The U.S. Social Security Administration (SSA) has set an urgent November 19 deadline for retirees to opt out of receiving paper notifications about the upcoming cost-of-living adjustment (COLA). Social Security recipients can manage this change through their online accounts, but those who miss the deadline will continue to receive mailed notices.

Social Security Retirees

| Key Fact | Detail/Statistic |

|---|---|

| Deadline for Opt-Out | November 19, 2025 |

| COLA Increase | 2.8% for 2026 |

| Impact on Retirees | Affects only those with “my Social Security” accounts who want digital communication |

| Official Website | SSA |

The November 19 deadline for opting out of paper COLA notices may seem minor, but it’s an important step for Social Security recipients who prefer digital updates. As inflation continues to impact daily expenses, the 2.8% COLA increase provides essential relief, but beneficiaries must ensure their communication preferences are up to date to avoid unnecessary mail.

With the holiday season approaching, retirees are urged to act now and manage their accounts to receive timely and accurate notifications regarding their benefits.

Social Security’s November 19 Deadline Explained

The U.S. Social Security Administration (SSA) has announced that retirees who prefer to receive digital communications about their annual cost-of-living adjustment (COLA) must take action by November 19, 2025. This deadline applies specifically to those who wish to opt out of paper notices and choose electronic delivery through their “my Social Security” online accounts.

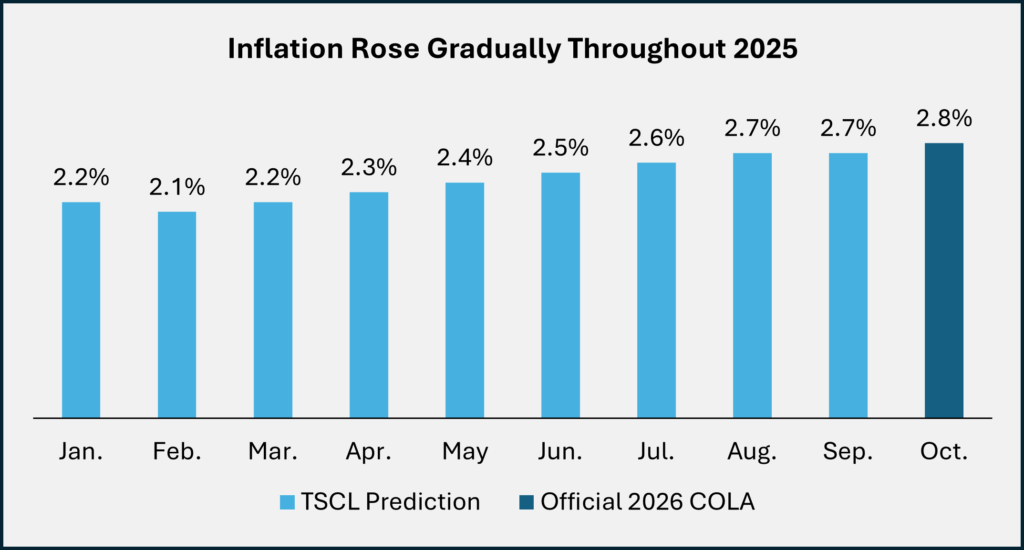

The SSA sets the COLA each year to help Social Security benefits keep pace with inflation. This year, retirees will see a 2.8% increase in their benefits for 2026. Those who are already enrolled in the online system can bypass the traditional mailed notice by adjusting their settings before the deadline. Failure to do so will result in the receipt of a physical letter in December 2025, detailing the COLA adjustment.

Why the Deadline Matters

For many retirees, especially those with a preference for digital communication, the November 19 deadline is crucial. It allows them to receive notifications in a more convenient format, without the delay and clutter of physical mail. The SSA urges all beneficiaries with “my Social Security” accounts to review their notification preferences before the deadline to avoid unnecessary mail.

It’s important to note that the November 19 date is not related to benefit payments. Social Security recipients will continue to receive their benefits according to their birthdate in November 2025, unaffected by the government shutdown or the COLA change.

Understanding the COLA Adjustment for 2026

Each year, the SSA adjusts Social Security benefits to account for rising costs of living. The 2.8% increase for 2026 is significant but not as high as the inflation-driven adjustments seen in previous years. According to SSA’s estimates, the average monthly benefit for retired workers will increase by $59, bringing the total to $2,110.

This COLA increase helps offset inflation, particularly for seniors who may face rising healthcare and living costs. However, experts caution that while the COLA provides necessary relief, it may not fully cover all the increases in expenses experienced by retirees.

When Will Benefits Be Paid?

The Social Security Administration continues to follow its regular payment schedule. Retirees whose birthdays fall between the 1st and 10th of the month will receive their payment on November 12, those born between the 11th and 20th will receive payments on November 19, and retirees born between the 21st and 31st will see their payments on November 26, 2025.

Despite the ongoing federal government shutdown, Social Security payments will not be delayed or affected, as the program is classified as mandatory spending.

The Role of Digital Accounts in Social Security Management

The SSA has been encouraging retirees to manage their benefits online through the “my Social Security” portal for several years. This platform allows individuals to track payments, adjust personal information, and opt for digital communications like the COLA notice.

For those still receiving paper notifications, the SSA urges individuals to transition to digital options, which are faster and more environmentally friendly. Additionally, digital notices help the SSA reduce administrative costs and enhance efficiency.

What Happens After the November 19 Deadline?

Retirees who miss the deadline and do not opt out of paper notices will continue receiving mailed notifications for all future updates, including the annual COLA announcements. This could lead to delays and extra clutter for those who prefer digital communication. However, retirees can always switch to digital communication in the future by updating their preferences in the “my Social Security” portal.

Steps to Opt-Out of Paper Notices

- Step 1: Log into your “my Social Security” account.

- Step 2: Navigate to the “Notifications” section.

- Step 3: Select the option to receive digital communications instead of paper mail.

- Step 4: Confirm the change by November 19, 2025.

The History and Importance of COLA

The Cost-of-Living Adjustment (COLA) was introduced in 1975 as a way to ensure that Social Security benefits kept pace with inflation. Prior to the COLA system, retirees’ purchasing power would decline over time as prices increased, leaving many seniors at risk of financial hardship.

The decision to link COLA to inflation is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W tracks changes in the cost of living, including housing, food, and transportation. By using this index, the SSA ensures that benefit increases are based on real-world inflation that retirees are likely to experience.

Why COLA Matters

COLA adjustments are vital for ensuring that Social Security benefits remain effective in preserving purchasing power. Over time, as prices for essential goods like healthcare and housing rise, a consistent COLA helps retirees maintain their standard of living.

Impact of COLA on Different Groups of Retirees

While COLA increases are a lifeline for many retirees, the impact of these adjustments varies widely across different demographics.

- Low-Income Retirees: For those who rely solely on Social Security benefits, the COLA adjustment is crucial. However, the 2.8% increase may not be enough to fully offset rising costs in healthcare and housing. Seniors living on fixed incomes often struggle to keep up with the pace of inflation.

- Veterans and Disabled Retirees: Many veterans and individuals with disabilities depend heavily on Social Security benefits, particularly those in lower income brackets. Although the COLA increase provides some relief, it may not fully address the higher costs these groups often face, including medical care and specialized services.

- High-Income Retirees: Retirees with substantial savings may feel less of an impact from the COLA increase, as they have other income sources. For them, Social Security serves as a supplement, but it still plays a significant role in ensuring financial security during retirement.

Challenges Retirees Face with COLA and Inflation

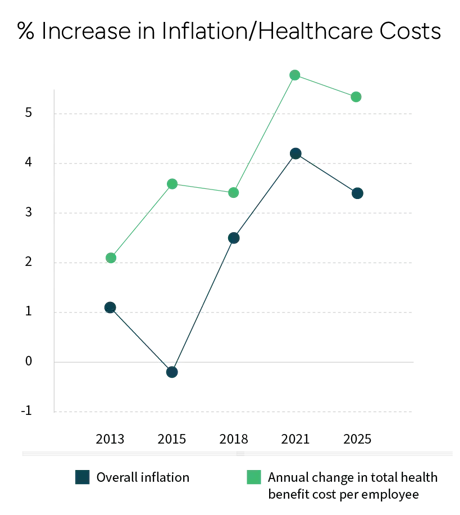

Despite the annual COLA adjustments, many retirees find that the increase does not fully cover the rising costs they face. For instance, healthcare costs are often the largest financial burden for retirees, with premiums, medications, and out-of-pocket expenses increasing faster than the COLA adjustment. Similarly, rent and property taxes can outpace the rate of COLA, further straining retirees’ finances.

Healthcare Costs

Medicare premiums often increase each year, sometimes outpacing the COLA adjustment. In 2025, for instance, Medicare Part B premiums rose significantly, leading many retirees to feel that their COLA increase was largely absorbed by these additional expenses.

Housing and Transportation

Rising housing costs, particularly rent, are another area where retirees struggle to keep up. In some regions, rents have been increasing at rates higher than inflation, making it difficult for retirees to maintain their standard of living on a fixed income.

Social Security Services Beyond COLA

Beyond COLA notifications, the “my Social Security” portal offers retirees a wide range of tools and services to manage their benefits effectively. These services include:

- Survivor Benefits: The portal allows retirees to manage survivor benefits, ensuring that their spouses or dependents are taken care of in the event of their passing.

- Medicare Updates: Retirees can update their Medicare information and review eligibility for additional benefits.

- Financial Planning Tools: The portal also provides access to online calculators, helping retirees estimate their benefits and plan their retirement more effectively.

Massive Payment Gap Revealed: Why November’s Social Security Schedule Just Set Off Alarms

Expert Insights on the COLA and Retirement Security

According to Dr. Jonathan Miller, a financial economist at the Brookings Institution, “While COLA is an important adjustment, it doesn’t fully address the income disparity faced by many retirees. As healthcare and housing costs continue to rise, the real impact of COLA may not be as significant as intended.”

Financial planners also recommend that retirees consider other sources of income, including personal savings, pensions, or part-time work, to supplement their Social Security benefits.

FAQ About Social Security Retirees

Q: What is the COLA for 2026?

A: The COLA for 2026 is 2.8%, a modest increase to help Social Security benefits keep up with inflation.

Q: What happens if I miss the November 19 deadline?

A: If you miss the deadline, you will continue receiving paper notices about your COLA adjustment in the mail.

Q: Can I switch to digital notices after November 19?

A: Yes, you can switch at any time through your “my Social Security” account, but you will still receive paper notices for the current year if you miss the deadline.