A new proposal before the U.S. Senate seeks to grant a temporary Social Security $200 monthly increase for retirees, people with disabilities, and other federal benefit recipients in 2026. The plan, known as the Social Security Emergency Inflation Relief Act, aims to offset rising living costs that continue to strain millions of Americans on fixed incomes.

The bill, introduced by Democratic Senators Elizabeth Warren of Massachusetts and Sherrod Brown of Ohio, would provide the extra payment for six months, from January through June 2026. The proposal comes amid continuing public concern over inflation and modest cost-of-living adjustments (COLA) that many argue fail to keep pace with actual expenses.

New $200-a-Month Social Security Boost

| Key Fact | Detail |

|---|---|

| Monthly increase proposed | $200 per month for six months |

| Eligible beneficiaries | Recipients of Social Security, SSI, SSDI, veterans’ and railroad retirement benefits |

| Duration of payment | January–June 2026 |

| Total potential increase | $1,200 per recipient |

| Legislative status | Proposed — not yet law |

Who Would Qualify for the Social Security $200 Monthly Increase

Under the proposed legislation, the temporary benefit boost would apply to individuals receiving Social Security retirement, Social Security Disability Insurance (SSDI), and Supplemental Security Income (SSI). It would also extend to recipients of veterans’ disability compensation, veterans’ pensions, and railroad retirement benefits.

“The cost of living has outpaced benefit growth for years,” Sen. Warren said when introducing the bill. “This proposal provides immediate relief to those who rely most on Social Security and other earned benefits.”

The payments would be distributed automatically through existing benefit systems, requiring no action by recipients. According to the Social Security Administration (SSA), this would streamline implementation and reduce administrative costs.

A Response to Rising Costs

The measure arrives as U.S. households face persistent inflation pressures despite slowing price growth. The Consumer Price Index (CPI) rose 3.4 percent in 2024 and is projected to increase by another 2.9 percent in 2025, according to the Bureau of Labor Statistics (BLS). Essential expenses such as housing, food, and medical care have climbed even faster, eroding the purchasing power of fixed-income retirees.

For 2026, the SSA announced a 2.8 percent cost-of-living adjustment, which will raise the average monthly Social Security benefit by about $56. Critics argue that the modest increase fails to reflect the true cost burden faced by seniors.

“Even after the COLA, many older Americans are still choosing between food, medication, and utilities,” said Nancy Altman, president of Social Security Works, a nonprofit advocacy organization. “A $200 monthly boost won’t solve the long-term challenges, but it could provide immediate breathing room.”

Historical Context: A Familiar Debate

This is not the first time lawmakers have proposed a benefit increase to address inflation. In 2020, during the COVID-19 pandemic, several similar measures were floated — including a permanent $200 monthly increase introduced by Rep. Peter DeFazio and Sen. Warren — but they failed to pass amid concerns about the Social Security Trust Fund’s long-term solvency.

Historically, the program’s automatic COLA mechanism, established in 1975, has been the main tool for keeping benefits aligned with inflation. However, analysts argue that the CPI-W measure used to calculate COLAs does not accurately capture seniors’ spending patterns, especially in healthcare and housing.

“The CPI-W reflects wage earners, not retirees,” said Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College. “A more tailored index would better reflect the true inflation faced by the elderly population.”

Human Impact: Everyday Americans Feeling the Pinch

For millions of seniors and disabled Americans, even small benefit changes carry significant consequences. Mary Whitaker, a 72-year-old retiree from Des Moines, Iowa, said her Social Security check covers just enough to pay her rent and groceries.

“I worked for 40 years,” Whitaker said. “But with rent up $200 in the last year and my prescriptions costing more every month, there’s nothing left over. That extra $200 would mean I could finally afford my dental appointment.”

According to a 2024 AARP survey, 61 percent of retirees report difficulty covering basic needs due to rising costs. The same study found that nearly one in five relies entirely on Social Security for income.

Fiscal and Political Considerations

While the proposal has drawn praise from advocacy groups and progressive lawmakers, it faces skepticism from fiscal conservatives. Some legislators have raised concerns over how the temporary boost would be financed and whether it sets a precedent for future emergency payouts.

Senator Chuck Grassley of Iowa, a senior Republican on the Senate Finance Committee, said in a recent statement that while “supporting seniors during inflationary times is important,” any new spending “must be paid for responsibly.”

Proponents argue that the measure could be funded using unspent pandemic relief allocations and that its short-term design would minimize fiscal strain. Preliminary estimates from independent budget analysts suggest the program could cost approximately $80 billion if implemented.

“The impact on the overall federal budget would be negligible compared to the benefit it provides,” said Kathleen Romig, a policy director at the Center on Budget and Policy Priorities (CBPP).

Broader Implications: Social Security Reform on the Horizon

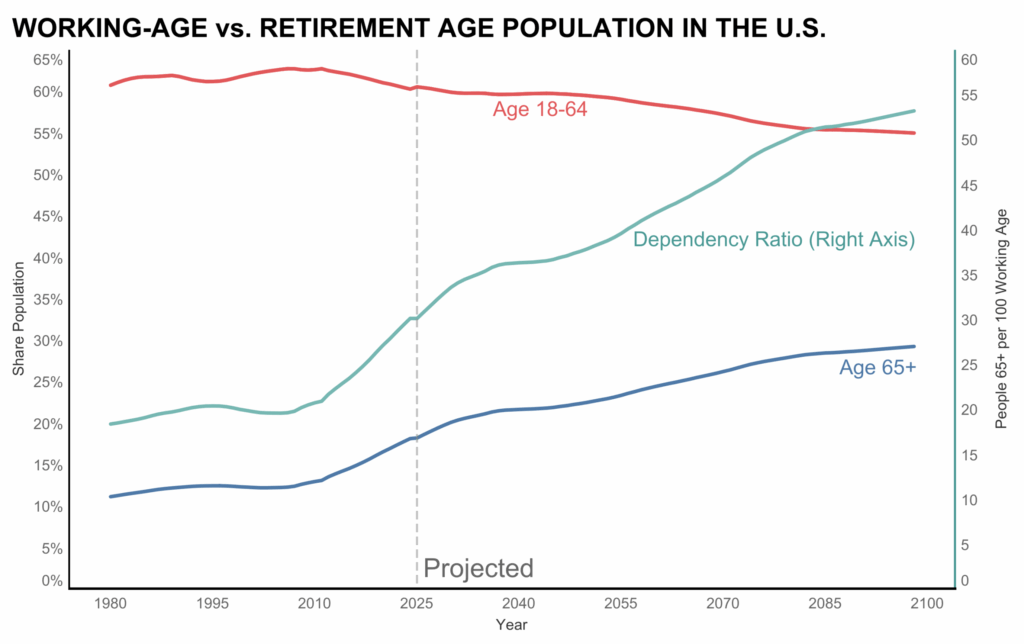

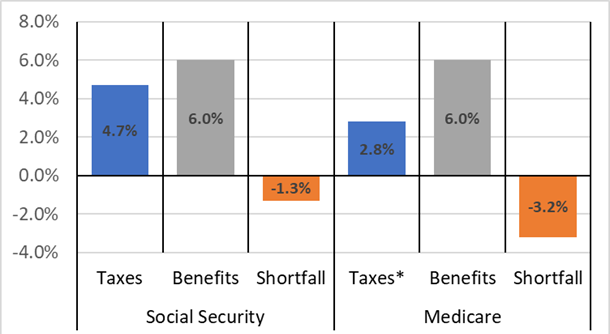

Beyond temporary relief, the debate highlights deeper challenges facing the Social Security system. The Social Security Trustees Report released earlier in 2025 projected that the trust fund could be depleted by 2034, potentially triggering an across-the-board benefit reduction of about 17 percent if Congress does not act.

“The program remains sound but requires timely reform,” said Andrew Biggs, a senior fellow at the American Enterprise Institute (AEI) and former deputy commissioner of the SSA. “Short-term measures like this can help politically, but they don’t address the structural imbalance.”

Lawmakers from both parties have proposed a range of long-term solutions — from raising payroll tax caps to modifying benefit formulas or increasing the retirement age. None have yet gained bipartisan traction.

Public Reaction and Support

Public sentiment for the proposal appears strong. A Pew Research Center poll conducted in late October 2025 found that 72 percent of Americans support a temporary Social Security increase to offset inflation. Support was highest among voters aged 55 and older.

Veterans’ organizations and senior advocacy groups have also voiced approval. The American Legion and Disabled American Veterans (DAV) both released statements endorsing the measure’s inclusion of VA beneficiaries.

“This is about dignity,” said DAV National Commander Nancy Espinosa. “Veterans on fixed incomes have been hit hard by inflation, and this relief recognizes their service and sacrifice.”

Outlook: A Difficult Path Ahead

The bill is now before the Senate Committee on Finance, where it could be folded into a larger spending package expected early next year. Lawmakers face a crowded legislative calendar and mounting debate over federal deficit priorities.

Analysts say the proposal’s fate will hinge on whether both parties can reach consensus on temporary relief measures without expanding long-term obligations. “This is a politically popular bill,” said Dr. Elaine Kamarck of the Brookings Institution, “but popularity doesn’t always translate to passage in a divided Congress.”

If enacted, payments would begin in January 2026, appearing automatically in beneficiaries’ regular deposits. The SSA has confirmed it could execute the change within 60 days of passage.

A Broader Conversation on Economic Security

The debate over a Social Security $200 monthly increase underscores a broader question: how to preserve financial stability for older and disabled Americans in a shifting economy. Rising healthcare costs, longer life expectancy, and insufficient personal savings have left millions dependent on public benefits.

“The conversation about temporary relief is really a conversation about adequacy,” said Teresa Ghilarducci, a labor economist at the New School for Social Research. “If Social Security is the primary income for nearly half of retirees, we must ensure it’s enough to live on with dignity.”