The Social Security Administration (SSA) is preparing a major rule change that could alter how disability benefits are awarded, redefining eligibility for millions of Americans. While officials say the plan aims to modernize the system and protect the trust fund, independent analysts warn it may make it harder for older and less-skilled workers to qualify for aid — potentially cutting off up to 750,000 people from essential support over the next decade.

Secret Plan Could Strip Social Security

| Key Fact | Detail / Statistic |

|---|---|

| Estimated Impact | Up to 750,000 Americans could lose or be denied disability benefits |

| Program Affected | Social Security Disability Insurance (SSDI) |

| Timeline | Proposal under consideration; not finalized |

| Central Issue | Revisions to age, skill, and job adaptability criteria |

| Estimated Recipients | 8.4 million current SSDI beneficiaries |

| Official Website | SSA.gov |

A Closer Look at the Proposed Social Security Rule Change

The SSA’s proposed rule would update the “medical-vocational guidelines” — often called the grid rules — that determine whether an individual’s physical or mental limitations, age, education, and work experience qualify them for disability benefits under Social Security Disability Insurance (SSDI).

These guidelines, last significantly updated in 1978, were designed for a workforce dominated by manufacturing and manual labor. Today’s job market is markedly different, with more emphasis on service and digital work. The SSA argues that the criteria must evolve to remain relevant.

“Modernizing the grid rules is essential to ensuring fair and consistent decisions in the 21st-century economy,” an SSA spokesperson said in an email statement. “We are committed to a careful, transparent process that balances equity with sustainability.”

How Disability Benefits Are Determined

To qualify for SSDI, applicants must prove they cannot perform any substantial work due to a severe, long-term medical condition. Under the current system, older workers — particularly those aged 50 and above — receive additional consideration because retraining for new types of employment is more difficult at that stage of life.

If the proposed rule is enacted, the SSA could remove or reduce the weight given to age and retraining challenges, instead focusing more heavily on whether other forms of work exist that claimants could theoretically perform, regardless of age or regional job availability.

Policy analysts say this would likely lead to a sharp reduction in approvals for claimants over 50, especially those without college degrees or transferable technical skills.

Projected Impact: Who Could Be Affected

The Urban Institute estimates that a 10 percent reduction in disability eligibility would translate to about 750,000 fewer beneficiaries over ten years. The reduction would disproportionately impact workers in industries such as construction, transportation, warehousing, and manufacturing, where physical demands are high and job retraining options are limited.

Kathleen Romig, Director of Social Security and Disability Policy at the Center on Budget and Policy Priorities, said the change would “radically redefine disability in America.”

“For decades, Social Security has recognized that age and limited job options compound disability,” Romig said. “Erasing that reality would deny support to people who’ve spent their lives in physically demanding work and can no longer do it.”

The AARP warned that the proposal could “undermine the economic stability of millions of older Americans,” many of whom rely on SSDI as their only source of income before retirement eligibility begins at 62.

Fiscal and Political Context

The SSA maintains that the proposed changes are necessary to ensure long-term solvency. According to the 2024 Social Security Trustees Report, the Disability Insurance Trust Fund is expected to remain solvent until 2052, but the combined retirement and disability trust funds could be depleted by 2035 without new revenue or cost adjustments.

Officials argue that aligning disability criteria with modern medical and occupational standards could reduce administrative delays and save money.

However, critics counter that fiscal prudence should not come at the expense of social protection. Senator Sherrod Brown (D-Ohio) called for a full public review, saying,

“The American people deserve transparency when policies could affect the livelihoods of hundreds of thousands.”

Republican lawmakers, including Representative Drew Ferguson (R-Georgia), have voiced support, arguing that “the SSA must focus on those truly unable to work, not on outdated definitions that inflate costs.”

Historical Parallels: A Pattern of Restrictive Reforms

This is not the first time disability policy has come under scrutiny.

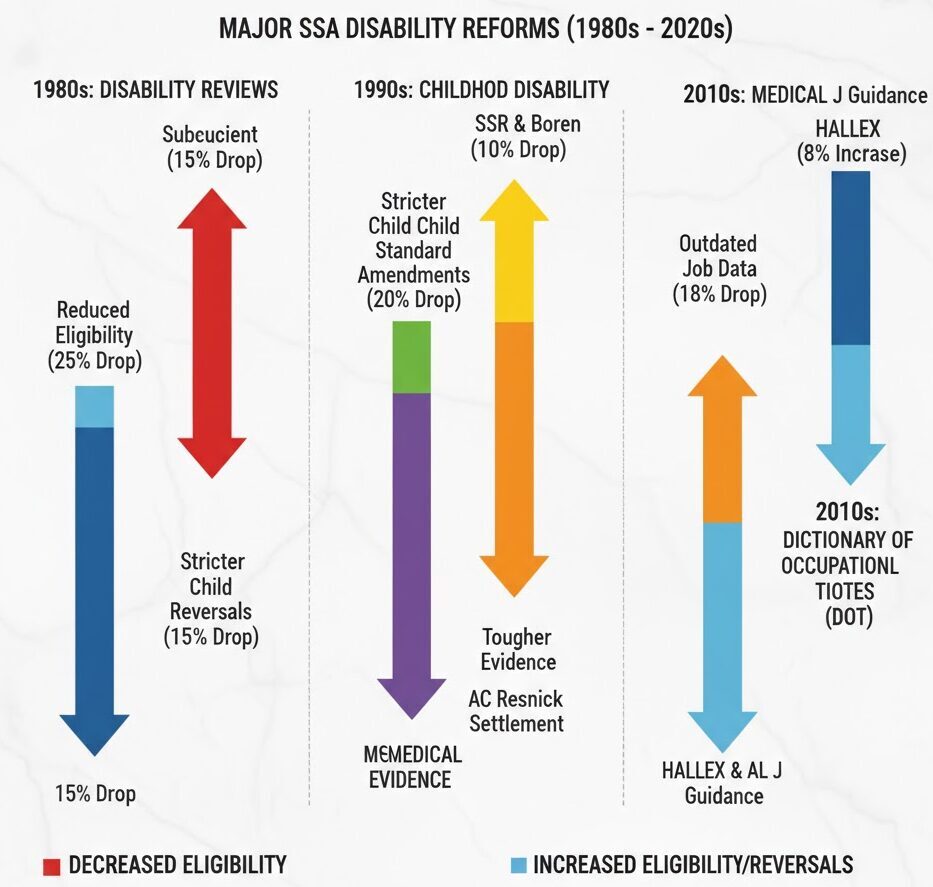

In the 1980s, the Reagan administration initiated similar reforms, increasing continuing disability reviews that resulted in hundreds of thousands of benefit terminations. Public backlash and legal challenges later forced Congress to roll back some of those cuts.

More recently, under the Trump administration in 2019, the SSA proposed more frequent reviews for disability recipients. That rule was ultimately withdrawn after widespread criticism from medical and legal experts.

“These proposals tend to resurface every decade,” said Dr. Jason Fichtner, a senior lecturer at Johns Hopkins University and former SSA official. “Each time, the balance between fiscal responsibility and compassion is tested.”

Human Consequences: Stories Behind the Numbers

While statistical modeling paints a broad picture, the potential human toll is equally significant.

Many Americans who apply for disability benefits have already exhausted savings or left the workforce due to chronic health issues.

Lisa Harrington, 58, a former truck driver from Ohio, said she worries the new rules would exclude people like her.

“I can’t sit at a desk for eight hours because of spinal issues. They say I could do light work, but nobody hires you when you can’t bend or lift,” she said in an interview with The Washington Post.

For people in similar circumstances, the loss of SSDI eligibility could mean turning to other federal programs such as Supplemental Security Income (SSI), which offers lower monthly payments and stricter financial limits.

Broader Economic Effects

Economists warn that restricting disability access could increase poverty among older workers and strain state-level welfare programs.

According to the U.S. Census Bureau, nearly one in four Americans aged 55 to 64 live with a disability. Reducing access to SSDI could therefore increase homelessness, medical debt, and reliance on Medicaid.

“Cutting SSDI doesn’t make disability disappear,” said Dr. Melissa Kearney, an economist at the University of Maryland.

“It simply shifts costs from one government account to another — from the SSA to states, hospitals, and families.”

International Comparison: How the U.S. Measures Up

Globally, the U.S. maintains stricter disability benefit standards than most industrialized nations.

According to the Organisation for Economic Co-operation and Development (OECD), the United States ranks below average among member countries in terms of disability coverage and replacement rates — the proportion of income replaced by benefits.

European nations such as Germany, the Netherlands, and Sweden have restructured their disability systems to emphasize rehabilitation and gradual reentry into the workforce rather than denying eligibility outright.

“Modernization doesn’t have to mean exclusion,” said Dr. Anya Sharma, a policy analyst at the London School of Economics. “Other nations have successfully updated their disability criteria without reducing protection for vulnerable populations.”

Public Opinion and Advocacy Response

Public response to the proposal has been swift. Advocacy groups, including Disability Rights Education and Defense Fund (DREDF) and National Disability Rights Network (NDRN), have mobilized campaigns urging the SSA to halt the rulemaking process.

The hashtag #ProtectSocialSecurity trended across social media platforms in late October, with thousands of users sharing personal stories about how SSDI benefits sustained their families.

Next Steps: The Regulatory Path Ahead

The SSA is expected to publish the proposed rule in the Federal Register in early 2026, triggering a 60-day public comment period.

After reviewing submissions, the agency can issue a final rule, revise its draft, or withdraw the proposal altogether.

If enacted, analysts expect the new standards to take effect gradually between 2026 and 2028, beginning with new applicants before expanding to reassessments.

Legal experts caution that lawsuits are likely. Civil rights groups could challenge the rule under the Administrative Procedure Act, arguing that it constitutes an arbitrary reduction of benefits without adequate empirical justification.

Shocking Shutdown Fallout: 1 Million+ Americans Facing Nearly $1,000 in Lost Benefits

The Broader Debate: Reform vs. Retrenchment

At its core, the debate reflects a broader national tension between fiscal reform and social responsibility.

While policymakers agree that Social Security must adapt to remain solvent, they diverge sharply on how to achieve that balance.

Supporters frame the change as pragmatic modernization; opponents see it as erosion of a foundational safety net. Both sides acknowledge that the outcome will shape not only disability policy but the country’s broader understanding of economic dignity.

“Social Security is not a handout — it’s an earned insurance program,” said Nancy LeaMond, Executive Vice President of AARP. “Americans deserve to know that the system will be there when they need it most.”

The Road Ahead

As policymakers debate, millions of Americans wait anxiously. The coming year will determine whether the Social Security rule change becomes another chapter in a long history of reform — or a cautionary tale about how nations treat their most vulnerable.

“Every rule change reflects a choice,” said Dr. Kearney. “The question is whether that choice reflects who we are.”