For millions of Americans, Social Security serves as the backbone of retirement income. In 2025, the Social Security Administration (SSA) confirmed that the highest possible monthly retirement payment — available only under specific conditions — stands at $5,251.

This figure represents the maximum payout for individuals who have earned at or above the taxable wage base for at least 35 years and delay claiming benefits until age 70. While often framed in media headlines as a “newly uncovered government trick,” this process is based on long-standing federal formulas that determine retirement benefits.

“The so-called ‘three-step trick’ isn’t new,” said Andrew Biggs, senior fellow at the American Enterprise Institute. “It’s simply the culmination of how the Social Security system rewards high lifetime earners who postpone retirement.”

Max Out Your Social Security

| Key Fact | Detail / Statistic |

|---|---|

| Maximum monthly benefit (2025) | $5,251 at age 70 |

| Minimum years of earnings counted | 35 years |

| Maximum taxable income (2025) | $173,400 |

| Average monthly benefit (2025) | $1,882 |

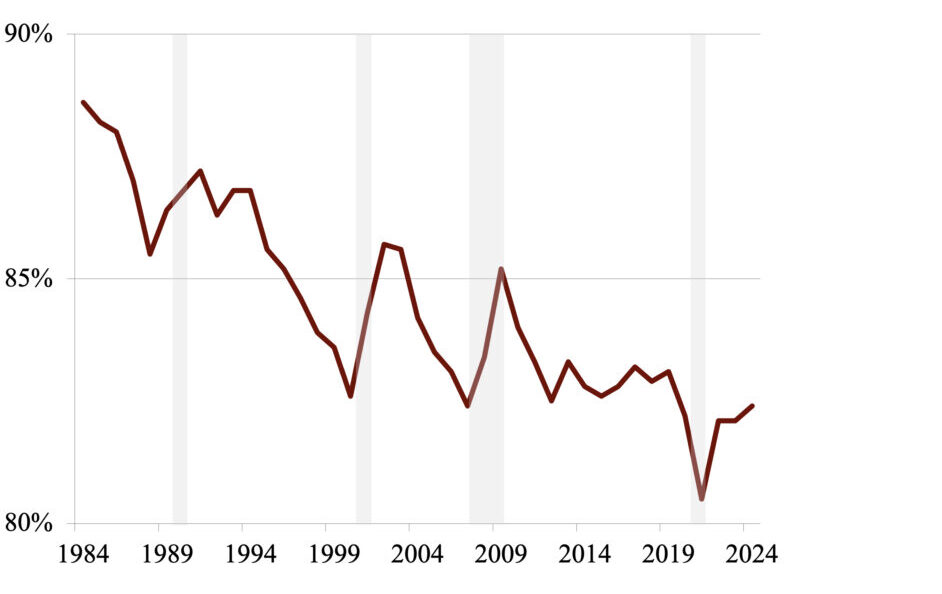

| Share of retirees relying on Social Security | 90% |

| Official Website | Social Security Administration |

Step 1: Build a 35-Year Work Record

The SSA calculates benefits using a worker’s average indexed monthly earnings (AIME) over the 35 years in which they earned the most. Any years with no income count as zeros, significantly lowering the final calculation.

“If someone has only 30 years of reported earnings, the missing five years drag down their average,” said Mary Beth Franklin, a certified financial planner and author of Maximizing Social Security Retirement Benefits. “That’s why many near-retirees choose to work a few more years — every additional year can raise the benefit.”

For example, someone who replaces a zero-income year with a $100,000 earning year could add over $100 per month to their future benefit.

Step 2: Earn at or Above the Wage Cap

Social Security taxes apply only to income up to a set taxable maximum each year. In 2025, that limit is $173,400. Earnings beyond that threshold are not taxed for Social Security and do not increase future benefits.

To qualify for the top payout, workers must meet or exceed this cap for most of their careers. That typically includes doctors, executives, engineers, and senior professionals.

“The maximum benefit isn’t a goal everyone can reach,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “It’s primarily designed for those with long-term, high-wage employment.”

From 2000 to 2025, the wage base has grown by nearly 75%, reflecting wage inflation and the system’s indexing formula.

Step 3: Delay Claiming Until Age 70

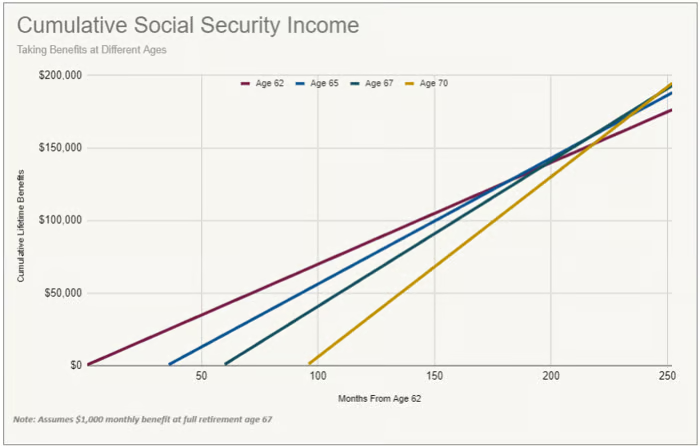

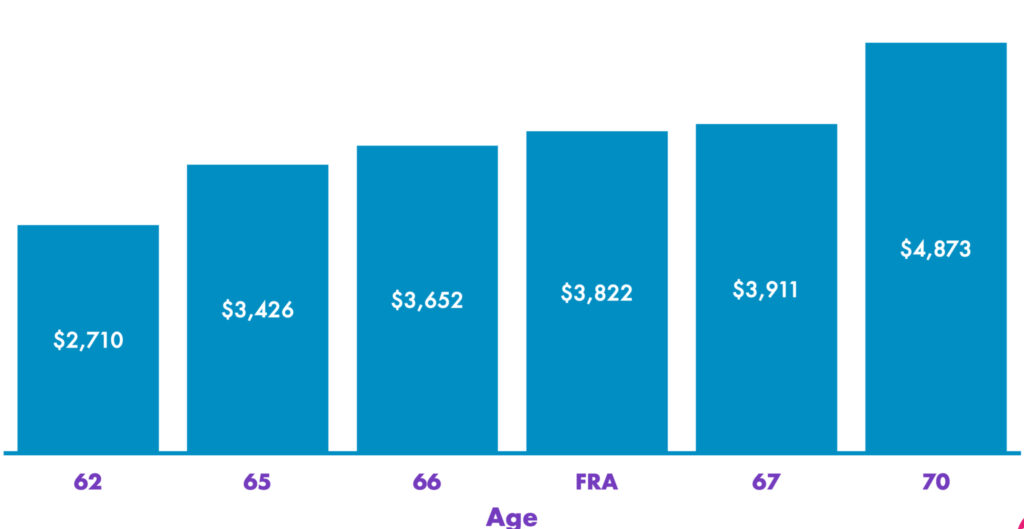

Workers may begin claiming benefits as early as age 62, but doing so results in a permanent reduction — up to 30% below what they would receive at Full Retirement Age (FRA).

Delaying benefits beyond FRA, up to age 70, increases monthly payments through delayed retirement credits (DRCs). The credits grow by approximately 8% per year after FRA, creating one of the most reliable “returns” available to retirees.

“Delaying benefits is essentially an investment in longevity,” said Laurence Kotlikoff, professor of economics at Boston University. “You give up some payments now in exchange for larger, inflation-protected payments later.”

In 2025, an individual eligible for $3,700 per month at FRA (age 67) would receive approximately $4,588 if they waited until age 70.

The Cost-of-Living Factor

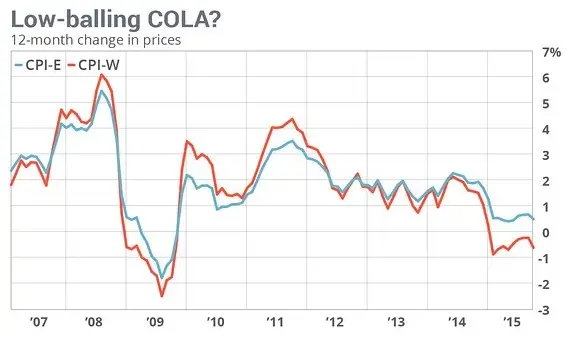

Each year, Social Security benefits adjust for inflation through the Cost-of-Living Adjustment (COLA). For 2025, the SSA announced a 3.2% increase, following a 3.4% rise in 2024.

According to the Bureau of Labor Statistics (BLS), these adjustments are tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The COLA helps preserve retirees’ purchasing power, although rising healthcare and housing costs often outpace the adjustments.

How Social Security Is Funded — and Why It Matters

Social Security benefits are financed primarily through payroll taxes collected under the Federal Insurance Contributions Act (FICA). Workers and employers each pay 6.2% of wages up to the annual taxable maximum.

The Social Security Trustees Report (2025) warns that the Old-Age and Survivors Insurance (OASI) Trust Fund may face depletion by 2035, after which payroll tax revenue alone could cover about 83% of scheduled benefits.

Policymakers are considering potential solutions, including:

- Raising the payroll tax cap or rate

- Gradually increasing the full retirement age

- Adjusting benefit formulas for high earners

“While insolvency doesn’t mean the program disappears, it does signal the need for reforms soon,” said Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities (CBPP).

The International Context

Compared to other developed nations, the United States replaces a smaller share of pre-retirement income through public pensions. According to the Organization for Economic Cooperation and Development (OECD), the U.S. net replacement rate averages about 51%, compared with 74% in Germany and 82% in Italy.

“Americans rely far more on personal savings and employer-sponsored plans like 401(k)s,” said Dr. Olivia Mitchell, a pension policy expert at the Wharton School, University of Pennsylvania. “That makes understanding how to optimize Social Security even more critical.”

Avoiding Common Pitfalls

Experts warn against misconceptions that can reduce lifetime benefits.

- Claiming too early: Filing at 62 can reduce benefits permanently by nearly one-third.

- Earnings test confusion: Those working while collecting before FRA may see temporary withholding if income exceeds annual limits ($22,320 in 2025).

- Spousal strategies: Married couples may maximize household income through coordinated claiming, such as delaying the higher earner’s benefit.

“It’s not just about one person’s benefit — it’s about optimizing across the household,” said David Freitag, financial planning consultant at MassMutual.

Planning Beyond the Maximum

While only a small fraction of retirees achieve the $5,251 figure, experts emphasize that the principles of maximizing benefits — working longer, earning more, and delaying claims — apply broadly.

For middle-income retirees, even modest improvements can yield thousands in lifetime gains. A 2024 analysis by the National Institute on Retirement Security found that delaying claiming from 62 to 67 increases total lifetime benefits by roughly $100,000 for the average household.

Technology and Tools for Planning

The SSA’s My Social Security portal provides personalized estimates and calculators that project benefits under different claiming ages and earnings scenarios. Private platforms such as SmartAsset, Fidelity, and AARP’s Social Security Calculator also offer free modeling tools.

Financial planners recommend using multiple tools to compare results and simulate economic variables such as inflation and longevity.

“Estimating benefits should be a dynamic process,” said Michael Kitces, head of planning strategy at Buckingham Wealth Partners. “The closer you are to retirement, the more accurate the SSA projections become.”

Looking Ahead

Social Security remains the most significant guaranteed income source for most retirees, but demographic shifts — longer lifespans, smaller families, and slowing wage growth — pose mounting challenges.

Congressional discussions on reform are likely to intensify before the next presidential election cycle, as the 2035 trust fund depletion date draws closer.

“Social Security is both remarkably durable and politically untouchable,” said Jason Fichtner, chief economist at the Bipartisan Policy Center. “But its long-term sustainability depends on legislative courage — and public understanding of how the system actually works.”

FAQ About Max Out Your Social Security

Q: Can both spouses receive the maximum benefit?

A: Only if both have 35+ years of high earnings and delay claiming until age 70. Spousal benefits are capped at 50% of the higher earner’s benefit at full retirement age.

Q: Are benefits adjusted for inflation each year?

A: Yes, through the Cost-of-Living Adjustment (COLA), which reflects changes in the Consumer Price Index.

Q: Are Social Security benefits taxable?

A: Up to 85% of benefits may be taxable depending on combined income, according to the Internal Revenue Service (IRS).

Q: What happens if the trust fund runs short?

A: Current projections indicate benefits could still be paid at about 83% of scheduled levels after 2035, unless Congress acts.