The Social Security Payments November 2025 schedule includes a maximum monthly benefit of $5108, the highest in the program’s history. But only a small fraction of retirees will receive that amount. The figure reflects the maximum benefit for Americans who delayed retirement until age 70 and earned the maximum taxable income throughout their careers, according to the Social Security Administration (SSA).

$5108 Social Security Payments

| Key Fact | Detail/Statistic |

|---|---|

| Maximum Monthly Benefit (Age 70, 2025) | $5,108 |

| Average Retired Worker Benefit (2025 estimate) | ~$1,907 per month |

| 2025 Cost-of-Living Adjustment (COLA) | 3.2% |

| November 2025 Payment Dates | 2nd, 3rd, and 4th Wednesdays |

| Official Website | Social Security Administration (SSA) |

Understanding the $5108 Maximum Social Security Benefit

The $5108 Social Security payment represents the highest possible monthly retirement benefit available in 2025. To reach that amount, individuals must have earned the maximum taxable income—$168,600 in 2024—and must delay claiming benefits until age 70.

For those claiming earlier, the difference can be substantial. A retiree who files at their full retirement age of 67 will receive a maximum of $4,018 per month, while someone who begins at 62 could get as little as $2,831. The SSA’s formula rewards delayed claiming through “delayed retirement credits,” which increase monthly benefits by roughly 8 percent for each year after full retirement age until 70.

“Waiting until 70 provides roughly an 8 percent increase per year after full retirement age,” said Andrew Biggs, senior fellow at the American Enterprise Institute. “For high earners, that delay can mean several thousand dollars more each month.”

A Brief History of Maximum Benefits

Social Security’s maximum monthly benefit has more than doubled over the past decade, largely due to wage growth and inflation adjustments.

In 2015, the top benefit for age-70 retirees stood at $2,663. By 2020, it had risen to $3,790, and in 2025, it surpasses $5,100. This increase reflects both inflationary pressures and higher average national wages, which determine the SSA’s “bend points” in its benefit formula.

Despite those increases, experts say the real purchasing power of benefits has not kept pace with essential costs like healthcare, housing, and food.

Who Qualifies for the Full Amount

The Three Key Requirements

To receive the maximum Social Security benefit, a retiree must:

- Work at least 35 years. SSA calculates benefits using the 35 highest-earning years, adjusted for inflation.

- Earn the maximum taxable amount in most of those years.

- Delay benefits until age 70.

According to SSA data, only about 2 percent of retirees meet all three criteria. Most Americans earn below the taxable wage limit or claim benefits before full retirement age.

“Very few retirees will ever see $5,108 a month,” said Mary Johnson, policy analyst with The Senior Citizens League. “The majority receive between $1,500 and $2,000 monthly, depending on their work history and claiming age.”

The Impact of Early or Late Retirement

For someone eligible for a $4,000 monthly benefit at full retirement age, waiting until 70 can raise the amount to roughly $4,960, while claiming early at 62 would reduce it to around $2,800. Over a 20-year retirement, that difference could exceed $400,000 in lifetime benefits.

Still, waiting is not always best. “The decision depends on life expectancy, savings, and health,” said Olivia Mitchell, a pension expert at the Wharton School of the University of Pennsylvania. “For some, claiming early provides financial stability when it’s needed most.”

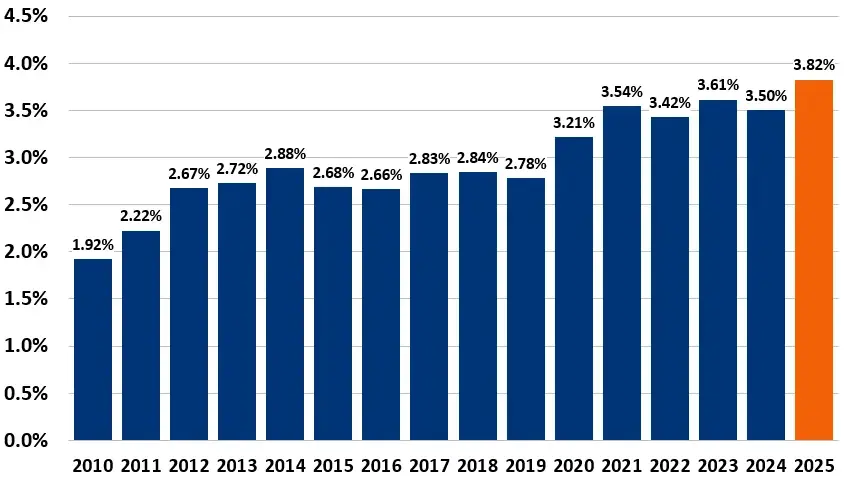

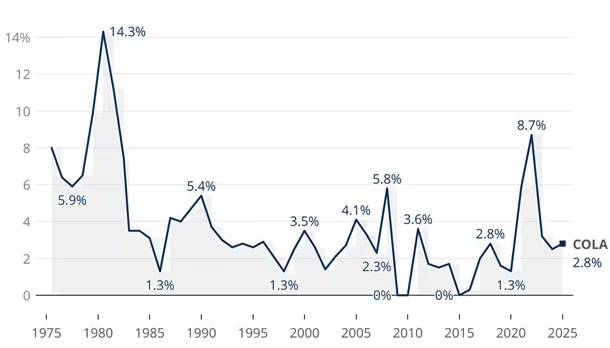

How the COLA 2025 Adjustment Works

The Cost-of-Living Adjustment (COLA) protects Social Security payments from inflation. Each October, the SSA calculates the next year’s increase based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), comparing third-quarter data with the same period from the previous year.

In 2025, benefits rose 3.2 percent, following a 3.4 percent inflation rate in 2024. That’s far lower than the record 8.7 percent COLA in 2023, which came amid surging post-pandemic inflation.

Advocates argue the CPI-W does not reflect seniors’ true expenses, as it underweights medical and housing costs. Some propose shifting to a Consumer Price Index for the Elderly (CPI-E), which better tracks senior spending.

“Retirees spend more on healthcare and less on transportation than the average worker,” said Nancy Altman, president of Social Security Works. “That makes the CPI-W an inaccurate measure for adjusting benefits.”

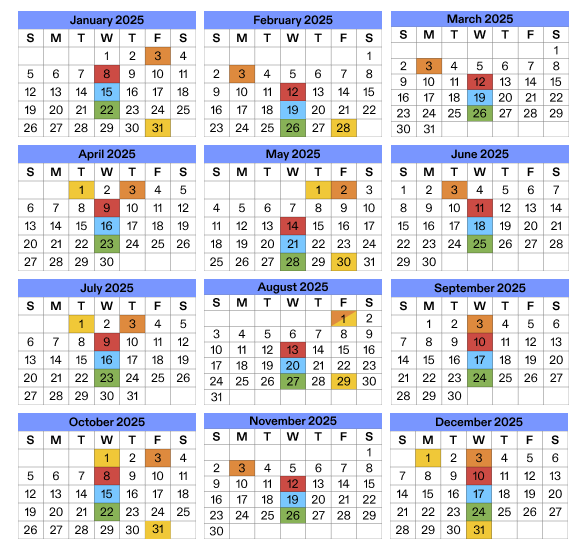

November 2025 Payment Schedule

Most retirees will receive their Social Security Payments in November 2025 according to the following schedule:

- November 12: For birthdays between the 1st and 10th.

- November 19: For birthdays between the 11th and 20th.

- November 26: For birthdays between the 21st and 31st.

Those who began receiving benefits before May 1997 or who also collect Supplemental Security Income (SSI) will receive payments on November 3.

“The schedule ensures consistency and reliability for beneficiaries,” said Diana Varela, SSA spokesperson. “Recipients can always verify their payment date through their ‘my Social Security’ online account.”

Economic and Policy Context

Social Security remains a vital income source for more than 67 million Americans, including retirees, disabled workers, and survivors. According to the Pew Research Center, about 40 percent of older adults rely on the program for at least half their income. For roughly one in five, it provides 90 percent or more.

Yet rising inflation has eroded the real value of benefits. A study from The Senior Citizens League estimates that Social Security’s purchasing power has fallen by 36 percent since 2000. Healthcare costs, in particular, have outpaced COLA adjustments nearly every year.

“Seniors are paying more for essentials, especially medical care,” said Johnson. “COLA increases help, but they lag behind the actual rise in expenses.”

Disability and Survivor Benefits

While retirement benefits receive the most attention, the SSA also administers disability and survivor benefits. Disabled workers receive an average of $1,537 per month in 2025, while surviving spouses of deceased workers collect about $1,780, according to SSA data.

Eligibility and calculations for these programs differ, but both rely on the same payroll tax funding system that supports retirement benefits.

Global Comparison: How the U.S. Stacks Up

Compared to other advanced economies, U.S. Social Security benefits are modest. According to the Organisation for Economic Co-operation and Development (OECD), average replacement rates—the share of pre-retirement income provided by public pensions—stand at about 37 percent in the United States. In contrast, Germany provides 51 percent, and France nearly 60 percent.

Experts attribute this gap to the U.S. system’s original design as a supplement to personal savings and employer pensions, not as a sole retirement income source.

The Future of Social Security

The 2024 Social Security Trustees Report projects that the Old-Age and Survivors Insurance (OASI) Trust Fund will be depleted by 2035. Without legislative action, incoming payroll taxes would fund only about 83 percent of scheduled benefits.

Proposals to strengthen the program include:

- Raising or eliminating the taxable wage cap.

- Gradually increasing the full retirement age.

- Adjusting payroll tax rates.

- Introducing means testing for high-income retirees.

“The program’s long-term solvency is one of the most pressing fiscal challenges facing Congress,” said Dr. Anya Sharma, economist at the Urban Institute. “The sooner reforms are enacted, the less drastic they’ll need to be.”

Real-Life Example: What the Numbers Mean

Consider two retirees, both age 67 in 2025.

- Maria Lopez, a retired teacher earning $60,000 annually, receives about $2,200 per month.

- David Chen, a corporate executive who consistently earned the taxable maximum, delayed benefits to 70 and now receives the full $5,108.

The difference illustrates how earnings history and claiming age can dramatically affect retirement income, even under the same program rules.

Looking Ahead

As the SSA prepares for its 90th anniversary in 2026, debates over solvency, fairness, and modernization are likely to intensify. For now, November’s $5,108 headline serves as both a symbol of the system’s promise and a reminder of its limits.

“The maximum benefit is a powerful example of what Social Security can provide,” said Sharma. “But the real question is whether it can continue to meet the needs of average Americans in the decades to come.”

FAQ

1. Are the $5108 payments a new benefit or a one-time bonus?

No. They represent the maximum monthly retirement benefit under SSA rules, not a special payment or stimulus check.

2. What happens if I claim before 70?

Your monthly amount will be permanently reduced. Claiming at 62 can cut benefits by roughly 30 percent.

3. Are Social Security benefits adjusted for inflation every year?

Yes. The annual COLA ensures benefits rise with inflation, though the formula may underrepresent seniors’ true expenses.

5. Could Congress reduce future benefits?

If no reforms are made before 2035, automatic cuts could occur. Lawmakers from both parties are discussing solutions to prevent that outcome.