Social Security recipients will see a 2.8% cost-of-living adjustment (COLA) beginning in January 2026, marking a significant boost to the purchasing power of millions of Americans. This adjustment will result in an average increase of $56 per month for retirees and other beneficiaries. While the raise is designed to help combat inflation, its actual impact varies based on state averages. This article explores how the increase breaks down across different states, helping recipients understand what they can expect in their next checks.

Social Security Raise

| Key Fact | Detail/Statistic |

|---|---|

| COLA Increase for 2026 | 2.8% |

| Average Monthly Increase | $56 |

| Impact on High-Benefit States | Larger dollar increases in high-benefit states |

| Official Website | Social Security Administration |

What Does the 2.8% Raise Mean for Social Security Recipients?

The 2.8% increase in Social Security benefits for 2026 is part of the federal government’s annual adjustment to help beneficiaries keep pace with inflation. This raise, known as the Cost-of-Living Adjustment (COLA), is calculated based on the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the prices of a range of goods and services, including food, housing, and healthcare.

For the typical Social Security recipient, this will translate into an additional $56 per month on average. However, the amount will vary depending on the beneficiary’s starting monthly benefit, which is influenced by factors such as work history, earnings, and the year they began claiming Social Security.

COLA Adjustment History: A Snapshot of Trends

Social Security’s COLA adjustments have fluctuated over the years. In the 1970s, the adjustment was introduced to help beneficiaries keep up with inflation. The highest COLA increase in history occurred in 1980, when benefits increased by 14.3%, largely due to the high inflation rates at the time.

In recent years, however, COLA increases have been more modest. The 2021 adjustment was only 1.3%, while 2022 saw an increase of 5.9%, the largest in over 40 years. The upcoming 2.8% is more in line with the average COLA increase in recent decades, reflecting more moderate inflation levels.

Which States Are Most Affected by the 2026 Social Security Raise?

While the percentage increase is uniform across the country, states with higher-than-average Social Security benefits will see larger dollar increases due to the raise. States such as New Hampshire, Maryland, and Michigan, where average benefits tend to be higher, will experience a more substantial boost.

For example, in New Hampshire, where the average benefit is $2,039 per month, the 2.8% increase will result in a $57.11 monthly boost. In Maryland, the average benefit of $2,007.70 will rise by around $56.13. This is significantly more than the $40 increase that will be seen in states with lower average benefits, like Mississippi.

Social Security Impact by State:

- New Hampshire: $2,039 → $2,096 (Increase: $57.11)

- Maryland: $2,007.70 → $2,064 (Increase: $56.13)

- Michigan: $1,900 → $1,954 (Increase: $54.70)

- Mississippi: $1,650 → $1,692 (Increase: $42.00)

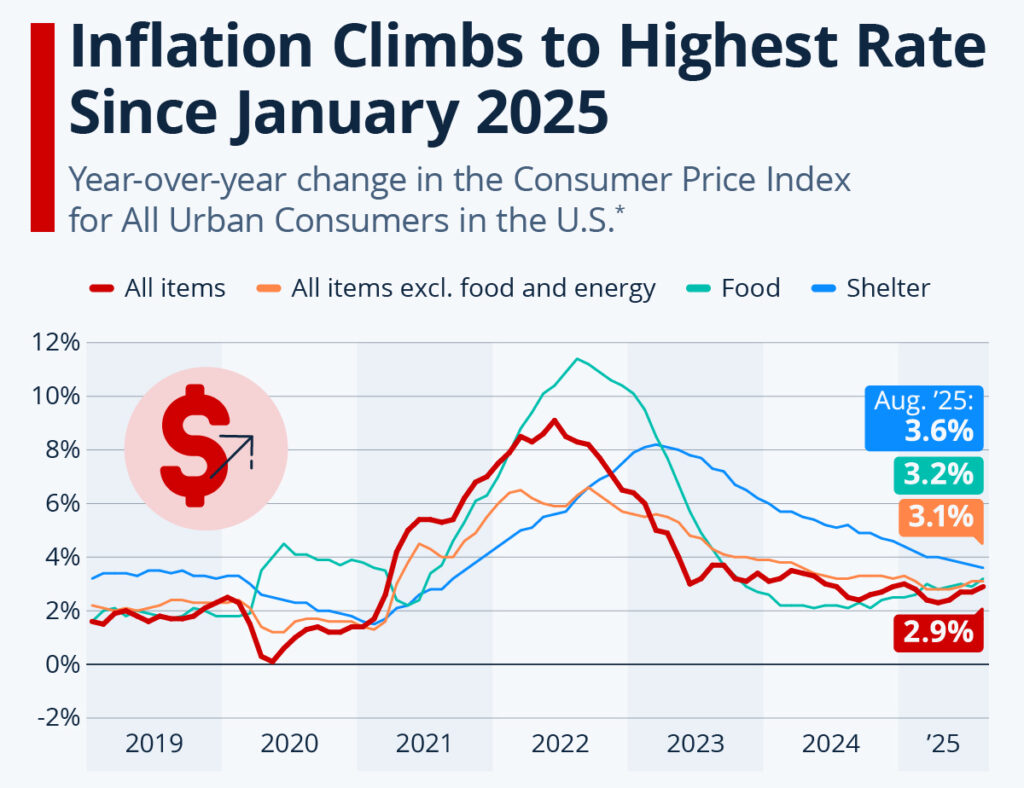

Why the 2.8% COLA May Not Fully Offset Inflation

While a 2.8% COLA is a welcome boost for many Social Security recipients, some experts warn that it may not be sufficient to fully offset the rising costs of everyday goods and services. Healthcare and housing expenses, in particular, have been rising at a faster pace than general inflation, which could mean that beneficiaries still struggle to maintain their purchasing power.

Dr. Emily White, an economist with the Brookings Institution, explains: “While the 2.8% COLA increase helps, it doesn’t fully match the cost increases in essential areas like healthcare, which remain major expenditures for retirees.”

For seniors on fixed incomes, the gap between the COLA adjustment and actual inflation could lead to further financial strain, particularly for those living in high-cost areas.

Personal Impact Stories: How the Raise Affects Beneficiaries

Many beneficiaries are eagerly awaiting the 2.8% raise, but its true impact is deeply personal. Patricia Evans, a 72-year-old retiree from Florida, shared how the increase will help ease the burden of rising prescription drug costs. “It’s not a huge amount, but it will certainly help cover some of my medications,” she said. “Every little bit counts.”

Similarly, James Foster, a disabled veteran from Texas, noted that the raise would offset the increasing costs of food and utilities. “It’s a small relief,” Foster said, “but with the way things are going, it’s better than nothing.”

How Social Security Benefits Are Calculated

Social Security benefits are based on a formula that takes into account a recipient’s highest-earning years and the age at which they start claiming benefits. The formula is designed to replace a percentage of pre-retirement income, with lower-income workers receiving a higher percentage of their past earnings than higher-income workers. The COLA is applied to all beneficiaries, regardless of how much they receive, but those with larger benefits will naturally see a bigger dollar increase.

Economic Implications of COLA Increases: A Broader View

The 2.8% COLA increase will have economic implications beyond just Social Security recipients. Federal spending on Social Security is set to increase as a result of the raise, which will add to the budget deficit unless other changes are made. The Social Security Trust Fund is projected to be insolvent by 2034 if current trends continue, leading some economists to advocate for reforms such as increasing the retirement age or means testing.

Dr. Alan Greenspan, former Chairman of the Federal Reserve, has spoken about the need for long-term reforms to the program, warning that COLA increases could further exacerbate the program’s financial strain. “If inflation continues to rise at current rates, we will have to reconsider how we adjust Social Security payments in the future,” he said.

Policy Proposals and Legislative Discussions: What’s Next for Social Security?

Amid rising concerns about the program’s sustainability, there are ongoing discussions in Congress about potential reforms. Some lawmakers have proposed reducing COLA adjustments to slow the growth of benefits, while others have called for targeting benefits to those in need, rather than applying blanket increases across all beneficiaries.

In the coming years, Social Security will likely become a central issue in political debates, especially as the population of retirees continues to grow. Some economists argue that adjusting COLA formulas or adopting new cost measurement tools could ensure that the program remains viable without sacrificing the financial security of its beneficiaries.

Max Out Your Social Security: The Government’s Newly Uncovered 3-Step Trick to Hit $5,251 Monthly

Conclusion: A Mixed Picture for Social Security Beneficiaries

While the 2.8% COLA increase for 2026 will provide much-needed relief to millions of Americans, it may not be enough for those who are particularly vulnerable to rising living costs. States with higher-than-average Social Security benefits will see larger increases, but many beneficiaries, especially those in low-income brackets, will still feel the squeeze from inflation. The ongoing challenge will be to find a balance between maintaining the program’s financial health and ensuring it meets the needs of those it is designed to support.

As the debate over Social Security’s future continues, it is clear that both recipients and lawmakers will have to carefully consider how best to manage COLA increases to ensure the program’s long-term stability.