New York State has started issuing $400 Inflation Refund Checks to eligible taxpayers across the state, with payments expected to continue through November 2025. The initiative, part of the state’s latest fiscal budget, is aimed at easing inflation-related burdens on working and middle-income households. Officials say the program will reach more than eight million residents automatically — without the need for an application — and is one of the most significant state-level relief efforts introduced this year.

$400 Inflation Refund Checks

| Key Fact | Detail / Amount |

|---|---|

| Maximum Payment | Up to $400 per household |

| Eligibility | Full-year residents who filed 2023 income tax returns |

| Distribution Period | Late September – November 2025 |

| Application Requirement | None – payments are automatic |

| Estimated Recipients | 8 million New Yorkers |

| Funding Source | 2025–2026 State Budget Surplus |

| Official Website | NYS Department of Taxation and Finance |

A Direct Response to Rising Living Costs

The $400 Inflation Refund Checks represent a targeted relief measure introduced by Governor Kathy Hochul’s administration in response to persistent inflation that has outpaced wage growth for much of the state’s workforce.

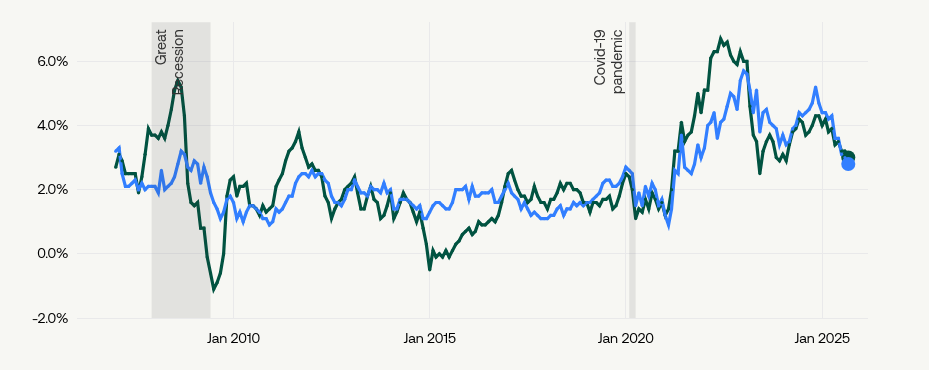

According to the U.S. Bureau of Labor Statistics (BLS), the New York–New Jersey region’s consumer price index rose 3.4 percent in 2024 — a decline from the 2022 high of nearly 7 percent but still significantly above pre-pandemic levels.

Governor Hochul said the measure “acknowledges that even as inflation cools on paper, working families continue to feel real pain at the grocery store, gas pump, and pharmacy.”

Eligibility and Payment Structure

Eligibility for the payments is based on 2023 state income tax filings. To qualify, taxpayers must be full-year New York residents who filed Form IT-201, and they cannot have been claimed as dependents on another return. The refund amount varies by filing status and income level:

| Filing Status | Adjusted Gross Income (2023) | Payment Amount |

|---|---|---|

| Married filing jointly | ≤ $150,000 | $400 |

| Married filing jointly | $150,001–$300,000 | $300 |

| Single or head of household | ≤ $75,000 | $200 |

| Single or head of household | $75,001–$150,000 | $150 |

According to the New York State Department of Taxation and Finance, no action is required for eligible residents. Checks are automatically mailed to the most recent address on file, typically the one provided on a taxpayer’s 2023 return.

The Department expects most checks to arrive by late November 2025.

How to Verify Eligibility and Track Your Refund

To check whether you qualify or track a delayed payment, taxpayers can visit the state’s Inflation Refund Check Portal and log in using their NY.gov credentials.

Residents who have not received payment by December 1, 2025, should:

- Confirm that they filed a 2023 resident return (Form IT-201).

- Verify their mailing address is current with the tax department.

- Report missing or stolen checks by submitting Form DTF-32 or Form DTF-36.

How New York’s Program Compares to Other States

New York joins a growing number of U.S. states implementing one-time inflation relief checks or tax rebates as a response to lingering cost-of-living pressures.

According to the Pew Charitable Trusts, at least 15 states distributed similar payments between 2022 and 2025, including California, Maine, and Minnesota.

California’s “Middle-Class Tax Refund” sent up to $1,050 per household in 2023, while Maine issued $450 checks in early 2024. However, New York’s program is narrower in scope, targeting middle-income residents rather than the entire tax base.

“This is a fiscal policy middle path,” said Dr. Anya Sharma, senior fellow at the Brookings Institution. “It offers tangible support to households without introducing significant budgetary strain or inflationary effects.”

The Broader Economic Context

Economists say the refund checks highlight a tension between state-level fiscal relief and national monetary policy.

While the Federal Reserve continues to maintain a cautious stance on interest rate reductions, state governments are increasingly using budget surpluses to cushion residents from price instability.

“Inflation has become more localized in its effects,” explained Dr. Elaine Wu, professor of economics at Columbia University. “Rent, childcare, and transportation costs vary dramatically across regions. State governments are filling a gap that federal programs can’t always address.”

According to the Federal Reserve Bank of New York, median household savings have fallen nearly 15 percent since 2022, largely due to rising costs in housing, insurance, and food. The Inflation Refund program is therefore seen as a stopgap measure to relieve short-term financial stress.

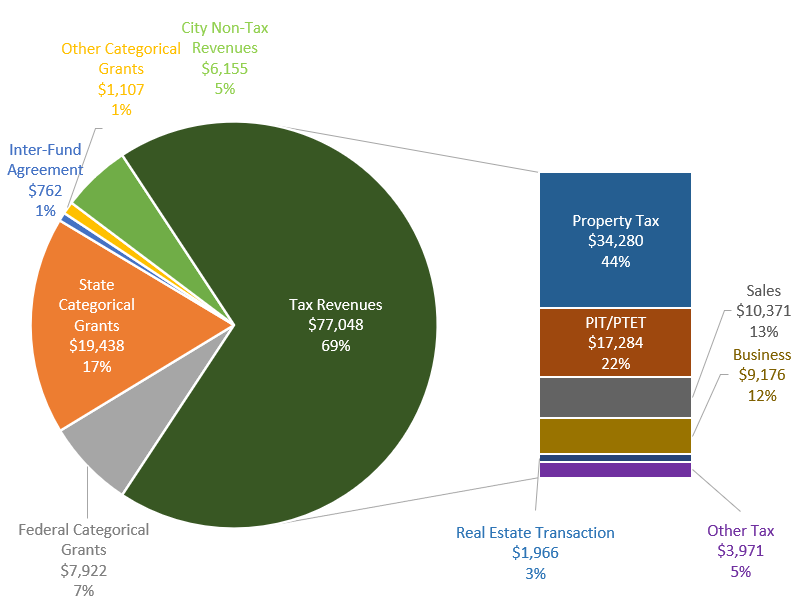

Funding and Budget Impact

The refund initiative is financed through a budget surplus resulting from stronger-than-expected tax revenues and unspent federal pandemic aid.

The New York Division of the Budget estimates the total cost of the program at roughly $1.9 billion.

Budget officials argue the one-time nature of the refund minimizes long-term fiscal risk. “We wanted to return some of the surplus directly to taxpayers, rather than expanding recurring expenditures,” said Robert Mujica, Director of the Division of the Budget.

Independent fiscal analysts have largely endorsed that view. The Citizens Budget Commission called the initiative “a prudent use of temporary revenue gains,” but cautioned that “permanent tax relief should be approached with care until revenue patterns stabilize.”

Challenges: Check Delivery and Fraud Concerns

The state’s reliance on paper checks, rather than direct deposits, has generated some logistical issues.

Banks including JPMorgan Chase and several local credit unions temporarily limited mobile deposits of the refund checks due to security concerns, according to The Sun.

The Department of Taxation and Finance has reassured residents that all legitimate checks bear the official state watermark and are printed by the state’s fiscal agent.

Officials also warn of fraudulent text messages and emails mimicking state communications. The department emphasized it will never request personal information, bank details, or fees to process payments.

“Scammers are using the language of inflation relief to exploit people,” said James Gazzale, department spokesperson. “The only legitimate updates come directly from tax.ny.gov.”

Human Impact: How New Yorkers Are Using the Relief

While modest in amount, the refund checks are already proving meaningful for many households.

For Maria Hernandez, a school administrator from Rochester, the check helped cover rising heating bills ahead of winter.

“It’s not a huge amount, but every bit helps right now,” she said. “Groceries are still expensive, and utilities keep going up.”

In Brooklyn, small business owner Alex Grant said the refund offset part of his quarterly tax payment. “It’s not transformative, but it’s appreciated — and it shows the state is at least acknowledging how tight things are,” he said.

A Siena College Research Institute poll conducted in October 2025 found that 63 percent of New Yorkers viewed the program favorably, though only 28 percent said it would have a “significant” impact on their finances.

The Policy Debate: Relief vs. Reform

Not all experts view one-time refunds as a sustainable solution.

Critics argue that while direct payments offer temporary relief, they do little to address structural cost drivers such as housing shortages, medical costs, and childcare expenses.

“The checks are politically popular but economically limited,” said Dr. William Torres, senior economist at the New York Fiscal Policy Institute. “Without longer-term reforms, households will be right back where they started once the money runs out.”

Supporters, however, maintain that the refunds strike a necessary balance between fiscal discipline and public assistance. “This is about timing and trust,” said Assemblymember Linda Rosenthal (D–Manhattan). “People need help now, not in the next budget cycle.”

Looking Ahead

State officials expect all checks to be issued by November 30, 2025, with replacement requests accepted through mid-2026.

While the refund program will not be repeated annually, the Governor’s Office has hinted that future budgets may include targeted credits or rebates tied to inflation trends.

Economists predict that the refunds will have a modest but measurable effect on short-term consumer spending during the holiday season.

“The macroeconomic impact is small, but the psychological boost is real,” said Dr. Wu. “For many families, it’s a reminder that their government is paying attention to everyday economic pain.”

FAQ

1. Do I need to apply for the $400 Inflation Refund Check?

No. Eligible residents will receive their checks automatically based on 2023 state tax filings.

2. How will I receive my payment?

Payments are mailed as paper checks to the address on your 2023 tax return. Direct deposit is not available for this program.

3. What if I moved recently?

Update your address with the New York State Department of Taxation and Finance immediately using their online services or by calling the taxpayer helpline.

4. Can part-year residents or dependents receive the refund?

No. Only full-year residents who are not dependents qualify for the payment.

5. What should I do if my check is lost or stolen?

File Form DTF-32 (Lost Check Affidavit) or Form DTF-36 (Replacement Request) on the department’s website.

6. Is the refund taxable?

No. The payment is considered a non-taxable state rebate and does not need to be reported as income on your federal return, according to the Internal Revenue Service (IRS).