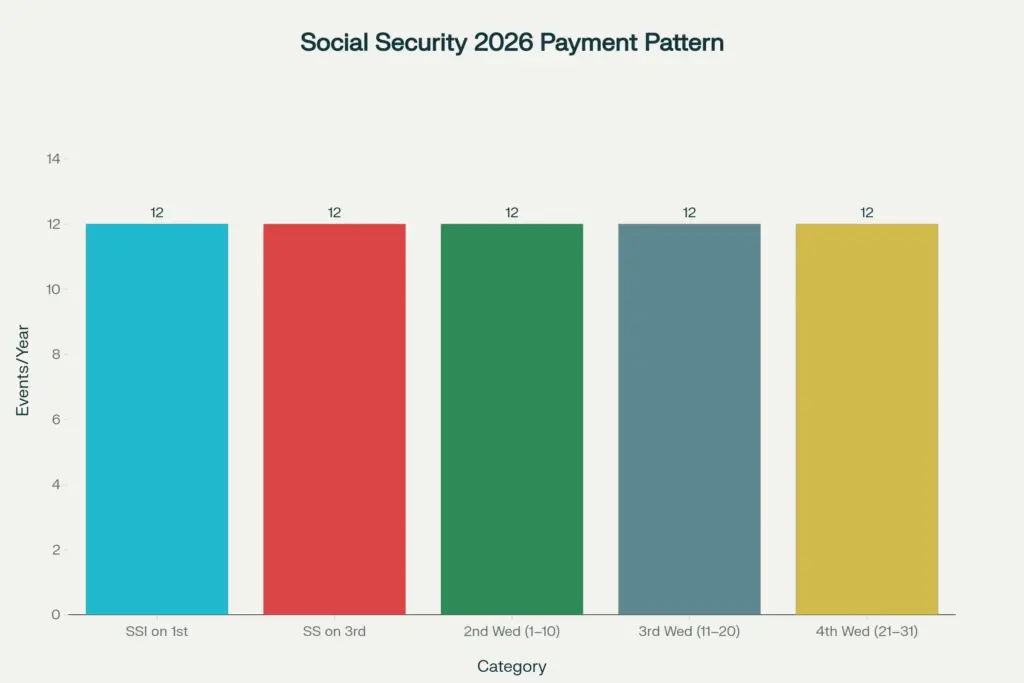

If you’ve been waiting for the Social Security 2026 calendar to lock in your budget, here’s the complete, plain-English guide to every deposit date all year retirement, SSDI, survivors, and SSI included. The rules are straightforward: most people who started benefits after May 1997 are paid on a Wednesday based on the day of the month they were born, while SSI is paid on the 1st with early deposits when the 1st falls on a weekend or federal holiday. Keep this schedule handy to plan bills, avoid surprises, and keep your cash flow smooth throughout 2026.

The Social Security 2026 payment schedule keeps the familiar structure beneficiaries rely on. If you began your benefits after May 1997, your pay date is tied to your birthday band: birthdays on the 1st–10th are paid the second Wednesday, 11th–20th is paid the third Wednesday, and 21st–31st are paid the fourth Wednesday. Those who received Social Security before May 1997 or who receive both Social Security and SSI are paid Social Security on the 3rd of each month and SSI on the 1st. When a scheduled date lands on a weekend or a federal holiday, the payment moves to the previous business day.

Social Security 2026 Calendar

| What | Details |

|---|---|

| Wednesday Schedule (post–May 1997) | Paid by birthday band: 1–10 = second Wednesday; 11–20 = third Wednesday; 21–31 = fourth Wednesday. |

| “3rd of the Month” Group | If you received Social Security before May 1997, or receive both Social Security and SSI, Social Security pays on the 3rd and SSI on the 1st. |

| SSI Timing | Scheduled on the 1st; when the 1st is a weekend/holiday, payment arrives on the preceding business day. |

| Holiday/Weekend Rule | No payments on weekends/federal holidays; affected deposits shift to the prior business day. |

| Late Payment Guidance | If a payment doesn’t arrive, allow three additional mailing days before contacting Social Security. |

| COLA Timing Note | The 2026 COLA is reflected in January 2026 Social Security payments; SSI reflects the increase in the late-December deposit that counts for January. |

Use the Social Security 2026 calendar as your financial north star: identify your group, circle your exact dates, and sync your bills so each month flows smoothly. With a predictable “Social Security 2026 payment schedule,” a quick glance at the calendar is all it takes to plan your essentials, time your savings transfers, and keep your budget on track all year.

How The Wednesday Rule Works

- Birthdays on the 1st–10th: paid the second Wednesday of each month. This applies to most retirement, SSDI, and survivors who began benefits after May 1997.

- Birthdays on the 11th–20th: paid the third Wednesday of each month.

- Birthdays on the 21st–31st: paid the fourth Wednesday of each month.

Who Still Gets Paid On The 3rd

Not everyone follows the Wednesday cycle. If you started receiving Social Security before May 1997, your payment comes on the 3rd of each month, regardless of your birthday. The same 3rd-of-the-month rule generally applies if you receive both Social Security and SSI. Standard holiday/weekend adjustments apply if the 3rd is a weekend or holiday, expect the deposit to arrive on the prior business day.

SSI Dates and Early Months

SSI is scheduled for the 1st of each month. Because Social Security doesn’t pay on weekends or federal holidays, the SSI deposit often arrives earlier when the 1st falls on a Saturday, Sunday, or holiday. This early timing can be very helpful for rent and utilities check months where the 1st conflicts with New Year’s Day, weekends, or other federal holidays to see when the deposit advances to the prior business day.

Holidays, Weekends, And Shifted Dates

The holiday/weekend rule is simple and consistent: no payments are made on weekends or federal holidays. When a scheduled date hits one of those, the deposit is shifted to the preceding business day. This is seen most frequently with SSI because the 1st often intersects with holidays. For the Wednesday groups, the mid-month timing usually avoids most holidays, but keep an eye on months with federal holidays that land midweek.

2026 COLA: What Changes and When

The 2026 cost-of-living adjustment (COLA) increases monthly Social Security and SSI benefits beginning with January 2026 for Social Security and with the late-December deposit that counts as January for SSI. There’s nothing you need to do for the increase to apply; it’s automatic. Plan your January budget with the higher amount, and remember that SSI’s January benefit typically arrives at the end of December when January 1 is a holiday.

How To Read and Use the Calendar

Think of the official calendar as your master planning tool. First, identify your payment category: Wednesday group, 3rd-of-the-month, or SSI. Next, mark your dates for each month. Finally, note any shifts for weekends and holidays especially for SSI on the 1st. With those three steps, you’ll have a yearlong view of your cash inflows and can align recurring bills accordingly.

Month-By-Month Planning Tips

- Align recurring bills with your known deposit date: second, third, or fourth Wednesday; the 3rd; or the 1st for SSI.

- For SSI, highlight “early” months so you can pay rent or utilities ahead when the deposit arrives before the 1st.

- If newly entitled in 2026, confirm which cycle applies to you Wednesday schedule vs. 3rd-of-the-month especially if also receiving SSI.

- Set calendar reminders a week before your deposit to cue bill scheduling, grocery planning, and automatic transfers to savings.

- Consider splitting expenses: fixed bills right after the deposit; discretionary spending later in the cycle to stretch funds.

- If you manage multiple household benefits, create color-coded entries for each person’s date to avoid overlap confusion.

What To Do If Your Payment Is Late

If your deposit doesn’t land when expected, allow three additional mailing days before seeking help. After that buffer, contact your financial institution to verify receipt and then reach out to Social Security for a payment trace if needed. Also check that your direct deposit information is current; outdated routing or account numbers are a common source of delays.

New Beneficiaries In 2026: Quick Orientation

- Determine your category: Wednesday cycle (post–May 1997), 3rd-of-the-month (pre–May 1997 or dual SSI), or SSI on the 1st.

- If on the Wednesday cycle, use your birth day of month to identify second, third, or fourth Wednesday.

- Enroll in direct deposit or a Treasury-recommended electronic option to reduce delays and mail issues.

- Save a copy of the 2026 calendar and keep it with your bill file; review it monthly for any holiday shifts.

- For SSI, note months where the payment lands on the last business day of the prior month.

Budgeting With The 2026 Calendar

A predictable schedule is a budgeting superpower. Start by listing fixed expenses housing, utilities, insurance, prescriptions and assign due dates that follow immediately after your deposit. Then earmark a percentage for groceries, transport, and personal needs, leaving a small buffer for surprises. If your deposit lands late in the month (fourth Wednesday), consider splitting large bills so less hits at once. Where possible, negotiate bill due dates with utilities or creditors to better match your deposit day.

Smart Safeguards For Social Security 2026

- Turn on bank alerts for deposits and low balances.

- Keep a small emergency cushion one week of expenses in your account to cover a delayed deposit.

- Double-check account info if you change banks; a mismatch can delay payments by weeks.

- Store a printed or digital copy of the calendar with your essential documents.

- If you travel or snowbird, confirm continued access to your bank and avoid holds by notifying your institution.

Social Security Tax Changes Coming in 2026 — How the New Rules Could Cut or Boost Your Benefits

Key Takeaways You Can Print

- Most post May 1997 beneficiaries are paid on a Wednesday by birthday band: 1–10 = second Wednesday; 11–20 = third Wednesday; 21–31 = fourth Wednesday.

- Pre May 1997 and dual SSI beneficiaries typically receive Social Security on the 3rd and SSI on the 1st.

- SSI pays early when the 1st is a weekend or federal holiday; check the calendar for each month’s exact timing.

- The 2026 COLA applies in January 2026 for Social Security; SSI reflects it in the late-December deposit that serves as January’s benefit.

- If a deposit appears late, allow three mailing days, then contact your bank and Social Security for help.

FAQs on Social Security 2026 Calendar

When will the 2026 COLA show up in my payment?

January 2026 payments include the COLA for Social Security. SSI reflects the increase with the late-December deposit that counts as January.

How do I know which Wednesday I’m paid?

If you started after May 1997, use your birthday: 1–10 is the second Wednesday; 11–20 is the third Wednesday; 21–31 is the fourth Wednesday.

I receive both SSI and Social Security when do I get paid?

Generally, SSI is on the 1st and Social Security is on the 3rd of each month, with earlier deposits when those dates fall on weekends or holidays.

What if my payment date is a federal holiday or weekend?

Deposits move to the prior business day. This affects SSI most often because the 1st frequently aligns with holidays.

What should I do if my payment is late?

Wait three additional mailing days, then contact your bank and, if necessary, Social Security for a trace. Verify your direct deposit info to prevent recurrences.