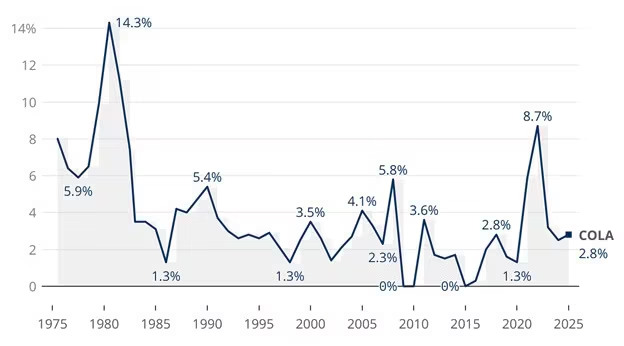

The U.S. Social Security Administration (SSA) has confirmed a 2.8% cost-of-living adjustment (COLA) for 2026, marking a significant boost for millions of American retirees and beneficiaries. As part of this adjustment, the maximum monthly Social Security benefit will increase to $5,251. This adjustment is expected to impact the financial security of many, especially those planning for long-term retirement.

New Maximum Social Security Benefit

| Key Fact | Detail/Statistic |

|---|---|

| 2026 Social Security COLA | 2.8% increase |

| Maximum Benefit (2026) | $5,251 per month |

| Earnings Subject to Tax (2026) | $184,500 |

| Average Monthly Social Security Benefit | $1,827 (2025) |

| Official Website | SSA.gov |

While the 2.8% COLA adjustment is a positive step for many Social Security recipients, it remains crucial for beneficiaries to evaluate their long-term retirement strategies. The $5,251 maximum benefit for those delaying their claim until age 70 provides a higher level of security, but most Americans will not reach this threshold. As inflation continues to outpace increases in benefits, retirees may need to look for other ways to supplement their income.

Social Security COLA Increase for 2026: What to Expect

The Social Security Administration’s recent announcement of a 2.8% increase in benefits for 2026 marks a noteworthy shift for retirees and others who rely on Social Security. The increase, which applies to more than 70 million Americans, reflects the rising costs of living, including inflation. This adjustment will provide crucial financial relief to many who have been impacted by higher living expenses in recent years.

What Does the 2.8% COLA Mean for You?

The COLA for 2026 means that monthly benefits will see a substantial rise. For the average retiree, this increase could mean a boost of roughly $50 to $100 per month, depending on individual benefits. However, for those who qualify for the maximum benefit, this change is even more significant. In 2026, the maximum monthly benefit will increase to $5,251, up from $5,108 in 2025.

The increase applies to those who delay claiming their Social Security benefits until the age of 70, which maximizes the monthly benefit amount. While this adjustment is beneficial, it remains crucial for retirees to carefully plan their Social Security strategy, as claiming benefits before age 70 reduces the amount they will receive.

How the 2026 Social Security Increase Affects Retirees

Social Security’s COLA boost is designed to help beneficiaries keep up with inflation, but it does not always fully offset the rising costs of everyday living. Healthcare, housing, and food costs have increased at a faster pace than the 2.8% increase for many retirees, leaving some questioning whether this adjustment is enough to meet their needs.

Increases in the Taxable Earnings Limit

For those still working and earning income while receiving Social Security benefits, another important change for 2026 is the increase in the taxable maximum earnings. This refers to the income that is subject to Social Security taxes. In 2026, the new taxable maximum will be $184,500, up from $182,200 in 2025. This increase impacts high earners, who will pay more in Social Security taxes.

The Impact of Early Social Security Claims

While the maximum benefit amount receives significant attention, most Social Security recipients will receive less than the $5,251. Individuals who claim their benefits earlier than age 70 will see reduced monthly payments. The full retirement age (FRA) for those born in 1960 or later is 67, and those who claim at FRA will receive a larger benefit than those who claim early but less than those who delay until age 70.

Adjusting Your Social Security Strategy

For individuals approaching retirement, it’s essential to understand how these increases will affect their retirement planning. Experts recommend reviewing your benefits statement regularly and considering the long-term impact of claiming early versus delaying benefits. The SSA provides personalized estimates of future benefits, helping individuals make informed decisions.

The Broader Context: Why the Social Security Raise Matters

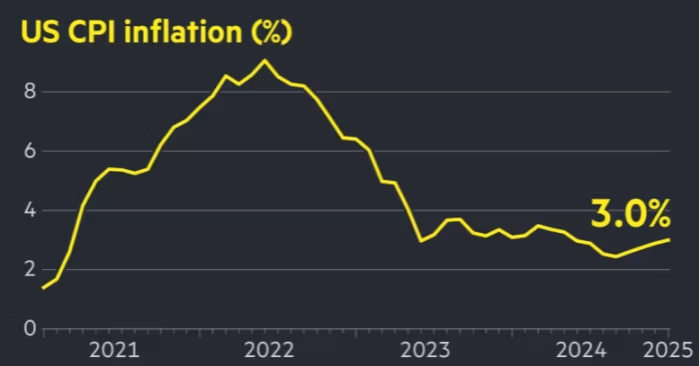

The 2.8% COLA increase is not just an adjustment to monthly payments; it is a reflection of broader economic conditions, such as inflation rates and the cost of living. The Federal Reserve’s ongoing adjustments to interest rates, as well as changes in consumer prices, have driven up the cost of essential goods and services, prompting the need for such a raise in Social Security benefits.

A Safety Net for Millions

Social Security remains a critical source of income for retirees, disabled workers, and survivors. In 2025, the average monthly benefit for retirees is $1,827, a modest sum that supports many households. The COLA raise will provide relief to these individuals, but experts stress the importance of supplementing Social Security with other forms of retirement savings, such as 401(k)s and IRAs.

Additional Factors Influencing Social Security’s Effectiveness

While Social Security provides a crucial safety net for many Americans, its long-term sustainability is often debated. According to the latest Social Security Trustees Report, the trust fund that finances Social Security benefits is projected to be depleted by 2034, at which point the program will only be able to pay about 80% of promised benefits from ongoing payroll taxes. This has led to concerns about future increases in Social Security taxes or potential reductions in benefits unless reforms are implemented.

Can Social Security Reform Address the Funding Gap?

The looming shortfall in the Social Security Trust Fund has prompted discussions about potential reforms. Some proposals include raising the payroll tax cap, which currently applies to earnings up to $160,200 (in 2023). Others have suggested increasing the retirement age or adopting means-testing for benefits, where wealthier individuals might receive reduced benefits.

While these reforms are still under discussion, they highlight the ongoing pressure to preserve the financial stability of the program. For those approaching retirement, these discussions underscore the need to plan for the possibility of future changes to Social Security, even as the current increases provide some relief.

What the Future Holds for Social Security

As the U.S. faces an aging population and evolving economic conditions, the Social Security program will continue to be under scrutiny. Advocates argue that Social Security remains a vital lifeline for millions, while critics warn that the program’s long-term viability requires reform.

For now, recipients can take advantage of the 2026 COLA to increase their monthly benefits, but planning for the future remains essential. Whether through other retirement savings or by adjusting when benefits are claimed, the need for careful financial planning is more important than ever.

FAQ About New Maximum Social Security Benefit

Q: How does the 2026 Social Security COLA impact the average retiree?

A: The 2.8% increase in Social Security benefits will provide an additional $50-$100 per month for most retirees, depending on their benefit amount.

Q: What is the new taxable earnings limit for 2026?

A: In 2026, the taxable maximum earnings for Social Security will be $184,500.

Q: Will claiming Social Security early reduce my benefit?

A: Yes, claiming Social Security before age 70 reduces your monthly benefit. The full benefit is available only if you wait until age 70 to claim.

Q: How sustainable is Social Security in the long term?

A: The Social Security Trust Fund is projected to be depleted by 2034, which could result in a reduction in benefits unless reforms are made to the program.