The Social Security $5251 Club refers to a select group of U.S. retirees eligible for the program’s maximum monthly benefit of $5251 in 2026. Achieving this level requires a combination of long-term high earnings, at least 35 years of work, and delaying benefits until age 70, making it accessible to only a small fraction of Americans.

$5251 Social Security Club

| Key Fact | Detail / Statistic |

|---|---|

| Maximum Monthly Benefit | $5,251 in 2026 for someone claiming at age 70 |

| Career Requirement | Minimum 35 years of earnings to calculate average |

| Claiming Age | Maximum benefit requires delaying until age 70 |

| Average Benefit | $1,827 per month for all retired workers |

| Official Website | Social Security Administration |

Understanding the Social Security $5251 Club

The Social Security $5251 Club refers to retirees eligible for the maximum Social Security retirement benefit of $5,251 per month in 2026. Membership is limited and highly dependent on three factors: career earnings, work history, and claiming age.

According to the Social Security Administration (SSA), benefits are calculated using the 35 highest-earning years. Individuals with fewer than 35 years have their averages reduced by zeros, significantly lowering potential payouts.

“Reaching the maximum benefit requires consistent high earnings and careful planning on when to claim benefits,” said Andrew Biggs, resident scholar at the American Enterprise Institute.

Historical Context of Maximum Social Security Benefits

The concept of a maximum Social Security benefit has existed since the program’s inception in 1935, but the actual dollar amounts have changed dramatically due to inflation and wage growth. For example:

- In 2000, the maximum benefit at age 65 was $1,551 per month.

- Adjusted for inflation, the purchasing power of today’s $5,251 is roughly equivalent to $3,400 in 2000 dollars.

Over the past two decades, both the taxable maximum wage and annual cost-of-living adjustments have increased the number of high earners eligible for larger payouts, though the proportion of workers reaching the absolute maximum remains extremely small.

Who Qualifies for the Maximum Payout

To join the $5,251 Club, retirees generally must:

- Earn at or above the maximum taxable wage for most working years

- In 2026, the taxable wage base is $168,600. Only those consistently earning near or above this amount can reach the maximum benefit.

- Maintain a 35-year work history

- Zero-income years reduce the average used in the Social Security formula, lowering total benefits.

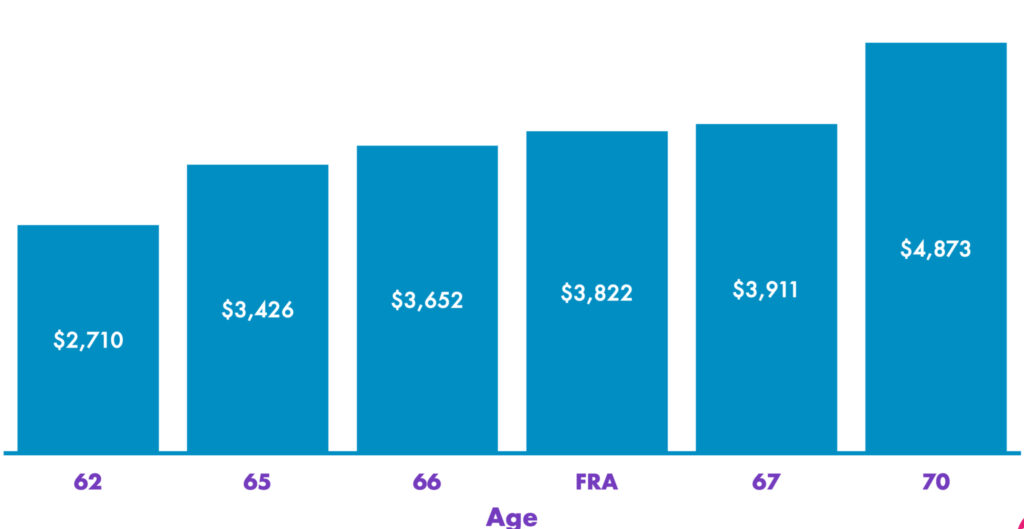

- Delay claiming until age 70

- Delayed retirement credits increase monthly benefits by 8% annually after full retirement age, until age 70.

Demographics of Maximum Benefit Recipients

According to the Urban Institute, fewer than 1% of U.S. retirees qualify for the maximum benefit. The likelihood is higher among:

- Professionals in finance, law, and executive roles, where annual earnings consistently exceed the taxable wage base.

- Workers with continuous employment, avoiding prolonged periods of unemployment or part-time work.

- Married couples, who can combine strategic claiming to maximize household Social Security benefits.

Women are generally less likely than men to reach the $5,251 maximum due to career interruptions, lower average wages, and part-time work trends.

Why Most Retirees Won’t Reach the Maximum

Despite awareness of the $5,251 Club, most retirees do not qualify. Early claiming and limited career earnings are the main obstacles.

- Many claim benefits at full retirement age (66–67), reducing the payout.

- Health concerns or workforce changes can force early retirement.

- Life expectancy impacts the net benefit; shorter lifespans may make delayed claiming less advantageous.

“Even high earners often underestimate the value of delaying benefits,” said Melissa Dittman, senior analyst at the Center for Retirement Research at Boston College.

The Impact of Life Expectancy on Claiming Strategy

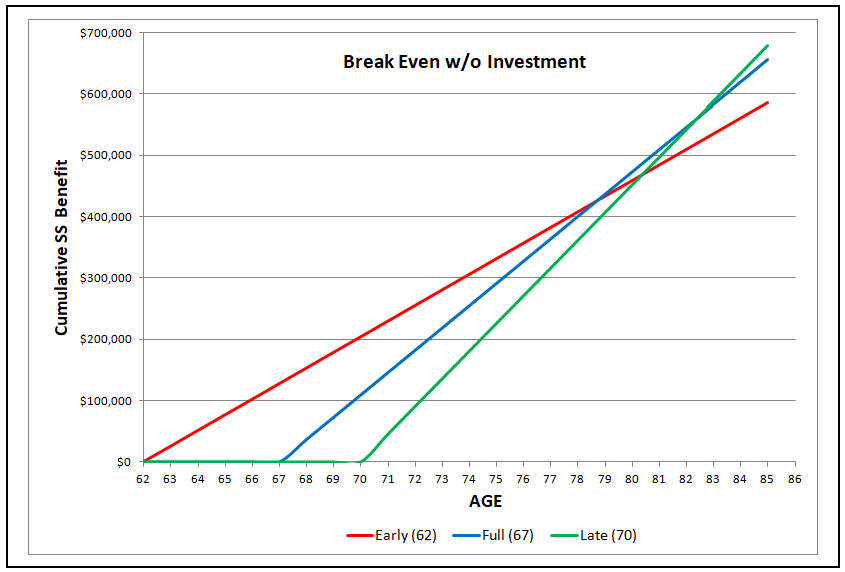

Retirees must weigh the benefits of early claiming against delayed retirement credits. The SSA notes that the break-even age — when delaying surpasses early claiming in total lifetime benefits — typically falls between 78 and 82 years.

For individuals with family history of longevity, delaying benefits can substantially increase lifetime payouts. Conversely, those with serious health conditions may opt for earlier claiming to secure immediate income.

Three Strategies to Boost Social Security Benefits

1. Work Longer and Strategically Replace Low-Earning Years

Adding years of high earnings can replace zeros or low-income years in the 35-year calculation. This strategy is particularly effective for individuals with non-linear career paths, such as entrepreneurs or professionals with career breaks.

2. Maximize Earnings During Peak Years

Targeting income near the Social Security taxable maximum ensures the highest average for benefit calculations. Retirees should review their SSA earnings record to correct errors and ensure all eligible earnings are counted.

3. Delay Claiming Benefits Until Age 70

Delayed retirement credits can increase monthly benefits by up to 32% over claiming at full retirement age. Couples should also coordinate claiming to maximize spousal benefits.

Spousal and Survivor Benefits

Married couples and survivors can use strategic claiming to increase household income. Key points include:

- Spousal benefits: Up to 50% of the primary worker’s benefit at full retirement age.

- Survivor benefits: Widows and widowers may receive the full benefit of the deceased spouse if claiming at full retirement age.

- Divorced spouses: Eligible if the marriage lasted at least 10 years, regardless of remarriage.

Comparison with Average Social Security Benefits

In 2026:

- Average retired worker benefit: $1,827 per month

- Maximum $5251 benefit: Nearly three times the average

This disparity underscores the rarity of maximum benefits and the importance of personal financial planning for retirement security.

Policy Considerations and Future Outlook

Social Security faces long-term solvency concerns. According to the 2025 Social Security Trustees Report, the combined trust funds could be depleted by 2035 if no legislative action is taken. Potential reforms could affect:

- Future cost-of-living adjustments

- Maximum taxable wage caps

- Early vs. late claiming incentives

“The $5251 Club may become even more exclusive if benefit growth slows or wage caps increase more slowly than inflation,” said Ellen Seidman, former SSA deputy commissioner.

Practical Retirement Planning Tips

Even if retirees cannot reach the maximum benefit, informed planning can optimize outcomes:

- Coordinate Social Security with 401(k)s, IRAs, and pensions.

- Avoid common mistakes like claiming early without financial necessity.

- Regularly review SSA earnings records for errors.

- Consider delaying benefits to enhance survivor security for spouses.

Hypothetical Scenarios

Scenario 1: High Earner, Age 70

- Works 40 years, consistently earns near the taxable maximum, delays claiming until 70

- Monthly benefit: $5,251

Scenario 2: Similar Earnings, Claims at 66

- Same career, claims at full retirement age

- Monthly benefit: $4,150

These examples illustrate the dramatic impact of claiming strategies and timing.

Looking Ahead

The Social Security $5251 Club highlights the intersection of long-term earnings, strategic planning, and delayed claiming. While only a small percentage of retirees reach this maximum, the strategies used to achieve it can guide broader retirement planning.

“Even if retirees cannot achieve the absolute maximum, understanding the rules and planning carefully improves financial security for all,” said John R. Miller, financial planning advisor at Vanguard.

How Claiming Social Security at 62 vs. 70 Could Create an $800 Monthly Gap in Benefits

FAQ About $5251 Social Security

Q: Can anyone reach the $5251 maximum benefit?

A: Only individuals with at least 35 years of high earnings who delay claiming until age 70 can achieve this maximum.

Q: How much does claiming earlier reduce benefits?

A: Claiming at full retirement age (66–67) or earlier reduces monthly benefits significantly, while delaying to 70 increases them.

Q: Does the maximum benefit apply to spouses?

A: Spouses receive up to 50% of the primary worker’s benefit at full retirement age, depending on their own earnings history.