Former President Donald Trump has proposed delivering a “tariff-funded dividend” of at least $2000 per person to most Americans, portraying it as a way to return “America’s wealth” to its citizens. The plan, revealed at a rally in Ohio, would rely on federal tariff revenues and could reshape debates over trade, taxation, and fiscal policy.

$2000 Stimulus from Tariff Revenues

| Key Fact | Detail/Statistic |

|---|---|

| Proposed Payment | $2000 per eligible adult (“tariff dividend”) |

| Funding Source | Federal tariff revenues collected by the U.S. Treasury |

| Estimated Tariff Revenue FY2025 | ~$195 billion (customs duties) |

| Estimated Cost of Payments | ~$300–$350 billion if 150 million adults qualify |

| Legal Requirement | Congressional authorization required for disbursement |

Tariff-Funded Stimulus: The Core of Trump’s Proposal

Speaking before a crowd in Dayton, Ohio, Trump described the initiative as a way to “make Americans shareholders in our success.” He argued that U.S. tariffs on imported goods—particularly from China—would generate enough revenue to fund direct payments.

“Instead of letting Washington waste the money, we’ll send it straight back to the people who built this country,” Trump said in remarks broadcast by national networks.

He added that the plan would exclude “high-income individuals,” though neither the income threshold nor the mechanism for distribution was specified. Economists and Treasury officials say such details will be critical for determining feasibility.

Legal and Fiscal Barriers

Under current law, tariff revenues flow into the general fund of the U.S. Treasury, and spending from that account must be approved by Congress. The Constitution grants Congress authority over federal expenditures, meaning the White House cannot unilaterally authorize a payout.

A Treasury official, speaking on condition of anonymity, said no formal planning has begun within the department. “This remains a proposal, not a policy,” the official said.

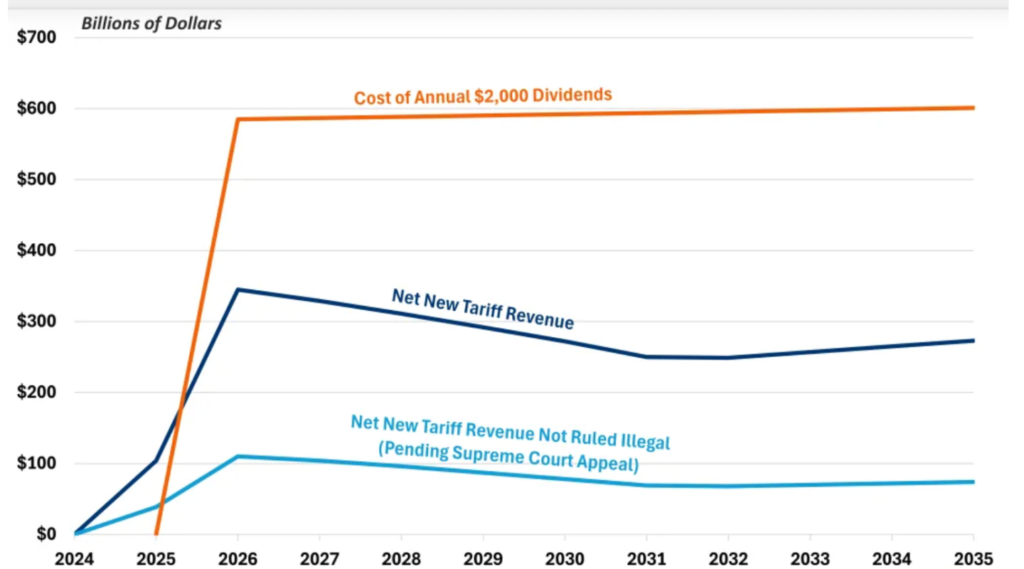

Customs duties brought in roughly $195 billion in the first nine months of fiscal year 2025, according to Treasury data—less than one-third of what would be required to fund the payments.

“Even under favorable projections, tariff income cannot sustain a $300 billion disbursement,” said Dr. Elaine Roberts, a senior fellow at the Brookings Institution. “Without borrowing or reallocating funds, it’s fiscally unworkable.”

Economic Impact and Expert Analysis

Economists say the proposal’s impact would depend on its funding structure. If financed purely from tariffs, it could redistribute rather than create new wealth—essentially refunding part of the higher prices consumers already pay for imported goods.

The Peterson Institute for International Economics (PIIE) estimates that current tariffs have already increased average consumer costs by 0.3% annually. Redirecting those revenues, analysts warn, could provide short-term relief while fueling long-term inflationary pressure.

“You can’t tax imports, drive up prices, and then claim victory by handing part of that money back,” said Dr. Marcus Li, a trade economist at PIIE. “It’s like charging people for entry, then giving them a partial refund.”

Other experts see potential political value even if economic benefits are limited. “This proposal blends populist appeal with fiscal symbolism,” said Dr. Helen Kwan, professor of international trade at the University of California, Berkeley. “It’s politically potent, even if economically constrained.”

Historical Context: Tariffs and Dividends in American Policy

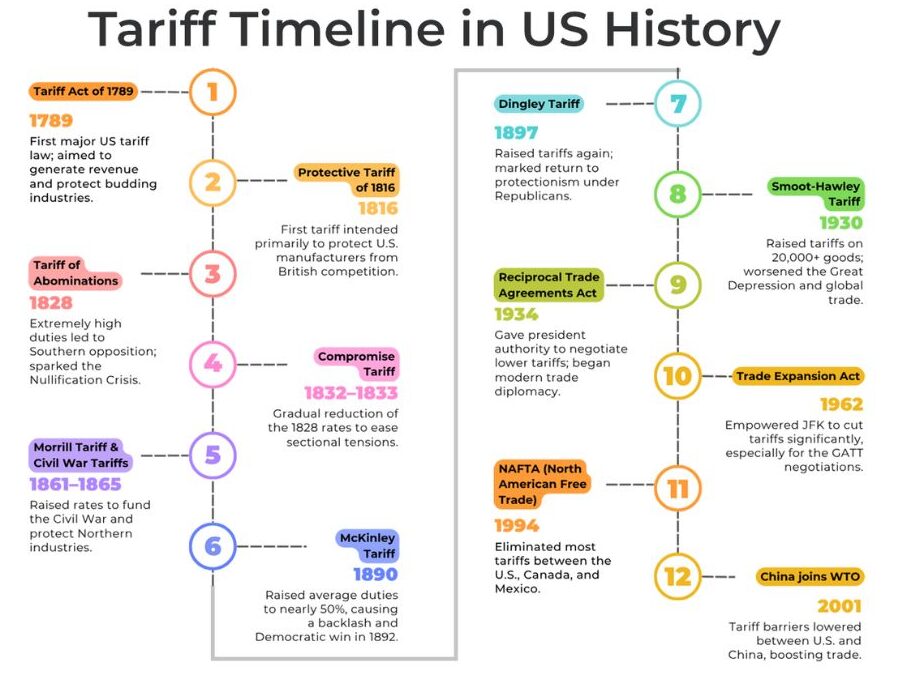

While the concept of direct payments from government revenues is not new, tying them explicitly to tariffs is unusual. In the late 19th century, tariffs were a major federal revenue source, funding the government before the introduction of income tax. However, those funds were not distributed directly to citizens.

The closest precedent may be the Alaska Permanent Fund, which pays residents annual dividends from state oil revenues. Analysts note that Trump’s proposal echoes that model in spirit, though Alaska’s program operates under specific state constitutional authority.

“The idea of a national resource dividend has long appealed to both populists and fiscal conservatives,” said Dr. Janet Carver, a historian at Georgetown University. “What’s novel here is applying that logic to tariff policy.”

Comparison With Past Stimulus Programs

The $2000 tariff dividend differs sharply from the COVID-19 stimulus checks distributed in 2020 and 2021, which were funded by congressional appropriations through deficit spending. Those payments totaled about $867 billion across three rounds.

Unlike the pandemic relief measures, the tariff dividend does not appear tied to emergency conditions or economic downturns. Analysts say that distinction may influence how Congress evaluates its necessity.

“Stimulus payments are typically used to counter economic recessions,” noted Jason Furman, former Chair of the Council of Economic Advisers under President Obama. “This proposal functions more as a political dividend than a macroeconomic one.”

Public Opinion and Political Reactions

Polling conducted by Morning Consult following Trump’s announcement found 61% of likely voters supported the idea of a one-time $2000 payment, though only 38% believed tariffs would generate sufficient funds. Support was strongest among households earning under $75,000 per year.

Republican lawmakers largely praised the initiative. Senator Rick Scott (R-FL) described it as “a fair return for American families.”

Democrats, meanwhile, called it “misleading,” with Representative Pramila Jayapal (D-WA) saying tariffs were “taxes by another name.”

“People like checks in the mail,” said Dr. Kwan of UC Berkeley. “But if the funding source ultimately raises consumer costs, it’s a zero-sum transaction.”

International and Market Implications

Global markets responded cautiously to Trump’s remarks. The S&P 500 dipped 0.4% the following morning, with declines concentrated in retail and manufacturing stocks sensitive to trade policy. The U.S. dollar briefly strengthened before stabilizing.

In Beijing, a spokesperson for China’s Ministry of Commerce said the country would “monitor developments closely” and “reserve all rights under the World Trade Organization framework.”

Economists warn that if implemented alongside new tariffs, the plan could escalate existing trade disputes and pressure global supply chains already strained by geopolitical tensions.

“If additional tariffs accompany this plan, the global economy could face another round of retaliatory measures,” said Dr. Li of PIIE. “That would raise costs for American consumers and exporters alike.”

Implementation Uncertainty and Legal Challenges

Even if Congress endorses the plan, execution would be complex. The Internal Revenue Service (IRS) would likely manage disbursement using taxpayer databases, similar to prior stimulus programs. However, questions remain over whether tariff-derived funds could legally bypass general appropriations procedures.

The Congressional Budget Office (CBO) reaffirmed that “tariff receipts are not discretionary funds” and cannot be reallocated without congressional action.

Legal scholars also warn of potential constitutional challenges if the executive branch attempts to act without legislative approval.

“This would test the boundaries of fiscal authority,” said Professor Linda Chavez, a constitutional law expert at Harvard University. “The courts would almost certainly be involved if the Treasury attempted unilateral disbursement.”

Public Warnings Against Scams

Following the announcement, the Federal Trade Commission (FTC) and Internal Revenue Service (IRS) issued warnings about fraudulent claims related to the so-called “tariff dividend.” Officials stressed that no official registration or payment portal exists.

“Scammers often exploit headlines like these,” said FTC Chair Lina Khan in a statement. “Consumers should ignore messages promising early access to funds or requesting personal data.”

These States Just Got the Biggest Social Security Raise — See the Full Breakdown

Looking Ahead: Political Symbol or Economic Shift?

With no formal legislation yet introduced, the tariff-funded dividend remains a campaign proposal. Still, it underscores Trump’s broader strategy to link trade policy with direct economic benefits for voters.

Some analysts suggest the plan could reframe debates over government revenue and middle-class support. Others see it as a test of how far populist fiscal ideas can go in an era of rising deficits and global trade tension.

“Whether or not it ever becomes law,” said Dr. Roberts of Brookings, “the $2,000 tariff dividend is redefining how Americans think about the intersection of trade, taxation, and fairness.”