Rumors that the Internal Revenue Service (IRS) will issue a $2,000 stimulus check in November 2025 have flooded social media and online forums. Yet, according to official statements and public records, no such payment has been authorized or scheduled. The so-called “$2,000 stimulus check” is unverified, leaving many Americans wondering where the story came from and what the real facts are.

$2000 Stimulus Checks

| Key Fact | Detail / Statistic |

|---|---|

| Past federal stimulus checks completed | The IRS confirmed all three rounds of Economic Impact Payments (EIPs) from 2020–2021 are complete and no further payments are pending. |

| No new legislation for direct federal payments | Congress has not approved any new stimulus-style checks for 2025. |

| State relief programs active | Some U.S. states, such as Alaska and New York, continue limited rebate or inflation-relief programs. |

| Scams exploiting false claims | The IRS and Federal Trade Commission have issued warnings about fraudulent messages offering “new IRS checks.” |

Understanding the $2000 Stimulus Check Rumor

What the Rumor Claims

The viral claim suggests that the IRS will automatically send out $2,000 checks or direct deposits to qualifying taxpayers beginning in November 2025. Many posts describe the payment as “a new federal stimulus” meant to ease the burden of inflation and rising living costs. Some versions even cite supposed “updates” from financial websites or social media influencers.

The rumor gained traction because the idea of direct cash support resonates with Americans who benefited from previous pandemic-era payments. However, none of the current claims link to official documents, agency statements, or credible legislative sources.

What the IRS Actually Says

According to the IRS, there are no new federal Economic Impact Payments authorized. The agency’s website lists past stimulus checks as “historical information” and explicitly states that the programs under the CARES Act and the American Rescue Plan have concluded. In short, the IRS is not preparing to send any nationwide $2,000 payments.

An IRS spokesperson reiterated earlier this year that the agency does not announce payments via text messages, emails, or social-media posts. All official communications appear on irs.gov. Any other source, the spokesperson emphasized, should be treated with skepticism.

Why the Rumor Spread So Quickly

Lingering Expectations from Past Stimulus Checks

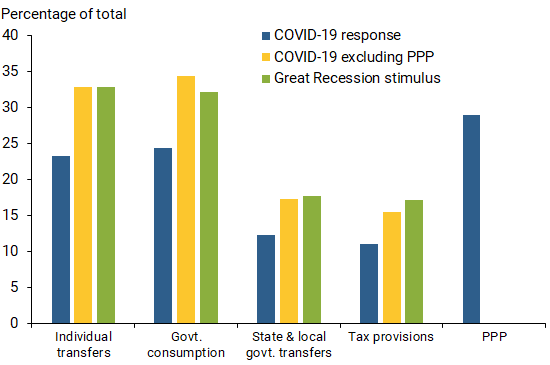

From 2020 through 2021, the U.S. government issued three major rounds of stimulus checks totaling thousands of dollars per household. These payments, intended to stabilize the economy during the COVID-19 pandemic, became one of the most visible forms of government relief in modern history. Many Americans still associate the IRS with those direct deposits and assume the same mechanism might be used again in tough economic times.

Social Media Amplification

False or misleading information spreads fast online—especially when it involves money. Posts containing official-looking images or fabricated “IRS announcements” have been widely shared on platforms such as Facebook, X (formerly Twitter), and TikTok. Some even use real IRS logos to appear authentic. Algorithms favor highly engaging content, allowing misinformation to circulate more quickly than official corrections.

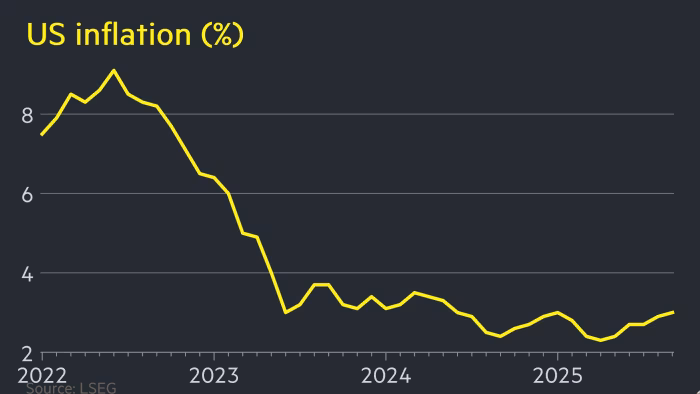

Economic Anxiety

High living costs, stubborn inflation, and concerns about a possible slowdown have left many families financially strained. As prices for housing, food, and healthcare rise, the idea of a fresh federal payment seems appealing—and plausible—to many. Economists say this environment creates fertile ground for rumors promising financial relief.

What Would Need to Happen for a Real $2,000 Payment

A new federal stimulus payment cannot happen without congressional approval. The process would include the following steps:

- Legislation Introduced — A member of Congress must sponsor a bill proposing a new direct-payment program.

- Approval by Both Chambers — The bill must pass both the House of Representatives and the Senate.

- Presidential Signature — The President must sign the bill into law.

- Funding and Implementation — Congress must allocate funds, and the Department of the Treasury would then direct the IRS to distribute payments.

- Public Announcement — Only after these steps would the IRS issue official statements explaining eligibility, timing, and distribution methods.

As of November 2025, no such legislation exists. Neither the Treasury Department nor the White House has proposed a federal direct-payment program this year. Without these legal steps, the IRS has no authority to issue new stimulus checks.

The Real Sources of Relief: State and Local Programs

While the federal government has not announced new payments, several states have implemented their own relief initiatives:

- New York: A one-time “inflation relief check” program offers up to $400 for eligible households that filed state income taxes.

- Alaska: The state continues to distribute its annual Permanent Fund Dividend, providing roughly $1,300 to residents.

- California and Colorado: Both have expanded state-level tax credits and rebates targeted at lower-income families.

These programs are state-funded and not connected to the IRS. Their purpose is to help offset local inflation and living costs rather than to serve as national stimulus efforts.

What Economists and Policy Experts Say

Economists note that broad federal stimulus checks, while politically popular, carry mixed consequences. Direct payments can boost short-term spending, supporting retail and service industries. However, they also add to federal debt and may fuel inflation if issued during an already strong economic cycle.

Dr. Elaine Porter, a fiscal policy researcher at the nonpartisan Brookfield Institute, says, “The federal government faces a significant budget deficit in 2025. Any new cash-transfer program would require offsetting cuts or new revenue sources to avoid expanding the national debt.”

Similarly, financial analyst Marcus Liu notes that Congress is focused on revising tax brackets and deductions rather than approving new mass-payment programs. “The political momentum is not there for another nationwide check,” he says. “Lawmakers are instead targeting smaller, more specific relief through tax credits and energy subsidies.”

Common Scams Exploiting the Rumor

The IRS and the Federal Trade Commission (FTC) have warned that scammers often use false stimulus claims to steal personal and banking information. Typical red flags include:

- Emails or text messages claiming you must “verify eligibility” to receive a $2,000 payment.

- Fake application websites mimicking the IRS portal, asking for Social Security or bank account numbers.

- Phone calls from individuals claiming to be IRS agents demanding a “processing fee.”

Officials emphasize that the IRS never contacts taxpayers through unsolicited calls, emails, or direct messages. Anyone encountering such communications should report them immediately to the IRS’s Phishing and Online Scams page or to the FTC’s ReportFraud.gov.

The Broader Economic Context

Inflation and Public Sentiment

Although inflation has slowed from its 2022 peak, prices remain elevated. Many Americans report that groceries, rent, and medical costs consume a larger share of their income. These pressures have kept public interest in potential stimulus payments high, even when no new program exists.

Federal Budget Constraints

The federal budget deficit has widened again in fiscal year 2025, limiting the government’s ability to authorize large new spending packages. Lawmakers across party lines have expressed caution about adding further debt without a clear economic emergency.

Political Dynamics

With a presidential election year approaching, economic relief remains a politically sensitive topic. Some lawmakers advocate new tax credits or rebates for working families, but others warn against measures that could reignite inflation. This divided landscape makes another universal stimulus check unlikely in the near term.

How to Verify Future Announcements

Taxpayers can protect themselves by confirming information directly through official government channels:

- Visit irs.gov — All official announcements appear under “News Releases” or “Economic Impact Payments.”

- Check the Treasury Department — The Treasury’s press page lists any approved payment programs.

- Consult Reputable News Outlets — Reliable organizations such as Reuters, the Associated Press, and major national newspapers provide verified updates.

- Ignore Viral Posts — If an offer appears only on social media and not on official websites, it is almost certainly false.

Practical Steps for Taxpayers

- Keep your tax information current. Filing your 2024 return on time ensures your eligibility if any future payment program is enacted.

- Maintain direct-deposit details. The IRS uses bank information from your latest tax return for any refunds or authorized payments.

- Avoid responding to unsolicited messages. The IRS never requires “registration” or “fees” for stimulus payments.

- Monitor state programs. Relief may still be available at the local or state level.

Why Accurate Information Matters

False claims about government payments can cause financial harm and erode trust in public institutions. Families counting on nonexistent checks may delay bills or make financial decisions based on misinformation. Meanwhile, scammers profit from confusion.

Accurate, transparent communication from both the government and media is essential. By understanding how these programs are actually created—and by verifying information through official channels—citizens can protect themselves from fraud and misinformation.

Looking Ahead

At present, there is no federal $2,000 stimulus check scheduled for November 2025. Economic conditions, congressional negotiations, and public pressure could always shift the policy landscape, but any legitimate payment would require formal legislative approval and public notice.

For now, taxpayers should remain cautious, stay informed, and focus on verified relief options available through state programs or tax credits. The IRS continues to emphasize that if a real stimulus program ever returns, it will announce it directly and publicly—not through viral posts or private messages.