Waiting until 70 for Social Security sounds smart because the monthly check is larger, but here’s the rub: for many retirees, that decision can quietly reduce lifetime spendable income once health odds, taxes, Medicare IRMAA, and survivor rules are factored in. The break-even math assumes you’ll live long enough for the bigger check to outweigh the years of missed payments, and that your later-in-life income won’t trip higher Medicare premiums or tax brackets. In real life, that’s not always how it plays out. The smarter move is to optimize for after-tax, after-premium lifetime income—not just the size of the monthly benefit.

Waiting Until 70 for Social Security can make sense if you’re healthy, expect longevity, and want to insure against living into your 80s and 90s with an inflation-adjusted income stream. But it isn’t a one-size-fits-all rule. A retirement planner’s key warning is that the “always delay” mantra often ignores break-even risk, survivor dynamics, IRMAA cliffs, and the opportunity cost of eight years of skipped cash flow that could have funded Roth conversions, reduced risky withdrawals, or paid down high-interest debt. The right claiming age is the one that maximizes your household’s lifetime net spending power.

Waiting Until 70 for Social Security

| Key Factor | Why It Can Backfire | What To Consider |

|---|---|---|

| Break-Even Age | If you don’t live past the break-even (often early 80s when delaying to 70), you may never recoup skipped checks. | Health status, family history, and personalized longevity probabilities matter more than averages. |

| Survivor Dynamics | One benefit disappears at first death; survivor may face higher tax brackets and IRMAA tiers. | Coordinate timing so the higher earner often delays while the lower earner claims earlier. |

| IRMAA Exposure | Larger benefits later can trigger higher Medicare Part B/D premiums. | Map Modified AGI across years and manage IRMAA thresholds with proactive timing. |

| Opportunity Cost | Skipped checks from 62–70 can’t fund investing, Roth conversions, or debt payoff. | Earlier benefits can improve total wealth and flexibility depending on returns and goals. |

| Insurance Value | Delaying is valuable longevity insurance only if you live long enough. | Healthy, long-lived higher earners benefit most from waiting up to, but not beyond, 70. |

Waiting Until 70 for Social Security is a powerful longevity hedge, but it is not a universal rule. The optimal age is the one that maximizes lifetime net spending after taxes and Medicare premiums for your specific health profile and household structure. For many retirees, a blended strategy higher earner delays, lower earner claims earlier strikes the best balance between today’s flexibility and tomorrow’s security. Treat age 70 as a tool, not a rule, and let your plan not a slogan decide.

What “Wait To 70” Gets Right and Where It Fails

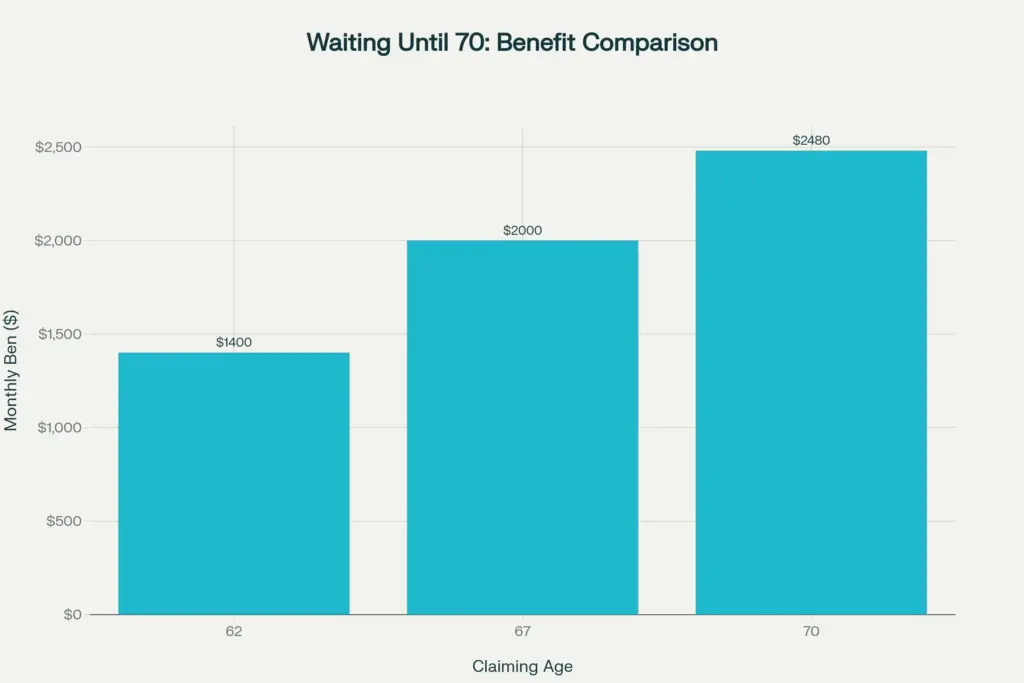

Delaying from full retirement age to 70 typically raises benefits about 8% per year, creating a larger, inflation-adjusted check that helps hedge longevity, market volatility, and inflation. That’s a real advantage for long-lived retirees and especially for the higher earner in a couple because it can lift the survivor benefit. Where the rule fails is when it glosses over health realities, tax drag, and Medicare surcharges, which can erode the net value of those larger checks. Bigger isn’t always better if a significant slice is siphoned away by IRMAA or higher marginal tax rates.

The Break-Even Math Isn’t Your Life

The classic break-even when waiting to 70 often lands around age 81–82 if you would otherwise file in your mid-60s. That’s a population average, not your personal reality. If your health, family history, or risk profile suggests a shorter life expectancy, earlier filing can deliver more lifetime income even if the monthly benefit is smaller. Conversely, if your health and family history point to a longer lifespan, the insurance value of a larger, inflation-adjusted benefit can be compelling. The point is to anchor the decision to your life, not a spreadsheet average.

Survivor Scenarios That Change The Answer

Social Security is a household decision. When one spouse dies, only one check remains the larger of the two and the survivor shifts into single tax brackets while often facing required minimum distributions and investment income alone. That combination can push the survivor over IRMAA thresholds and into steeper marginal tax rates. A blanket “both delay to 70” can therefore backfire. A common planning approach is for the higher earner to delay (to bolster the survivor benefit) while the lower earner claims earlier to improve current cash flow and reduce the need for portfolio withdrawals.

IRMAA And Taxes: The Stealth Drag

IRMAA (Income-Related Monthly Adjustment Amount) increases Medicare Part B and D premiums when modified adjusted gross income exceeds specified thresholds. Larger Social Security benefits in your late 60s and 70s can nudge you into these tiers—especially when combined with capital gains, part-time work, or RMDs. Strategic timing—such as claiming earlier with smaller benefits while completing Roth conversions before Social Security ramps up—can help you avoid IRMAA cliffs, reduce lifetime taxes, and increase net spendable income.

Opportunity Cost: Eight Years of Cash You Didn’t Use

From 62 to 70, delaying means forgoing guaranteed cash flow you could have put to work. That money can reduce risky withdrawals in down markets, fund Roth conversions in low brackets, pay down high-interest debt, or be invested according to your risk tolerance and time horizon. For some households, the compounding benefits of acting on these opportunities outweigh the actuarial uplift from a bigger check at 70. Liquidity and optionality have value, particularly in the go-go years of retirement when health and lifestyle opportunities are richest.

When Waiting Until 70 Still Shines

If you’re healthy, anticipate a long life, and want to hedge sequence-of-returns risk while locking in a larger, inflation-adjusted baseline of guaranteed income, waiting can be optimal. The case is strongest for the higher earner in a couple to enhance the survivor benefit. Just remember: there’s no additional increase past age 70. If you choose to delay, set a hard stop at 70 and build a bridge strategy for the intervening years, ensuring your portfolio withdrawals (or work income) are sustainable and tax-efficient.

A Practical Decision Framework

- Start With Health And Longevity: Use personal and family medical history to set realistic longevity assumptions. If longevity odds are below average, consider filing earlier to secure more lifetime payments.

- Map Taxes And IRMAA Over 10–15 Years: Project Modified AGI, RMDs, capital gains, and Roth conversion windows against IRMAA thresholds. Optimize claiming to minimize lifetime taxes and Medicare surcharges.

- Coordinate Spouses: Often the higher earner delays while the lower earner files earlier. Stress test survivorship outcomes under different sequences to protect the surviving spouse’s cash flow and tax position.

- Integrate Portfolio Strategy: Align claiming with investment risk. Earlier benefits can reduce sequence risk by lowering withdrawals in bear markets, while delaying might be better if your guaranteed income floor is too low.

- Plan The Bridge: If delaying, detail how you’ll fund living expenses cash reserves, bond ladders, part-time work, or targeted withdrawals so you don’t undermine the strategy with forced, tax-inefficient sales.

Social Security Tax Changes Coming in 2026 — How the New Rules Could Cut or Boost Your Benefits

Action Steps Before You Decide

- Run A Break-Even With Health Adjustment: Don’t rely on averages; use realistic longevity inputs for your household.

- Build A Roth And IRMAA Plan: Identify conversion windows and IRMAA cliffs; sequence income to stay below premium surcharges when feasible.

- Compare Two Household Strategies: “Higher earner delays/lower earner files earlier” vs “both wait” and review lifetime, after-tax, after-premium outcomes.

- Stress Test Bad Markets: Model a weak first five years of retirement; check which approach requires fewer portfolio withdrawals.

- Set A Hard Stop At 70: If delaying, don’t drift past 70; there’s no benefit increase beyond that age.

FAQs on Waiting Until 70 for Social Security

Is waiting until 70 always the best move?

No. It’s often beneficial for healthy, long-lived retirees, but it can backfire if you won’t reach the break-even age or if higher future benefits trigger IRMAA surcharges and higher taxes that reduce net income.

What’s the typical break-even when delaying to 70?

A common range sits in the early 80s if you would otherwise file in the mid-60s. Your personal health, lifestyle, and family history can move that earlier or later.

How do Medicare IRMAA surcharges affect this?

IRMAA raises Medicare premiums when your modified adjusted gross income crosses set thresholds. Larger benefits later can push you over those tiers. Thoughtful sequencing like earlier claiming or Roth conversions before benefits start can mitigate IRMAA.

Should the higher earner in a couple delay benefits?

Often yes, because it boosts the survivor benefit. But coordinate with the lower earner’s earlier filing and evaluate the survivor’s future tax bracket and IRMAA exposure.