The 2025 COLA will raise Social Security benefits for more than 70 million Americans beginning in January, but much of that increase is expected to be absorbed by rising Medicare Part B premiums. Analysts say the net gain that retirees actually see may be far smaller than the headline cost-of-living adjustment suggests.

2025 COLA Crushed by Soaring Medicare Part B Costs

| Key Fact | Detail / Statistic |

|---|---|

| 2025 COLA increase | Approximately 3.2% |

| 2025 Medicare Part B premium | Expected increase of about $15–$20 per month |

| Average retiree’s net gain | ~$30–$40 after premium deduction |

| Official Website | Social Security Administration |

How Rising Healthcare Costs Are Reducing the Value of the 2025 COLA

The annual cost-of-living adjustment is designed to protect Social Security beneficiaries from the effects of inflation. It is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers, a federal measure of inflation that tracks price changes for common goods and services.

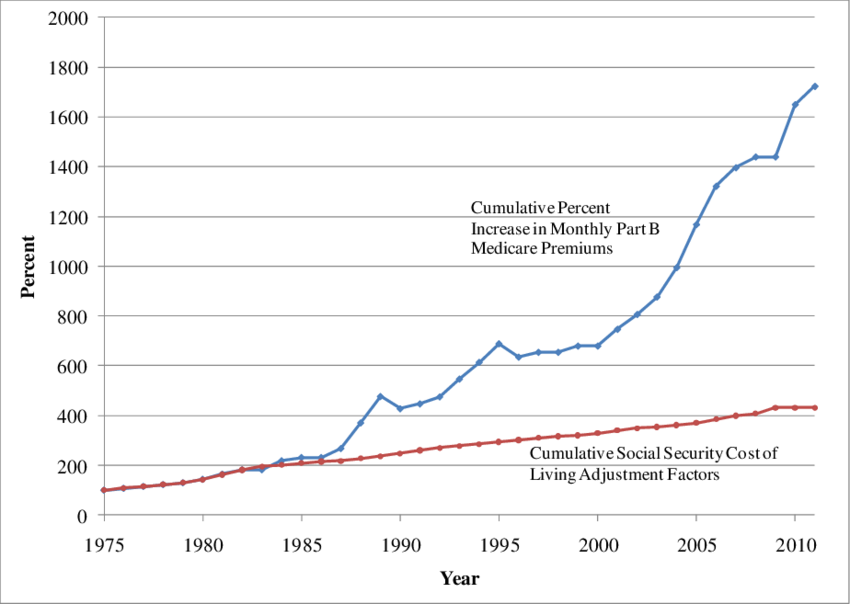

But many experts argue that the index does not adequately account for the spending patterns of older Americans, who devote a larger share of their income to healthcare, prescription drugs, and housing. Because these categories often rise faster than general inflation, retirees frequently experience a decline in purchasing power even when benefits increase.

Retirement policy researchers note that healthcare inflation in particular routinely outpaces overall inflation. They warn that the 2025 COLA, though higher than average, cannot keep pace with the medical expenses older adults face each year.

Dr. Melissa Hardy, a professor who studies aging and financial security, explained that “medical care inflation runs hotter than the inflation measure used to calculate Social Security adjustments. That gap matters, because seniors feel the strain far more quickly than the general population.”

What the 2025 COLA Means for the Average Retiree

A Modest Benefit Increase

For the average retiree receiving Social Security, the 3.2% COLA amounts to roughly $55–$60 more per month. This increase will appear automatically in benefit checks beginning in January.

However, most beneficiaries also have their Medicare Part B premium deducted from their monthly Social Security deposit. This means higher premiums directly reduce the net increase retirees take home.

How Premium Deductions Shrink the Raise

If Medicare premiums rise by $15–$20 per month, as projected, retirees will keep only a portion of their COLA. For many, the real increase will be closer to $30–$40 per month once all deductions are accounted for.

Senior advocacy organizations emphasize that this modest gain falls short of covering rising costs for everyday necessities. Their surveys show that food prices, rent, utilities, and out-of-pocket medical costs continue to rise faster than Social Security benefits.

The Hold-Harmless Rule

There is one legal safeguard for lower-income retirees: the “hold-harmless” rule. This rule prevents a beneficiary’s Social Security payment from decreasing because of a Medicare premium increase.

However, the rule does not guarantee that beneficiaries keep the full COLA. Instead, it ensures that the increase is simply not erased entirely. Higher-income retirees are not protected by this provision and may see an even smaller net gain because they pay higher income-related premiums.

Retirees Paying Income-Related Premiums

Beneficiaries with higher incomes pay additional charges on top of the standard Part B premium. These “income-related monthly adjustment amounts” can significantly reduce the net monthly benefit increase, especially for couples filing jointly.

For some retirees in higher income brackets, the increased Medicare deductions may offset most of the COLA or eliminate it entirely.

Why Medicare Costs Keep Rising

Medicare officials cite several reasons for the expected premium increase:

- Higher use of outpatient and specialist services.

- Rising prices for medical technology and physician-administered treatments.

- Increased demand for prescription drugs covered under the medical benefit.

- General inflation across hospitals and outpatient clinics.

- Growing enrollment as the baby-boomer generation ages.

Healthcare analysts say these drivers are persistent and structural, meaning higher premiums are likely to continue in future years. Many expect Medicare Part B costs to rise faster than Social Security benefits through the end of the decade.

Dr. David Lipschutz, an expert on Medicare policy, noted that “the combination of an aging population and rapidly advancing medical treatments is pushing Medicare spending upward every year. Premiums follow that trend.”

Other Financial Pressures on Seniors

Rising Medicare premiums are only one part of the financial strain older Americans face. Retirees report increasing pressure from several other areas:

Inflation for Essential Goods

Though headline inflation has cooled from record highs, many essentials remain costly. Food, rent, home insurance, and utilities continue to rise at rates faster than the overall economy.

Older households spend more on healthcare, property taxes, and home maintenance than the average family, and those costs have risen significantly in recent years.

Housing Costs

Whether renting or owning, many retirees face rising housing expenses. Rent increases, higher property insurance premiums, and maintenance costs are common concerns, especially for seniors living on fixed incomes.

Prescription Drug Costs

Even with Medicare Part D coverage, many older adults face steep out-of-pocket costs for medications not fully covered or subject to specialty-tier pricing. Some medications have seen double-digit price increases in recent years.

Longevity and Savings Pressure

Retirees are living longer, which places additional pressure on retirement savings. Financial planners note that the combination of modest COLA increases, rising medical costs, and uncertain markets increases the risk that retirees may outlive their savings.

Regional and Demographic Differences

Regional Cost Variations

The impact of the COLA varies widely across the United States. In high-cost states in the Northeast and West Coast, even a full COLA increase does not cover rising housing and healthcare costs. Conversely, retirees in lower-cost areas may see their benefits go further.

Income and Demographic Factors

- Lower-income retirees are partially protected by the hold-harmless rule.

- Middle-income beneficiaries often feel the squeeze the most; they earn too much for subsidies but not enough to absorb rising healthcare costs easily.

- Higher-income retirees face larger premium surcharges.

- Women and minority retirees, who often have smaller lifetime earnings and lower savings, are more vulnerable to inflation.

Policy Debate: Can COLA Be Improved?

Economists, lawmakers, and advocacy groups are debating how to strengthen Social Security’s ability to keep pace with inflation.

A widely discussed change is shifting from the CPI-W to the Consumer Price Index for the Elderly, a measure that more accurately reflects seniors’ spending patterns. This index gives more weight to healthcare and housing.

Supporters argue it would better protect retirees from rising costs. Critics warn that it would accelerate the depletion of the Social Security trust fund.

Other proposals include:

- Expanding benefits for low-income retirees.

- Strengthening Medicare’s ability to negotiate drug prices.

- Reducing out-of-pocket expenses through benefit redesign.

- Increasing payroll tax contributions for high earners.

- Adjusting the age thresholds for income-related Medicare premiums.

None of these proposals have yet gained enough bipartisan support to advance through Congress.

SNAP Benefits Shift Again in December — New Income Rules and Who Could Lose Aid

What Retirees Can Do Ahead of 2025

Experts recommend several practical steps older adults can take:

1. Review Medicare Options Carefully

Open enrollment offers a chance to compare plans, evaluate costs, and assess whether supplemental insurance or Medicare Advantage plans offer better coverage.

2. Prepare a Revised Budget

With a modest net gain expected from the COLA, retirees should update their household budgets to account for higher insurance premiums, out-of-pocket medical costs, and rising utility bills.

3. Track Income for Premium Purposes

Because Medicare premium surcharges are based on income from two years prior, retirees should pay close attention to withdrawals from retirement accounts, investment income, and tax planning.

4. Plan for Long-Term Costs

Experts suggest reassessing long-term financial plans, especially for retirees with limited savings. Small monthly increases may not keep pace with inflation, making it important to plan ahead.

Looking Ahead

Economists expect that healthcare costs will continue to rise, potentially outpacing future COLA adjustments. Preliminary forecasts for 2026 already suggest that Medicare premiums will rise again, continuing the pattern seen in recent years.

As federal policymakers debate how best to strengthen Social Security and Medicare, retirees are left navigating a system in which benefit increases are regularly undermined by the high cost of medical care. For now, the 2025 COLA offers modest relief that may fall short of the expectations of millions of older Americans.