A rarely discussed rule inside the Social Security Administration allows retirees to pause or even withdraw their benefits and later reapply for a higher Social Security benefit. The option, accessed through a form few people know about, could increase monthly income by thousands of dollars over time — but strict deadlines and repayment rules mean it’s not for everyone.

Government Form Could Boost Your Social Security by Thousands

| Key Fact | Detail |

|---|---|

| Hidden form | Form SSA-521, “Request for Withdrawal of Application,” lets retirees cancel their initial claim within 12 months. |

| Suspension rule | After reaching full retirement age (66–67), retirees may suspend benefits to earn 8% annual credits until age 70. |

| Potential increase | Delaying benefits from age 62 to 70 can raise lifetime monthly payments by up to 77%. |

| Awareness gap | Less than 10% of retirees report knowing about the withdrawal or suspension options. |

| Official Website | Social Security Administration |

The Hidden Path to a Higher Social Security Benefit

The “Do-Over” Option: Form SSA-521

Form SSA-521, officially known as the Request for Withdrawal of Application, allows individuals to reverse their decision to claim Social Security benefits. If filed within 12 months of the first payment, this form cancels the original claim as if it never happened.

That means retirees can repay all benefits received — including any issued to a spouse or dependent — and later reapply at an older age. Because Social Security benefits increase each month you delay up to age 70, this “do-over” can dramatically raise future payments.

However, it’s available only once per lifetime. The process also requires repaying all funds received, which can be challenging for retirees without substantial savings.

The Suspension Strategy: Pausing Benefits for Growth

For those who have reached their full retirement age (FRA) but are younger than 70, another option exists — the voluntary suspension. This rule allows beneficiaries to pause payments and earn “delayed retirement credits” worth about 8% per year.

For instance, a retiree who begins collecting at age 66 and suspends benefits for three years could increase their future monthly check by roughly 24%. The suspended payments resume automatically at age 70, when maximum credits are reached.

This approach doesn’t require repayment of past benefits. However, dependents or spouses receiving benefits based on that worker’s record will also see their payments suspended during the same period.

Why This Option Exists

The flexibility to withdraw or suspend benefits was built into Social Security to accommodate changing personal circumstances. Some retirees claim early out of financial need, only to later return to work or realize their benefits are lower than expected. The “withdrawal” and “suspension” provisions allow limited correction.

Economists say the SSA rarely promotes these rules because they complicate the system’s communication. “The options are there in law, but they are not emphasized in standard outreach materials,” explained Dr. Ellen Greene, a retirement policy researcher at Georgetown University. “It reflects a tension between administrative simplicity and individual optimization.”

Understanding the Stakes

How Claiming Age Affects Benefits

The size of a Social Security benefit is determined by three main factors:

- Lifetime earnings (based on the 35 highest earning years).

- Full retirement age (FRA), typically between 66 and 67.

- Age at which you claim.

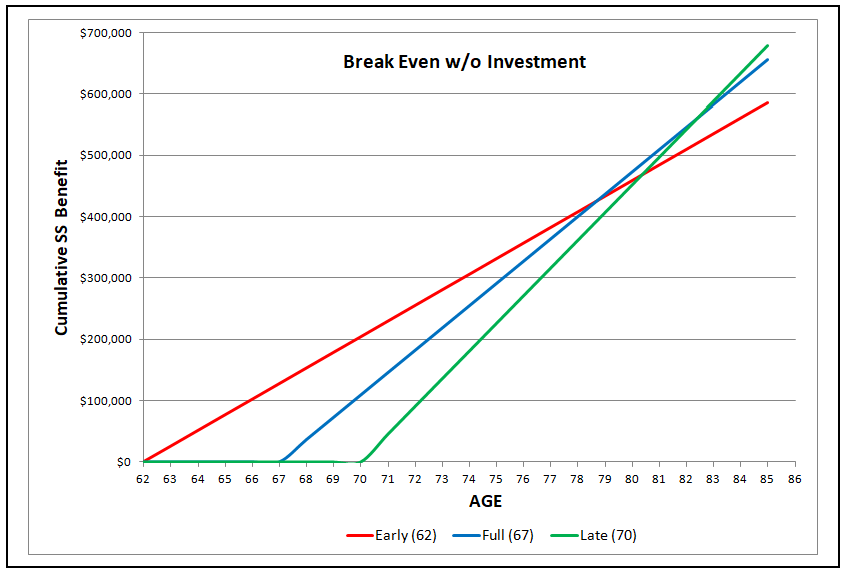

Claiming early (at 62) permanently reduces your monthly payment. Waiting until FRA yields the full benefit, and delaying beyond FRA until age 70 adds up to 8% more for each year waited. Over a lifetime, this can amount to tens of thousands of dollars in extra income.

When the Do-Over Makes Sense

The withdrawal form is most useful for people who:

- Claimed early but later realized they could afford to wait.

- Returned to the workforce and no longer need immediate income.

- Experienced a major change in financial or family circumstances.

Example:

A retiree who began collecting at age 63 receives $1,500 per month. After eight months, they go back to work and file Form SSA-521 to cancel their claim. They repay roughly $12,000 in benefits and reapply at age 67, raising their new benefit to around $1,900 per month for life.

When Suspension Works Best

Voluntary suspension is ideal for people who reach their FRA and want to increase their payments but don’t need the income right away. This can also benefit surviving spouses, as survivor benefits are based on the deceased’s final benefit amount.

For instance, if a worker suspends benefits from age 67 to 70, their surviving spouse may later inherit a higher monthly payment. That makes suspension an important estate-planning tool, especially for couples with significant age gaps.

The Broader Context: Social Security’s Future

The Social Security program faces long-term funding challenges. The 2024 Trustees Report projected that the combined retirement and disability trust funds could be depleted by 2035, potentially reducing benefits by about 20% if Congress takes no action.

Given this uncertainty, optimizing benefits under current law has become increasingly important. “We can’t control what policymakers decide, but we can make the most of existing rules,” said Martha Lang, a certified financial planner based in Chicago. “These options may help retirees stretch their guaranteed income in a period of rising costs.”

Common Misconceptions

Myth 1: Once you start Social Security, you can’t change it.

False. Both withdrawal and suspension options exist, but strict time limits apply.

Myth 2: You can withdraw anytime.

False. The withdrawal form must be filed within 12 months of your first payment.

Myth 3: The process is automatic.

False. The SSA does not automatically offer these choices; you must file a request.

Myth 4: Everyone benefits from delaying.

Not necessarily. Those in poor health or with limited savings might be better off taking benefits earlier.

Expert Perspectives

Economists and retirement planners stress that while the “hidden form” can lead to higher long-term income, it requires careful planning.

“This is one of the most powerful yet under-used Social Security tools,” said Dr. Michael Torres, professor of public policy at Boston College. “But it’s not free money. You’re trading time and, in the case of withdrawal, repaying what you’ve already received.”

“The mistake I see most often is retirees learning about this too late,” added Linda Perez, a Social Security claims specialist with 25 years of experience. “Once the 12-month window closes, your decision is essentially locked in.”

How to Decide

Step 1: Review Your Statement

Log in to My Social Security at ssa.gov to confirm your earnings record and projected benefits.

Step 2: Identify Your Full Retirement Age

Your FRA depends on your birth year — 66 for those born before 1955, gradually increasing to 67 for those born in 1960 or later.

Step 3: Evaluate Your Finances

If you can live without your monthly benefit for several years, delaying may offer significant long-term gains. However, you must weigh this against longevity, taxes, and inflation.

Step 4: Consider Your Spouse and Family

Suspending your benefit also suspends most auxiliary benefits for your spouse or dependents. Always discuss these effects before making a decision.

Step 5: Consult a Professional

A financial planner or Social Security specialist can calculate your break-even age — the point where delayed benefits surpass what you would have earned by claiming earlier.

Case Example: Early Claim Reversal

Elaine Parker, a 64-year-old retiree from Ohio, claimed Social Security in early 2024 but later found she didn’t need the income. After reading about the withdrawal form, she filed SSA-521, repaid $10,800 in benefits, and resumed work. Two years later, she re-applied and secured a 22% higher benefit. “It wasn’t easy repaying the money,” Parker said, “but it’s the best financial decision I’ve made.”

Historical Background

The ability to withdraw or suspend benefits dates back to the Social Security Act’s original provisions for flexibility. However, changes in 2015 restricted some of the more complex “file and suspend” strategies that couples once used to double-dip benefits.

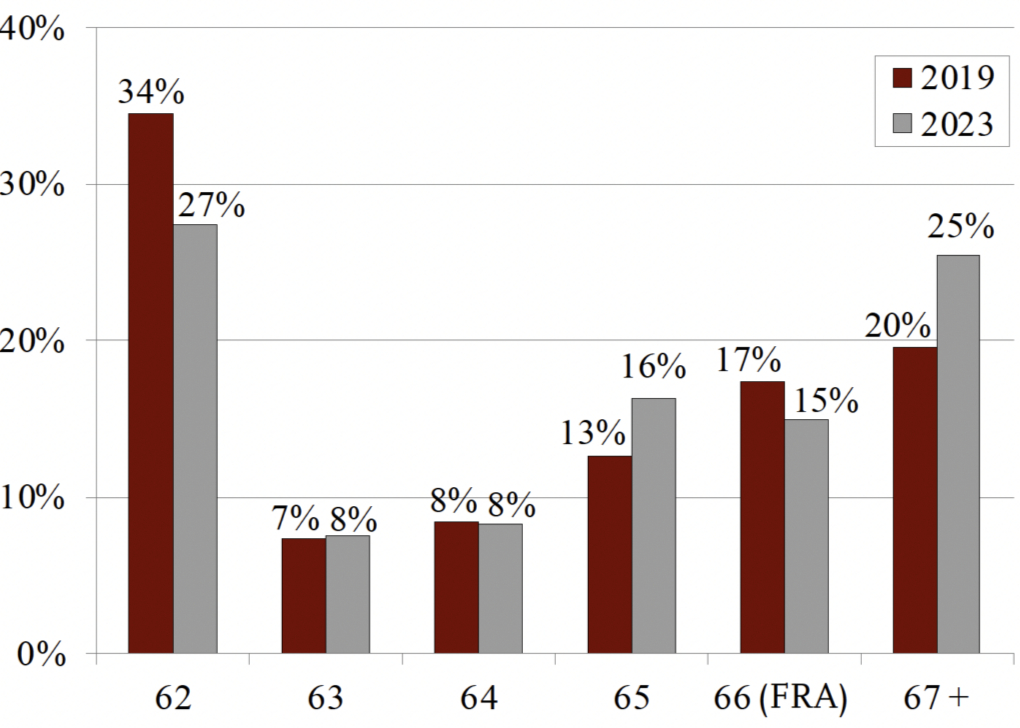

Today, while the system is simpler, most Americans remain unaware these options still exist. According to retirement policy experts, the average claimant age has risen slightly over the past decade — suggesting more people are learning to delay — but awareness of the withdrawal form remains minimal.

Common Pitfalls to Avoid

- Missing the deadline. You have only one year from your first payment to use Form SSA-521.

- Ignoring Medicare premiums. If your benefits are suspended, you must pay Medicare premiums directly.

- Forgetting family impact. Dependents relying on your record will lose benefits during your suspension.

- Assuming automatic growth. You must actively request suspension to earn delayed credits.

- Skipping documentation. Always get written confirmation from SSA when submitting or canceling forms.

The Bigger Picture: Retirement Planning Integration

Using these options effectively requires viewing Social Security as one part of a larger retirement strategy. Combining delayed benefits with other assets — such as 401(k) withdrawals or annuities — can create a smoother income stream and reduce taxes.

Delaying benefits also provides a form of “longevity insurance.” For retirees who live well into their 80s or 90s, a higher monthly Social Security check can make the difference between financial stability and strain.

Expert Tip Box

| Situation | Recommended Option | Key Advantage |

|---|---|---|

| Claimed early and regret it | Withdrawal (Form SSA-521) | Reset and claim later for a higher benefit |

| Reached full retirement age, still working | Suspension | Earn 8% credits per year until 70 |

| Limited savings, poor health | Keep benefits active | Early income may outweigh future gain |

| Married with younger spouse | Suspension | Potentially larger survivor benefit |

Looking Ahead

Financial experts warn that as inflation and longevity increase, maximizing guaranteed income sources like Social Security becomes essential. “This isn’t a loophole — it’s smart use of the law,” said Torres. “The key is timing and knowledge.”

The SSA offers detailed guides online, but many retirees rely on financial advisors or workshops to learn about these under-used options. As more Americans enter retirement, awareness of tools like Form SSA-521 could help millions make better-informed decisions.

Final Paragraph

The Social Security benefit remains the foundation of retirement income for most Americans. Understanding and using the rarely mentioned withdrawal and suspension rules can significantly change a retiree’s financial trajectory. For those within the 12-month withdrawal window or at full retirement age, these options provide a second chance — a powerful reminder that, even in retirement, timing matters.