By 2026, West Virginia will complete the repeal of its tax on Social Security benefits, leaving only eight states that continue to tax retirees’ federal benefits in some form. According to the Tax Foundation and Newsweek, 41 states and Washington, D.C. already exempt Social Security income entirely.

The shift marks a significant moment in state tax reform, underscoring the growing political and economic importance of aging voters and the broader financial pressures facing retirees.

“The trend is unmistakable,” said Katherine Loughead, senior policy analyst at the Tax Foundation. “States are recognizing that taxing Social Security benefits can drive retirees away — and they’re responding accordingly.”

Stop Taxing Your Social Security Benefits

| Key Fact | Detail / Statistic |

|---|---|

| States currently taxing benefits | 9 (as of 2025) |

| States ending tax by 2026 | West Virginia (phaseout complete 2026) |

| States fully exempting benefits | 41 + D.C. |

| Average monthly benefit (2025) | $1,907 |

| Projected U.S. retirees by 2030 | 73 million |

| Official Website | Social Security Administration |

Why Some States Still Tax Social Security

Taxation of Social Security benefits at the state level dates back to the early 1980s, when many governments aligned their tax codes with federal law. As federal taxes applied to higher-income beneficiaries, several states mirrored those rules.

Over time, however, economic shifts and political pressure led most states to roll back or eliminate these taxes. By 2025, only Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, and West Virginia continued some form of taxation — often with income-based exemptions or phaseouts.

“In the 1980s, taxing Social Security seemed logical to align with federal definitions of income,” explained Dr. Richard Kaplan, an elder law expert at the University of Illinois. “But as demographics changed, it became clear the policy disproportionately affected lower- and middle-income retirees.”

Demographic Pressure and Policy Change

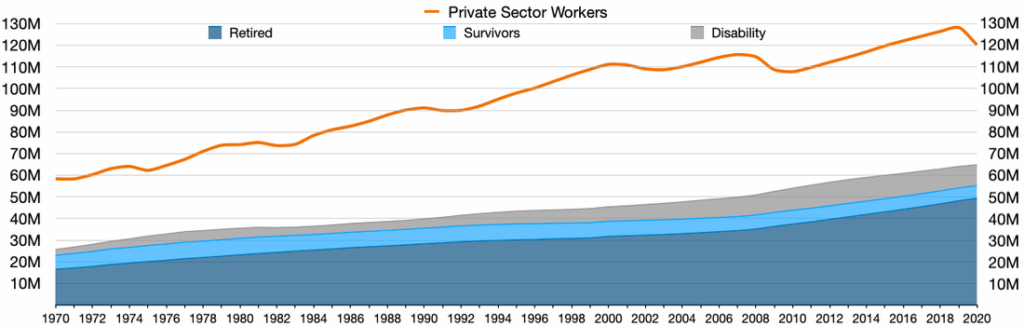

The U.S. Census Bureau projects that by 2030, one in five Americans will be over 65 — the largest senior population in U.S. history. With millions of Baby Boomers entering retirement, states face a demographic transformation that affects budgets, healthcare, and labor markets alike.

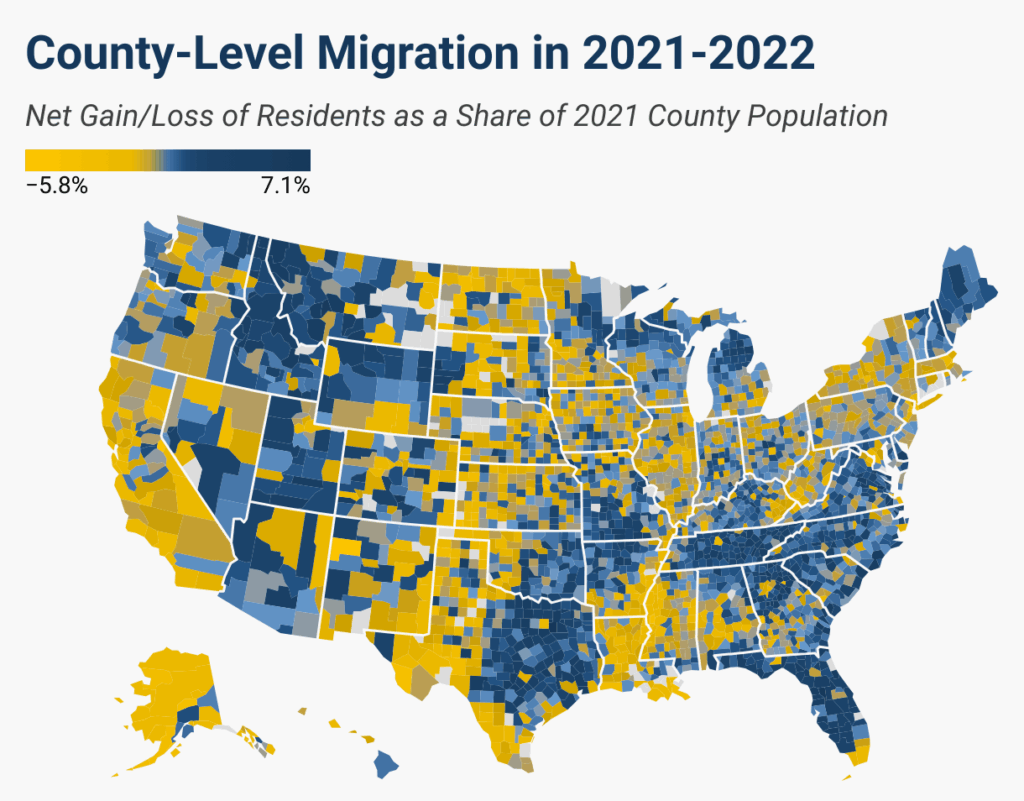

Retirees are also increasingly mobile. According to the National Association of Realtors, more than 20% of Americans aged 60 and older move across state lines upon retirement — often choosing low- or no-income-tax states like Florida, Texas, and Tennessee.

“States that rely on income taxes are watching retirees vote with their feet,” said Mary Johnson, a Social Security policy analyst at The Senior Citizens League. “Eliminating Social Security taxes is both a political and economic survival strategy.”

West Virginia: The 2026 Turning Point

In 2023, West Virginia lawmakers passed legislation phasing out the state tax on Social Security benefits over three years. The tax reduction began in 2024, with a one-third decrease each year until full exemption in 2026.

Governor Jim Justice praised the measure as “common sense,” noting it will bring West Virginia in line with surrounding states like Virginia, Ohio, and Pennsylvania — all of which exempt benefits fully.

According to the West Virginia State Tax Department, the repeal is expected to benefit around 170,000 retirees and cost the state roughly $37 million annually in lost revenue — a relatively small amount compared to the potential economic stimulus from retirees spending locally.

“Our seniors deserve to keep what they’ve earned,” Governor Justice said during the signing ceremony. “We’re building a more retiree-friendly West Virginia.”

Economic and Political Motivations

For many lawmakers, the decision to end Social Security taxes extends beyond direct economic gain. It’s also about competitiveness and voter sentiment. Seniors represent one of the most consistent voting blocs in U.S. politics.

A Pew Research Center analysis in 2024 found that adults aged 65 and older had the highest voter turnout rate of any age group, exceeding 72% in the 2020 presidential election. Their political influence has made senior benefits an enduring legislative focus.

Economically, retirees’ spending power remains substantial. A 2023 AARP report estimated that older Americans contributed over $1.7 trillion in consumer spending nationally, much of it in housing, healthcare, and local services. States that can retain or attract this population gain a steady flow of tax revenue through sales and property taxes, even if they forgo income taxes.

The Human Impact: Retirees Feel the Difference

For individuals, the end of Social Security taxation offers tangible relief. Elaine Roberts, 71, a retired nurse from Charleston, West Virginia, said the repeal will add nearly $600 a year to her disposable income.

“It might not sound like much to some people,” Roberts said, “but it means I can cover rising utility costs without dipping into savings. That peace of mind is priceless.”

Across the country, advocates for older adults argue that such changes can make the difference between financial security and hardship, especially as inflation and healthcare costs rise faster than benefit adjustments.

National Trends and Fiscal Trade-offs

While the movement to abolish Social Security taxes has broad public support, it poses fiscal challenges for some states. The Center on Budget and Policy Priorities (CBPP) warns that eliminating these taxes without alternative revenue sources could strain public budgets.

Some states, such as Minnesota and Connecticut, rely on progressive income tax systems where high-income retirees still pay partial taxes. Policymakers argue this ensures fairness and revenue stability.

“For states with aging populations and limited tax bases, these exemptions are a balancing act,” said Michael Leachman, director of state fiscal research at CBPP. “The political benefit is clear, but the long-term fiscal math requires caution.”

How the U.S. Compares Globally

Internationally, the U.S. approach to retirement income taxation remains moderate. Many advanced economies — including Canada and Germany — also tax pension income but offer broad exemptions for lower earners.

However, the federal-state split in the U.S. adds complexity. Because each state sets its own rules, retirees face a patchwork system that can significantly alter their take-home income depending on where they live.

“A retiree in Florida and a retiree in Vermont could pay vastly different effective tax rates on identical Social Security benefits,” said Dr. Lauren Tedesco, an economist at Brookings Institution. “That disparity shapes migration and long-term planning decisions.”

What Comes Next: Policy Outlook Beyond 2026

Experts anticipate more states will revisit their tax codes over the next five years. States like Minnesota and New Mexico, both currently taxing Social Security in limited ways, are already considering new exemptions.

Some analysts predict the eventual national standardization of retirement income policy — though not through federal mandate, but through competitive convergence as states seek to attract retirees and businesses.

At the same time, ongoing discussions in Congress about federal Social Security solvency could intersect with state reforms, influencing how benefits are adjusted or taxed at all levels.

“As the population ages, the interaction between federal and state tax policy will become more important than ever,” said Tedesco. “We’re seeing the groundwork for a broader debate about how to finance retirement in an aging America.”

The Bottom Line

By 2026, West Virginia’s repeal will leave only eight states taxing Social Security benefits. The rest of the nation will fully exempt them — a reflection of shifting priorities in retirement income policy and an acknowledgment of the economic and social importance of older Americans.

For retirees, the change offers not only modest financial relief but also a symbolic affirmation: their decades of contributions are being recognized at every level of government.

“This is part of a larger national conversation,” said Loughead of the Tax Foundation. “States are learning that supporting retirees isn’t just good politics — it’s good economics.”

FAQ About New 2026 Map

Q: Will federal taxes on Social Security change?

No. Federal rules remain unchanged. Depending on income, up to 85% of benefits may still be taxable at the federal level.

Q: Which states have no income tax at all?

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming — none tax Social Security benefits.

Q: Does eliminating Social Security taxes affect other retirement income?

Not directly. Pensions, 401(k) withdrawals, and investment income may still be taxed depending on state laws.