for decades, but Congress has not yet adopted it as the basis for Social Security adjustments.

Economic Conditions Leading to the 2026 Increase

Inflation trended lower in 2024 and 2025, but prices for essentials—particularly housing, groceries, and medical care—remained elevated. The Federal Reserve indicated in multiple statements that inflation had cooled but not fully stabilized.

“Older adults are experiencing price pressure in categories that continue to rise faster than the national average,” said Alicia Munnell, director of the Center for Retirement Research at Boston College.

Despite slower overall inflation, the Social Security Administration observed enough upward consumer price movement to justify the 2.8% increase.

How Retirees Nationwide Will Feel the Impact

The average retired worker currently receives about $1,900 per month. A 2.8% increase raises that to roughly $1,956. Married couples who both collect benefits will see their combined monthly income rise accordingly.

However, rising prices for medical services and prescription drugs may offset much of the added income. Medicare Part B premiums, which are often deducted directly from Social Security checks, may also increase in 2026 depending on federal policy decisions later in the year.

“COLA helps retirees keep up, but it rarely allows them to get ahead,” said Nancy Altman, president of Social Security Works. “Many older adults still face financial strain, especially those with limited savings.”

How State Taxes Influence the Real Value of the Increase

Not all retirees will retain the full benefits of the COLA. Thirteen states still tax Social Security income in some form, according to the Tax Foundation. While several states have phased out or reduced such taxes in recent years, many have not.

For example:

- Colorado and New Mexico tax a portion of benefits for higher-income residents.

- Nebraska is eliminating its Social Security tax by 2025.

- West Virginia is phasing out taxes depending on income.

In states that do not tax Social Security income—such as Florida, Tennessee, and Nevada—retirees may feel the increase more directly, even if their nominal benefit is smaller.

Real-World Examples: How Retirees May Experience the Increase

Retirees in high-cost states may still struggle despite the increase. A retiree in Connecticut paying high property taxes and rising utility costs may feel little relief compared to someone living in a lower-cost area such as Arkansas or Mississippi.

A typical senior spending patterns:

- Housing: 30–35%

- Medical expenses: 12–15%

- Food: 10–12%

- Transportation: 12%

- Other costs: 25%

Even with a COLA increase, rising healthcare costs may consume much of the added income.

Financial Advice for Retirees Preparing for the COLA

Financial planners recommend that retirees take several steps as the new COLA approaches:

- Review budgets and adjust spending categories affected by inflation.

- Check Medicare Part B and Part D premium updates.

- Update beneficiary information in the “My Social Security” portal.

- Consider delaying Social Security if not yet retired, since benefits rise 8% per year until age 70.

“Retirees should take the COLA announcement as a reminder to reexamine their financial plan,” said Sarah Kim, a certified financial planner at Vanguard. “It’s a good time to reassess spending and prepare for healthcare-related increases.”

Legislative Debate and Future Uncertainty

The Congressional Budget Office projects that Social Security’s trust funds will be able to pay full benefits until early 2033. After that, benefits may be reduced by around 20% unless Congress intervenes.

Several proposals are under discussion:

- Raising the payroll tax cap

- Increasing payroll tax rates

- Adjusting benefit formulas

- Introducing a higher minimum benefit for low-income retirees

No plan has received enough bipartisan support to advance.

What Might Future COLAs Look Like?

Economists predict that future adjustments may remain in the 2–3% range unless inflation spikes again. The Federal Reserve has signaled that price growth will likely remain moderate through 2027.

However, uncertainty around energy costs, housing supply shortages, and global supply chain pressures may influence future inflation.

$2000 Stimulus Checks Could Drop Soon—But Only If You Earn Under This Critical Threshold

Looking Ahead

The 2026 COLA offers meaningful relief for millions of retirees, but analysts warn that the adjustment alone may not fully offset rising living costs. The extent to which older adults benefit will depend on inflation trends, Medicare premiums, and state-level tax rules. For now, retirees in states with higher baseline benefits will see the largest nominal increases in Social Security checks, though the real-world impact will vary widely.