The possibility of a $2000 stimulus check has gained national attention after Trump administration officials suggested the payment could be limited to households earning under roughly $100,000. While the proposal has been discussed publicly, no legislation has been introduced or approved, and economists warn the plan faces major fiscal, legal, and logistical hurdles before any funds could reach eligible Americans.

$2000 Stimulus Check

| Key Fact | Detail / Statistic |

|---|---|

| Proposed payment amount | $2000 per eligible adult |

| Suggested income threshold | “Families earning less than, say, $100,000” |

| Legislative status | No approved bill; no payments issued |

| Estimated annual cost | Roughly $300 billion for 150 million adults |

| Proposed revenue source | Federal tariff revenues |

The $2000 stimulus check remains a high-profile proposal with uncertain prospects. While millions of Americans may qualify under the expected income threshold, the plan faces serious fiscal, legal, and operational challenges. As Treasury Secretary Bessent noted, “There are a lot of options here that the president’s talking about,” leaving households awaiting more definitive guidance in the coming months.

What the $2000 Stimulus Check Proposal Actually Promises

How the Idea Emerged

The $2000 stimulus check proposal originated from Donald Trump’s public remarks in late 2025, when he described issuing a “tariff dividend” to Americans “not including high-income people.” Later, Treasury Secretary Scott Bessent suggested that eligibility might focus on families making under $100,000 per year, describing the payment as part of a broader economic relief strategy.

Trump has repeatedly asserted that tariff revenues from importers would fund the plan. Economists, however, dispute this claim, noting that tariffs are typically paid by U.S. companies and often passed on to consumers through higher prices.

A Payment With Several Possible Forms

Bessent clarified that the $2000 stimulus check might not resemble the pandemic-era stimulus payments. Instead, it could be delivered as a direct payment, a tax credit, or expanded tax relief, depending on how Congress constructs the related legislation.

“The $2000 dividend could come in lots of forms,” Bessent said in an interview. “It could be a payment or a tax decrease that leaves more money in families’ pockets.”

Who Might Qualify Under the Proposed $2000 Stimulus Check Rules

The Suggested $100,000 Income Threshold

Although no official criteria have been released, public statements from federal officials indicate that the $2000 stimulus check could target families earning less than around $100,000 per year. This approach mirrors the income-based phase-outs used for the pandemic stimulus checks issued between 2020 and 2021.

Potential Number of Eligible Americans

If income eligibility mirrors previously discussed thresholds, as many as 123 million households could qualify. Analysts believe the number of eligible adults could reach 150 million, making the payment one of the largest federal relief initiatives in modern history if enacted.

Who Could Be Excluded

Based on Trump’s initial remarks, high-income earners would not receive the $2000 stimulus check. Other exclusions could include:

- Nonresident aliens

- Undocumented immigrants without valid Social Security numbers

- Adult dependents, unless lawmakers expand eligibility

“We still lack clarity on how the government would verify eligibility or structure phase-outs,” said Erica York, a senior economist at the Tax Foundation.

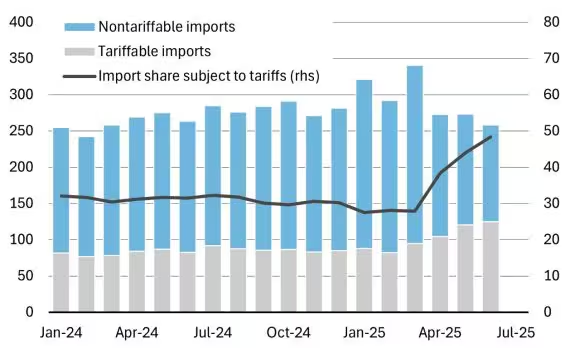

Can Tariffs Realistically Fund the $2000 Stimulus Check?

The Revenue Gap

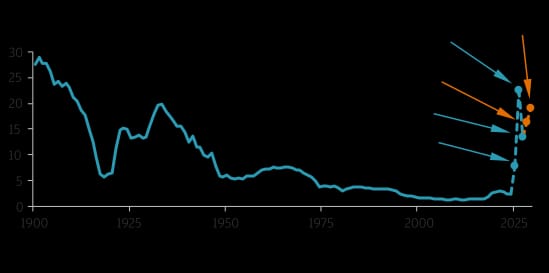

The administration argues that tariff revenues will be enough to finance the $2000 stimulus check. Federal customs data shows annual tariff revenue of about $195.9 billion. But the proposed payment—costing roughly $300 billion per distribution—would exceed that revenue unless tariffs are expanded significantly.

Economic Impact of Tariff Funding

Economists warn that relying on tariffs to fund household payments introduces structural challenges. Tariffs can raise the price of imported goods, increasing inflation and shifting costs to consumers.

Dr. Matthew Klein of the Peterson Institute for International Economics said, “Tariffs are paid by Americans, not foreign governments. Using them to fund checks may give with one hand and take more with the other.”

Debt and Long-Term Fiscal Implications

If tariff revenues fall short, the federal government may turn to deficit financing. With the U.S. national debt at roughly $38 trillion, budget analysts caution that additional borrowing could weaken long-term fiscal stability.

“There is no way to send $300 billion out the door without affecting the federal balance sheet,” a Congressional Budget Office official said.

How the Proposal Compares to Past Federal Payments

Differences from Pandemic Stimulus Checks

The $2000 stimulus check proposal differs significantly from the payments distributed during the COVID-19 pandemic:

- It is not tied to a national emergency.

- It would be funded by tariffs, not standard federal spending.

- It may be delivered through tax relief instead of direct deposits.

- It would require new legislation, likely after extensive negotiations.

International Comparisons

No major advanced economy currently funds household payments using tariff revenue. Tariff-funded dividends are uncommon and lack long-term economic precedent, prompting analysts to question whether such a system can be sustained.

Where Public Opinion Stands

Growing Interest Among Lower- and Middle-Income Families

Polling from major public research organizations shows strong support for the $2000 stimulus check among households earning under $75,000. Support declines among higher-income groups concerned about inflation and potential price increases from tariffs.

Political Reactions

Democrats generally argue that tariff-funded payments could increase inflation or disproportionately burden consumers. Some Republicans support the income-targeted relief but oppose broad tariffs.

“You cannot build a stable economic policy purely on tariffs,” said Sen. Lisa Murkowski (R-AK).

Implications for the 2026 Midterms

With millions of households potentially benefiting, the $2000 stimulus check could become a defining issue in the 2026 midterm elections. The fate of the proposal may influence voter turnout among working-class families.

Administrative and Legal Challenges

IRS Capacity Concerns

Distributing another national payment would require significant IRS resources. The agency has faced budget constraints, modernization issues, and staffing shortages.

Former IRS administrators warn implementation could take months—especially if the $2000 stimulus check is issued as a tax credit instead of a direct payment.

Legal Challenges to Tariffs

Several tariffs central to the funding plan face ongoing litigation. If courts limit or strike them down, the payments could lose their primary revenue source.

Risk of Delays

Income verification, outdated IRS systems, and legislative negotiations could delay payments well beyond any announced timeline.

What Americans Should Watch Next

Key indicators to monitor include:

- Introduction of an actual bill in Congress

- Updated revenue projections from the Treasury Department

- Tariff-related court rulings

- IRS statements on operational readiness

- Economic modeling from the Congressional Budget Office

Until these elements become clearer, the timeline for any $2000 stimulus check remains uncertain.