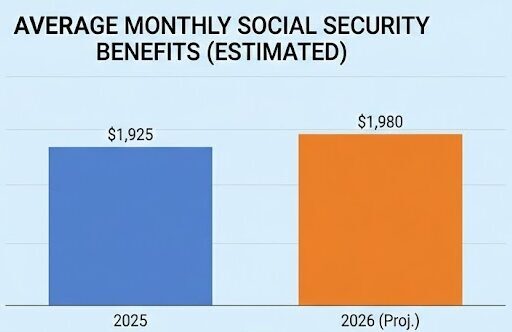

The federal government will implement a 2026 Social Security increase that raises monthly benefits by 2.8%, adding approximately $56 per month for the average retired worker. The adjustment takes effect in January 2026 and applies to retirees, people with disabilities, survivors, and recipients of Supplemental Security Income (SSI).

The increase is automatic and reflects changes in consumer prices measured over the previous year. Roughly 75 million Americans receive Social Security or SSI benefits, making the annual adjustment one of the most consequential income changes for older households in the United States.

For many recipients, Social Security provides the backbone of monthly income. Government data consistently show that a significant share of retirees rely on the program for at least half of their income, while a smaller but notable group depends on it for nearly all of their financial support.

2026 Social Security Increase

| Key Fact | Detail |

|---|---|

| COLA rate | 2.8% |

| Average monthly increase | ~$56 |

| Effective date | January 2026 |

| Beneficiaries affected | ~75 million |

| SSI payment timing | December 31, 2025 |

How the Social Security Increase Is Calculated

The annual cost-of-living adjustment, commonly known as COLA, is calculated using a federal inflation index that tracks price changes for urban wage earners and clerical workers. When prices rise, benefits increase proportionally. When prices remain flat or decline, benefits do not increase.

The formula was established to prevent erosion of purchasing power over time. Once inflation data for the relevant period are finalized, the adjustment is locked in. Congress does not vote on the annual increase, and beneficiaries do not need to apply.

Supporters of the system say its automatic nature provides stability and predictability. Critics argue that the inflation index does not reflect how retirees actually spend money, particularly on healthcare and housing.

What a $56 Monthly Increase Means for the Average Retiree

For the average retired worker, monthly benefits were just over $2,000 in 2025. The 2026 Social Security increase raises that figure to roughly $2,060 before deductions such as Medicare premiums.

Over the course of a year, the increase amounts to about $670 in additional income. For households living on fixed budgets, that money may help offset rising grocery prices, utility bills, or transportation costs.

Other beneficiary groups also receive modest gains:

- Spousal beneficiaries see increases of roughly $25 to $30 per month.

- Survivor beneficiaries receive increases closer to $40 or $45.

- Disabled workers experience similar adjustments based on their base benefit.

Why the Increase May Feel Smaller Than Expected

Despite the headline number, many beneficiaries may not feel a full $56 increase in their bank accounts. One major reason is healthcare.

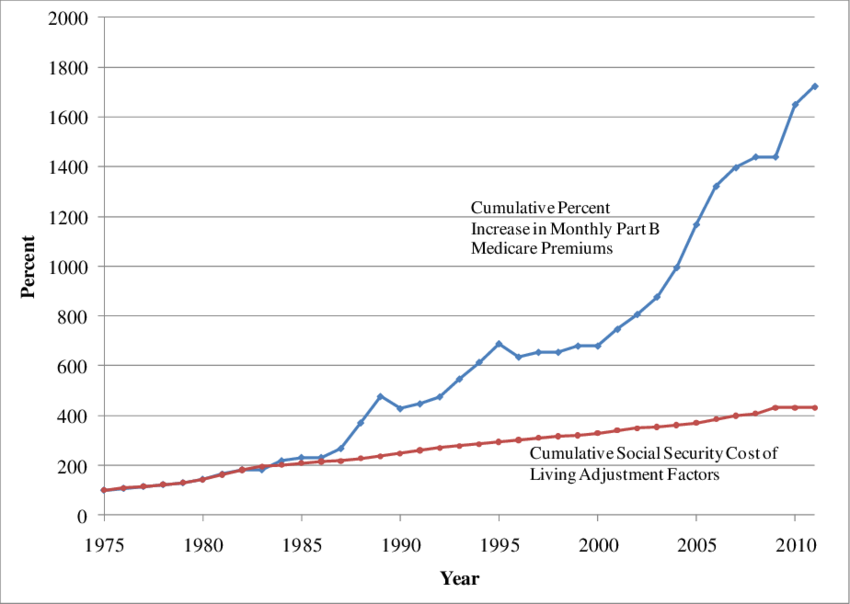

Most beneficiaries have Medicare Part B premiums deducted directly from their Social Security payments. When premiums rise, they reduce the net benefit increase. Even a modest premium hike can absorb a large portion of the COLA.

Housing costs present another challenge. Rent increases in many regions have consistently outpaced general inflation. Retirees who rent rather than own their homes outright are especially vulnerable to cost pressures that COLA adjustments may not fully cover.

The Inflation Measurement Debate

Economists have long debated whether the current inflation measure accurately reflects retiree spending patterns. Older households typically spend a larger share of their income on medical care, prescription drugs, and housing than younger workers.

Because the COLA formula emphasizes wage-earner spending patterns, critics say it understates real inflation faced by retirees. Alternative measures that weigh healthcare costs more heavily have been proposed, but no changes are currently scheduled.

Government officials counter that altering the formula could significantly increase long-term program costs, raising difficult fiscal questions.

Who Benefits Most — and Least — From the Increase

The impact of the 2026 Social Security increase varies widely depending on household circumstances.

Homeowners without mortgages often benefit more, as housing costs remain relatively stable.

Renters, particularly in urban areas, are more exposed to rising costs.

Women, who on average receive lower benefits due to earnings gaps and caregiving interruptions, may find the increase less sufficient.

Rural retirees may benefit slightly more due to lower average living costs, though access to healthcare can be more expensive.

For lower-income beneficiaries, even small increases can be meaningful. For higher-income retirees, the COLA represents a smaller share of total household income.

Historical Context: How 2026 Compares

The 2.8% increase for 2026 is larger than some recent adjustments but far below the unusually high increases seen during periods of elevated inflation earlier in the decade.

Historically, COLA increases have ranged from zero in years of very low inflation to well above 5% during periods of economic turbulence. The 2026 adjustment reflects a period of moderating but still persistent price pressures.

From a long-term perspective, the increase continues a gradual upward trend in nominal benefits, even as real purchasing power remains a concern.

Budgeting Behavior and Household Impact

Financial planners note that retirees often respond to modest COLA increases by reallocating spending rather than expanding it. Additional income may be directed toward healthcare, emergency savings, or debt reduction rather than discretionary purchases.

For households living close to the margin, the increase may reduce financial stress without significantly improving lifestyle. For others, it may simply help maintain the status quo.

Behavioral economists emphasize that predictability matters as much as size. Knowing that benefits will rise annually allows households to plan, even if the increase is modest.

Long-Term Outlook for Social Security

The 2026 Social Security increase arrives amid ongoing discussions about the program’s long-term financial health. Demographic changes, including longer life expectancies and lower birth rates, are placing pressure on the system.

Absent policy changes, future adjustments could involve higher payroll taxes, benefit formula changes, or other reforms. No such changes are included in the 2026 adjustment.

Officials stress that current beneficiaries will continue to receive scheduled payments, while lawmakers debate longer-term solutions.

Payment Timing and What Beneficiaries Should Expect

Most beneficiaries will receive their increased payment according to their normal monthly schedule in January 2026. Payment dates depend on birth date and benefit category.

Recipients of Supplemental Security Income will see the higher amount reflected in a payment issued at the end of December due to the New Year’s holiday.

Beneficiaries are encouraged to review their payment statements carefully to understand how deductions affect net amounts.

$4983 Direct Deposit in 2025? What’s Confirmed, Who Qualifies, and What to Expect

Looking Ahead

The 2026 Social Security increase provides incremental relief at a time when many retirees remain concerned about affordability and financial security. While the adjustment helps benefits keep pace with inflation, it does not fully resolve broader cost pressures facing older Americans.

Economists say future COLA adjustments will depend on inflation trends, healthcare costs, and policy decisions yet to be made. For now, the increase reinforces Social Security’s role as a stable, inflation-adjusted income source — modest in size, but vital in reach.

FAQs About 2026 Social Security Increase

Do beneficiaries need to apply for the increase?

No. The increase is automatic.

Does the increase apply to disability and survivor benefits?

Yes. All benefit categories receive the same percentage increase.

Will taxes apply to the increase?

Yes. The increase is treated as regular Social Security income and may be taxable depending on total household income.