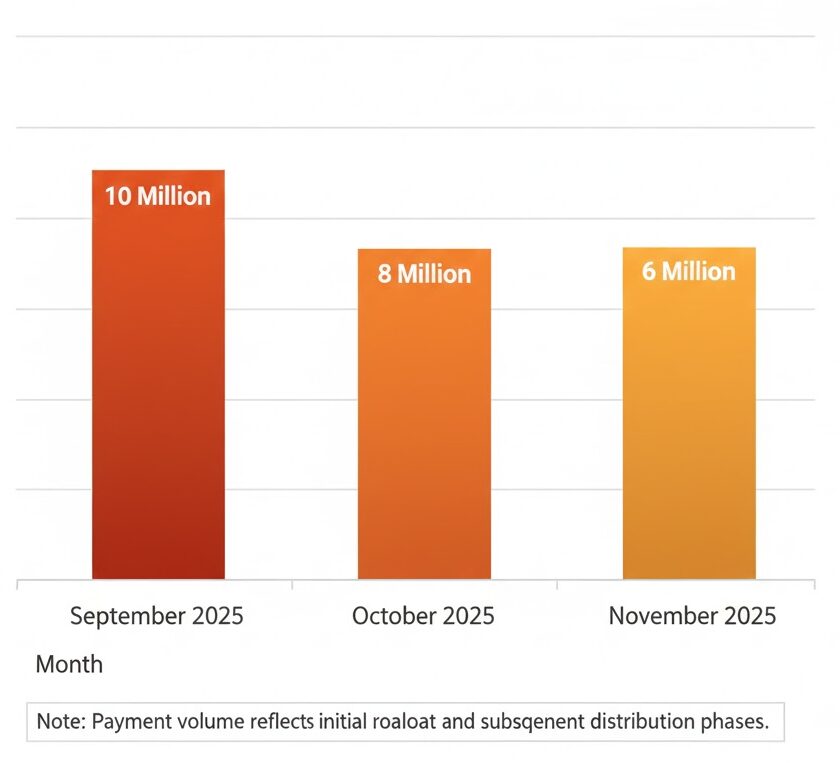

New York has begun mailing its $400 Inflation Relief Payments, a statewide program approved in the 2025–2026 budget to help households manage rising living costs. State officials say more than eight million residents qualify for the one-time payments, which are being issued between late September and November. The initiative requires no application, with eligibility determined solely through 2023 state tax filings.

$400 Inflation Relief Payments

| Key Fact | Detail |

|---|---|

| Maximum Payment | $400 per eligible household |

| Distribution Window | Late September–November 2025 |

| Delivery Method | Mailed paper checks only |

| Eligible Recipients | Based on 2023 AGI and filing status |

Understanding the $400 Inflation Relief Payments Program

New York created the $400 Inflation Relief Payments to help households manage persistent price increases. While inflation has cooled nationally from its 2022 highs, state analysts report that housing, food, childcare, and transportation costs remain elevated across much of New York. These increases have placed disproportionate pressure on low- and middle-income families.

The one-time payments provide targeted assistance. According to the New York State Department of Taxation and Finance, married couples filing jointly with a 2023 adjusted gross income of $150,000 or less receive the full $400 benefit. Single filers may receive $150–$200 depending on their income, while heads of household fall within similar tiers.

State Budget Director Elena Márquez said the program was designed to get money to residents “as quickly and as simply as possible.” Because it is based entirely on previously filed tax returns, the state bypasses the administrative delays often associated with application-based programs.

How This Program Fits Into New York’s Relief Strategy

New York has instituted several targeted relief programs over the past decade, especially during periods of economic stress.

Notable examples include:

- 2022 Homeowner Tax Rebate Credit, which issued more than two million payments to offset rising property taxes.

- COVID-era emergency relief checks, distributed to lower-income families in 2021.

- Enhanced Earned Income Tax Credit expansions, offering increased benefits for working households.

Policy experts say these past efforts provided the state with valuable infrastructure to launch the current initiative efficiently. Dr. Jason Leland, a fiscal policy researcher at Columbia University, said the new program “builds on the administrative lessons New York learned during the pandemic, particularly the importance of using existing tax data to speed up distribution.”

Eligibility Requirements and How They Are Determined

Income Thresholds and Filing Status

Eligibility is based entirely on 2023 New York State personal income tax returns. The state uses adjusted gross income (AGI), filing status, and residency information to determine payment levels.

Households qualify if they:

- Filed a 2023 Form IT-201

- Maintained a New York residence during the tax year

- Are not claimed as dependents

- Fall within the state’s AGI thresholds

Residents do not need to take any additional steps. Checks are automatically mailed to the address on file.

Dr. Melissa Henry of the State University of New York at Albany said that this method reduces fraud risks. “Programs that rely on prior-year tax information are significantly less vulnerable to fraudulent claims because the state has already verified revenue and residency,” she explained.

How and When $400 Inflation Relief Payments Are Delivered

Checks are being mailed in rolling batches from September 26 through November. The state confirmed that all payments are issued as paper checks, even if the taxpayer previously opted for direct deposit.

A spokesperson said that paper checks simplify tracking procedures and reduce complications from closed or changed bank accounts. This decision follows an internal audit showing that a substantial number of direct-deposit refunds in recent years were returned due to outdated banking information.

Residents should expect standard U.S. Postal Service delivery times. Those who have moved may experience delays if their address was not updated in their most recent tax return.

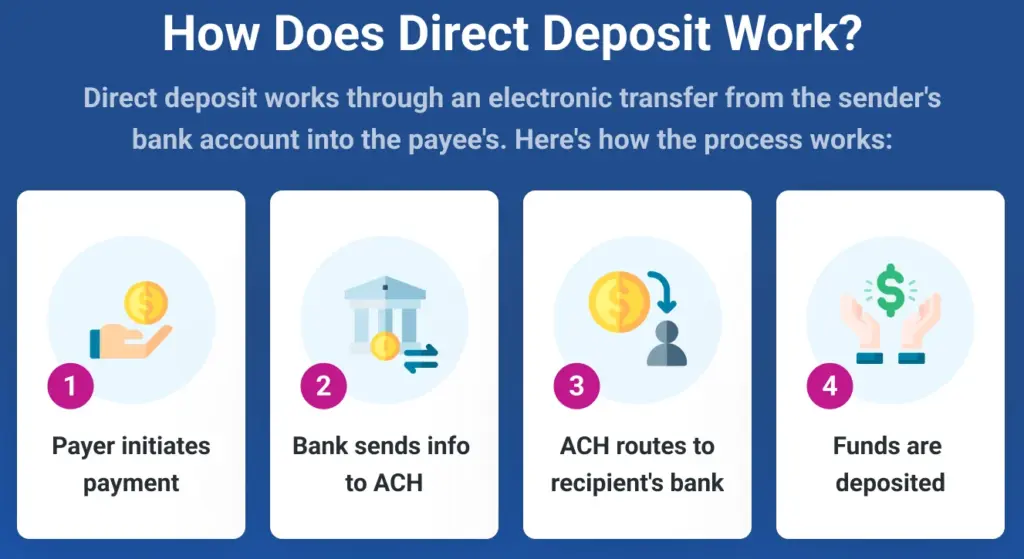

Why Direct Deposit Was Not Used

State officials say direct deposit was considered but ultimately dismissed because:

- A large number of taxpayers change banks annually

- Returned electronic deposits create processing delays

- Paper checks give residents a physical record of the payment

- Fraud attempts using stolen banking information have risen nationwide

Karen Liu, a payments systems specialist at the National Association of State Treasurers, said New York’s approach “reflects a broader trend among states seeking tighter controls over relief funds.”

Budget Impact and Political Debate

The $400 Inflation Relief Payments program is funded through a designated allocation in the $233 billion 2025–2026 state budget. The initiative is expected to cost approximately $2.4 billion, according to budget estimates released by the New York State Division of the Budget.

During legislative negotiations, some lawmakers questioned whether one-time checks were the most effective use of funds. Supporters argued that immediate relief was necessary, especially for renters and families with stagnant wages.

Assemblymember Richard Halloran, who backed the program, said during floor debate that “New Yorkers need real help paying for groceries and commuting, not theoretical long-term proposals.” Opponents countered that recurring tax credits or housing subsidies might deliver more lasting benefits.

Inflation and Cost-of-Living Pressures in New York

According to the U.S. Bureau of Labor Statistics, the Northeast region continues to experience higher inflation in key categories than the national average. The state’s own analysis found:

- Housing costs up 5.7% year-over-year

- Food prices up 4.1%

- Transportation costs up 6.3%

- Childcare costs among the highest in the country

Mark Dalton, analyst at the Rockefeller Institute of Government, said the payments “offer temporary breathing room but do not address long-term cost drivers like housing supply constraints.” However, he noted that households struggling with utilities or childcare may find the relief meaningful.

Resident Perspectives: How Households Are Using the Funds

Several residents shared how they plan to use the relief payments.

Maria Torres, a childcare worker in Rochester, said the check would help cover rising heating costs heading into winter. “Every dollar counts right now,” she said.

In Brooklyn, Tyrone Bennett, a delivery driver, said he intended to put the money toward groceries and transportation. “Gas and food have gone up so much that even $400 barely makes a dent, but it still helps,” he said.

These examples highlight how the payments provide short-term support for households facing persistent financial strain.

How Residents Can Check Their $400 Inflation Relief Payments Status

New York does not provide an online tracker for the Check If Your Deposit Has Been Sent process. However, the state advises residents to:

- Confirm the address listed on their 2023 tax return

- Wait until the end of November before requesting a replacement

- Contact the Department of Taxation and Finance only after the distribution window closes

State officials emphasized that the mailed checks may arrive at different times depending on postal volumes and regional processing speeds.

Lost Checks, Taxability, and Non-Filer Guidance

If a check is lost, residents may request a reissue after November. The state requires identity verification to complete the process.

Regarding taxes, the payment is not considered taxable income at the state level. Federal tax treatment will depend on Internal Revenue Service guidance, though most state tax rebates in recent years have been classified as non-taxable.

Low-income residents who did not file a 2023 return may still qualify if they meet specific requirements. The state encourages non-filers to contact its helpline for eligibility assessments.

Fraud Warnings and Consumer Protection

New York officials warn residents to be cautious about unsolicited calls or emails claiming to expedite payments. The state does not contact residents to verify bank information, Social Security numbers, or personal details.

Attorney General Letitia James advised residents to report suspicious activity. “Scammers frequently target relief programs, and New Yorkers should remain vigilant,” she said.

IRS Announces 2026 Tax Changes — New Brackets and Bigger Deductions for Millions

Comparisons to Other States

A few other states have issued similar one-time inflation relief payments, including:

- New Jersey’s ANCHOR property tax rebate program

- California’s Middle Class Tax Refund program (2022)

- Maine’s energy relief payments

New York’s program is among the largest in scale due to its population and high cost of living.

Looking Ahead

State leaders have not committed to making the $400 Inflation Relief Payments an annual program. However, lawmakers say future relief efforts may depend on revenue projections, inflation trends, and budget performance.