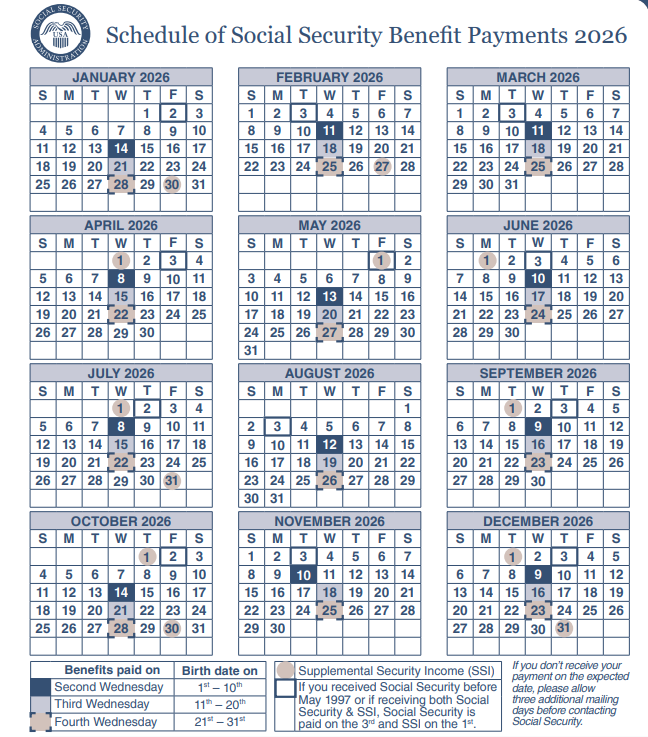

The 2026 Social Security payment calendar has been released, providing Americans with detailed information on when retirement, disability, and Supplemental Security Income (SSI) benefits will be deposited. The schedule outlines payments by birth date, incorporates holiday adjustments, and coincides with an announced 2.8 % cost-of-living adjustment (COLA) for beneficiaries in the new year. Understanding the calendar is crucial for millions of households that rely on Social Security as a primary source of income.

2026 Social Security Payment Calendar

| Key Fact | Detail |

|---|---|

| Cost-of-living adjustment (COLA) for 2026 | Benefits increase by 2.8 %, effective January 2026. |

| Standard retirement/disability schedule | For beneficiaries who started after May 1, 1997: – Born 1–10 → 2nd Wednesday; – Born 11–20 → 3rd Wednesday; – Born 21–31 → 4th Wednesday. |

| Early or combined benefits schedule | For those who started before May 1997 or receive both Social Security and SSI: payment occurs on the 3rd of each month or preceding business day. |

| SSI schedule | Payments issued on the 1st of each month, or preceding business day if the 1st falls on a weekend or holiday. |

| Official Website | SSA |

The 2026 Social Security payment calendar provides clarity and predictability for millions of beneficiaries. With payments scheduled according to birth date brackets and holiday adjustments accounted for, recipients can plan monthly budgets confidently. Coupled with the 2.8 % COLA increase, the calendar represents a modest but meaningful adjustment to support financial stability for retirees, people with disabilities, and SSI recipients.

Understanding the 2026 Payment Schedule

How Birth Dates Affect Payment Dates

Most Social Security beneficiaries’ payments are scheduled according to their day of birth:

- 1st–10th: Benefits arrive on the 2nd Wednesday of each month.

- 11th–20th: Benefits arrive on the 3rd Wednesday of each month.

- 21st–31st: Benefits arrive on the 4th Wednesday of each month.

This system allows the SSA to evenly distribute deposits throughout the month.

Special Cases

Beneficiaries who began receiving benefits before May 1997 or receive both Social Security and SSI have a fixed date payment, typically the 3rd of the month. If the 3rd falls on a weekend or federal holiday, the deposit is moved to the preceding business day. This helps ensure that all recipients receive funds in a predictable, reliable manner.

Holiday and Weekend Adjustments

The SSA adjusts payments to avoid weekends and federal holidays. For example, if a Wednesday payment coincides with a federal holiday, the funds are generally deposited the day before. SSI recipients may occasionally receive payments at the end of the prior month if the 1st falls on a Sunday or holiday. These adjustments ensure timely access to funds for essential expenses.

SSI Payment Schedule

The Supplemental Security Income (SSI) program follows a slightly different structure. Payments are normally issued on the 1st day of each month. Like standard Social Security payments, if the 1st falls on a weekend or holiday, the deposit occurs on the preceding business day. For some recipients, this can create instances where two payments occur in one month or a payment is received slightly earlier than the calendar month.

Importance of the 2026 Social Security Payment Calendar

Budgeting and Financial Planning

For millions of Americans, Social Security represents a critical portion of monthly income. Accurate payment dates allow households to manage rent, mortgage, utility bills, medications, and other living expenses effectively. Early knowledge of the schedule helps prevent financial disruptions and ensures recipients can plan for holidays or seasonal costs.

Cost-of-Living Adjustment (COLA)

The 2.8 % COLA for 2026 provides a modest increase in benefits, helping recipients offset inflation. For example, a beneficiary receiving $2,000 per month would see an increase of $56, while a typical retirement benefit might increase by $40–$60 per month. While helpful, this adjustment may not fully cover rising healthcare or housing costs, highlighting the need for careful budgeting.

Broader Financial Context

The Social Security trust fund remains a topic of long-term concern, with projections suggesting potential depletion by the mid-2030s if no reforms are enacted. However, the 2026 payment schedule itself provides short-term stability, ensuring recipients can access benefits reliably while policy discussions continue at the federal level.

Practical Guidance for Beneficiaries

- Verify your account information – Ensure bank details are accurate in the “my Social Security” portal to prevent misrouted payments.

- Mark your calendar – Note the deposit dates corresponding to your birthday bracket or fixed schedule.

- Anticipate early payments – For months affected by holidays or weekends, funds may arrive on the previous business day.

- Budget with the COLA increase – While 2.8 % is modest, it can slightly offset inflation-related costs.

- Report issues promptly – If a payment does not arrive on the expected day, contact the SSA immediately to resolve the issue.

Expert Insights

- Financial Planning Perspective: Experts recommend using the payment calendar to coordinate bill payments and avoid late fees. Some advisors suggest setting aside COLA increases for future healthcare or emergency expenses.

- Economic Context: Analysts note that while COLA adjustments keep pace with inflation partially, recipients with higher medical or housing costs may still experience pressure on their monthly budgets.

- Working Beneficiaries: For those who work while receiving Social Security, updated earnings limits are relevant. Exceeding these thresholds can temporarily reduce benefits, making awareness of both payment dates and rules essential.

Illustrative Examples

Example 1: Regular Beneficiary

Recipient A, born on the 5th of any month and started receiving benefits in 2010, receives payments on the 2nd Wednesday of every month. This provides predictable access for planning rent and utilities.

Example 2: Mid-Month Beneficiary

Recipient B, born on the 16th and started benefits in 2015, receives payments on the 3rd Wednesday of each month. Knowing this date allows coordination with recurring bills and grocery expenses.

Example 3: Pre-1997 or SSI Beneficiary

Recipient C began receiving benefits in 1995. Their payment arrives on the 3rd of each month. If the 3rd falls on a Saturday or Sunday, funds are deposited the preceding Friday, ensuring uninterrupted access.

Visual Aids

- Deposit Schedule Table – Month-by-month chart showing 2nd, 3rd, 4th Wednesday deposits and SSI/3rd-of-month payments.

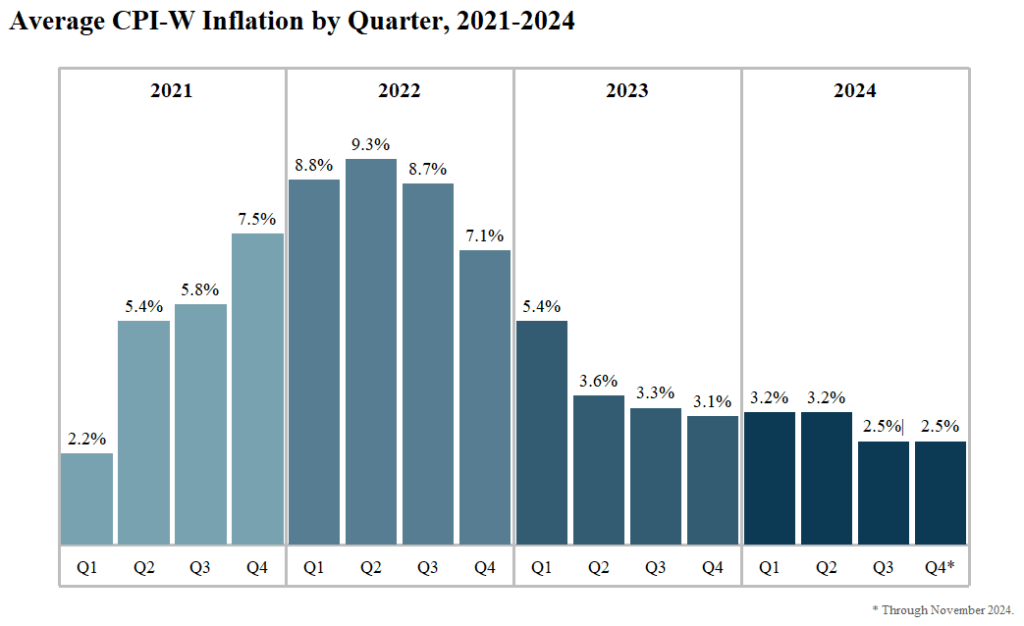

- COLA Trend Chart – Line graph showing the annual Social Security cost-of-living adjustment over the past five years compared to inflation.

These visuals help recipients quickly understand when funds are expected and how increases affect income over time.

Long-Term Considerations

While the calendar focuses on the 2026 payment schedule, it exists within a broader Social Security framework:

- Trust Fund Solvency: The Old-Age and Survivors Insurance (OASI) trust fund requires careful monitoring. Though 2026 payments are secure, discussions about program funding and long-term solvency continue.

- Inflation Impact: Rising costs of healthcare, housing, and energy can outpace COLA adjustments, affecting the real purchasing power of Social Security benefits.

- Policy Updates: Beneficiaries should stay informed about legislative changes that may affect benefit amounts, earnings limits, or taxation of Social Security income.

Social Security Raises Arrive Early: December Payments Will Shock Recipients!

Practical Tips for 2026

- Use the SSA portal regularly to monitor payments.

- Set up alerts through online banking to track deposits.

- Plan for months where holiday adjustments occur to avoid cash flow issues.

- Consider consulting financial advisors for budgeting with the COLA increase.

- Understand the interaction between working income and Social Security benefit reductions to avoid surprises.