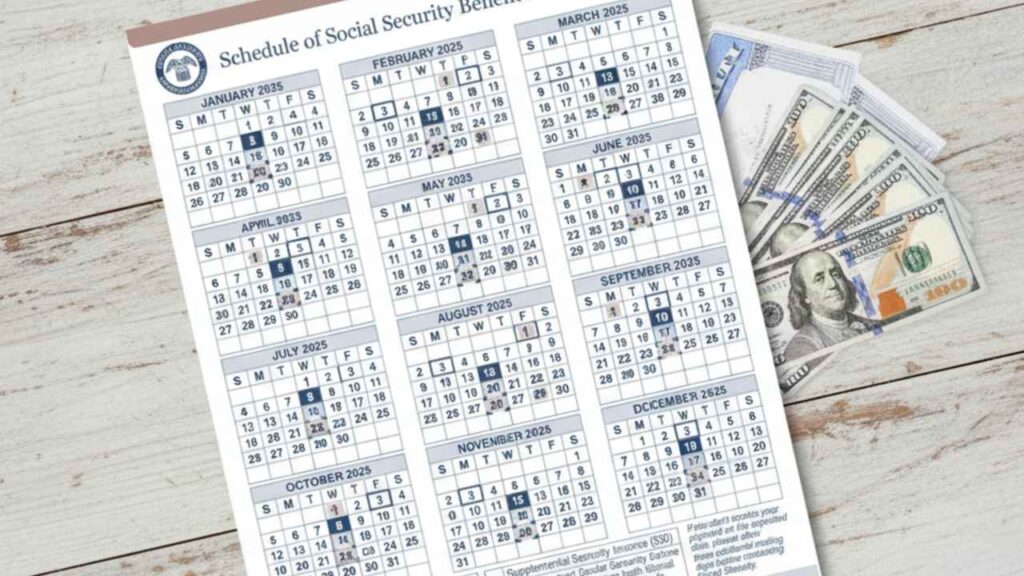

Millions of Americans who depend on Social Security checks for their monthly income will experience a shift in their November 2025 payment schedule, prompting questions and confusion about potential delays. According to the Social Security Administration (SSA), the timing change stems from a calendar alignment—not a disruption in benefit processing.

Social Security Checks Delayed This November

| Key Fact | Detail/Statistic |

|---|---|

| SSI payments issued early | November SSI benefits were paid on Oct. 31, 2025 |

| No SSI payment in November | Early October issue covers November obligations |

| Regular Social Security dates | Nov 12, 19, and 26 based on birth-date brackets |

| 2025 COLA increase | 2.6% adjustment effective January 2025 |

| Number of beneficiaries | Over 71 million Americans receive benefits |

| Official Website | SSA.gov |

Why Social Security Checks Appear ‘Delayed’ in November

The “one-week slip” affecting November’s payments has less to do with administrative backlog and more with federal scheduling logic. The SSA issues benefits based on birth date brackets, distributing payments across three Wednesdays each month to balance bank processing loads.

- Birthdays 1st–10th: paid Wednesday, Nov 12

- Birthdays 11th–20th: paid Wednesday, Nov 19

- Birthdays 21st–31st: paid Wednesday, Nov 26

- Early-cycle recipients (those who began benefits before May 1997, or receive both SSI and Social Security): paid Monday, Nov 3

These dates align with the Treasury Department’s Electronic Funds Transfer (EFT) cycle, which processes roughly $130 billion in monthly benefit payments nationwide.

“Nothing is technically delayed,” said Mark Hensley, a Social Security Administration spokesperson. “We simply follow the statutory calendar, which ensures accuracy and continuity of payments for all beneficiaries.”

The SSI Early Payment: What It Means

The Supplemental Security Income (SSI) program serves over 7.4 million Americans, providing monthly cash assistance to low-income seniors and people with disabilities. Because November 1 falls on a Saturday, SSI payments were issued one business day earlier—on Friday, October 31.

That early release has created confusion among recipients, many of whom expected an additional payment this month. “It happens several times a year,” said Lisa DeMarco, a financial counselor with the National Council on Aging. “If the first of the month lands on a weekend or federal holiday, SSI payments move up. Recipients think a check is missing, but it’s just been paid early.”

The next SSI payment is scheduled for December 31, meaning beneficiaries will receive two payments that month—one for December and one for January 2026.

Impact on Retirees and Fixed-Income Households

While the SSA insists all payments are “on time,” the schedule shift can still disrupt personal budgets. Many seniors plan bill payments and grocery purchases around the expected deposit date.

“Even a predictable delay feels significant when you’re living paycheck to paycheck,” said Dr. Andrew Rowe, an economist at the Urban Institute. “For households on fixed incomes, a few days can affect rent, medication refills, or utilities.”

Retiree Sharon Lewis, 72, from Ohio, said she noticed the absence of her usual early-month deposit. “I almost panicked until my daughter reminded me of the new schedule,” she said. “I wish the SSA would send text reminders—it would save a lot of stress.”

Understanding the Payment Rotation System

The SSA adopted the staggered schedule in 1997 to prevent delays caused by mass same-day deposits. Prior to that change, nearly all Social Security checks were issued on the third day of each month, overwhelming banking systems.

The current “Wednesday rotation”—based on beneficiaries’ birthdays—divides payments evenly across the month. According to SSA data, this structure reduces fraud risk and administrative errors by nearly 25 percent compared with the pre-1997 model.

The Bigger Picture: Cost of Living and Retiree Budgets

Beyond timing, many retirees are grappling with the broader challenge of rising living costs. The 2025 Cost-of-Living Adjustment (COLA) increased benefits by 2.6 percent, reflecting the moderate inflation recorded by the Consumer Price Index for Urban Wage Earners (CPI-W).

However, according to a Pew Research Center analysis, the average retiree household’s expenses have grown 4.1 percent year over year—mainly due to healthcare, rent, and food costs.

“The COLA helps, but it often trails real inflation,” said Dr. Janet Ellis, a public policy professor at Georgetown University. “For many retirees, a $40 monthly increase doesn’t offset a $100 rise in prescription costs.”

To mitigate these pressures, advocacy groups like AARP and the National Committee to Preserve Social Security and Medicare are urging Congress to consider alternative COLA formulas, such as the Consumer Price Index for the Elderly (CPI-E), which more accurately reflects seniors’ spending habits.

Social Security Funding: Stable but Stressed

While the November schedule adjustment has no connection to funding, it arrives amid renewed public concern about long-term solvency. The Social Security Trustees Report (2025) projects that the combined Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust funds will be depleted by 2035, after which the program could pay about 83 percent of scheduled benefits unless reforms are enacted.

Economists emphasize that the November issue is a calendar event, not a sign of financial instability.

“Funding debates are important, but they don’t affect monthly processing,” said David Knox, a senior fellow at the Center for Retirement Research at Boston College. “The Treasury guarantees these payments regardless of trust fund politics.”

Government Shutdowns and Payment Continuity

Concerns about a possible federal government shutdown have fueled speculation about interruptions in Social Security payments. The SSA and U.S. Department of the Treasury have confirmed that benefits fall under mandatory spending, meaning payments continue even during budget impasses.

During past shutdowns, including those in 2013 and 2018–2019, Social Security checks were issued on schedule, though local SSA offices temporarily reduced staffing and limited non-essential services.

“Beneficiaries should rest assured—payments won’t stop,” SSA Commissioner Kilolo Kijakazi said during an October press briefing. “Our systems are fully funded and automated to deliver benefits on time.”

How Beneficiaries Can Stay Informed

The SSA encourages recipients to manage benefits through My Social Security accounts, where they can view payment history, verify deposit dates, and update direct deposit information.

Experts also recommend:

- Setting up bank alerts for deposits.

- Keeping at least one week of living expenses as a buffer.

- Avoiding reliance on paper checks, which are more vulnerable to delays or theft.

Direct Express, the government’s debit card program, is another secure method for beneficiaries without bank accounts.

Real-World Reactions and Public Perception

Despite official reassurances, confusion persists online. Verified X (formerly Twitter) accounts of financial advisors and aging advocates have seen spikes in queries about “missing” payments.

Financial literacy educator Tyrone Brooks, who runs seminars for older adults, said the incident underscores the importance of “financial preparedness and digital literacy” among retirees. “Many seniors don’t know how to log into their SSA portal,” Brooks noted. “We need outreach, not just notices.”

Expert Advice: Planning for Future Shifts

Payment realignments like November’s occur several times each year due to weekends or holidays. Understanding the pattern can reduce anxiety and prevent unnecessary calls to SSA offices.

“Once you know your birthday group, you can map your payments for the entire year,” said DeMarco. “It’s predictable—just not always intuitive.”

Financial planners suggest maintaining automatic bill pay schedules that accommodate a few days’ flexibility, particularly for housing or loan payments.

Looking Ahead

While this month’s Social Security checks might feel “delayed,” the adjustment is standard and procedural. The SSA confirms all November 2025 payments will be completed on time, with dual SSI deposits next expected on December 31.

For retirees, the best approach remains vigilance: verify your payment schedule, plan ahead, and rely on official SSA communications—not social media rumors.

Shocking Shutdown Fallout: 1 Million+ Americans Facing Nearly $1,000 in Lost Benefits

FAQ About Social Security Checks Delayed

1. Why didn’t I get an SSI payment in November?

Because November 1 fell on a Saturday, SSI payments were released early on October 31. That was your November payment.

2. Is the government shutdown delaying my Social Security check?

No. Social Security payments are legally protected and continue during shutdowns.

3. How can I check my payment status?

Log in to your My Social Security account at ssa.gov/myaccount or call 1-800-772-1213.

4. Will December payments be affected?

Yes, SSI recipients will receive two deposits in December—on Dec 31 for January’s payment.