The Social Security Administration (SSA) announced two significant Social Security changes for 2025, including a 2.5% cost-of-living adjustment (COLA) and higher taxable income thresholds. The adjustments, which will affect about 75 million Americans, aim to preserve purchasing power amid easing inflation. While the increase is modest compared with previous years, it underscores efforts to maintain benefit stability in a cooling economy.

2 New Social Security Changes

| Key Fact | Detail/Statistic |

|---|---|

| COLA Increase | 2.5% benefit rise for 2025 |

| Average Monthly Gain | About $48 per recipient |

| SSI Adjustment | Effective December 31, 2024 |

| Workers’ Taxable Wage Cap | Rising to $168,600 |

| Full Retirement Age | Gradually increasing to 67 |

| Official Website | Social Security Administration (SSA) |

Social Security Adjusts Benefits for 2025 Amid Cooling Inflation

The SSA confirmed that benefits under Social Security and Supplemental Security Income programs will rise by 2.5% beginning in January 2025. The increase follows the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation trends relevant to retirees.

“These adjustments ensure that benefits keep pace with the cost of living,” said Kilolo Kijakazi, Acting Commissioner of Social Security. “Our goal is to protect beneficiaries’ purchasing power, especially those on fixed incomes.”

The new rates apply to retirees, survivors, and individuals receiving disability or SSI payments. For the average retired worker receiving $1,900 a month, the change adds approximately $48 monthly, according to SSA projections.

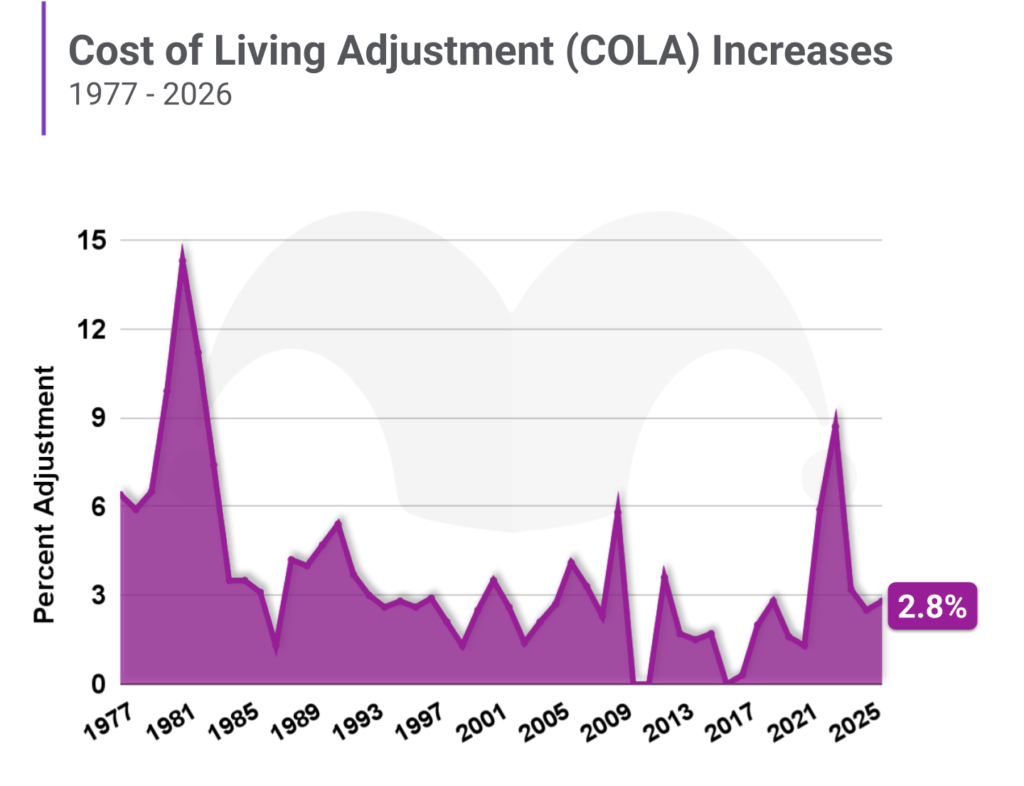

Historical Context: A Decade of COLA Variations

The 2025 adjustment continues a downward trend following record-setting increases in recent years. The 8.7% COLA in 2023 was the highest in four decades, reflecting surging post-pandemic inflation. The 3.2% rise in 2024 was smaller but still above the historical average of 1.8%.

According to the Bureau of Labor Statistics (BLS), inflation has cooled steadily since mid-2023, with consumer prices up 3.1% year-over-year as of September 2024. Economists say the latest COLA mirrors those conditions.

“This year’s adjustment is consistent with broader disinflation across the U.S. economy,” said Greg McBride, chief financial analyst at Bankrate. “It’s not a huge raise, but it’s a sign that inflation is stabilizing.”

How the Increase Impacts Beneficiaries

For millions of retirees and disabled workers, the adjustment will bring modest but meaningful relief.

A retiree receiving $2,000 per month in 2024 will now get $2,050 starting in January 2025. For SSI recipients, the increase begins December 31, 2024, in accordance with federal scheduling rules.

However, advocates warn that the COLA alone may not fully offset rising expenses for essentials like food, housing, and healthcare.

“Every dollar counts for seniors on tight budgets, but costs for prescription drugs and rent continue to outpace COLA increases,” said Nancy Altman, president of Social Security Works.

Earnings and Tax Changes Affecting Workers

Several other key Social Security changes 2025 will impact both current and future beneficiaries.

Higher Earnings Limit for Early Retirees

The earnings limit for beneficiaries who work before reaching full retirement age will rise from $21,240 to $22,320. Exceeding that amount will result in $1 withheld for every $2 earned above the threshold.

This adjustment allows limited-income workers to earn slightly more without temporarily losing benefits.

Increased Taxable Wage Base

The maximum amount of earnings subject to Social Security taxes will rise from $160,200 in 2024 to $168,600 in 2025. That means high-income earners will contribute more toward the program.

“The wage base adjustment helps maintain Social Security’s funding level amid changing demographics,” said Andrew Biggs, senior fellow at the American Enterprise Institute.

Medicare Costs Could Offset Gains

While retirees can expect slightly larger payments, many will also face higher Medicare Part B premiums, typically deducted from Social Security checks.

According to the Centers for Medicare & Medicaid Services (CMS), the standard Part B premium will increase to $179.80 per month in 2025, up from $174.70. That means some beneficiaries’ net monthly increase could fall below $30.

“Beneficiaries should focus on their take-home benefit—the amount they actually receive after deductions,” said Mary Johnson, policy analyst at The Senior Citizens League.

The Broader Economic Picture

The modest COLA reflects a more balanced economy after two years of high inflation. The Federal Reserve’s interest rate hikes, aimed at curbing price growth, have slowed inflation to near-target levels.

“A lower COLA means inflation is easing, which is positive overall,” said Jason Furman, former White House Council of Economic Advisers chair. “But for retirees living on fixed incomes, even moderate price increases can erode stability.”

Consumer spending has remained steady, but economists warn that housing and healthcare costs—critical for older Americans—continue to climb faster than overall inflation.

Global Perspective: How Other Nations Adjust Pensions

Unlike the U.S., where the COLA is tied to the CPI-W, other advanced economies use different models.

The United Kingdom applies a “triple lock” guaranteeing pension increases by the highest of inflation, wage growth, or 2.5%.

Canada indexes benefits quarterly to the Consumer Price Index, while Japan adjusts pensions based on wage and price changes.

Experts say the U.S. model is relatively stable but can lag during periods of rapid inflation, delaying relief for retirees.

Policy Debate: The Future of Social Security

The 2025 changes arrive amid renewed debate over the program’s long-term viability. The Social Security Trustees Report projects that combined trust funds could be depleted by 2035 if Congress takes no action. After that, payroll tax revenue would cover roughly 83% of scheduled benefits.

Lawmakers have proposed varying solutions, from raising the payroll tax cap to adjusting the full retirement age or introducing new funding sources.

“Without reform, future generations may face reduced benefits,” said Jason Fichtner, chief economist at the Bipartisan Policy Center. “The sooner Congress acts, the smaller the adjustments needed.”

While President Biden and several congressional leaders have pledged not to cut benefits, budget analysts caution that structural changes are inevitable within the next decade.

Real-World Impact: Voices from Retirees

Many older Americans view even modest increases as vital. Linda Harper, a 72-year-old retiree from Ohio, said her 2023 and 2024 COLAs helped her afford higher heating and grocery bills.

“It’s not a windfall,” Harper said. “But when your income doesn’t grow much, even $40 a month makes a difference.”

Economists note that Social Security remains the largest source of income for nearly 40% of U.S. seniors, highlighting its enduring importance in reducing poverty among older adults.

How Beneficiaries Can Prepare

Beneficiaries are encouraged to verify their updated benefits by logging into my Social Security accounts at ssa.gov/myaccount. Notices detailing new payment amounts will arrive by mail in December 2024.

Steps to take now:

- Review and update direct deposit or mailing information.

- Compare your projected 2025 income and healthcare costs.

- Consult a financial advisor about tax implications or benefit timing.

- Reassess retirement plans based on changes in the earnings limit and taxable wage cap.

Looking Ahead

The SSA will announce the next COLA in October 2025, based on inflation data from the preceding year. Analysts expect future adjustments to remain moderate unless economic shocks reignite inflation.

For now, the 2025 Social Security changes offer modest but meaningful relief to millions of Americans navigating an uncertain economic landscape.

“The COLA is a reminder of the system’s promise,” said Kilolo Kijakazi. “Social Security remains a lifeline for generations of Americans.”

FAQ About 2 New Social Security Changes

1. When will the 2025 COLA take effect?

Payments reflecting the 2.5% increase will begin January 2025 for most beneficiaries and December 2024 for SSI recipients.

2. How much more will I receive?

The average retiree will see about $48 extra per month, though the exact amount depends on individual benefit levels.

3. Will Medicare premiums offset the increase?

Yes, some beneficiaries may see smaller net gains due to rising Medicare Part B costs.

4. How do I check my new benefit?

Log into your my Social Security account or review your mailed notice in December 2024.