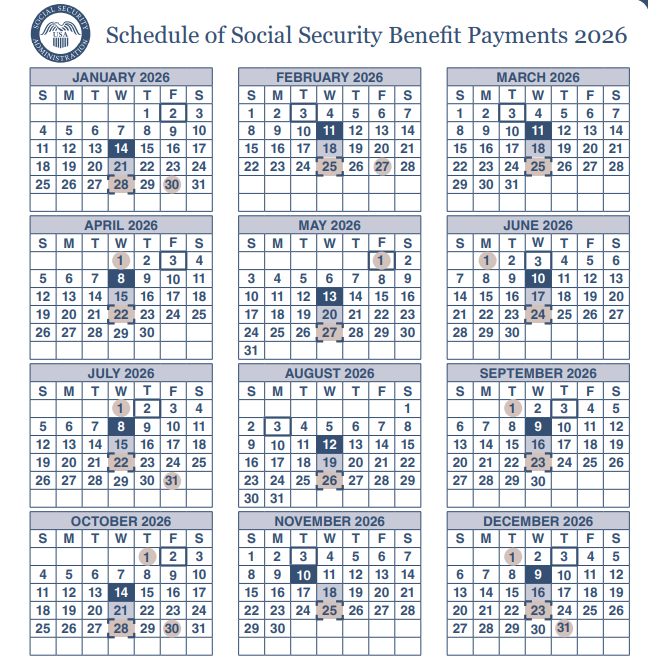

The Social Security Administration (SSA) has released the official Social Security Payment Schedule 2026, confirming monthly benefit dates for more than 70 million Americans. Most retirement benefits will continue to be issued on the second, third, or fourth Wednesday of each month, depending on the beneficiary’s birthdate. The system, designed to ease administrative pressure and ensure predictable timing, will remain unchanged from previous years.

2026 Social Security Pay Dates

| Key Fact | Detail |

|---|---|

| Basis of 2026 payment dates | Payments issued on 2nd–4th Wednesdays based on birthdate groups |

| January 2026 examples | 1–10: Jan. 14, 11–20: Jan. 21, 21–31: Jan. 28 |

| Beneficiary exceptions | Pre–May 1997 filers and dual Social Security/SSI recipients follow different dates |

| 2026 COLA increase | 2.8% cost-of-living adjustment for most beneficiaries |

| Official Website | Social Security Administration |

The release of the Social Security Payment Schedule 2026 gives retirees a clear framework for planning their year. While the dates themselves remain consistent with past schedules, the broader financial environment—including inflation trends and Social Security’s long-term funding debate—continues to shape the experience of beneficiaries. For now, the schedule offers reliable monthly support as millions prepare for the year ahead.

Understanding the Social Security Payment Schedule 2026

The Social Security Payment Schedule 2026 maintains the staggered format introduced in 1997. According to the SSA, tying payment dates to birthdate ranges helps the agency spread its workload throughout the month, improving processing accuracy and reducing delays.

How the Birthdate Rule Works

The 2026 schedule follows these rules:

- Birthdates 1–10: Second Wednesday of every month

- Birthdates 11–20: Third Wednesday

- Birthdates 21–31: Fourth Wednesday

This means most beneficiaries will receive 12 scheduled payments throughout the year, with rare adjustments for holidays and weekends.

Why It Matters

For millions of retirees, timing is critical. Many rely on these payments for rent, groceries, medications, and other essential expenses. Predictable deposit dates allow beneficiaries to plan budgets, avoid overdraft fees, and maintain financial stability.

January 2026 Payment Dates: What Retirees Can Expect

The first payments of 2026 will follow the model:

- January 14: Beneficiaries born 1–10

- January 21: Birthdates 11–20

- January 28: Birthdates 21–31

This pattern continues steadily throughout the year.

Exceptions to the Standard 2026 Schedule

While most recipients follow a Wednesday schedule, the SSA maintains two major exceptions.

1. Beneficiaries Who Filed Before May 1997

Individuals who began receiving benefits before May 1997 will continue to receive payments on the third day of every month.

If the third day falls on a weekend or holiday, the benefit is deposited on the prior business day.

2. Recipients of Both Social Security and SSI

Dual beneficiaries follow a hybrid schedule:

- SSI: Paid on the 1st of each month

- Social Security: Typically paid on the 3rd of the month

If either date hits a weekend or federal holiday, payments shift to the preceding business day.

Historical Context: How Today’s Schedule Came to Be

The SSA adopted staggered payments in 1997. Before that, nearly all beneficiaries were paid on the same day: the third of the month. According to one retired SSA administrator, the older system “struggled to handle enormous single-day volume,” prompting Congress to approve a more efficient and predictable method.

Dr. Elaine Markham, a professor of public policy at Georgetown University, explains:

“The staggered payment schedule helped the agency distribute its workload and reduced deposit delays at financial institutions. It also made the system more manageable at a time when the retiree population was expanding rapidly.”

Budgeting, Inflation, and the COLA Effect

A major factor influencing the 2026 benefit experience is the cost-of-living adjustment (COLA). The SSA confirmed a 2.8% increase to support beneficiaries amid rising consumer prices.

Economist James Hollenbeck of the Brookings Institution notes:

“While a 2.8% COLA is moderate compared to the post-pandemic spikes, it still provides meaningful support for older Americans facing increased housing and healthcare costs.”

The average retirement check in 2026 is expected to rise by roughly $52 per month, depending on the beneficiary’s earnings history.

How the Payment Schedule Affects Retirees’ Financial Stability

The timing of Social Security payments plays a key role in household stability for many older adults. According to the National Council on Aging, nearly 40% of retirees rely on Social Security for at least half of their income.

Monthly Cash Flow Management

Financial planners often advise beneficiaries to:

- Align rent or mortgage payments with expected deposit dates

- Schedule automatic withdrawals after the payment date to avoid overdrafts

- Keep at least one month of expenses in reserve to bridge timing gaps

Avoiding Scams and Delays

The SSA recommends using direct deposit through a bank account or Direct Express debit card to reduce fraud risk. Paper checks, though still available in limited cases, pose higher exposure to theft and postal delays.

Inside the 2026 Calendar: Month-by-Month Overview

Below is an example of how the 2026 payment schedule aligns in a typical month:

| Birthdate Range | Payment Day | Example Month |

|---|---|---|

| 1–10 | Second Wednesday | March 11, 2026 |

| 11–20 | Third Wednesday | March 18, 2026 |

| 21–31 | Fourth Wednesday | March 25, 2026 |

Comparing 2025 and 2026 Schedules

Although the structure remains the same, slight differences in weekdays and holiday placements mean payment dates shift year to year.

Notable comparisons:

- In 2025, the second Wednesday in January fell on the 8th; in 2026, it falls on the 14th.

- Federal holidays, such as New Year’s Day or Independence Day, occasionally shift SSI payments.

- No significant disruption is expected in 2026.

Long-Term Outlook: Program Sustainability and Policy Debates

The Social Security system faces long-term funding pressures as aging demographics reshape the nation’s workforce-to-beneficiary ratio. The Social Security Trustees report indicates that the Old-Age and Survivors Insurance (OASI) trust fund could face depletion in the 2030s without congressional action.

Policy proposals include:

- Increasing the payroll tax cap

- Adjusting the full retirement age

- Modifying benefit formulas for high earners

Despite the debate, experts stress that benefits will not disappear. Dr. Marcus DeLeon, a senior analyst with the Center for Retirement Research at Boston College, notes:

“Even if the trust fund were exhausted, ongoing payroll taxes would still cover the majority of scheduled benefits. But Congress will need to act to preserve full payouts.”

How Beneficiaries Can Prepare for 2026

1. Set Up a My Social Security Account

This online system allows users to review payment history, benefit amounts, and personal information.

2. Confirm Banking Details

Outdated bank accounts or routing errors are leading causes of delays.

3. Review Monthly Budget Needs

Housing, healthcare, and grocery costs typically rise year over year.

4. Watch for SSA Notices

The agency occasionally issues reminders or updates, especially when holidays affect payments.

Social Security Reversal: Government Quietly Walks Back ‘Final’ Deadline on Paper Checks

FAQ About 2026 Social Security Pay Dates

When will my first Social Security payment arrive in 2026?

Your January payment will arrive on Jan. 14, 21, or 28, based on your birthdate group.

Does the Social Security Payment Schedule 2026 affect my benefit amount?

No. Payment dates do not influence monthly benefit amounts.

Will weekends or holidays change my payment timing?

Yes. If a scheduled date lands on a holiday or weekend, your payment is issued the prior business day.

What if my payment is late?

The SSA recommends waiting three business days before contacting them.