Starting in January 2026, major adjustments to the Social Security system will take effect, bringing both benefits and challenges to retirees and workers approaching retirement. These changes are not just about increases or decreases in payments but reflect broader shifts in the structure of Social Security. Understanding these changes is crucial for ensuring long-term financial stability and planning for those in or near retirement.

This article breaks down the four most significant adjustments and offers expert insights on what they mean for you. Whether you are already collecting benefits, planning to retire soon, or helping a loved one plan for the future, these changes will shape your financial outlook.

Social Security Changes

| Key Fact | Detail/Statistic |

|---|---|

| COLA Increase | 2.8% boost in Social Security benefits |

| Earnings Limit for Pre-FRA Workers | Raised to $24,480 for those under Full Retirement Age |

| Taxable Earnings Cap | Increased to $184,500 |

| Full Retirement Age (FRA) | For those born in 1959, FRA will be 66 years, 10 months |

| Official Website | Social Security Administration |

1. Cost-of-Living Adjustment (COLA) Boost

Every year, the Social Security Administration adjusts benefits to help recipients keep up with inflation. In 2026, beneficiaries will receive a 2.8% cost-of-living adjustment (COLA). While not a record-breaking increase, this adjustment will still have a meaningful impact on the purchasing power of retirees.

For example, the average Social Security benefit of $2,015 will increase by around $56, bringing the monthly payment to $2,071. Though this increase can help offset rising costs, particularly in areas such as healthcare and housing, it is important to note that the COLA often lags behind inflation in essential sectors like medical costs.

The Impact on Retirees:

- Health Care: Many retirees rely on Social Security benefits to cover their healthcare costs, and with healthcare inflation consistently outpacing the overall rate, the 2.8% COLA may not be enough to fully offset these expenses.

- Housing Costs: Rising rents and home prices in many areas may limit the impact of the COLA increase, meaning many retirees will still feel a pinch in their budgets despite the raise.

While the COLA adjustment is certainly a welcome change, retirees should plan for the possibility that inflation in essential expenses, such as prescription medications, long-term care, and utilities, may still outstrip this raise.

2. Earnings Limits for Workers Before Full Retirement Age (FRA)

For individuals who claim Social Security before their Full Retirement Age (FRA) but continue to work, the earnings limit will increase to $24,480 in 2026. This is a key change for retirees who want to keep working while receiving Social Security benefits, as it allows them to earn more without seeing a reduction in their monthly payments.

Under the previous system, Social Security recipients who earned above the earnings limit faced a reduction of $1 for every $2 earned above the cap. With the new increase in the earnings limit, more individuals will be able to earn extra income without sacrificing their benefits.

How This Affects Working Retirees:

- Higher Flexibility: Retirees who want to stay engaged in the workforce or supplement their retirement savings will benefit from this higher threshold. For those working part-time or in freelance roles, this increase offers the flexibility to earn more without losing Social Security payments.

- Boosting Savings: For retirees who can work and still draw Social Security, the extra income can be used to boost savings for emergencies or future goals, such as long-term care or home repairs.

While these changes are beneficial for many, retirees should be mindful that exceeding the new earnings limit could result in a permanent reduction of their benefits in future years, so careful planning is essential.

3. Increased Taxable Earnings Cap

In 2026, the maximum earnings subject to Social Security taxes will increase to $184,500. This means that individuals who earn more than this amount will see their Social Security tax rate increase, as a larger portion of their earnings will be subject to payroll taxes.

Why It Matters for High Earners:

- More Contributions: High earners will pay more into the Social Security system under this new cap. The additional revenue helps support the program, but it may also affect the future benefits of these individuals.

- Potential Impact on Benefits: For those who have earned significant salaries over their lifetime, this increase in taxable earnings could raise the amount used to calculate their future benefits. However, for those who are already at or near the maximum benefit, this increase will likely not result in a significantly larger payout, as there are maximum benefit caps in place.

For retirees, especially those with high lifetime earnings, it’s important to plan for both the additional taxes they’ll pay on earnings above the new cap and how it might affect their future benefits calculations.

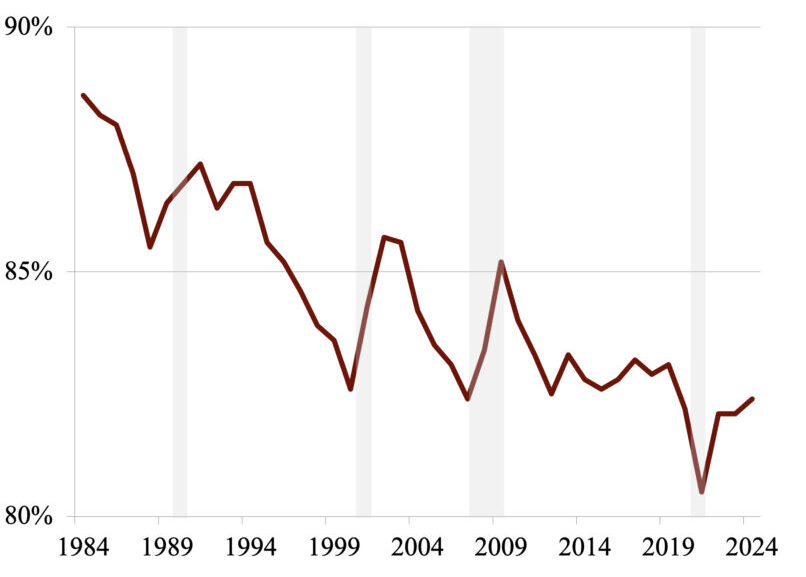

4. Gradual Increase in Full Retirement Age (FRA)

As life expectancy has increased over the years, the Full Retirement Age (FRA) has gradually been increasing. For individuals born in 1959, the FRA will be 66 years and 10 months. Those born in 1960 or later will reach FRA at 67.

This change in FRA means that individuals who want to collect their full Social Security benefit will need to wait longer to do so. While the change might seem small for those close to retirement, it has important implications for both the amount of money you’ll receive and the timing of when you can start drawing benefits.

Delaying Benefits:

- Increased Monthly Benefits: Delaying Social Security past FRA can result in a higher monthly benefit, as individuals can earn delayed retirement credits for each year they wait to claim benefits beyond their FRA.

- Permanent Impact: Once you reach FRA, the benefits you receive will be based on your earnings history and the age at which you start collecting. If you begin collecting benefits before FRA, your benefits will be permanently reduced. If you delay claiming until after FRA, you’ll receive a higher benefit. Understanding how these rules work will help you decide the optimal time to begin receiving benefits.

5. Why These Changes Matter: Broader Implications

These changes to Social Security come at a time when the program is facing significant long-term funding challenges. The Social Security trust fund, which supports benefits, is projected to deplete in the coming decades, meaning Congress may need to take further action to preserve the program. While these adjustments help keep the system viable in the short term, they also highlight the ongoing need for reform to ensure Social Security remains sustainable for future generations.

Expert Perspectives on Social Security’s Future

Dr. Michael Spencer, a professor of economics at Harvard University, explains: “These incremental changes reflect an ongoing effort to adapt Social Security to modern economic realities. However, the system’s long-term sustainability will depend on comprehensive reforms, including potential tax rate increases, raising the full retirement age further, or revising benefit formulas.”

Max Out Your Social Security: The Government’s Newly Uncovered 3-Step Trick to Hit $5,251 Monthly

6. Practical Advice for Retirees

While the changes for 2026 are relatively straightforward, there are several actions retirees should consider to optimize their benefits:

- Review Social Security Statements Regularly: Check the Social Security Administration website for updates on your earnings and estimated benefits, ensuring you’re on track to meet your retirement goals.

- Consult with a Financial Planner: Given the complexities of Social Security, it may be beneficial to speak with a professional to assess how these changes affect your retirement plans.

- Consider Delaying Benefits: If you can afford to delay taking Social Security, doing so may result in a significantly higher monthly benefit once you do start receiving it.

- Optimize Work and Earnings: If you are working and receiving Social Security, ensure you stay under the new earnings limit to avoid unnecessary benefit reductions.

Looking Ahead

The Social Security changes for 2026 represent part of an ongoing evolution of the system aimed at making it more adaptable to the financial realities of today’s retirees. With careful planning and the right advice, retirees can navigate these changes to maximize their benefits.

As we move closer to 2026, more adjustments may be needed to ensure Social Security’s long-term viability. Keeping up with these changes and understanding their impact on your retirement strategy is essential for ensuring a secure financial future.