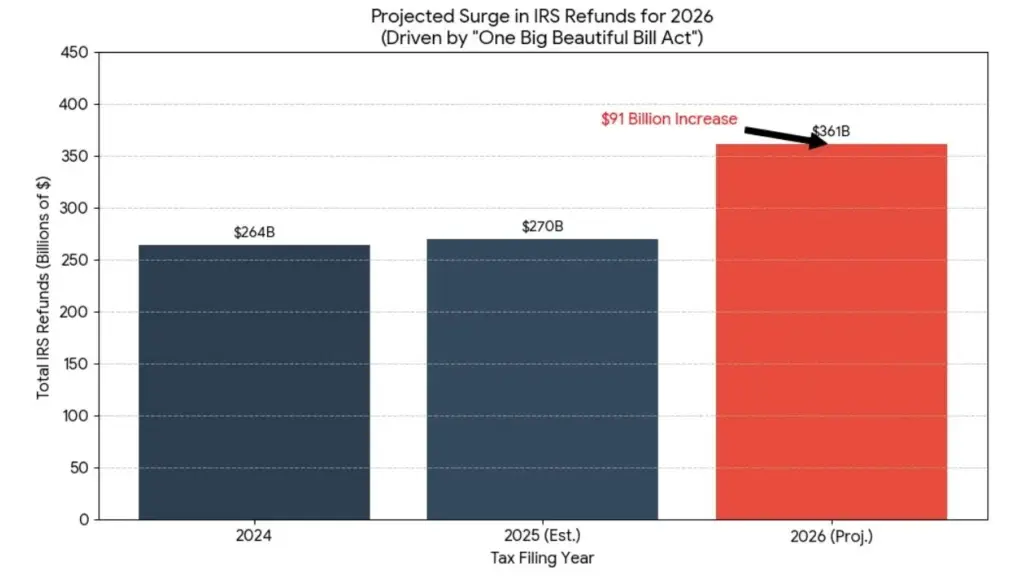

Millions of American taxpayers are projected to receive significantly larger federal payments during the 2026 tax refund season. This shift stems from a unique convergence of retroactive tax legislation, aggressive inflation adjustments, and a strategic decision by the Internal Revenue Service (IRS) regarding payroll withholding tables. Financial analysts and government officials indicate that the One Big Beautiful Bill Act (OBBBA), signed into law in mid-2025, has created a scenario where many households effectively overpaid their taxes throughout the 2025 calendar year.

2026 Tax Refund Outlook

| Key Factor | Impact on Taxpayer | Financial Projection |

| OBBBA Legislation | Retroactive cuts for 2025 reduce total tax liability. | Average refund could rise by $1,000. |

| Withholding Gap | Employers used old tax tables, leading to overpayment. | Total refund pool to grow by $91 billion. |

| Standard Deduction | Increases shield more income from federal taxation. | $15,750 (Single) / $31,500 (Joint). |

The IRS has emphasized that while the refund pool is growing, taxpayers should remain vigilant against identity theft and refund fraud, which often increase during high-volume seasons. As the 2026 filing deadline of April 15 approaches, the influx of capital—estimated by J.P. Morgan Asset Management to act as a “stimulus-like” event—is expected to provide a significant boost to consumer spending in the first half of the year.

The “Withholding Gap”: The Primary Driver for Growth

The most significant technical reason for the expected surge in 2026 tax refund amounts is a discrepancy in how taxes were collected throughout 2025. Because the OBBBA was finalized in July 2025 but applied retroactively to the beginning of the year, most employers continued to withhold taxes based on the higher 2024 rates for the majority of the year.

The IRS elected not to issue mid-year withholding adjustments for 2025, a move that ensured stable take-home pay but resulted in massive over-collection. According to analysis from Piper Sandler, this “withholding gap” means the federal government has collected billions of dollars more than taxpayers actually owe under the new law. When taxpayers file their returns in early 2026, the IRS must reconcile these overpayments, which experts suggest could boost the average refund check to approximately $4,151 per filer—a 30% increase over the previous year.

Substantial Increases to the Standard Deduction

In addition to the legislative changes, the IRS implemented significant inflation adjustments to protect taxpayers from “bracket creep.” For the 2025 tax year (the returns filed in 2026), the standard deduction rose considerably.

For single filers, the deduction increased to $15,750, while married couples filing jointly saw their deduction rise to $31,500. These adjustments, combined with the OBBBA making the 2017 tax rate reductions permanent, shield a larger portion of household income from the 10%, 12%, and 22% tax brackets. This creates a “quiet” increase in the refund for middle-class families who do not itemize their deductions.

Targeted Relief: No Tax on Tips and Overtime

A cornerstone of the 2025 legislative reforms is the introduction of exemptions for specific types of labor income. Under the new rules, certain income streams that were previously fully taxable now qualify for significant exclusions, though they were still subject to standard withholding throughout 2025.

Exemptions for Service and Hourly Workers

- No Tax on Tips: Service industry workers can now exclude tip income from their federal taxable income calculation.

- Overtime Pay Exemption: Certain hourly workers may exclude overtime earnings from federal taxation, rewarding increased productivity without pushing them into higher tax brackets.

- Impact: Since these earnings were withheld at standard rates for most of 2025, eligible workers will see these “saved” taxes returned as part of their 2026 refund check.

Enhanced Credits for Families and Seniors

The Child Tax Credit (CTC) was bolstered to $2,200 and indexed to inflation for the 2025 tax year. Furthermore, the OBBBA introduced a new $6,000 deduction for individuals aged 65 and older. Because these credits and deductions were applied to the 2025 tax year after many families had already planned their finances, the resulting surplus will manifest during the spring 2026 filing window.

The SALT Cap Expansion

For homeowners in high-tax states, the State and Local Tax (SALT) deduction cap was raised from $10,000 to $40,000. This adjustment allows millions of additional taxpayers to benefit from itemizing rather than taking the standard deduction. While this primarily benefits middle- and upper-middle-income households, the expansion is subject to a phase-out for those earning more than $500,000, ensuring the largest benefits are concentrated among families earning between $60,000 and $400,000 annually.

Social Security Confirms 2.8% COLA for 2026 — How It Affects a $1,800 Monthly Benefit

FAQs About 2026 Tax Refund Outlook

1. When can I expect to receive my 2026 tax refund?

The IRS generally begins processing 2025 tax returns in late January 2026. Most taxpayers who file electronically and choose direct deposit receive their refunds within 21 days. However, those claiming the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) may see delays until mid-February due to federal anti-fraud laws.

2. Why didn’t I see this extra money in my paycheck during 2025?

The IRS decided not to update the employer withholding tables mid-year following the passage of the OBBBA. This means your employer took out taxes based on older, higher rates. The “extra” money was essentially held by the government and will be returned to you when you file your return.

3. Does everyone qualify for a larger refund?

While the average refund is expected to rise, individual results vary. Households earning between $60,000 and $400,000 are projected to see the most significant increases. Those who adjusted their W-4 forms in late 2025 to reduce their withholding may have already received their “refund” in the form of larger paychecks.

4. How does the “No Tax on Tips” rule affect my refund?

If you are a tipped employee, your employer likely withheld federal taxes on your reported tips throughout 2025. Because the OBBBA retroactively made those tips non-taxable for 2025, those withheld funds will be fully refunded to you when you file your 2026 return.

5. Are there any new forms I need to fill out?

The IRS is updating the standard Form 1040 to include new lines for the senior deduction, overtime exemptions, and tip income exclusions. Most major tax software providers will automatically update their platforms to account for these changes.