If you rely on Social Security or SSI to cover monthly essentials, the 2026 COLA update probably sounded like a long-awaited relief. A 2.8% across-the-board increase feels decent on paper and looks even better when you see your “new” benefit amount in the notice. But once the deposit hits your bank account, many retirees and disabled workers realize something frustrating: the raise is smaller than expected, and in some cases, their real buying power barely moves at all. The truth is that the 2026 COLA update improves your gross benefit, not automatically your take-home pay. Medicare premiums, taxes, earnings rules, and inflation itself all chip away at that increase before you ever see or spend it. Understanding how these moving parts interact is the key to making sense of your 2026 Social Security and SSI payments—and to planning your budget so the numbers do not catch you off guard.

The 2026 COLA update is designed to keep Social Security and SSI benefits roughly in step with inflation. The adjustment is calculated from an official inflation index and then applied as a 2.8% raise to existing benefits. That is why every article and TV segment keeps repeating the same percentage: it is the single nationwide number that governs how much every eligible check goes up. But that percentage does not tell the full story. First, the COLA is calculated using last year’s inflation data, not this year’s prices. If your rent, food, and utility bills have already shot up over the past 12 months, the 2.8% bump can feel like it is arriving late to the party. Second, the COLA is applied mechanically to your gross benefit before any deductions. What really matters for your day-to-day life is the net amount that hits your account after premiums, withholding, and other adjustments.

2026 COLA Update

| Item | 2025 Amount | 2026 Amount | What It Means For You |

|---|---|---|---|

| COLA percentage | Previous year’s lower rate | 2.8% increase | A modest raise aimed at tracking inflation, not a windfall. |

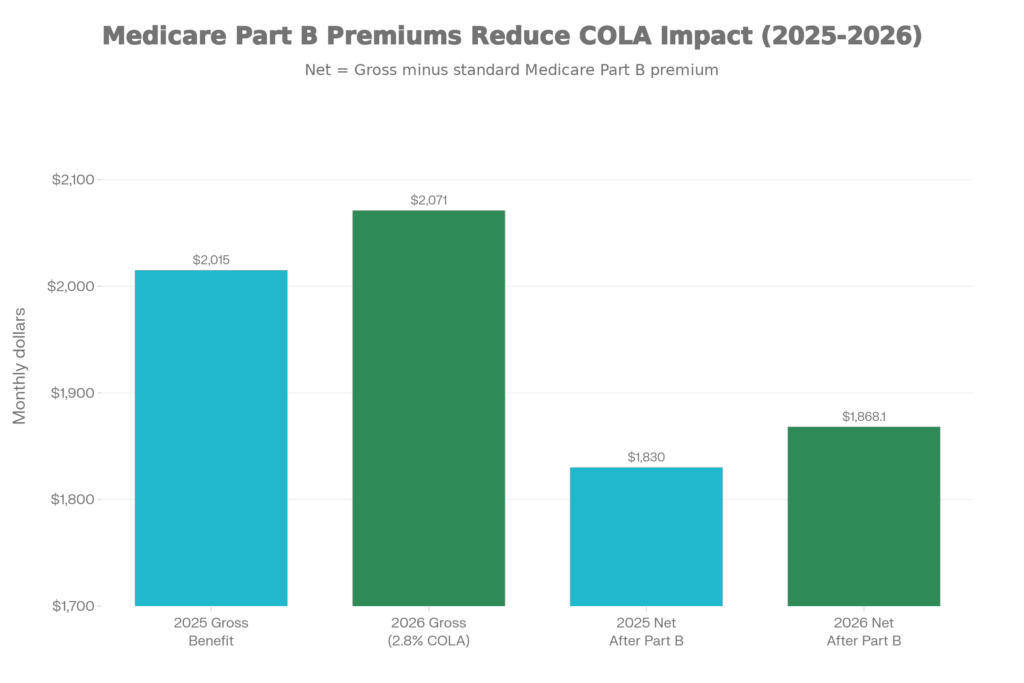

| Average retired worker benefit | About 2,015 dollars | About 2,071 dollars | Roughly 56 dollars more per month before deductions. |

| Maximum benefit at full retirement age | About 4,018 dollars | About 4,152 dollars | Larger checks get bigger raises in dollars, but can face higher taxes and surcharges. |

| Average disabled worker benefit | Around 1,586 dollars | Around 1,630 dollars | A small monthly bump that rising medical costs can quickly absorb. |

| SSI federal benefit rate (individual) | 967 dollars | 994 dollars | Around 27 dollars more in the standard federal payment. |

| SSI federal benefit rate (couple) | 1,450 dollars | 1,491 dollars | Around 41 dollars more for an eligible couple. |

| Taxable maximum (Social Security wages) | 176,100 dollars | 184,500 dollars | More earnings are subject to Social Security tax for high-wage workers. |

| Earnings test limit (under full retirement age) | 23,400 dollars | 24,480 dollars | Slightly higher limit before work starts to reduce benefits. |

| Medicare Part B premium (standard, approximate) | About 185 dollars | Just over 200 dollars | A sharp premium increase that can swallow a large share of the COLA. |

Why Your Take-Home Pay May Not Rise

- On the surface, a 2.8% raise sounds straightforward: your check should go up by 2.8%, and you should feel the difference. In reality, several forces claw back part of that gain before it reaches you. The biggest one for most beneficiaries is the Medicare Part B premium, which is automatically deducted from Social Security for those who are enrolled.

- For 2026, the standard Part B premium is expected to jump significantly from the mid‑180‑dollar range to just over 200 dollars a month. That increase alone can take roughly 15 to 20 dollars off the top of your new benefit. If your gross COLA gain is only around 56 dollars, losing 17 or 18 dollars of it to higher premiums leaves you with less than 40 dollars of true extra money which shrinks further if you also have tax withholding.

- Higher-income retirees face another complication: income-related surcharges on Medicare (often called IRMAA). These surcharges add extra dollars to Part B and Part D premiums for people whose incomes cross certain thresholds. If you are in that group, part of your 2026 COLA may be funneled into higher surcharges instead of your pocket, leaving your net benefit barely higher than before, or in some edge cases even slightly lower.

How SSI Recipients Experience The 2026 COLA

- SSI recipients are not left out of the 2026 COLA update. The same 2.8% adjustment pushes the federal base payment for individuals to 994 dollars and for couples to 1,491 dollars a month. On paper, that is a meaningful percentage, and for someone living on the edge, even 20 to 40 extra dollars can matter.

- However, SSI works differently from regular Social Security. It is a needs‑based program, with strict limits on income and resources. When the federal benefit rises, other parts of a person’s financial picture may shift in response. Some states provide their own SSI supplements that can be recalculated after a federal increase. Small amounts of earned or unearned income can offset the federal bump. The end result is that the full 2.8% raise does not always translate into a 2.8% increase in total support.

- It is also worth remembering that many SSI recipients have already been hit hard by rising housing and food costs. By the time the new higher payment arrives, they may simply be plugging holes that have been widening all year. The COLA brings them back toward where they were, rather than lifting them into genuinely better financial shape.

The Inflation Catch-Up Problem

- One of the least understood aspects of the 2026 COLA update is timing. The adjustment is based on inflation readings from the previous year, which means you are always playing catch‑up. When inflation accelerates, people feel the pain months before they receive any extra help in their benefits. By the time the raise lands, a good chunk of its power has been soaked up by bills that were already higher.

- Another issue is that the inflation index used for COLA does not perfectly match how older adults actually spend money. Retirees and disabled beneficiaries tend to spend more heavily on healthcare, rent, property taxes, utilities, and food categories that often rise faster than the overall index. So even a correctly calculated 2.8% adjustment can lag behind a senior’s real‑life cost increases. That is why so many middle‑class retirees say that COLA announcements sound better on TV than they feel in their wallets.

How Work and Taxes Can Eat into The Raise

- If you are still working while collecting Social Security before full retirement age, the earnings test can also affect how much of the 2026 COLA you see. The limit before benefits start getting withheld is higher in 2026, but the rule stays the same: for every 2 dollars you earn above that limit, 1 dollar of benefits can be held back. If your wages rise at the same time benefits rise, the net effect can be that part of your COLA never actually arrives in your bank account because it is offset by the earnings test.

- Taxes are another quiet factor. The COLA can push a slice of your Social Security into taxable territory or increase the portion of benefits already subject to tax. If you have voluntary tax withholding taken from your check, your net benefit might increase by less than the gross COLA would suggest. Some retirees even discover that they owe more at tax time because their taxable Social Security income nudged them into a slightly higher effective rate.

Practical Steps to Protect Your Net Benefit

- Even though you cannot control the 2026 COLA update itself, you do have some control over how much of it you keep. Start by carefully reviewing your benefit notice for 2026. Focus on three numbers: your new gross benefit, your updated Medicare deductions, and your final net deposit. Comparing those to last year’s figures will tell you what the raise really looks like in your life.

- Next, take a fresh look at your Medicare coverage, check whether you qualify for any programs that help with premiums or prescription costs, and make sure your current plan still fits your health needs and budget. For some people, choosing a different plan or drug coverage option can save more per month than the COLA adds effectively boosting your take‑home benefit even if the official increase is modest.

- If you are working, keep a close eye on the earnings test thresholds. Strategically managing when you take overtime, bonuses, or part‑time work can prevent benefit withholding from erasing the value of your 2026 increase. And for those with higher incomes, talking with a tax or financial professional about maanaging taxable income, retirement account withdrawals, and IRMAA brackets can help you hold on to more of what the COLA is supposed to provide.

Using The 2026 COLA Update In Your Budget

- Finally, treat the 2026 COLA update as an opportunity to reset your budget, even if the raise feels small. List your must‑pay expenses housing, utilities, food, medications and see exactly how the new net benefit covers them. If your surplus is thin, this is the moment to look for ways to trim recurring costs, renegotiate bills, or shift non‑essential spending.

- Even a few extra dollars per month can be put to work: building a small emergency cushion, reducing high‑interest debt, or covering preventive healthcare that might save bigger bills later. The COLA may not feel like the generous raise you hoped for, but with careful planning, it can still help you edge your finances in a safer direction rather than simply disappearing into the background noise of higher prices.

FAQs on 2026 COLA Update

1. Why doesn’t the 2026 COLA increase show up fully in my bank account?

Because the 2.8% COLA is applied to your gross Social Security benefit, and then Medicare premiums, tax withholding, and any other deductions are taken out before the deposit is sent.

2. Can my 2026 COLA raise actually be wiped out completely?

Yes, especially for people with smaller benefits or high medical costs. A sharp jump in the standard Medicare Part B premium alone can absorb most or all of a modest COLA increase.

3. Do SSI recipients really benefit from the 2026 COLA?

SSI recipients do receive the same 2.8% COLA, which pushes the federal base rates higher, but strict income and resource rules mean some of that gain can be offset.

4. How do work and earnings affect my 2026 COLA increase?

If you are under full retirement age and keep working, the earnings test still applies. While the yearly limit is a bit higher, you can lose 1 dollar of benefits for every 2 dollars of wages above that threshold.