As policymakers finalize inflation adjustments and debate expiring provisions, the 2026 tax season is shaping up to bring meaningful changes for millions of U.S. taxpayers. Higher deductions, revised tax credits, and updated Internal Revenue Service rules could affect refund sizes when Americans file their 2025 returns early next year.

These developments arrive as households continue to navigate elevated living costs, shifting labor markets, and increased scrutiny of federal tax administration.

2026 Tax Season

| Key Fact | Detail |

|---|---|

| Filing period | Returns for tax year 2025 filed in early 2026 |

| Inflation adjustments | Standard deduction and brackets rise annually |

| Policy uncertainty | Several provisions depend on congressional action |

As inflation data and legislative negotiations continue, the full shape of the 2026 tax season will come into focus later this year. For now, taxpayers are advised to stay informed and prepare for incremental—but meaningful—changes to how refunds are calculated.

What Is Driving Changes in the 2026 Tax Season

Most shifts expected in the 2026 tax season stem from inflation indexing, a routine process required under federal law. The Internal Revenue Service adjusts tax brackets, the standard deduction, and certain credits each year to prevent “bracket creep,” where inflation pushes taxpayers into higher tax rates without real income gains.

According to IRS guidance, final figures will be announced in late 2025, but early estimates suggest modest increases across income thresholds.

Inflation adjustments have taken on added significance in recent years, as price growth following the COVID-19 pandemic altered household budgets and wage dynamics. While inflation has slowed from its 2022 peak, it remains high enough to trigger notable tax parameter changes.

At the same time, Congress faces deadlines on several temporary provisions enacted under earlier tax legislation. Whether lawmakers extend, revise, or allow those measures to expire remains unresolved, creating uncertainty for taxpayers and tax professionals alike.

“Taxpayers should expect change, but also uncertainty,” said Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center. “The exact impact will depend on both inflation data and political decisions made in Washington.”

Historical Context: How 2026 Tax Season Compares

Historically, tax seasons following periods of elevated inflation tend to produce larger nominal refunds, largely because withholding tables often lag real-time economic changes. During the late 1970s and early 1980s, for example, inflation-driven bracket adjustments frequently altered refund patterns.

More recently, the tax seasons between 2022 and 2024 saw refund volatility tied to the expiration of pandemic-era credits and stimulus-related provisions. The 2026 tax season differs in that changes are incremental rather than abrupt, but their cumulative effect may still be meaningful.

Tax analysts note that even small adjustments can have outsized effects when applied across millions of returns.

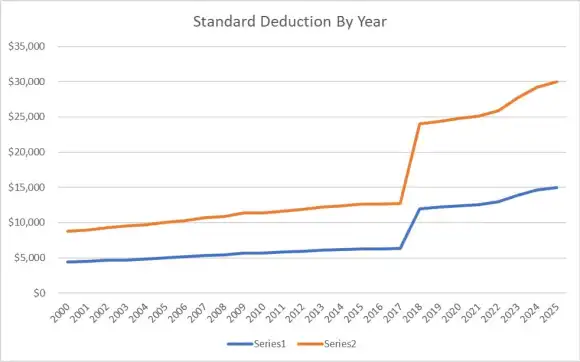

Changes to the Standard Deduction

Higher Baseline Deductions Expected

The standard deduction—claimed by nearly 90 percent of filers—will rise again in the 2026 tax season due to inflation adjustments.

While official numbers are pending, analysts expect increases similar to recent years. That would reduce taxable income for most households, often resulting in lower overall tax liability.

Tax experts caution, however, that a higher deduction does not automatically translate into a larger refund. Refund size depends heavily on withholding levels and refundable credits.

For middle-income taxpayers, a higher standard deduction often simplifies filing by reducing the incentive to itemize, particularly as mortgage interest deductions decline over time for newer homeowners.

Tax Credits That May Affect Refunds in 2026 Tax Season

Child and Earned Income Credits

Several tax credits, including the Child Tax Credit and Earned Income Tax Credit, are also indexed to inflation. That means eligible families may qualify for slightly higher credit amounts in the 2026 tax season.

According to the Congressional Research Service, refundable credits remain one of the strongest drivers of refunds for lower- and middle-income households.

“Credits matter more than deductions for refund outcomes,” said Elaine Maag, a principal research associate at the Urban Institute. “They directly reduce tax owed and, in many cases, generate refunds even when no tax is due.”

Any structural changes to these credits would require congressional action, which remains under debate.

Education and Energy-Related Credits

Education credits, such as those for qualified tuition expenses, are not automatically indexed to inflation. However, eligibility thresholds may shift indirectly as income limits change.

Meanwhile, some clean-energy incentives enacted earlier in the decade are scheduled to phase down. Taxpayers investing in home efficiency upgrades may need to act before certain credits diminish or expire.

IRS Administration and Filing Changes

Increased Enforcement, Expanded Digital Services

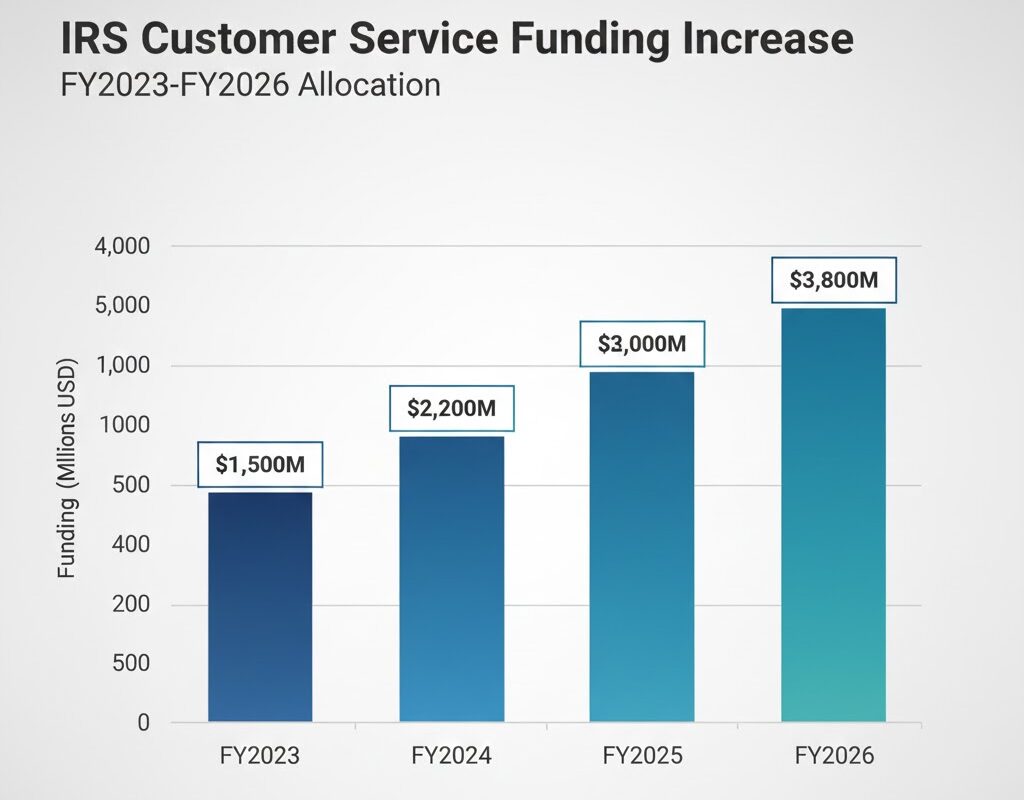

The Internal Revenue Service (IRS) is continuing a multi-year modernization effort funded by Congress, focusing on improved customer service and enforcement.

For the 2026 tax season, the agency plans to expand digital tools, including online account access and expanded pilot programs for direct electronic filing.

The IRS has stated that audit rates for households earning under $400,000 are not expected to increase, consistent with Treasury Department policy.

Officials say technology upgrades are intended to reduce filing errors, accelerate refunds, and improve transparency for taxpayers tracking their returns.

Enforcement and Compliance Considerations

While audit rates remain historically low, compliance remains a priority area. The IRS has emphasized enhanced scrutiny of complex returns, including those involving pass-through businesses and digital asset transactions.

Tax professionals advise taxpayers to retain documentation for income, deductions, and credits, particularly as information reporting requirements expand.

According to IRS officials, improved data matching tools are expected to identify discrepancies earlier in the filing process, potentially reducing post-filing correspondence.

What Remains Uncertain

Several tax provisions affecting the 2026 tax season depend on legislative outcomes, including the future of deductions and credits enacted on a temporary basis earlier in the decade.

The Congressional Budget Office has warned that failure to resolve these issues could lead to abrupt tax changes in later years, complicating long-term household planning.

Political analysts note that tax policy discussions may intensify as broader budget negotiations unfold, making last-minute changes possible.

What Taxpayers Can Do Now

Financial advisers recommend reviewing withholding levels and monitoring IRS announcements later this year. Early preparation can reduce surprises and help households adjust cash flow before filing season begins.

“The best defense against confusion is information,” said Nina Olson, former National Taxpayer Advocate. “Pay attention to IRS updates and seek professional advice if your situation is complex.”

Taxpayers experiencing life changes—such as marriage, childbirth, job transitions, or retirement—are especially encouraged to reassess withholding and estimated payments.

Planning to Retire in 2026? How to Estimate What Your Social Security Check Will Really Be

Case Examples: How Different Taxpayers May Be Affected

For a single worker earning a moderate income, a higher standard deduction may reduce taxable income enough to slightly increase a refund, assuming withholding remains unchanged.

A family with children may see a more noticeable effect if inflation-adjusted credits rise and income stays within eligibility limits.

By contrast, higher-income households may see little change in refunds but benefit from simplified filing if they continue to take the standard deduction.

FAQs About 2026 Tax Season

When does the 2026 tax season begin?

The IRS typically opens filing in late January. The exact date will be announced in December 2025.

Will everyone get a larger refund?

No. Refunds depend on income, withholding, credits, and filing status. Higher deductions do not guarantee larger refunds.

Where can taxpayers find official updates?

The IRS publishes all official guidance at IRS.gov.

Should taxpayers adjust withholding now?

Experts say reviewing withholding can help avoid unexpected balances due or unusually large refunds.