The U.S. Social Security Administration (SSA) has announced a series of changes to the program, potentially affecting millions of Americans’ retirement plans. These reforms, which include adjustments to cost-of-living increases, benefit eligibility, and earnings caps, are set to reshape how individuals plan for retirement, especially in the face of rising living costs and economic uncertainties.

5 Major Social Security Changes

| Key Fact | Detail/Statistic |

|---|---|

| Cost-of-Living Adjustment | 2.8% increase for 2026 benefits |

| Maximum Taxable Earnings | $184,500 in 2026 |

| Full Retirement Age | 67 years for those born after 1960 |

| Earnings Test Limit (Under FRA) | $24,480 in 2026 |

| Social Security Trust Fund | Could be depleted by 2034 |

| Official Website | Social Security Administration |

The announced changes to Social Security, while beneficial for some, present challenges for many Americans relying on the program for their retirement income. With rising costs and ongoing debates about funding sustainability, individuals must be proactive in adjusting their retirement plans. Whether that involves working longer, saving more, or preparing for potential future cuts, staying informed and prepared will be crucial as Social Security continues to evolve.

Social Security’s New Changes: What You Need to Know

Recent announcements by the Social Security Administration (SSA) regarding changes to Social Security benefits, eligibility, and other key rules are set to significantly impact retirement planning for millions of Americans. These adjustments, expected to take effect in the coming years, come amid broader discussions about the program’s future and sustainability.

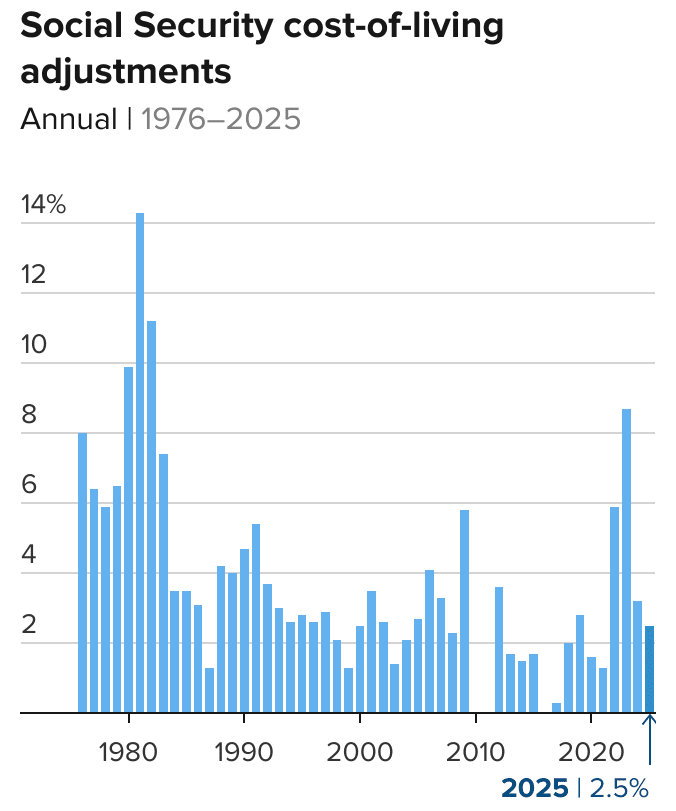

Cost-of-Living Adjustment (COLA) for 2026

The SSA has confirmed that beneficiaries of Social Security will see a 2.8% increase in their benefits starting in 2026. This annual Cost-of-Living Adjustment (COLA) is meant to help retirees keep pace with inflation, particularly as the cost of goods and services rises. However, experts caution that while the increase is notable, it may not fully offset the increased costs of healthcare and housing for many retirees.

The COLA adjustment is important because it affects millions of people receiving Social Security benefits, including retirees, disabled workers, and survivors. While the increase is expected to help most recipients, it also highlights the challenge of sustaining a retirement income that matches the rising cost of living.

For example, if you are a retiree receiving $1,500 per month, a 2.8% COLA increase would add $42 to your monthly benefit, bringing it to $1,542. However, in areas where healthcare costs or local inflation rates are particularly high, that increase might not cover the additional expenses retirees face. Many retirees will need to explore other ways to supplement their income.

Earnings Test and Work-Related Limits

For those who plan to work while receiving Social Security benefits, the earnings test—which reduces benefits if earnings exceed a certain threshold—will increase in 2026. Specifically, the earnings limit for individuals under Full Retirement Age (FRA) will rise to $24,480, up from previous years. Once an individual reaches FRA, they are no longer subject to the earnings test.

In addition, the maximum amount of earnings that are subject to Social Security taxes will increase to $184,500 in 2026, up from $160,200 in 2023. This means that high earners will contribute more to the Social Security system, potentially boosting their future benefits, but also contributing to the system’s funding.

This change is particularly relevant for those considering working part-time or returning to the workforce during retirement. Many people may not realize that they can continue to earn a substantial income and still receive their Social Security benefits, but those exceeding the limit will experience a reduction in their monthly check.

Full Retirement Age Increases

The Full Retirement Age (FRA)—the age at which individuals can start claiming their full Social Security benefits without a reduction—will increase for those born in 1960 or later. For these individuals, the FRA will be 67 years. This change could have significant implications for retirement planning, as individuals may need to work longer than anticipated to receive their full benefit.

The increase in FRA also impacts individuals who choose to retire early. Anyone retiring before reaching FRA will face reduced monthly benefits, which can amount to as much as 30% less for those retiring at age 62. For example, if your monthly benefit at FRA is projected to be $1,500, claiming early at age 62 could reduce that amount to $1,050, costing you an additional $450 per month for the rest of your life.

Understanding these rules is crucial for planning a financially secure retirement. While early retirement may sound appealing, it can lead to substantial long-term financial sacrifices.

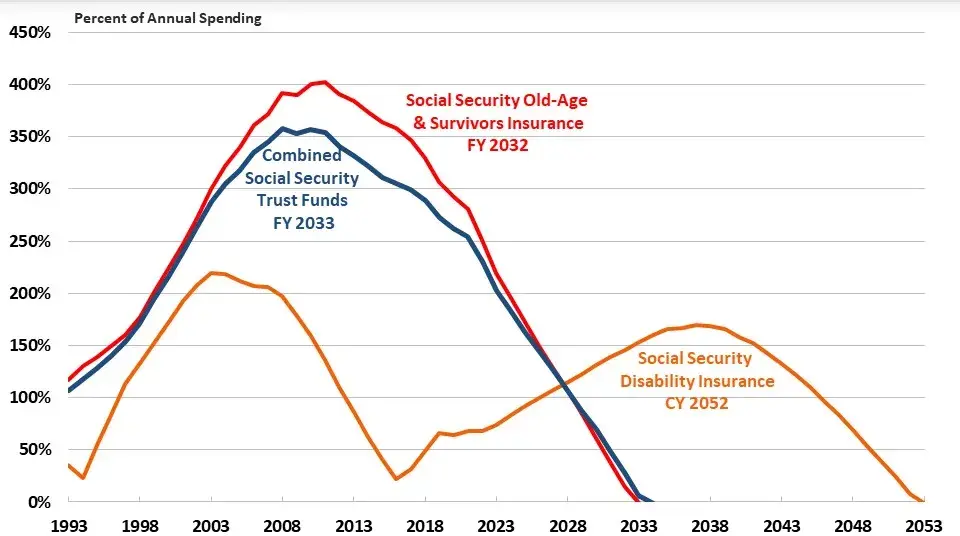

The Future of Social Security: Sustainability Concerns

Another key issue affecting the future of Social Security is the Trust Fund’s solvency. According to the latest report from the Social Security Trustees, the Trust Fund, which helps pay out benefits to retirees, could be depleted by 2034 unless changes are made to the system. If the fund runs out, benefits could be reduced by up to 20% for all recipients, meaning many retirees could face a shortfall in their expected income.

This looming shortfall has spurred discussions among lawmakers about potential reforms, including changes to the payroll tax, eligibility age, or even benefit cuts. However, no concrete solutions have emerged yet, and it remains uncertain how lawmakers will address the issue.

Dr. Maya Henderson, an economist at the Brookings Institution, explains that without reform, “Social Security will be forced to operate at a deficit, relying on the interest from the trust fund, which is unsustainable in the long term. While many Americans depend on Social Security as their primary income in retirement, this system was designed under assumptions that no longer hold true today.”

A variety of solutions are being discussed, including increasing the payroll tax cap, raising the retirement age further, or reducing benefits for wealthier retirees. However, each potential solution carries its own political and social challenges, especially as the U.S. demographic shifts toward an older population.

Preparing for the Future: What You Can Do

In light of these changes, individuals planning for retirement need to reassess their strategies. Here are some key recommendations:

- Review Your Benefits Statement: Ensure your work history is accurately recorded, as this will directly impact your Social Security benefit.

- Plan for Inflation: While the 2.8% COLA will help, inflation may still outpace your benefits. Consider additional retirement savings options, such as 401(k) or IRA contributions.

- Consider Working Longer: Delaying your retirement until after reaching FRA can result in a higher benefit. If possible, consider working longer to maximize your Social Security payout.

- Stay Informed on Policy Changes: Keep track of any legislative changes to Social Security. The future of the program is uncertain, and adjustments to taxes or eligibility could affect your retirement plans.

- Explore Alternative Retirement Strategies: Beyond Social Security, look into other retirement-saving options, including Roth IRAs, private savings, and employer-sponsored 401(k) plans. Annuities and life insurance products could also be worth considering.

The key to successful retirement planning is diversification. While Social Security provides a foundation, relying solely on it for income may not be sufficient, especially if the program faces future cuts.

FAQ About 5 Major Social Security Changes

What are the changes to the Full Retirement Age (FRA)?

The FRA is increasing to 67 years for individuals born in 1960 or later. This means that anyone retiring before this age will face reduced benefits.

How will the changes affect my Social Security benefits?

The 2.8% COLA increase will raise monthly benefits, but the full impact will vary based on individual circumstances. The earnings test limit will also rise, which may allow some individuals to earn more without a reduction in benefits.

Is Social Security facing a funding shortfall?

Yes, according to the Social Security Trustees, the Trust Fund may be depleted by 2034, which could result in a 20% reduction in benefits unless reforms are made.