The $2000 IRS Deposit rumor circulating widely on social media has generated national confusion as Americans search for clarity on potential federal relief. Despite the volume of public interest, neither the U.S. Treasury nor the Internal Revenue Service has authorized any such payment. Officials say no congressional action supports a new relief program, leaving the claim rooted in misinformation and broader anxiety about economic uncertainty.

$2000 IRS Deposit

| Key Fact | Detail |

|---|---|

| No $2000 IRS Deposit authorized | No federal legislation or Treasury directive approving payments |

| Origin of rumor | Misinterpretation of proposals, including tariff-based rebates |

| Public interest rising | Inflation and higher household costs increase searches for relief |

| Verification steps | All federal payments must be announced at IRS.gov |

Officials Say No Authorized $2000 IRS Deposit Exists

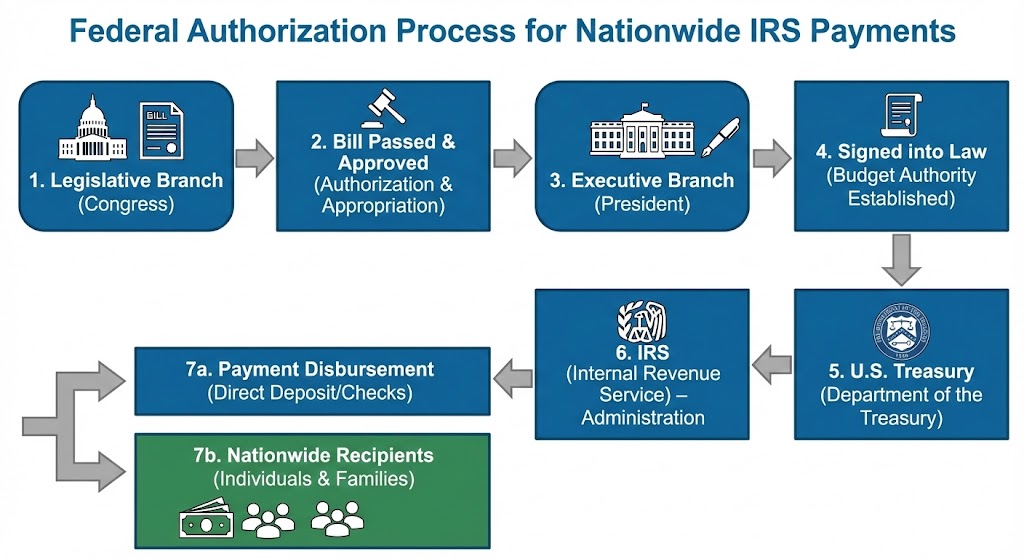

Federal authorities continue to clarify that the IRS is not issuing a $2000 deposit, despite persistent online claims. In previous guidance, the Internal Revenue Service stated that it “cannot distribute direct payments unless authorized by Congress and directed by the U.S. Treasury.”

The Treasury Department has released no statements related to a new deposit program. Historically, the department publicly announces national disbursements—such as the 2020 and 2021 Economic Impact Payments—through coordinated media releases, briefings, and updated IRS webpages. None of these indicators are present today.

Reuters and The Associated Press have issued multiple fact-checks debunking recent articles and social posts that falsely imply federal approval of a new disbursement.

Why the Rumor About $2000 IRS Deposit Emerged and How It Spread

Misinterpreted Policy Discussions

The rumor’s rise appears linked to discussions of possible tariff-based rebates, often described in news commentary as potential “dividends.” Analysts emphasize that these proposals remain conceptual and have not advanced into legislation.

The Brookings Institution reports that online discussions often blend hypothetical policy frameworks with outdated economic commentary, making it difficult for readers to distinguish between formal government action and exploratory ideas.

Economic Conditions Heighten Viral Spread

The Pew Research Center found in recent studies that public engagement with financial misinformation increases during periods of economic strain. Elevated costs for rent, groceries, and utilities make households more attentive to claims of possible federal assistance—even when sources are unclear.

Additionally, algorithm-driven news feeds reward high-engagement topics, causing unverified relief claims to circulate more rapidly than official corrections.

What a Real Relief Program Would Require

The Legislative Path

For an official relief payment to exist, Congress must:

- Draft and approve legislation defining the payment amount and eligibility rules.

- Pass the bill through the House and Senate, often requiring budget scoring by the Congressional Budget Office (CBO).

- Send the bill to the President for signature.

- Direct the Treasury and IRS to implement and distribute the payments.

This process applied to all three pandemic-era stimulus checks. Without these steps, federal agencies are legally barred from issuing mass payments.

Administrative Steps Inside the IRS

Even after authorization, IRS implementation involves:

- Updating eligible taxpayer files

- Coordinating with financial institutions

- Conducting identity verification

- Publishing official guidance for the public

- Updating digital tracking tools such as “Get My Payment”

These procedural requirements take weeks or months to complete, reinforcing that any legitimate relief program would be accompanied by extensive public communication.

Economic and Political Context Behind the Public Interest

Inflation and Consumer Costs

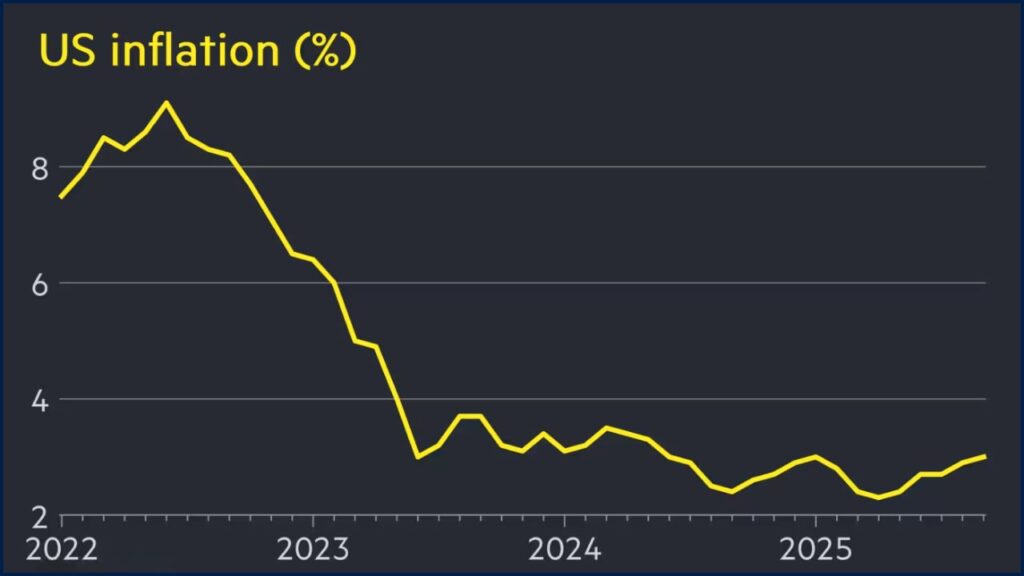

According to the Bureau of Labor Statistics, inflation has eased from the highs of mid-2022 but remains above the Federal Reserve’s long-term target. Shelter and food costs continue to exert disproportionate pressure on family budgets, especially for lower- and middle-income households.

A recent University of Michigan Consumer Sentiment Survey shows persistent public concern about long-term financial stability, despite improvements in wage growth and employment levels.

Fiscal Debates and Public Expectations

Economists at the Urban Institute note that policies introduced during the pandemic significantly shaped public expectations of federal intervention. As economic pressures linger, many Americans now view direct payments as a possible tool for future economic support—even though lawmakers across both parties remain divided on fiscal priorities.

Budget deficit considerations, political polarization, and questions about inflationary effects make broad payments unlikely without a clear economic trigger.

Historical Perspective: How Previous Payments Worked

The U.S. last issued widespread direct payments during the COVID-19 pandemic. These payments were authorized under:

- The CARES Act (March 2020)

- The Consolidated Appropriations Act (December 2020)

- The American Rescue Plan Act (March 2021)

In each case, Congress included explicit language mandating payment amounts, distribution schedules, and eligibility thresholds. The IRS then used taxpayer data from prior filings or benefit records from the Social Security Administration to issue funds.

No comparable legislation has been introduced in 2024 or 2025. Without such action, the IRS cannot create new payment mechanisms or modify existing ones.

Public Reaction to the Rumor

Search Trends Reflect Financial Stress

Google Trends data shows sharp increases in search terms such as “IRS direct deposit,” “stimulus update,” and “$2000 IRS Deposit,” particularly after viral posts on social platforms.

Economists say these spikes reflect household anxiety more than political developments.

Fact-Checking Plays a Growing Role

Organizations such as Reuters, AP News, and FactCheck.org have expanded their coverage to address economic rumors. These outlets confirm that no federal agency or legislative body has supported the claim of an upcoming $2000 deposit.

Cybersecurity Concerns and Scam Prevention

With rumors spreading quickly, federal agencies warn that scams often emerge in parallel. The Federal Trade Commission (FTC) lists several red flags:

- Messages requesting bank account verification

- Emails claiming to “confirm eligibility”

- Texts with unofficial links

- Social media posts demanding small “processing fees”

The IRS emphasizes that it never contacts taxpayers through unsolicited messages to request sensitive information.

If a Program Were Authorized, Who Might Qualify?

While no active program exists, past relief measures used similar criteria:

- Adjusted Gross Income (AGI) thresholds

- Valid Social Security numbers

- U.S. residency requirements

- Filing status and dependent claims

- Bank account information on file

These examples serve only to clarify how prior programs operated, not to suggest that new eligibility rules are in development.

Early Look at 2026 Social Security: How the New COLA May Change Your Take-Home Amount

Verifying Federal Information: What Americans Should Do

The IRS advises taxpayers to rely exclusively on:

- IRS.gov official notices

- Treasury.gov press releases

- The IRS newsroom for payment-related updates

- Government briefings from the White House or Department of the Treasury

Officials warn that any claim not supported by federal communication channels should be treated with caution.

Final Paragraph

While economic pressures continue to shape national debate, lawmakers have introduced no legislation authorizing a new direct payment. U.S. officials stress that there is no $2000 IRS Deposit forthcoming and encourage Americans to monitor only verified federal sources as discussions about future economic policy continue.