A growing number of Americans are unintentionally reducing their retirement income — the equivalent of a 30% Social Security cut — by claiming benefits too early. New research suggests that nearly 90% of workers expect to begin receiving Social Security payments before age 70, a decision that could significantly shrink lifetime earnings for millions.

30% Social Security Cut

| Key Fact | Detail / Statistic |

|---|---|

| 90% plan to claim before age 70 | Majority intend to draw benefits early |

| 30% reduction at age 62 | Compared with full retirement age (~67) |

| Trust fund depletion projected by 2033 | Would reduce benefits to ~77% of current levels |

| Median retirement savings under $100,000 | For Americans aged 55–64 |

Early Claiming: A Permanent “Voluntary Cut”

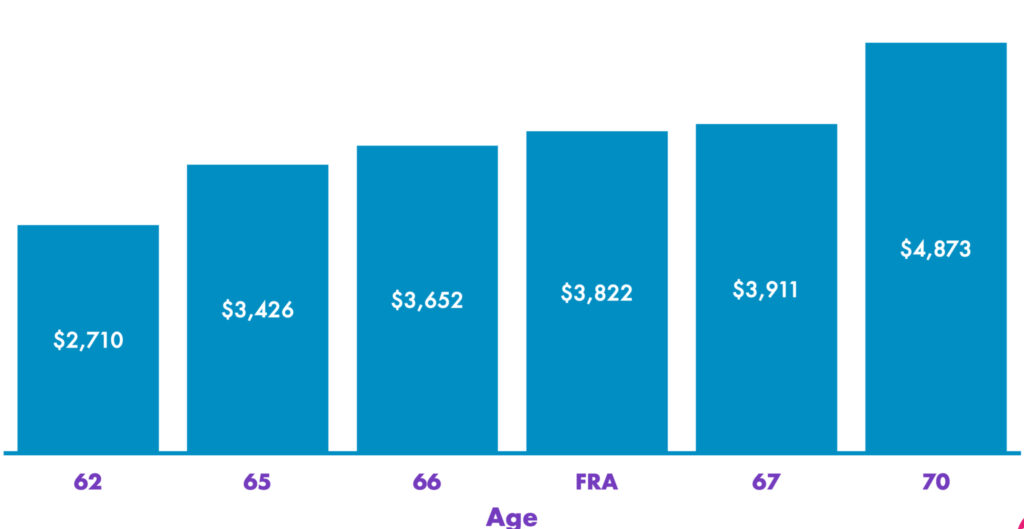

According to the Social Security Administration (SSA), Americans born after 1960 reach full retirement age (FRA) at 67. Those who claim benefits at 62, the earliest possible age, receive about 70% of their full monthly benefit. Each year of delay adds roughly 8% until age 70.

A 2024 study by Schroders found that 89% of working Americans plan to claim before 70, with only 10% willing to wait for the maximum benefit. “This isn’t a policy change — it’s a behavior change,” said Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College. “Millions are cutting their own benefits without realizing the long-term effect.”

The SSA estimates that delaying benefits from 62 to 70 could increase total lifetime payouts by more than $180,000 for an average earner who lives to age 90.

Why Americans Are Claiming Early

Economic Pressures and Rising Costs

For many, early claiming is a matter of survival. The Federal Reserve’s 2023 Economic Well-Being Report found that more than one-third of adults would struggle to cover a $400 emergency. Among lower-income retirees, Social Security accounts for over 90% of household income.

“People aren’t claiming early because it’s optimal,” said Andrew Biggs, a senior fellow at the American Enterprise Institute. “They’re doing it because they need the money now.”

Inflation has compounded this challenge. Although Social Security payments rose by 3.2% in 2024 through the annual cost-of-living adjustment, housing and medical costs have risen faster, eroding real purchasing power for retirees.

Distrust in the Program’s Future

Another driving factor is fear about the Social Security trust fund’s solvency. The Congressional Budget Office (CBO) projects the program’s main trust fund will run dry by 2033. Without legislative reform, future benefits would automatically fall to 77% of scheduled levels.

“People are nervous that if they wait, the system might not be there,” said Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities. “But historically, every time the trust fund has neared depletion, Congress has acted.”

Historical Context: From New Deal to Modern Dilemma

The Social Security Act of 1935, signed by President Franklin D. Roosevelt, established the first federal retirement insurance program. Initially designed to support older workers during the Great Depression, the program has expanded over decades to include survivors, disability, and spousal benefits.

Major amendments in 1983 extended the program’s solvency by gradually increasing the full retirement age from 65 to 67 and taxing some benefits. However, the demographic shift — with baby boomers retiring and fewer workers contributing — has reignited concerns.

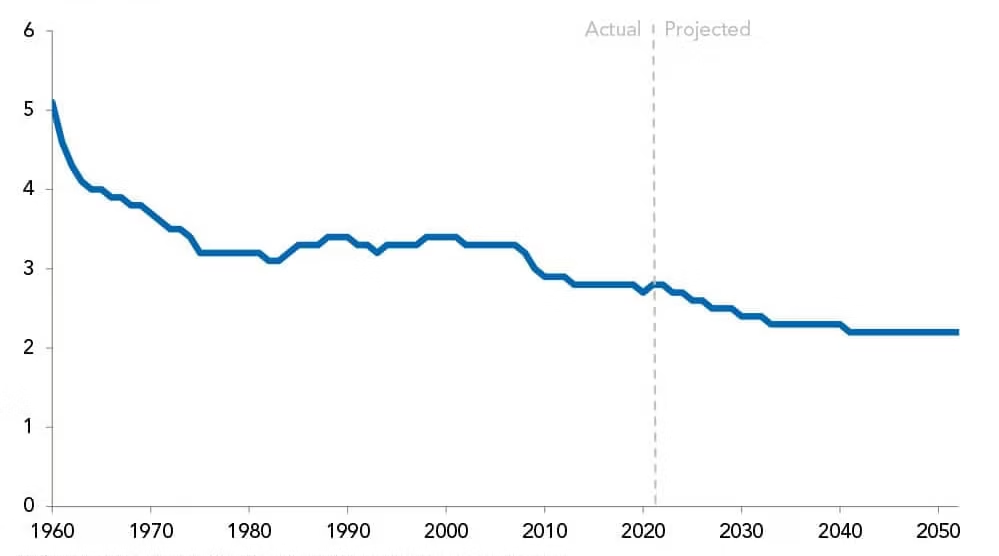

“The math is simple,” said Jason Fichtner, former chief economist at the SSA. “In 1960, there were five workers per retiree. Today, there are fewer than three.”

Who Is Most Affected by Early Claiming

According to SSA data, women, lower-income earners, and workers in physically demanding jobs are more likely to claim early. Many do so out of necessity, not choice.

A 2023 report by the Urban Institute found that nearly 60% of women begin collecting before full retirement age, compared with 54% of men. For lower-income households, the proportion rises above 70%.

“Social Security is the only guaranteed income many people have,” said Olivia Mitchell, a professor at the Wharton School of the University of Pennsylvania. “But the system wasn’t designed to be the sole source of retirement income.”

Comparing the U.S. to Other Countries

While Americans can begin claiming at 62, most Organisation for Economic Co-operation and Development (OECD) countries encourage later retirement. In Germany, for example, the statutory retirement age is rising to 67 by 2031, and early retirees face a 3.6% penalty per year. Japan offers incentives for delaying benefits until age 75.

“Compared internationally, the U.S. offers one of the most flexible — but also one of the most misunderstood — systems,” said Dr. Teresa Ghilarducci, economist at the New School for Social Research. “Flexibility without financial literacy leads to bad outcomes.”

Policy Debates and Possible Reforms

Lawmakers across the political spectrum agree that action is needed but remain divided on how to sustain Social Security benefits beyond 2033.

Proposals include:

- Raising payroll taxes: Currently capped at $168,600 of income (2024). Expanding the taxable cap could increase revenue.

- Increasing the retirement age: Some suggest gradually raising it to 69, citing longer life expectancy.

- Means testing: Reducing benefits for higher-income retirees to preserve funds for lower earners.

- Adjusting the cost-of-living formula: Using a “chained CPI” to better reflect inflation patterns.

A bipartisan plan introduced in 2023 by Sen. Angus King (I-ME) and Sen. Bill Cassidy (R-LA) proposed creating a sovereign investment fund to generate higher returns for Social Security reserves, but the measure remains under review.

Expert Advice: How to Maximize Benefits

Financial planners emphasize that delaying benefits — even by a few years — can yield significant long-term advantages.

“If you can work until 67 or 68, you’re essentially buying yourself a higher guaranteed income for life,” said Mark Hamrick, senior analyst at Bankrate.

Strategies include:

- Coordinating with a spouse’s benefits to optimize household income.

- Drawing from personal savings first to delay claiming.

- Using online SSA calculators to estimate the break-even age for delayed benefits.

“The single best move for many Americans is simply to wait,” said Certified Financial Planner Marguerita Cheng. “But that’s easier said than done when inflation eats your paycheck.”

Looking Ahead: Generational Challenges

Younger generations face a changing retirement landscape. Millennials and Generation Z will likely experience smaller replacement rates — the percentage of pre-retirement income covered by Social Security — unless the system is strengthened.

Automation and gig economy jobs also complicate contributions, as many independent workers pay inconsistent payroll taxes. “The system was built for stable, long-term employment,” said David John of the AARP Public Policy Institute. “That model no longer fits today’s workforce.”

You’re Getting a $56 Raise… But the Government Quietly Takes Back $21.50 — Here’s How

FAQ About 90% of Americans Just Took a 30% Social Security Cut

Is the government cutting Social Security benefits right now?

No. There are no official or across-the-board cuts. The “30% cut” refers to the reduction from claiming early, not a legislative change.

Will Social Security run out of money?

The trust fund is projected to be depleted by 2033, but the program would still pay about 77% of benefits through payroll taxes unless Congress intervenes.

When is the best age to claim benefits?

Financial experts generally recommend delaying until at least full retirement age (67 for most workers) or longer, depending on health and savings.

Can you reverse your decision if you claim early?

Yes — within 12 months of claiming, recipients can withdraw their application and repay benefits to reset at a later date.

The Bottom Line

The notion that Americans have “taken” a 30% Social Security cut is misleading. The real issue is behavioral — millions of individuals are choosing to claim benefits early, often under financial strain. While the system itself remains intact, the combination of economic pressure and policy inertia threatens to erode retirement security for future generations.

As the U.S. faces an aging population and shrinking workforce, experts agree that informed claiming decisions — and political will — will determine whether Social Security remains a lifeline or becomes a liability.