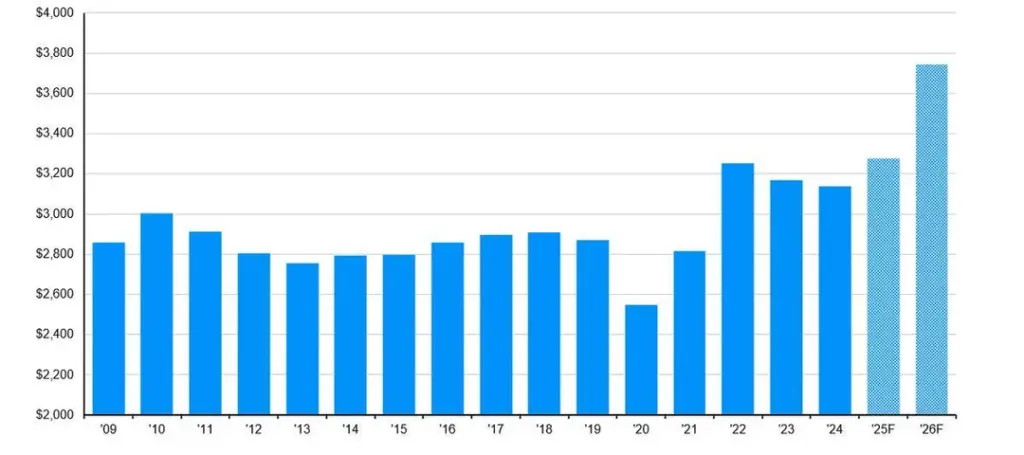

Millions of U.S. households may see larger refunds next year under the 2026 refund outlook, as new tax-code changes and delayed payroll adjustments combine to increase over-withholding across much of the workforce. Analysts estimate the average refund could rise by about $1,000 in early 2026. The projection follows major federal tax reforms passed in 2025 that continue to shift income calculations and withholding practices nationwide.

2026 Refund Outlook

| Key Fact | Detail / Statistic |

|---|---|

| Average projected refund increase | Roughly $1,000 in 2026 |

| Primary driver | Delayed employer adoption of updated IRS withholding tables |

| Groups most impacted | Middle-income workers; employees with tips or overtime |

| Timeline for normalization | Withholding systems may stabilize by mid-to-late 2026 |

Why Refunds Are Expected to Grow Under the 2026 Refund Outlook

Financial analysts say the unusually high refund projections stem from a combination of policy changes and administrative delays. The federal tax overhaul enacted in mid-2025 reshaped several deductions, credits, and income classifications. But employers and payroll software providers have taken longer than expected to update withholding tables.

A December 2025 analysis from Piper Sandler estimated that the average household may receive around $1,000 more than normal as a result of over-withholding. The firm said the mismatch appears “broad-based and most pronounced among workers whose employers rely on legacy payroll systems.”

During a late-2025 briefing, a U.S. Treasury spokesperson acknowledged the lag but emphasized that temporary inconsistencies were “anticipated and manageable,” noting that workers will see adjustments primarily through their refund amounts.

Economists say that while larger refunds may please many taxpayers, the underlying issue reflects a structural gap between rapid policy changes and slower administrative implementation.

Understanding the Tax Law Behind the Expected Increase

The 2025 federal tax overhaul introduced several revisions that alter how taxable income is calculated. These adjustments expanded certain deductions, raised income thresholds for tax brackets, and modified rules affecting tip income, overtime pay, and selected forms of interest.

According to the Joint Committee on Taxation, the law significantly reshapes liability calculations for workers earning between roughly $60,000 and $200,000 per year. Middle-income households—many of whom rely on standardized withholding—are expected to experience the largest year-over-year shifts.

Expanded Deductions and Eligibility Changes

Tax analysts note that the new law broadened eligibility for deductions that historically required itemization. Workers in service-oriented positions, especially those earning tips or variable overtime, may see the greatest changes in their withholding-to-liability balance. Because employers cannot adjust withholding for individualized deductions, workers in these categories often experience higher-than-necessary withholding until they file their returns.

Liquidity Effects on Households

Larger refunds can offer short-term budget relief, but economists warn they may mask higher effective withholding. Mark Mazur, former Assistant Secretary for Tax Policy at the U.S. Treasury, said the increase “does not reflect lower taxes,” noting that refunds are simply the difference between what workers owe and what was withheld.

Mazur said many taxpayers underestimate how significantly routine payroll withholding can diverge from annual liability calculations during periods of legislative change.

Who Stands to Gain the Most?

Analysts expect the largest refund increases to occur among:

• Middle-income wage earners

These workers typically rely on standard withholding and may experience the full effect of the mismatch. Reviews from financial publications such as Kiplinger suggest that households making between $60,000 and $150,000 annually stand to benefit the most.

• Workers with tip income or fluctuating wages

Service industry workers may see larger discrepancies because withholding systems often treat variable wages conservatively, increasing the likelihood of over-withholding.

• Households with new deductions not reflected in payroll systems

Expanded eligibility for deductions such as certain work-related expenses cannot be accommodated by employers during payroll processing, resulting in higher upfront withholding.

• Families with new or modified tax credits

Credits that must be claimed at filing, rather than accounted for in withholding, often lead to larger refunds when administrative systems lag behind statutory rules.

Historical Comparison: How Unusual Is the 2026 Refund Outlook?

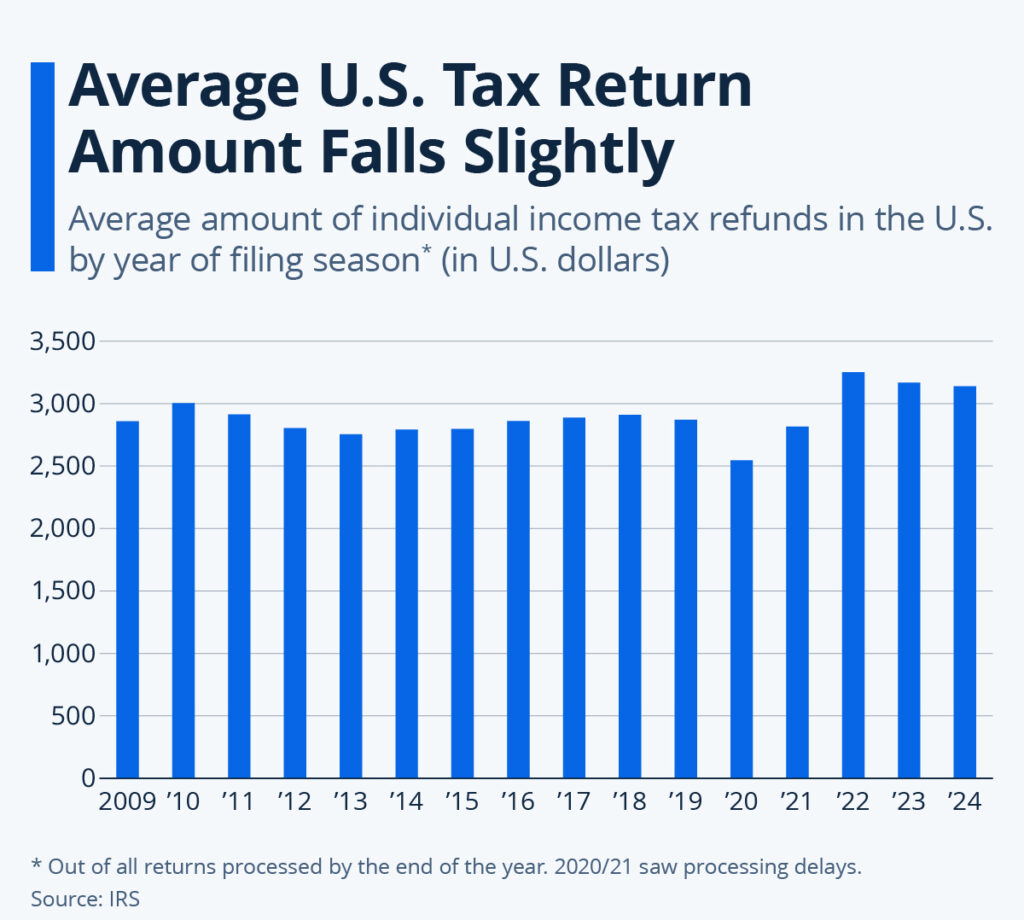

Tax historians and policy experts note that the U.S. has experienced spikes in refund amounts following major tax reforms, such as the 1986 Tax Reform Act and the 2017 Tax Cuts and Jobs Act (TCJA). However, the scale projected for 2026 appears larger, driven in part by the speed of recent legislative changes.

A policy analyst at the Tax Policy Center said, “Refund volatility is common after major tax reforms, but this cycle appears amplified due to technological and administrative backlogs.”

Historical IRS data show that refund increases of more than 10 percent are rare. Early projections suggest the 2026 filing season may exceed that threshold by a notable margin.

Economic Implications for the U.S. Consumer Market

Larger tax refunds could temporarily boost consumer spending in early 2026. Economists at major financial institutions say the influx may help retail, automotive, and service-sector activity during the first quarter.

Scott Bessent, a financial strategist interviewed by several financial outlets, said refunds “between $1,000 and $2,000 for many working families” could provide a meaningful stimulus effect. He cautioned, however, that households should be aware that refunds are not new government payments but the return of previously withheld income.

Several economists also noted that the macroeconomic impact will depend on how households allocate funds. Lower-income families historically use refunds for debt repayment, overdue bills, or essential purchases, while middle-income households more commonly spend on discretionary goods.

Potential Inflation Effects

Some analysts warn that sudden increases in consumer liquidity may create small inflationary pressures. However, Federal Reserve economists interviewed in late 2025 described the projected increase as “moderate” and “unlikely to meaningfully shift national inflation patterns.”

The timing of refunds—dispersed over three months—also reduces the concentration of spending.

Why Payroll Systems Lag Behind Tax Changes

The IRS issued new withholding tables in late 2025, but payroll systems across the country have struggled to implement them uniformly. Smaller employers, in particular, may not update software promptly due to cost or administrative burdens.

A report from the Government Accountability Office (GAO) found that delays in employer adoption of withholding updates are common in the first year following significant tax reforms. The report stated that “workers relying on standard withholding methods often bear the brunt of transitional discrepancies.”

Payroll providers have also cited the complexity of new rules for tip income, overtime, and supplemental wages, which require updated algorithms for accurate calculation.

IRS Guidance and Taxpayer Recommendations

The Internal Revenue Service (IRS) has urged taxpayers to review their withholding early in 2026 to avoid over- or under-withholding for the remainder of the year. The agency recommends using the IRS Withholding Estimator, which reflects updated tax rules more accurately than many employer systems.

The National Association of Enrolled Agents suggests that workers seeking a more precise match between withholding and annual liability update their W-4 forms in early 2026. Tax professionals note that households preferring larger refunds may choose not to adjust.

What to Expect as the Filing Season Approaches

The IRS is expected to open the 2026 filing season in late January, with refund processing timelines similar to recent years. Officials anticipate a higher-than-normal volume of early filers as households seek to recover excess withholding.

Congressional budget analysts expect withholding patterns to stabilize by late 2026, meaning the elevated refund levels are unlikely to persist beyond one cycle. A forthcoming Congressional Budget Office (CBO) analysis will assess how much liquidity is temporarily shifting from workers to the government before returning at filing.

Your December 2025 Social Security Calendar: Check the Exact Date Your Check Arrives

Potential Legislative Adjustments

Some lawmakers have suggested simplified withholding reforms to reduce volatility during future tax transitions. Treasury officials have indicated they are reviewing the feasibility of more dynamic employer reporting systems but emphasized that any such overhaul would require legislative action.

Final Outlook

Financial experts widely agree that the 2026 refund outlook will remain elevated unless employers accelerate payroll adjustments earlier than currently expected. While the prospect of larger refunds may offer timely assistance for many households, tax specialists stress that these increases are temporary and reflect administrative timing rather than long-term tax savings.

A senior Treasury advisor summarized the situation: “This is a transitional year. The system is still catching up with the law, and taxpayers will see the effects during filing. By 2027, we expect withholding to align more closely with actual liability.”