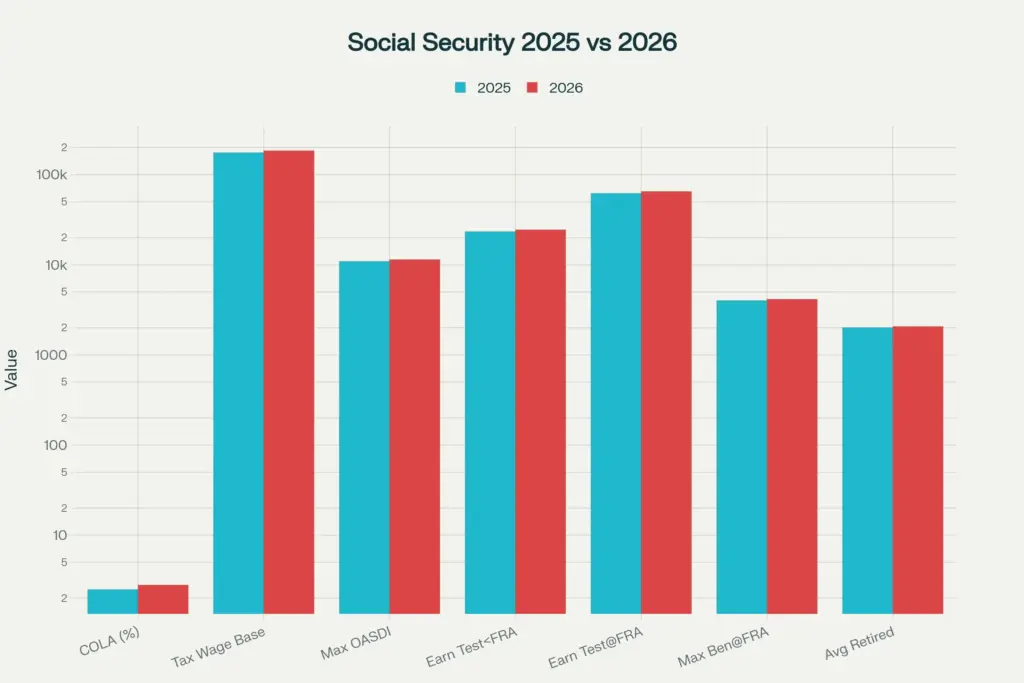

If you’re planning to work, retire, or reposition your tax strategy in 2026, the Social Security tax changes belong at the top of your checklist. A 2.8% cost-of-living adjustment (COLA), a higher taxable wage base of $184,500, and increased earnings test limits will directly affect your paycheck, your monthly benefits, or both. For higher earners, more wages will be subject to the Social Security payroll tax. For beneficiaries, the COLA and more generous earnings thresholds could translate into a slightly larger net benefit depending on Medicare premiums, claiming age, and work income.

Social Security tax changes 2026 target three levers most people feel: a 2.8% COLA beginning with January payments, a payroll tax cap lifted to $184,500, and higher earnings test thresholds $24,480 if you’re under full retirement age (FRA) all year and $65,160 in the year you reach it. The OASDI tax rate remains 6.2% for employees (12.4% for the self-employed), so the key shift is that a bigger slice of high earners’ wages falls under the cap. That pushes the maximum employee OASDI to $11,439 for 2026, matched by employers, while self-employed workers pay both sides with the usual income tax deduction for half the self-employment tax.

Social Security Tax Changes

| Item | 2025 | 2026 | What Changes For You |

|---|---|---|---|

| COLA | 2.5% (prior year) | 2.8% | Monthly checks rise beginning with January 2026 payments. |

| Taxable Wage Base (OASDI) | $176,100 | $184,500 | More wages subject to 6.2% payroll tax. |

| Max Employee OASDI | ~$10,918 | $11,439 | Higher earners pay more until the cap is reached. |

| Earnings Test (Under FRA) | $23,400 | $24,480 | $1 withheld for each $2 earned above the limit. |

| Earnings Test (Reaching FRA) | $62,160 | $65,160 | $1 withheld for each $3 above the limit until the month FRA is reached. |

| Max Benefit At FRA | $4,018/mo. | $4,152/mo. | Higher cap for new claimants at FRA. |

| Average Retired Worker | ~$2,015 | ~$2,071 | Roughly +$56 per month after COLA. |

Social Security tax changes 2026 bring a mixed bag: a 2.8% COLA that raises checks for most beneficiaries, a higher $184,500 wage base that increases payroll tax exposure for high earners, and earnings test thresholds that allow a bit more work income before any withholding applies. For employees and self-employed professionals, the headline is that more wages will be taxed at 6.2% until the cap, after which OASDI stops for the rest of the year. For beneficiaries, the key is to watch how the COLA interacts with Medicare premiums, your claiming status, and any work income subject to the earnings test.

What The COLA Means In Real Life

A 2.8% COLA raises benefit amounts for retirees, survivors, and disability beneficiaries, beginning with January 2026 checks. If the average retired worker benefit was roughly $2,015, a 2.8% bump pushes it to about $2,071 an increase of around $56 per month. That’s not life-changing, but it compounds over time, and if you’ve delayed claiming, the higher base magnifies future percentage adjustments.

Payroll Taxes and The Higher Wage Base

The Social Security portion of payroll tax (OASDI) stays at 6.2% for employees and 12.4% for the self-employed, but the maximum taxable earnings limit climbs to $184,500. Practically, higher earners will pay 6.2% on an extra $8,400 of wages compared to 2025. That brings the maximum employee OASDI to $11,439 in 2026, matched by employers; self-employed individuals pay the combined amount up to the same cap, with an income-tax deduction equal to half the SE tax. Medicare’s 1.45% tax still applies to all wages, and the 0.9% additional Medicare tax kicks in above statutory thresholds—separate from the Social Security cap.

Earnings Test Thresholds and Benefit Withholding

If you work while claiming before FRA, the retirement earnings test can temporarily reduce your cash flow. In 2026, the annual limit rises to $24,480 for those under FRA all year; benefits are reduced by $1 for every $2 earned above that limit. In the year you reach FRA, the threshold climbs to $65,160; in that window, $1 is withheld for every $3 above the limit until the month you hit FRA. From the month you reach FRA onward, there’s no earnings limit, and withheld months are credited back actuarially to increase your future checks.

How The Changes Could Cut Your Benefits

- Working While Claiming: If you’re under FRA and cross $24,480 in 2026, expect withholding at the $1-for-$2 rate; even though withheld benefits are later accounted for at FRA, your monthly cash flow can dip during the year.

- Higher OASDI For Top Earners: Wages between $176,100 and $184,500 will face Social Security payroll tax in 2026, shaving take-home pay until you hit the cap.

- Medicare Drag: The COLA can be partially offset by Medicare Part B premium increases if you’re enrolled, reducing the net gain you see from the 2.8% benefit boost.

How The Changes Could Boost Your Benefits

- COLA Lift Across Programs: The 2.8% adjustment increases Social Security and SSI payments, raising monthly income for retirees, survivors, and disabled workers.

- Bigger Covered Earnings, Better Record: Paying OASDI on more wages in 2026 can improve your average indexed monthly earnings if this year replaces a lower year in your top 35, nudging your eventual benefit higher.

- More Room To Work: Higher earnings test thresholds give working beneficiaries more headroom before any withholding kicks in, making part-time or seasonal work less likely to reduce monthly benefits.

Planning Moves to Consider Now

- Coordinate Work And FRA: If you’re close to FRA, shifting bonuses or extra shifts to months after you reach FRA avoids the earnings test altogether and prevents temporary withholding.

- Front-Load Paychecks: High earners often hit the cap before year-end; once you clear $184,500 in covered wages, OASDI stops for the rest of the year, boosting take-home pay in later pay periods.

- Update Estimated Taxes: Self-employed professionals should adjust quarterly payments for the higher wage base and remember the deduction for half of SE tax on the income tax return.

- Verify Your COLA Notice: Check your updated benefit and any Medicare premium changes in your online account so you can reconcile your expected January deposit.

Social Security Reversal: Government Quietly Walks Back ‘Final’ Deadline on Paper Checks

What To Watch Beyond the Basics

- FRA Progression: FRA tops out at 67 for those born in 1960 or later, and the earnings test never applies starting the month you reach FRA. Building your timeline around this milestone can spare you avoidable withholding.

- Disability And SSI Thresholds: Substantial gainful activity and trial work period amounts rise in 2026, which matters if you’re transitioning back to work; confirm the monthly limits before taking on hours.

- Spousal And Survivor Dynamics: The COLA applies across benefit types, but the net household effect depends on who’s claiming, Medicare enrollment, and whether one spouse continues working.

- Taxation Of Benefits: Up to 85% of Social Security can be taxable depending on provisional income. A higher COLA and work income can push you into higher taxable thresholds, so consider Roth conversions, withdrawal coordination, or charitable distributions if appropriate.

Actionably, consider timing discretionary income around your FRA, adjusting estimated tax payments if you’re self-employed, and confirming your January benefit amount once notices post. If your goal is to maximize lifetime benefits, align your claiming decision with your earnings outlook and health consideration while using the higher thresholds and updated numbers to avoid surprises in 2026 cash flow. Finally, remember the simple rule of thumb: Social Security tax changes 2026 help if you’re primarily receiving benefits without significant pre-FRA earnings, and they hurt temporarily if you’re a high earner paying OASDI up to the new cap or a pre-FRA worker exceeding the earnings test. With a few timely tweaks, you can keep more of what you earn and receive next year.

FAQs on Social Security Tax Changes

Will my Social Security taxes go up in 2026?

If you earn above the 2025 wage base and up to the new $184,500 cap, yes. You’ll pay 6.2% on that additional slice of wages, up to a maximum employee OASDI of $11,439 in 2026.

How much more will I get from the 2.8% COLA?

A typical retired worker benefit of about $2,015 increases to roughly $2,071, about $56 more per month starting with January 2026 payments. Your personal increase scales with your current benefit amount and may be partially offset by Medicare Part B premiums if enrolled.

Do earnings limits apply after I hit full retirement age?

No. The earnings test only applies before the month you reach full retirement age. In 2026, the limit is $24,480 if you’re under FRA all year and $65,160 in the year you reach FRA, with a more lenient $1-for-$3 withholding until the month you hit FRA.

Can working in 2026 increase my future Social Security?

Yes. If 2026 becomes one of your 35 highest earning years, it can replace a lower year in your benefit formula, potentially lifting your eventual monthly benefit.