In 2026, significant changes to U.S. Social Security eligibility will reshape retirement planning for millions of Americans. With new requirements for qualifying work credits, a rising full retirement age (FRA), and a cost-of-living adjustment (COLA) bump, the government aims to stabilize the program for the future. Here’s what these changes mean and how they will impact you.

Social Security Benefits

| Key Fact | Detail/Statistic |

|---|---|

| Increased Work Credit Requirements | More earnings needed to qualify for Social Security credits in 2026 |

| Rising Full Retirement Age (FRA) | FRA will increase to 67 for those born in 1960 and beyond |

| Cost-of-Living Adjustment (COLA) | A 2.8% increase in benefits for 2026 |

| Maximum Monthly Benefit | Expected to rise to $5,251 for full retirement age in 2026 |

| Official Website | Social Security Administration |

What You Need to Know About the New Social Security Rules

Raising the Eligibility Bar: What Does It Mean?

Social Security eligibility is primarily determined by the number of work credits a person has accumulated. For 2026, the government is increasing the earnings required to earn a single work credit. In previous years, workers earned one credit for every $1,640 in wages, but this will rise in the future as the cost of living increases.

This adjustment will affect individuals with lower earnings or those working part-time. For many, it means they’ll need to earn more or work longer to qualify for full benefits. While this may seem like a minor change, for those who rely on Social Security as their primary source of retirement income, this change could impact their long-term plans.

Full Retirement Age Will Be Higher

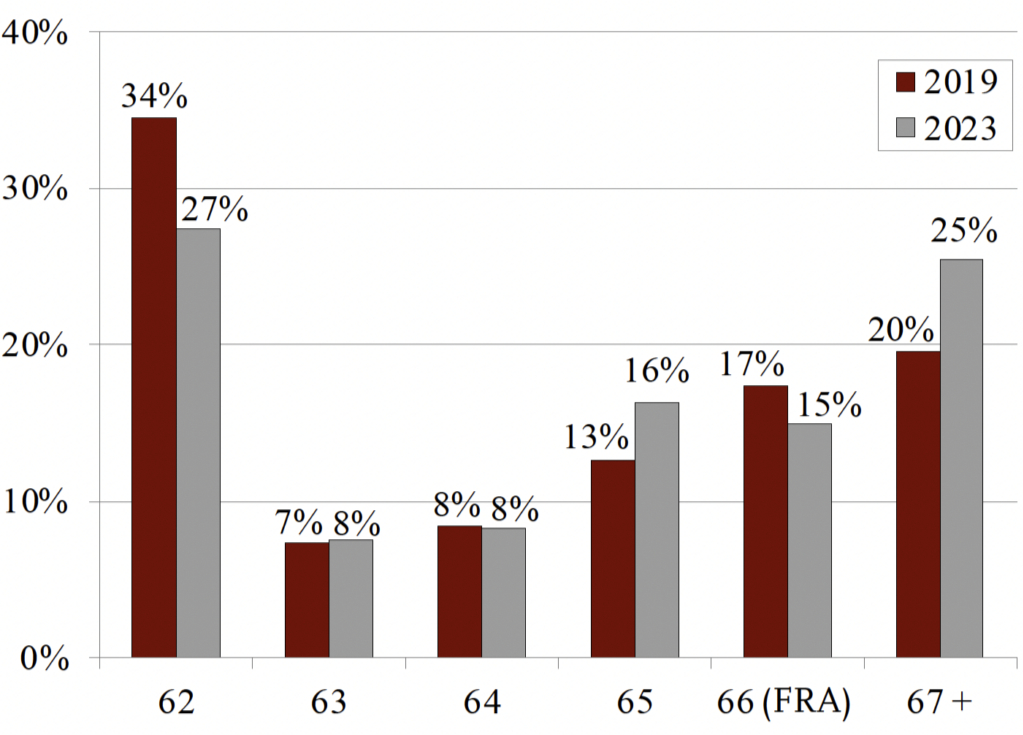

Full retirement age (FRA) determines when an individual is eligible for their full monthly Social Security benefits. The U.S. government has steadily increased the FRA to reflect longer life expectancies. For individuals born in 1960 or later, the FRA will increase to 67.

For people retiring earlier than their FRA, they’ll face a permanent reduction in their benefits. However, if they delay retirement beyond the FRA, their monthly benefits will rise by a percentage each year. It’s critical for workers to calculate how these changes will affect their retirement income and whether it might be more beneficial to delay claiming their benefits.

The Impact of COLA and Inflation

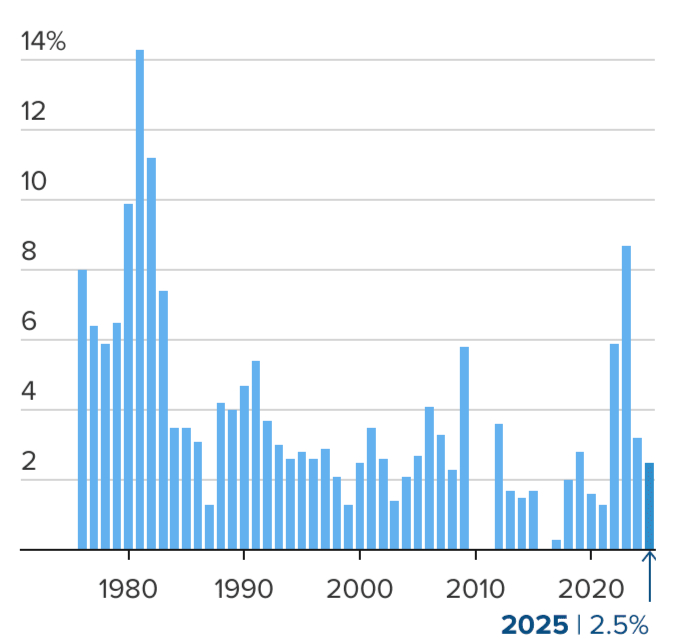

The Social Security Administration has announced a 2.8% cost-of-living adjustment (COLA) for 2026. This adjustment helps retirees keep pace with inflation. While the COLA increase will boost monthly benefits, many experts argue that it might not fully offset the rising costs of healthcare, housing, and other essential living expenses.

For example, the average monthly Social Security benefit for retirees will increase by roughly $140 in 2026, which can be crucial for low-income retirees who depend on this support. However, with healthcare costs rising at a faster pace than the COLA, many beneficiaries may still find themselves struggling to make ends meet. It’s important for retirees to factor in these real-world cost pressures when planning for the future.

Implications for Future Generations

Younger Americans will also feel the impact of these changes, even though they may not be able to claim Social Security benefits for several decades. For one, the rise in FRA means they may have to work longer to receive full benefits. Additionally, the increase in the number of work credits needed for eligibility could affect their long-term planning.

Social Security has historically been a key safety net for retirement, but with rising life expectancies, these benefits may be stretched thinner in the future. As a result, it’s critical for younger generations to consider other forms of retirement savings, such as 401(k)s, IRAs, or employer-sponsored pension plans.

A Deeper Look at Social Security’s Role in Addressing Inequality

Social Security is often viewed as a lifeline for retirees, but it plays an even more significant role in addressing income inequality. Lower-income workers, women, and people of color are more likely to rely on Social Security benefits due to the wage disparities they face over their careers.

For instance, women tend to earn less than men over their lifetimes and live longer, meaning they rely on Social Security for a higher percentage of their income in retirement. According to a report from the National Women’s Law Center, about 40% of women aged 65 and older rely on Social Security for 90% or more of their income. Similarly, Black and Hispanic workers often earn lower wages throughout their careers and depend heavily on Social Security as well.

As eligibility requirements tighten and full retirement age rises, these groups could be disproportionately affected by the changes. Policy experts have raised concerns about how these shifts could further widen the wealth gap and lead to greater economic insecurity for vulnerable groups in retirement.

State-Level Variations and Local Impact

While Social Security is a federal program, its effects vary widely depending on where you live. In states with a higher cost of living, such as California or New York, the rise in Social Security benefits may not be enough to keep pace with the local expenses. Conversely, in states with lower costs of living, retirees may feel a more substantial benefit.

In addition, some states tax Social Security benefits, while others do not. States like Florida, Nevada, and Texas do not impose state income taxes, which can provide a boost for retirees living there. However, in states like Illinois and Vermont, Social Security benefits are taxed, which can reduce the overall value of these benefits.

The Road Ahead: Can Social Security Survive the Next Decade?

As the U.S. population continues to age, the pressure on Social Security will only increase. According to a report by the Social Security Board of Trustees, the program’s trust fund reserves are projected to be depleted by 2034, unless major reforms are enacted. This could lead to significant cuts in benefits for future retirees unless new funding mechanisms are found.

The current changes, such as raising the FRA and tightening eligibility requirements, are only a part of the broader conversation about the future of Social Security. As policymakers debate potential solutions, including raising payroll taxes or cutting benefits, it remains to be seen how these discussions will unfold and what the future holds for Social Security recipients.

FAQs About Social Security Benefits

How does the rise in full retirement age affect me?

If you were born in 1960 or later, your full retirement age will increase to 67. This means you will have to wait until this age to claim full benefits. Retiring earlier will result in a permanent reduction in your monthly payout.

Why is Social Security eligibility being changed?

The changes are designed to address the increasing costs of the program due to longer life expectancies and an aging population. The aim is to ensure the program’s long-term sustainability.

Will the COLA increase be enough to keep up with inflation?

While the 2.8% increase will help with inflation, experts believe it may not fully cover the rising costs of healthcare and housing, which have increased at a faster pace.