When employees receive a wage increase, they often expect to see a direct boost in their take-home pay. However, in many cases, tax and deduction systems mean the actual increase is much smaller. For example, a $56 raise could result in just $34.50 in additional pay after taxes. This hidden reduction can leave workers feeling as though their raise has been “taken back” by the government.

You’re Getting a $56 Raise

| Key Fact | Detail/Statistic |

|---|---|

| Gross Raise | $56 increase in pay |

| Average Tax/Deduction | 38.4% of the raise is deducted through taxes and benefits |

| Net Take-Home Raise | $34.50 increase after deductions |

| Potential Impact on Worker | Lower-than-expected take-home pay |

Raises are often seen as a straightforward path to financial improvement, but taxes and deductions can significantly reduce their effectiveness. By understanding how tax brackets, payroll taxes, and other deductions work, employees can take steps to mitigate these effects and make the most of their wage increases. With careful planning and awareness, it is possible to retain more of your raise and enhance long-term financial stability.

How Your Raise Is Affected by Taxes and Deductions

The Role of Income Tax Brackets

In most tax systems, income is taxed progressively—meaning that the more you earn, the higher the rate applied to your additional income. So, while your gross pay may increase by $56, a portion of that raise could push you into a higher income tax bracket. For instance, in the United States, a worker who receives a raise could see their additional income taxed at a rate as high as 22% or more, depending on their total income.

According to Dr. Anya Sharma, an economist at the Brookings Institution, “Raising your income by a small amount may push you into a new bracket, where the new income is taxed at a higher rate, resulting in less of a benefit than expected.”

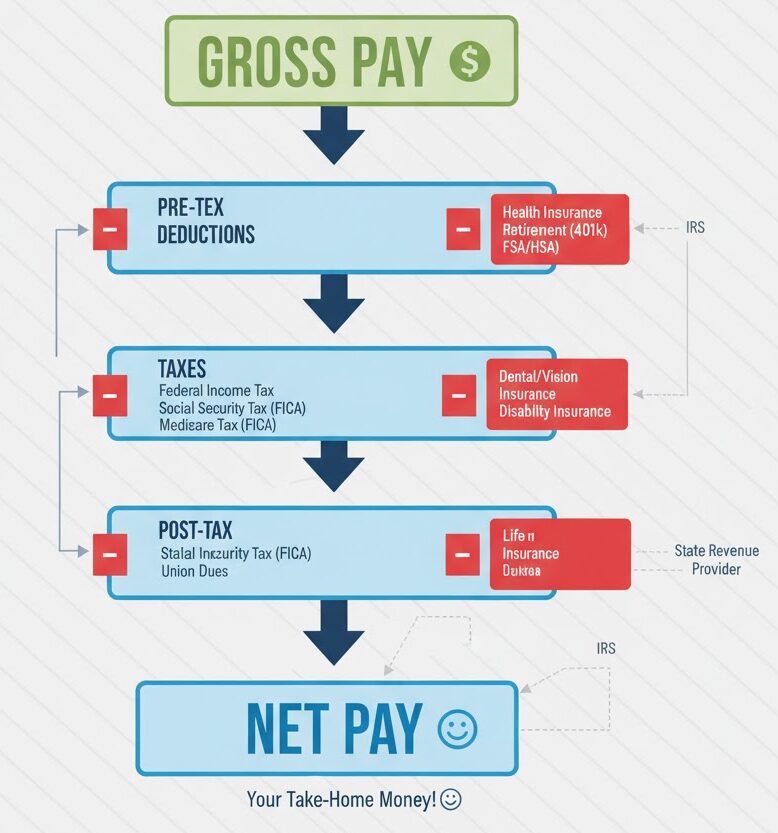

Other Payroll Deductions

In addition to taxes, raises often lead to an increase in other payroll deductions, such as contributions to social security, pension plans, and healthcare. These deductions, while vital for long-term savings and security, can further reduce the net effect of a wage increase.

The Hidden Costs of Payroll Taxes

Beyond income tax, payroll taxes—such as Social Security and Medicare in the United States—are automatically deducted from your paycheck. These taxes are calculated based on a percentage of your earnings and increase as your income grows. For example, the combined FICA (Federal Insurance Contributions Act) rate for Social Security and Medicare is around 7.65% for most workers, which means a portion of your raise is lost to these taxes before it even reaches your bank account.

Tax Credits and Benefits: Losing Eligibility

A less visible factor in how your raise is eroded is the potential loss of certain tax credits or government benefits. For example, a worker may lose eligibility for child tax credits, subsidies for health insurance, or other government benefits when their income crosses a specific threshold. As a result, they may effectively pay more in taxes or lose financial assistance, reducing the benefit of their raise.

Case Studies: Understanding the Real Impact of a Raise

To illustrate how tax deductions and benefits impact wage increases, let’s explore two hypothetical workers from different income brackets.

Case Study 1: Middle-Class Worker (Annual Salary: $50,000)

John is a 35-year-old single worker with an annual salary of $50,000. He receives a $56 raise, bringing his new salary to $50,056. After accounting for federal and state taxes (totaling 28%), he sees only $40 of his raise in his paycheck. Of the $56, $16 is deducted for taxes and social security. While John benefits from the raise, the actual increase in his take-home pay is just $40.

Case Study 2: High-Income Worker (Annual Salary: $150,000)

Sarah, a 45-year-old married worker, earns $150,000 annually. She also receives a $56 raise. However, due to her higher income, she falls into a 35% tax bracket. After taxes and deductions, Sarah only takes home about $36.40 of her $56 raise. Although the percentage of her raise lost to taxes is higher than John’s, her overall tax burden is greater due to her salary.

Analysis

These case studies show how raises affect employees differently based on their income levels. While a modest raise may seem appealing, the real impact is influenced heavily by tax rates, deductions, and the loss of benefits.

How Historical Tax Policies Have Shaped Raises

The relationship between wage growth and tax policies has evolved significantly over the past century. In the early 20th century, the federal income tax in the United States applied only to the wealthiest Americans, with tax rates starting at just 1%. As the economy grew, tax brackets became more progressive, with higher earners paying larger portions of their income in taxes.

However, over the past few decades, wage growth for the middle class has stagnated, while tax policies have often favored the wealthiest. As a result, the increase in gross income may not translate to the expected improvement in the financial security of the average worker. This phenomenon is part of a broader trend of growing income inequality in many countries, particularly in the U.S.

According to Dr. Samuel Greenfield, a professor of economics at Harvard University, “Wage growth has not kept pace with inflation, and tax policies often fail to provide relief for middle- and lower-income workers, who are the most affected by progressive tax brackets.”

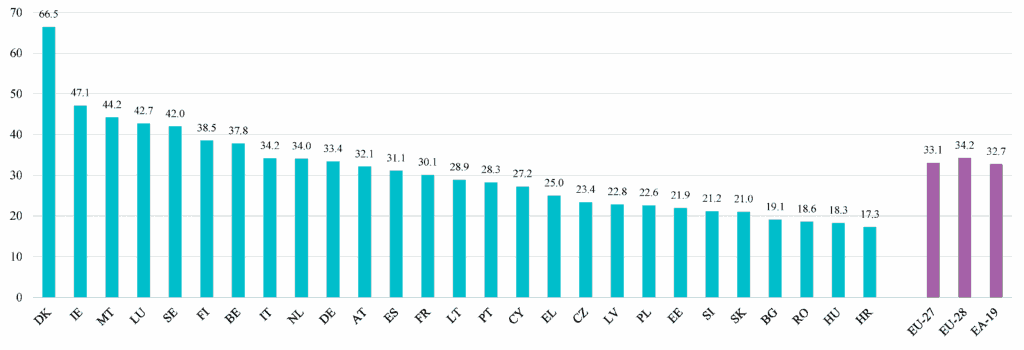

Global Perspectives: How Other Countries Manage Raises and Taxes

The impact of a raise can differ significantly depending on the country in which you live. For example, in Canada, the tax system is similarly progressive but offers more generous tax credits for families, making the net effect of a raise less detrimental for middle-income earners compared to the U.S. Similarly, countries like Germany and the UK have relatively higher tax rates but offer more extensive social services and benefits in return.

For example, in Germany, while taxes are higher, the state provides universal healthcare, generous parental leave, and subsidized childcare, which can offset the burden of higher taxes. In contrast, in the U.S., workers may receive less in benefits despite paying more in taxes, which means they feel the effects of tax increases more acutely.

Expert Analysis: The Economic Impact of Tax Systems

While much of the focus in wage increases revolves around the individual level, economists argue that the broader economic implications of tax systems are just as important. Dr. Andrew Zhang, an economist at the International Monetary Fund (IMF), explains, “Progressive taxation, when applied effectively, can reduce inequality and fund social programs. However, when tax brackets and deductions are not adjusted for inflation or wage growth, workers effectively face higher taxes without a corresponding increase in government benefits.”

As countries struggle to balance budget deficits, some economists suggest that tax systems will likely undergo significant changes in the coming years, potentially reducing deductions for higher-income earners while increasing benefits for middle- and lower-income groups.

These States Just Got the Biggest Social Security Raise — See the Full Breakdown

Future Trends: How Tax Policies Could Change

In the future, tax policies may undergo significant reforms aimed at addressing income inequality. Possible changes include expanding tax credits for middle-income workers, introducing universal basic income (UBI), or making healthcare and education more affordable through direct government funding.

One potential change gaining traction is the introduction of progressive payroll taxes, which would ensure that higher earners contribute more towards social security and healthcare, thus reducing the tax burden on lower-income earners.

Practical Tips to Navigate Deductions More Effectively

- Adjust Your Tax Withholding: If your raise pushes you into a higher tax bracket, consider increasing your withholding. This will prevent a larger-than-expected tax bill when you file.

- Maximize Retirement Contributions: By contributing more to tax-advantaged retirement accounts, you can reduce your taxable income, thereby lessening the impact of taxes on your raise.

- Use Flexible Spending Accounts: Tax-advantaged accounts for healthcare or dependent care expenses can reduce your taxable income, allowing you to save more while reducing your taxable earnings.

- Review Your Eligibility for Tax Credits: Be sure to regularly check whether your raise affects your eligibility for various tax credits and government programs. Adjust your financial planning accordingly.